Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

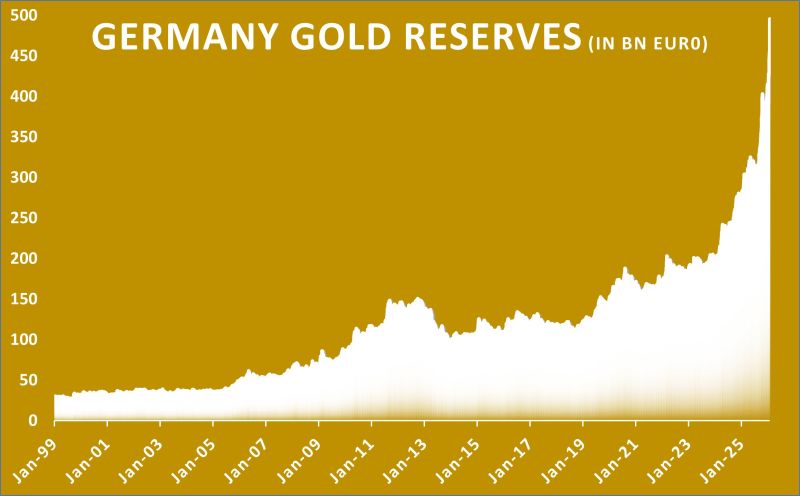

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

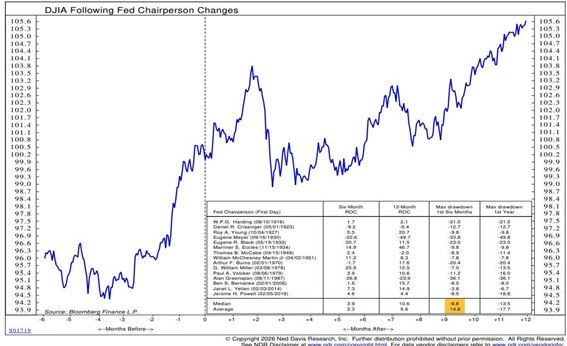

The average drawdown in the first 6 months of a new Fed Chair is 15%.

The market likes to test them... Source: NDR, RBC

Markets in Asia are getting shredded on Monday.

Indonesia and Korea down over 5% each; commodities tossed out the window Source: David Ingles

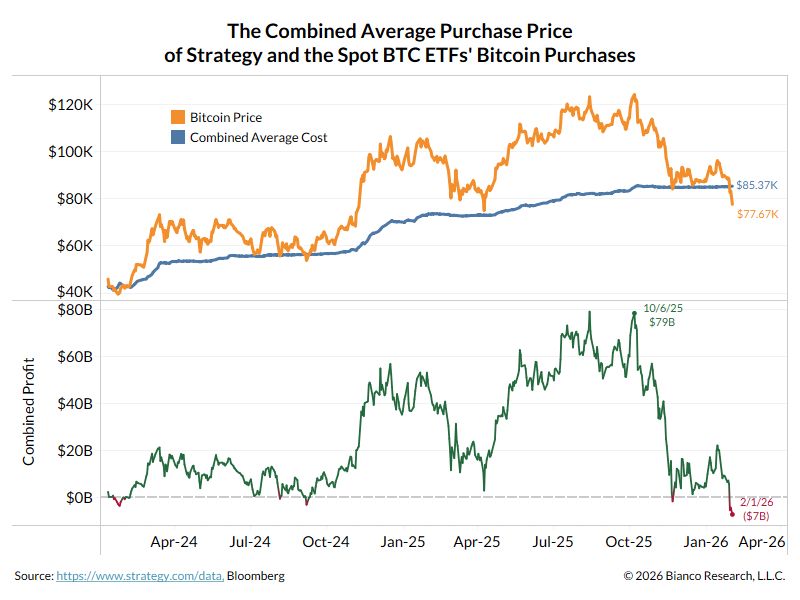

10% of the outstanding $BTC is held by $MSTR and the 11 Spot BTC ETFs.

These are the ways normies hold $BTC in regulated brokerage accounts. Collectively, the avg purchase price is $85.36K, meaning the average is now ~$8k underwater, with an unrealized loss of ~$7B. Source: Bianco Research

IS KEVIN WARSH A DOVE OR A HAWK ?

Interestingly, since his name came up yesterday, markets have been pricing in more his hawkish reputation than his more recent dovish tilt: - Risk assets lower: equities down, bitcoin / cryptos down, gold down and silver in bear market! - Steeper yield curve: could be related to the fact that he is in favour of a smaller Fed balance sheet - Stronger dollar So how should we interpret market erratic moves over the last two days? Stop labeling Kevin Warsh as just a "Hawk." 🦅❌ The social media "chattering class" loves a simple label, but the reality of the next Fed Chair is far more nuanced. If you’re building a strategy based on the idea that Warsh is purely a rate-hiker, you’re missing the bigger picture. Here is the "Warsh Playbook" that the headlines are missing: 1. The "Productivity Boom" Pivot 🚀 Warsh isn't looking to keep rates high for the sake of it. He believes the U.S. is in a massive productivity surge. If that’s true, the Fed can actually lower rates without sparking inflation. It’s a growth-friendly view that most "hawks" wouldn't touch. 2. The Policy Mix: Lower Rates + Tighter Balance Sheet ⚖️ This is the sophisticated play. Warsh wants to shrink the Fed’s massive balance sheet while simultaneously keeping interest rates manageable. It’s a "tighter but lower" approach that aims for long-term stability rather than short-term sugar rushes. 3. Pragmatism Over Ideology 🛠️ History check: During the COVID-19 onset, Warsh was weeks ahead of Jay Powell in calling for an aggressive response. When the alarm bells ring, he’s shown he’s a practical crisis manager, not a rigid academic. The Bottom Line: Calling him a hawk is a convenient narrative for his confirmation hearings—it shows independence from the White House. But in practice? Expect a Fed Chair who is data-driven, productivity-focused, and ready to move fast when the situation demands it.

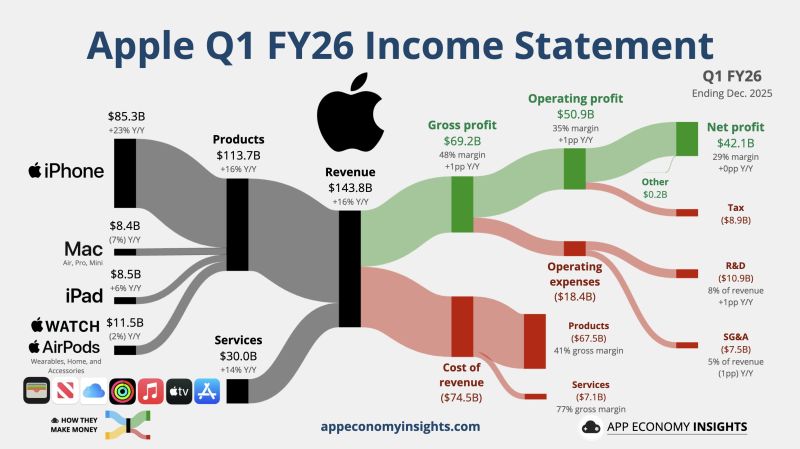

📢 Apple reported fiscal first-quarter earnings on Thursday that surpassed expectations, with revenue soaring 16% on an annual basis.

📌 The company reported $42.1 billion in net income, or $2.84 per share, versus $36.33 billion, or $2.40 per share, in the year-ago period. 🚀 Apple saw particularly strong results in China, including Taiwan and Hong Kong. Sales in the region surged 38% during the quarter to $25.53 billion. Apple quarterly results by App Economy Insights $AAPL Apple Q1 FY26 (Dec. quarter): 📱 Products +16% Y/Y to $113.7B. 💳 Services +14% Y/Y to $30.0B. • Revenue +16% Y/Y to $143.8B ($5.2B beat). • Operating margin 35% (+1pp Y/Y). • EPS $2.84 ($0.17 beat).

The unwinding of popular strategies such as the yen carry trade in traditional markets have been adding to the selling pressure on bitcoin.

The yen carry-trade strategy involves borrowing the relatively low-yielding yen and investing in other currencies offering higher returns. According to Matt Maley, chief market strategist at Miller Tabak & Co, “Bitcoin and other cryptocurrencies are assets that tend to move with liquidity. When liquidity is more plentiful, cryptos rally, and when it’s less plentiful, they decline.” “Well, one of the best indicators for the level of liquidity in the system is the yen carry trade.” Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks