Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Musk’s Companies Set to Add $613 Billion in Value Since Election

First Tesla Inc. surged. Then SpaceX became the world’s most valuable tech startup and xAI nearly doubled its valuation before looking to do it again. Now, X is looking to join Elon Musk’s other companies in leveraging the billionaire’s unprecedented political power. If the social-media company succeeds in its quest to raise money from investors at a $44 billion valuation, it will lift the cloud that has hung over it since Musk paid that much for it in 2022. It would also boost his wealth by about $20 billion, another lift for the world’s richest person. His companies have gained a combined $613 billion in value since the election assuming anticipated funding rounds go as planned, according to data compiled by Bloomberg. Even after retreating from an all-time high in December, Tesla is still worth nearly $400 billion more than it was the day before the election. Meanwhile, a flurry of new funding rounds for Musk’s private companies, including X, SpaceX and xAI, will add over $220 billion in combined value if investments in X and xAI close at the reported size. Musk’s net worth — $397.1 billion as of Tuesday’s close — is up more than 50% since the election, according to the Bloomberg Billionaires Index. If all the funding rounds close as planned, he’d be worth over $420 billion.

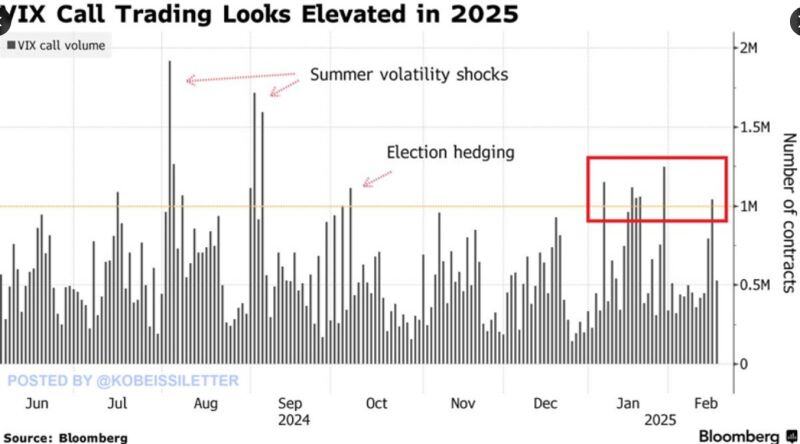

Call options volume on the volatility index, VIX, jumped above 1 million contracts on Tuesday for the 6th time this year.

Source : bloomberg

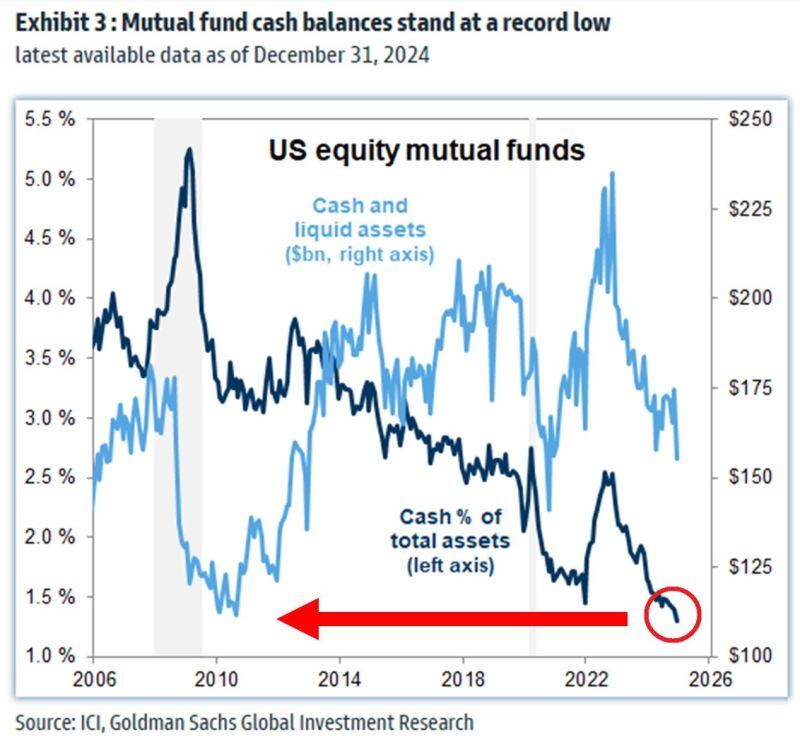

⚠️Is cash trash in this market?

US equity mutual funds cash as a percentage of total assets hit a RECORD LOW of 1.3%. Cash levels are even lower than in early 2022 when the bear market started. There is not much powder left to put into stocks anymore. Source: Global Markets Investor

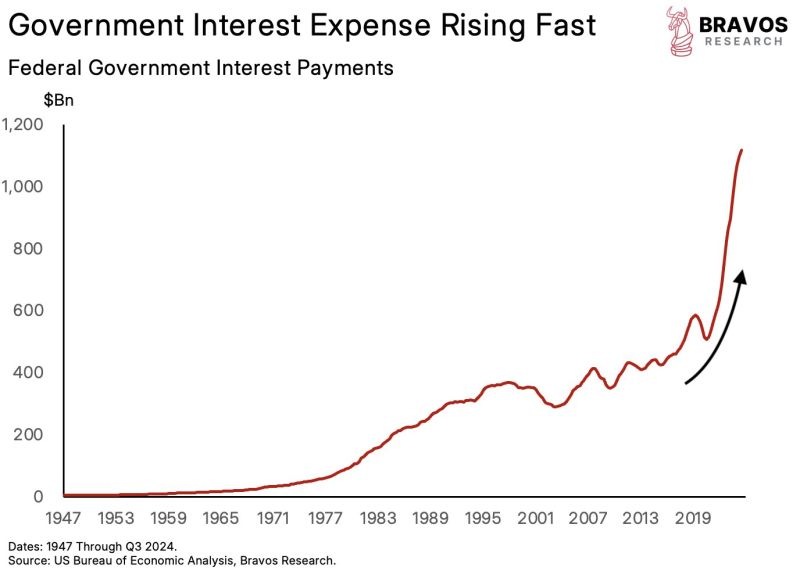

This is truly a historic moment for the US economy.

US government interest expense has gone parabolic in the past few years It has now crossed a staggering $1.1 TRILLION At this rate, it is expected to reach $1.7 trillion by 2034 US debt is now becoming a major concern Source: Bravos Research

BREAKING: 85% OF SWISS GOLD EXPORTS NOW HEADING TO THE USA.

Gold exports from Switzerland rose year on year in January as supplies to the United States soared to the highest in at least 13 years and offset lower deliveries to top consumers China and India, Swiss customs data showed on Thursday. Switzerland, the world's biggest bullion refining and transit hub, alongside Britain which is home to the world's largest over-the-counter gold trading hub, saw a surge in gold transfers to the U.S. in recent months as President Trump readies wide-reaching import tariffs that some market participants fear could affect gold deliveries. The concern has widened the price premium between U.S. gold futures and London spot prices, attracting massive deliveries to Comex gold inventories. According to the Swiss data, gold exports from the country to the U.S. rose to 192.9 tons in January from 64.2 tons in December. This was the highest monthly amount of exports in the customs data going back to 2012. Trump has not mentioned precious metals are likely to be targeted at all, but since late November, when he pledged to impose tariffs on imported products from Canada and Mexico, 20.4 million troy ounces (636 metric tons) of gold worth $60 billion at current prices were delivered to Comex-approved warehouses. These deliveries raised Comex gold stocks by 116% to 38.0 million ounces, the highest since March 2021, and tightened liquidity in the London OTC market. Source: Yahoo Finance, Make Gold Great Again on X

Nasdaq market capitalization to US M2 Money Supply has hit a RECORD 142%.

The ratio has DOUBLED over the last 5 years and even exceeded the Dot-com Bubble levels of ~130%. Equities rise has MATERIALLY outpaced the money supply increase. Source: Global Markets Investor

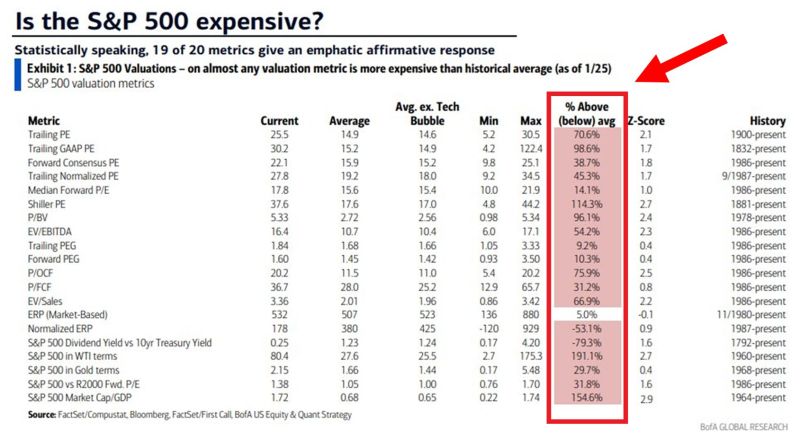

The S&P 500 is expensive on 19 out of 20 metrics, according to the BofA analysis.

Some metrics such as the Buffett Indicator (Market Cap to GDP ratio) are over 100% above historical averages. Source. Global Markets Investor

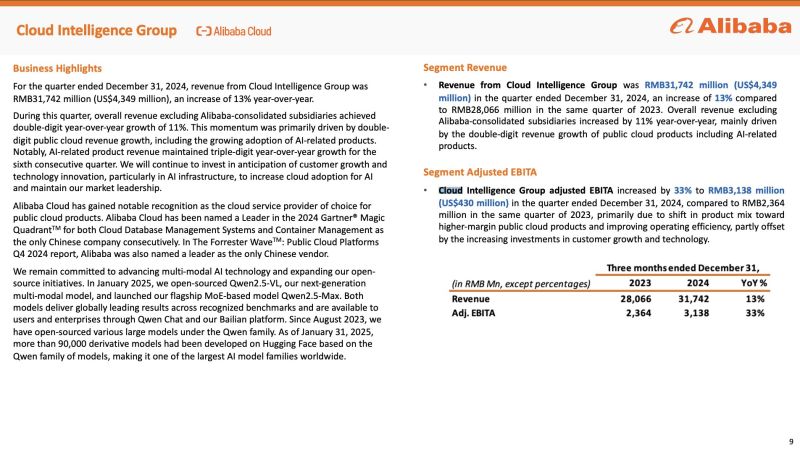

$BABA beats on the big three revenue, adjusted net income and adjusted EPS!

"Cloud revenue growth accelerated to double digits at 13% year-over-year, with AI-related product revenue achieving triple-digit growth for the sixth consecutive quarter" Source: The Transcript

Investing with intelligence

Our latest research, commentary and market outlooks