Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The $1.19 Trillion Elephant in the Room

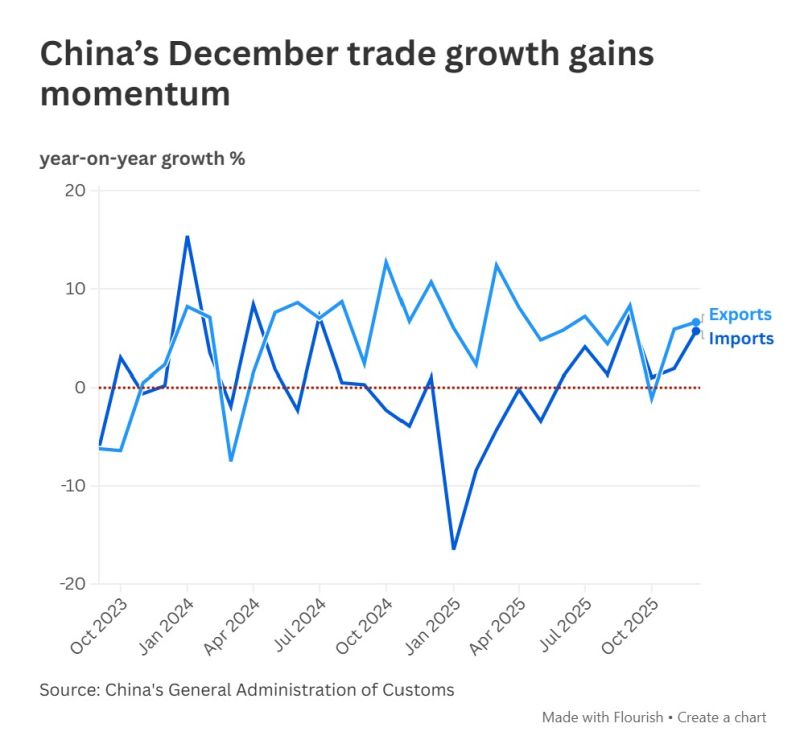

China’s December trade data just leaked, and it’s a masterclass in contradiction: ✅ The Good News: Exports beat expectations by 2x. Imports are at a 3-month high. The annual trade surplus hit a record high (up 20%). ❌ The Bad News: Trade with the U.S. is in freefall. Exports to the U.S. are down 30%. Imports from the U.S. are down 29%. What does this mean for 2026? - Diversification is king. China is filling the "U.S. gap" elsewhere. - Tariffs are working (but maybe not as intended). They are reducing bilateral trade, but China’s total global footprint is still growing. - Supply chains are shifting. Expect "China + 1" to move from a buzzword to a survival requirement. Source: CNBC

The Gold/Silver pair down to 52x - the lowest since Dec 2012

Since: zerohedge

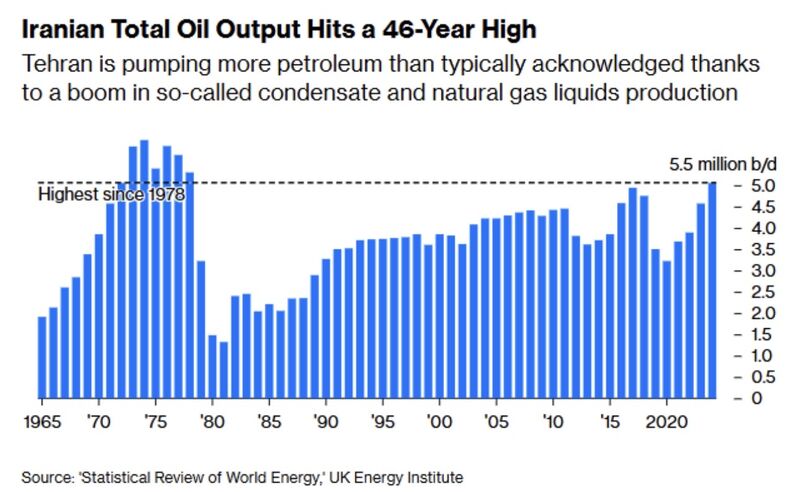

Iran’s Oil Output: A 46-Year Milestone You Might Have Missed

For the first time since 1978, Iran’s oil output has reached about 5.5 million barrels per day, marking a structural shift rather than a simple recovery. After years of volatility, production has surged since 2020, driven largely by growth in condensates and natural gas liquids (NGLs), which are less constrained by sanctions than conventional crude. Much of this supply is moving discreetly to China via shadow fleets, adding hidden liquidity to global markets and helping restrain oil prices despite geopolitical risks. Bottom line: Iran is re-emerging as a major energy player in a form that is harder to sanction, raising questions about how effective traditional oil sanctions remain in today’s market. Source: Jack Prandelli on X

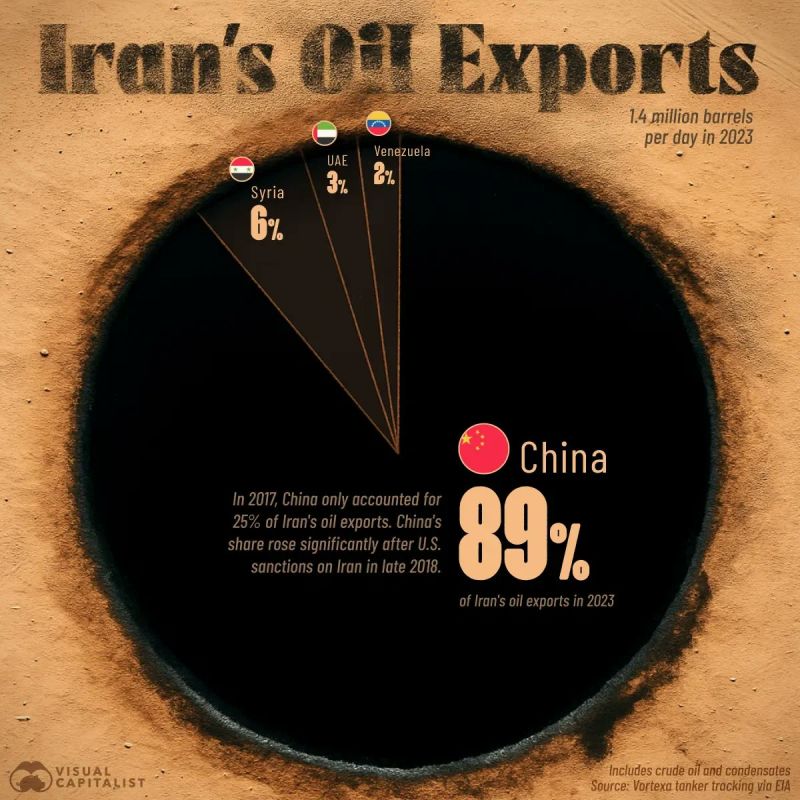

Iran is now the #1 risk for global oil markets

The global energy balance has shifted sharply as China now absorbs nearly 90% of Iran’s oil exports, up from 25% in 2017, creating a dangerous concentration of risk. Any disruption in Iran now directly threatens China’s energy security. The 2026 oil market is under pressure from rising political instability in Iran, already reflected in a $3–4/barrel geopolitical risk premium. Iranian oil stored offshore has reached record levels as buyers hesitate amid escalating sanctions and military risks. At the same time, the U.S. is threatening 25% tariffs on countries trading with Iran, extending the conflict from energy into global trade. With Iran increasingly reliant on Chinese “teapot” refiners, a break in this relationship could trigger severe economic fallout for Tehran and disrupt sanctioned oil flows globally. The system moving sanctioned oil is fragile, raising the risk of a supply shock for China and a major test of U.S. enforcement credibility. Source: Jack Prandelli in X, Visual Capitalist

The next 24 hours could be extremely volatile! supreme court tariff ruling is expected today at 10:00 am et

Markets price a 71% chance that courts rule Trump’s tariffs illegal, raising the prospect of $600B+ in refunds and significant market uncertainty. A non-consensus view argues the opposite outcome is more likely: keeping the tariffs may be less disruptive than reversing them. U.S. businesses have already adapted by restructuring supply chains, repricing goods, and adjusting investment plans, so a sudden rollback could punish those who adjusted and reward those who didn’t. Early fears of runaway inflation, collapsing earnings, and stalled growth have not materialized. Striking down the tariffs would also create legal and fiscal uncertainty around refunds and replacement measures, increasing volatility. Once embedded, tariffs function as a fiscal revenue tool, not just trade policy. Bottom line: The court may prioritize the least disruptive outcome—maintaining or modifying tariffs rather than eliminating them outright. Source: Cassian @ConvexDispatch, @BobEUnlimited

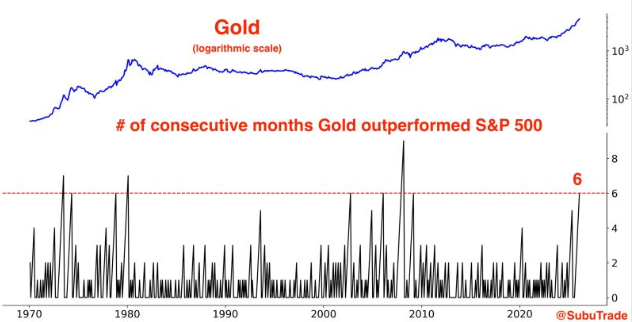

Gold has now outperformed the S&P 500 for 6 consecutive months, the longest streak since the Global Financial Crisis

Source: Barchart

Siegfried Holding rebounding from a major long-term level

After a 42% consolidation since September 2024, Siegfried is starting to show early signs of a trend change. 🔹 The stock successfully tested a major swing support zone at 56.60–70.35, a technically significant area 🔹 Volume is picking up, confirming renewed interest 🔹 A strong +24% move from the lows signals momentum returning ⚠️ That said, chasing the move here would be risky. After such a sharp rebound, patience is key. 👉 Pullbacks toward former resistance / short-term supports could offer much cleaner entry opportunities. This is a name to keep on the radar, not to rush into. Source: Bloomberg

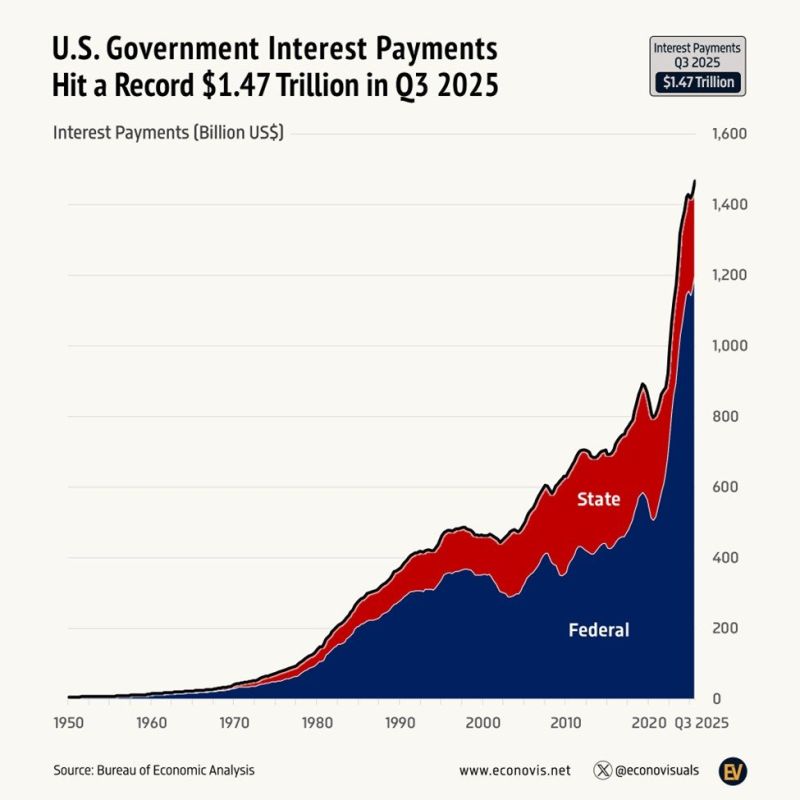

US government interest payments are now up to an annualized record of $1.47 trillion.

The Sovereignty Trap: By offshoring industry to China for higher margins, the West traded its independence for cheap labor; China now controls the minerals essential for Defense, EVs, and tech. Resource vs. Currency: The ability to print money is irrelevant if China refuses to sell the raw materials required for survival and industry. The Great Rebuild: To regain independence, Western nations are aggressively reshoring industry, stockpiling minerals, and rebuilding infrastructure. The Irony of Tech: Building the "New Economy" (Silicon Valley, AI, Green Tech) is impossible without massive amounts of "Old Economy" materials like copper, lithium, and steel. Source: Topdown charts, LSEG, Lukas Ekwueme @ekwufinance

Investing with intelligence

Our latest research, commentary and market outlooks