Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The former president had in February said Federal Reserve chair Jay Powell, a registered Republican, would cut interest rates to 'help the Democrats'.

https://on.ft.com/3B5Eg0O

BlackRock just put out a nine-page white paper that makes case for bitcoin ETF as a "unique diversifier" that can hedge against fiscal, monetary and geopolitical risks

also including section called "bitcoin's path to $1 trillion market cap". Read whole thing here: https://lnkd.in/e8XVW9gG Source: Blackrock

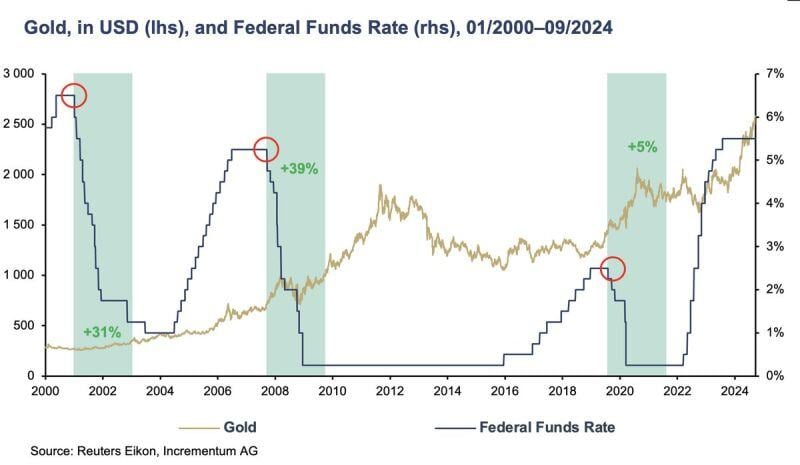

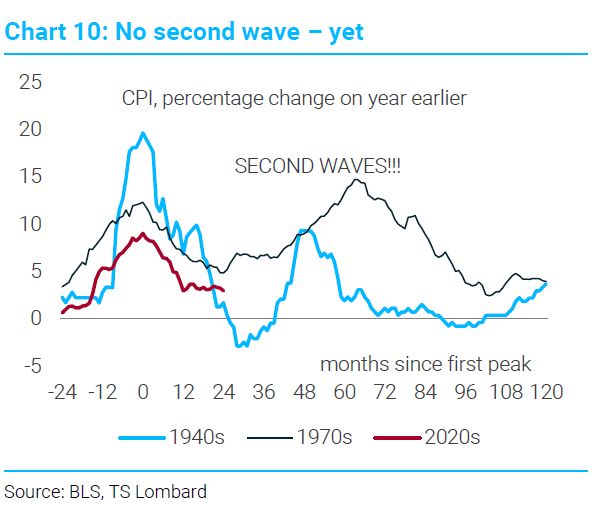

After yesterday jumbo Fed rate cut (days after core CPI MoM reaccelerarting), who doesn't have this chart in mind???

The Second Wave of Inflation. This is what the Fed is thinking but isn't saying out loud. If you expand the dataset to the CPI's of Western economies, 87% of the time there's a second wave. Source. TS Lombard, Eric Hale

The bulls are running WILD pre-market. Thank you Mr Powell...

$DIA +1.18% $SPY +1.61% $QQQ +2.18%

FED cuts rates by 50bp to 4.75%-5% range

The Federal Reserve lowered its benchmark interest rate by a half percentage point Wednesday, in an aggressive start to a policy shift aimed at bolstering the US labor market.Committee sees another half-point of cuts in rest of 2024Policymakers penciled in an additional percentage point of cuts in 2025, according to their median forecast.

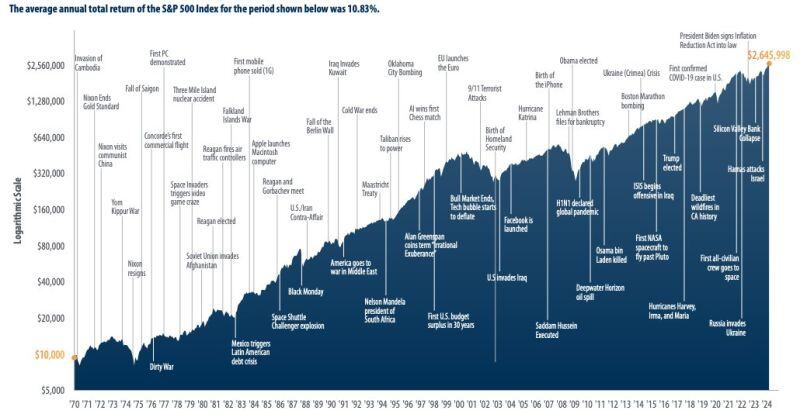

Regardless of what is happening in the world, or who happens to be President, the market finds a way forward.

Source: Peter Mallouk

Investing with intelligence

Our latest research, commentary and market outlooks