Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

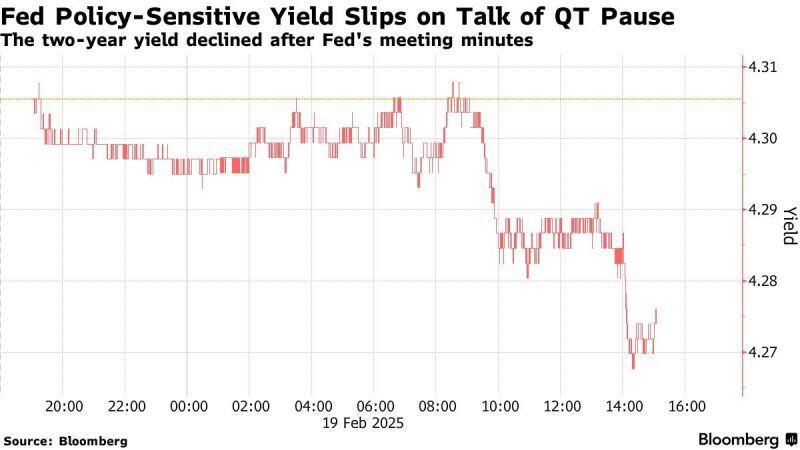

➡️ US Treasuries rose after the minutes from last month’s Federal Reserve meeting revealed policymakers discussed pausing or slowing the balance-sheet runoff ...

... until the government’s debt-ceiling drama is resolved. 👉 Various participants noted it may be appropriate to consider pausing or slowing balance sheet runoff until resolution of debt ceiling dynamics. 👉 Many participants noted after conclusion of balance sheet runoff it would be appropriate to structure asset purchases to move maturity composition closer to outstanding stock of Treasury debt. 👉 Reserves might decline quickly upon resolution of the debt limit and, at the current pace of balance sheet runoff, might potentially reach levels below those viewed by the Committee as appropriate. 👉 Fed survey respondents forecast balance sheet runoff process concluding by mid-2025, slightly later than previously expected. Source: Bloomberg, TalkMarkets

"... a structural regime shift is finally happening within China's equity market..."

Morgan Stanley drops bearish China call. thru David Ingles on X

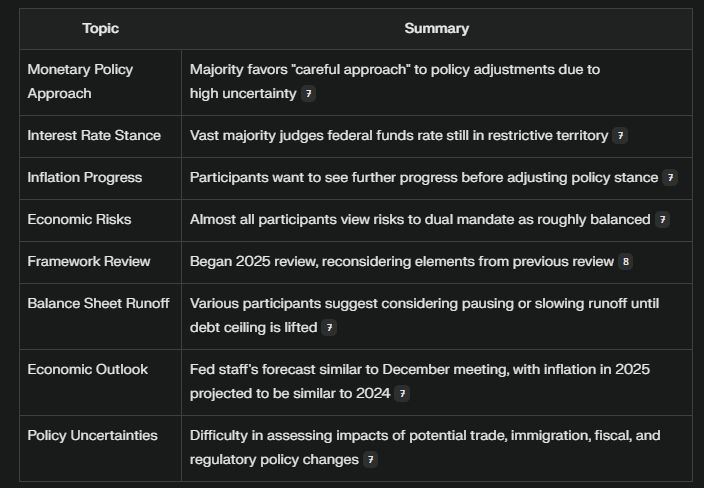

FOMC Minutes summary...

Source: Bloomberg, Mike Zaccardi

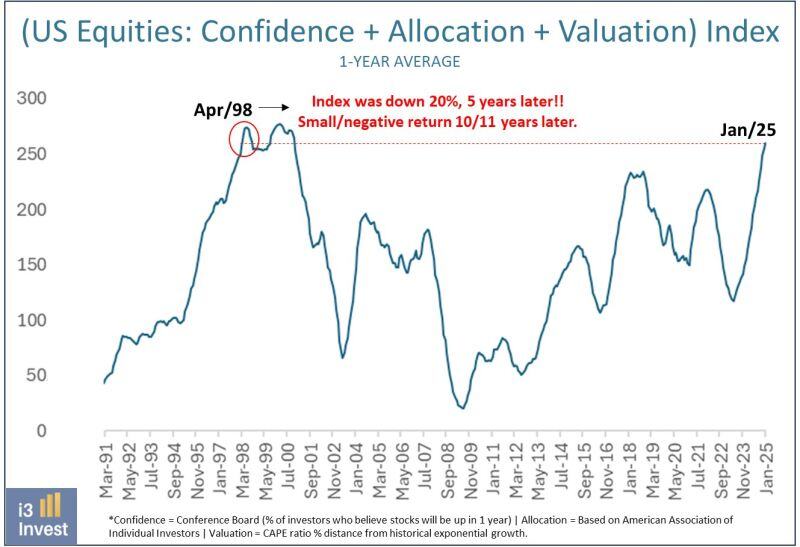

Interesting chart by Guilherme Tavares which calls for some caution on US equities:

1-Investors are extremely confident that stocks will go up 2-Individual allocation very high 3-Stretched valuation

EU SLAPS RUSSIA WITH NEW SANCTIONS

by Evan on X. As Trump’s administration hints at potential sanctions relief for Russia, the EU is doubling down with a fresh wave of restrictions, including a ban on Russian primary aluminum imports. Secretary of State Marco Rubio suggested that Europe will eventually have to join negotiations, stressing that “concessions on all sides” will be necessary to resolve the Ukraine conflict. Despite the shift in U.S strategy, EU leaders are holding firm, with Ursula von der Leyen insisting that the bloc remains committed to pressuring the Kremlin. Source: Euronews

Elon Musk considering sending $5,000 to EVERY SINGLE AMERICAN from DOGE savings...

Source: Barchart

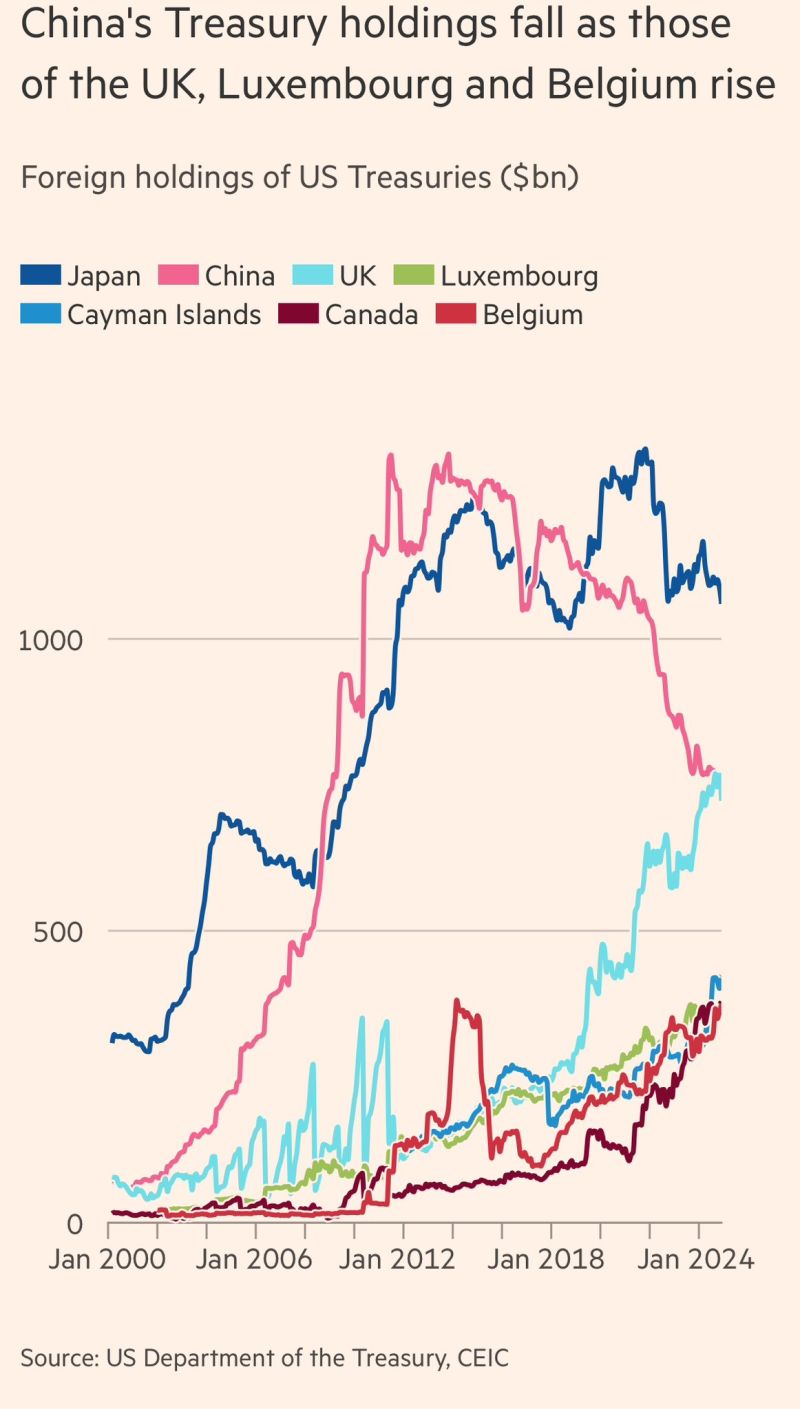

From the @FT article, “China’s holdings of US Treasuries fall to lowest level since 2009:”

“Analysts say the change partly reflects China’s desire to diversify its foreign reserves by buying assets such as gold. But they add that Beijing is seeking to disguise the true extent of its Treasury holdings by shifting them to custodian accounts registered elsewhere.” Source: FT, Mohamed El Erian

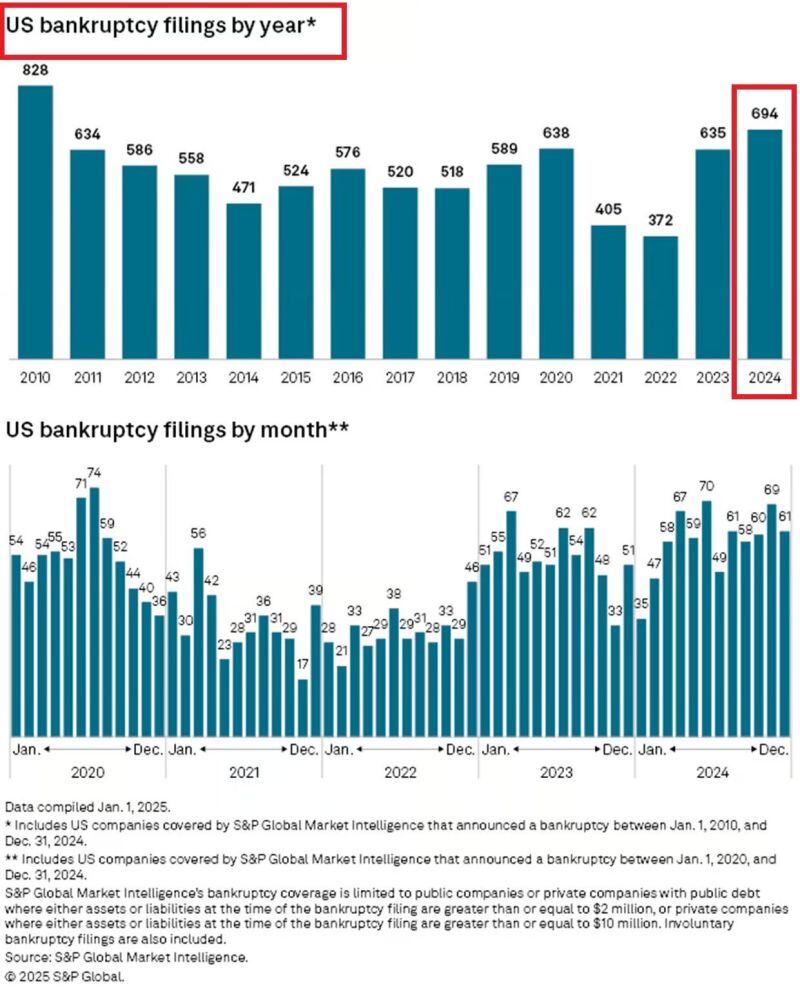

➡️ US large BANKRUPTCIES are accelerating:

There were 70 US bankruptcy filings in January, in line with the largest monthly number since the 2020 CRISIS. This comes after bankruptcies hit 694 in 2024, the most in 14 YEARS. Bankruptcies are rising as if there is a crisis. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks