Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The ECB has recorded the biggest loss in its 25y history.

This is the result of its aggressive policy responses to Eurozone crises & surging inflation—1st buying large amounts of bonds & then sharply raising interest rates. As a result, ECB is earning less interest from the bonds it holds than it has to pay to banks for their deposits. Source: HolgerZ, Bloomberg

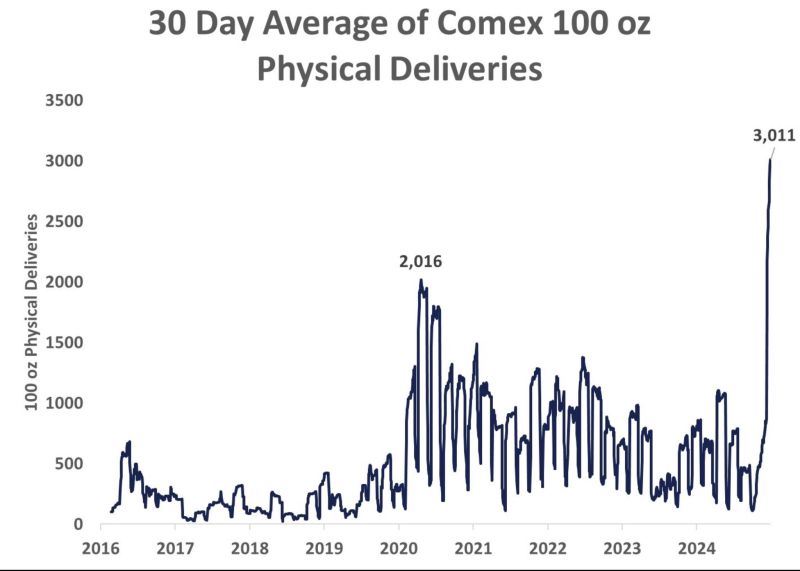

Pretty soon Fort Knox will be filled up again ;-)

Source: Willem Middelkoop @wmiddelkoop on X

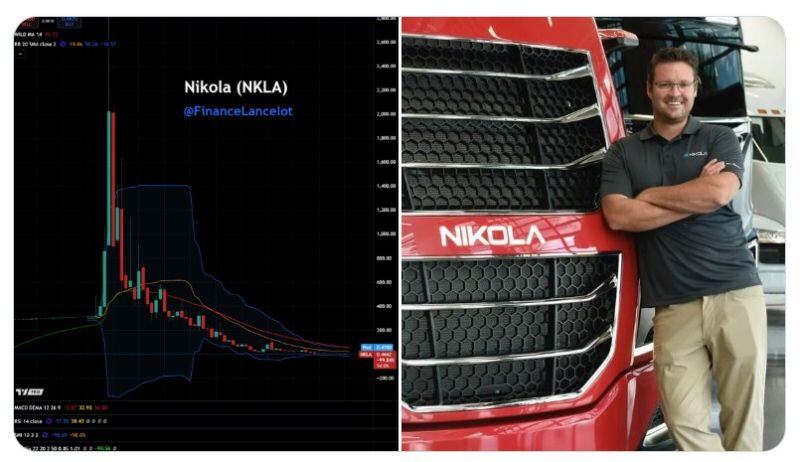

Nikola $NKLA officially files for bankruptcy.

From $2,828 to $0. What a ride... Source: Financelot @FinanceLancelot

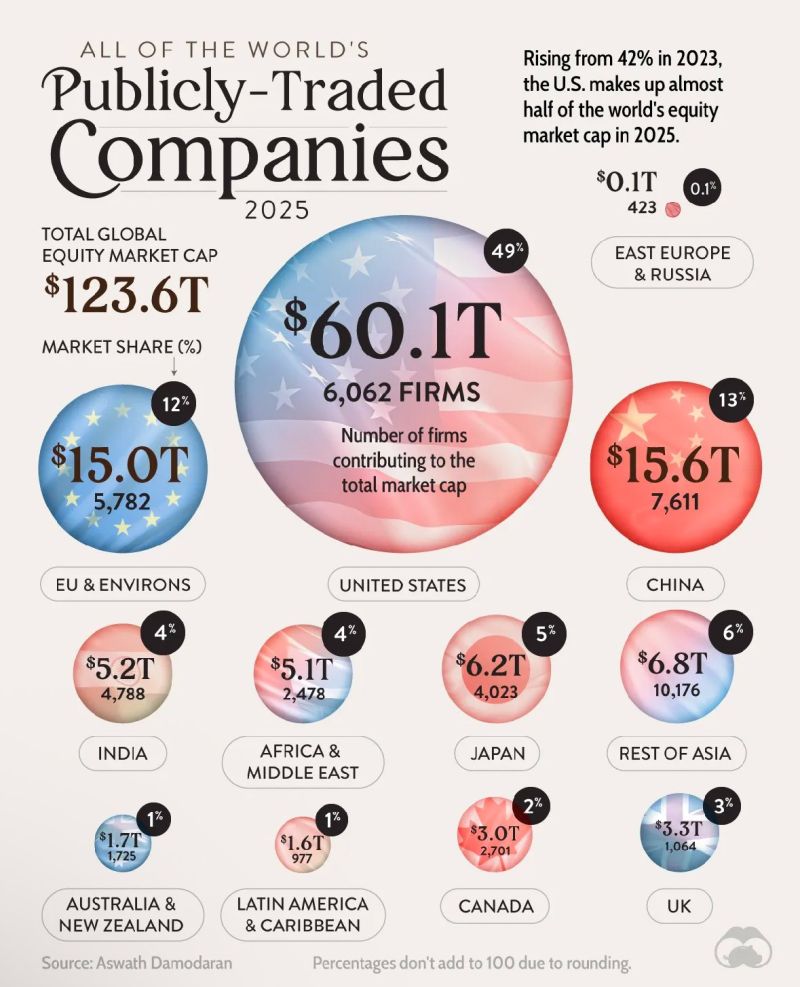

The United States makes up almost half of the world’s stock market

Source: Visual Capitalist

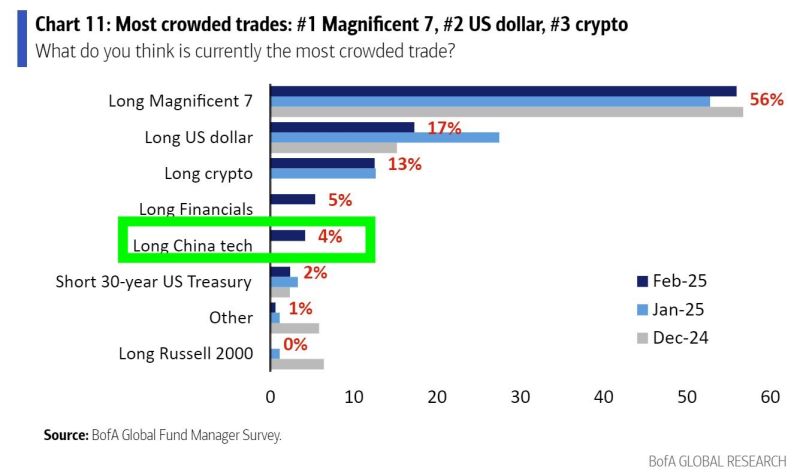

Most crowded trades according to latest BofA Fund managers survey China Tech is far behind Mag7

Source: BofA Global Fund Manager Survey

An interesting chart by stocktwit 👉 $PLTR insider transactions in 2024:

• Buys: $0 • Sells: $3,104,510,822.09 👀👀👀👀👀 Yesterday after the close, Palantir CEO Alex Karp has announced a new plan to sell $1.2 billion of stock. $PLTR 🔴 was down -12% in after-hours trading

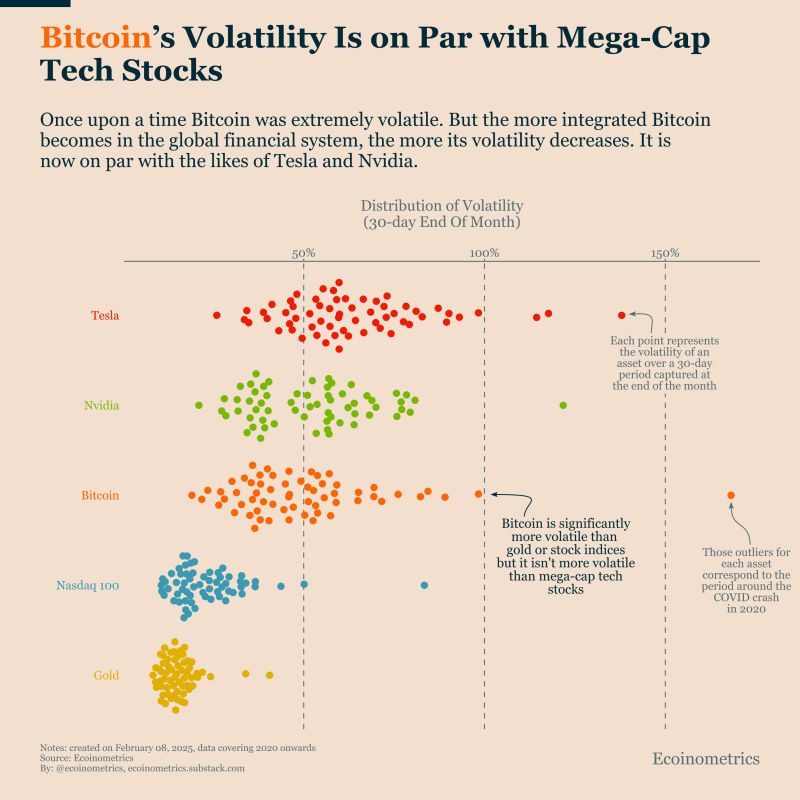

The price of Bitcoin is now as stable as the largest technology company stocks like Tesla and Nvidia.

Source: Documenting Bitcoin

Investing with intelligence

Our latest research, commentary and market outlooks