Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

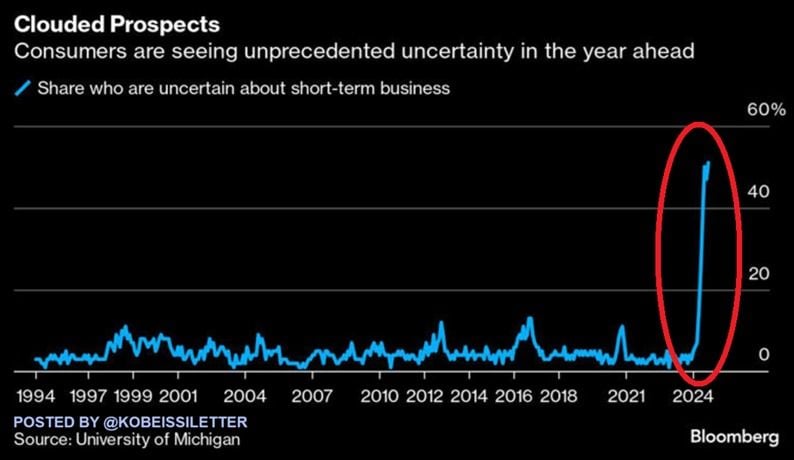

Americans have never been so worried about the year ahead:

The share of consumers uncertain about business conditions over the next year spiked to 51% in September, the most on record. The percentage has DOUBLED in 4 months. Over the last 30 years, the share of consumers concerned about short-term business prospects has never been so high. Americans have been hit by historically high costs of living, elevated borrowing costs, and the deteriorating job market. US households are struggling. Source: The Kobeissi Letter

US yieldcurve keeps steepening...

Source: Bloomberg, HolgerZ

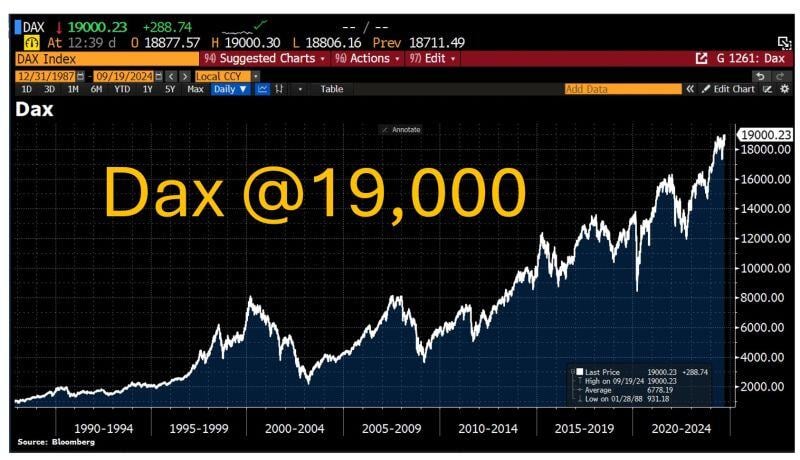

In case you missed it... While the german economy is struggling, the stock market doesn't care...

Germany's blue-chip index Dax jumped >19,000 points for the first time after Fed's jumbo rate cut. Source: HolgerZ, Bloomberg

BlackRock Reveals It’s Quietly Preparing For A $35 Trillion Federal Reserve Dollar Crisis With Bitcoin—Predicted To Spark A Sudden Price Boom

As fears swirl the U.S. dollar is on "the verge of a total collapse," the world's largest asset manager BlackRock has warned of "growing concerns" around the spiraling $35 trillion U.S. debt pile that's predicted to drive "institutional interest in bitcoin." "The growing concerns in the U.S. and abroad over the state of U.S. federal deficits and debt has increased the appeal of potential alternative reserve assets as a potential hedge against possible future events affecting the U.S. dollar," BlackRock's exchange-traded fund (ETF) chief investment officer, its head of crypto and its head of fixed income global macro wrote in a paper outlining the investment case for bitcoin. "This dynamic appears to be also taking hold in other countries where debt accumulation has been significant," the authors of the BlackRock paper added. "In our experience with clients to date, this explains a substantial portion of the recent broadening institutional interest in bitcoin." BlackRock, which has around $10 trillion in assets under management, described bitcoin as a "unique diversifier" to hedge against economic and political risk. "While bitcoin has shown instances of short-term co-movements with equities and other 'risk assets,' over the longer term its fundamental drivers are starkly different, and in many cases inverted, versus most traditional investment assets," the paper concluded. Source: Forbes Digital Assets >>> https://lnkd.in/ePufVM9J

Small Cap Stocks $IWM have now traded green for 7 consecutive days, their longest winning streak since November 2022

Souce: Barchart

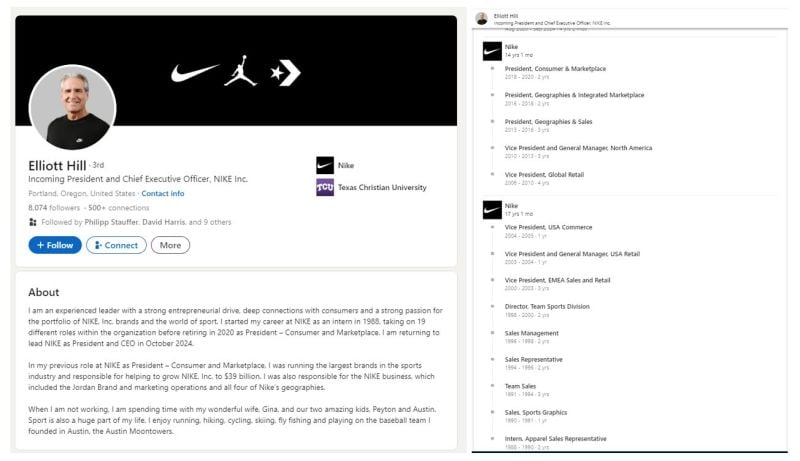

Watch out the Linkedin profile of Nike’s new CEO ...

32 years with the same company, from intern to CEO! https://lnkd.in/e-WA6aaK

Investing with intelligence

Our latest research, commentary and market outlooks