Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Great American Oil Paradox

The U.S. is executing a unique energy “double-play,” exporting massive amounts of light, sweet shale crude while still importing heavy, sour oil to match its legacy refinery infrastructure. This paradox being both a top exporter and importer makes the country the central hinge of the global oil market. Far from a weakness, this interdependence gives the U.S. leverage, allowing it to balance supply and influence prices worldwide as we head into 2026. Source: Jack Prandelli

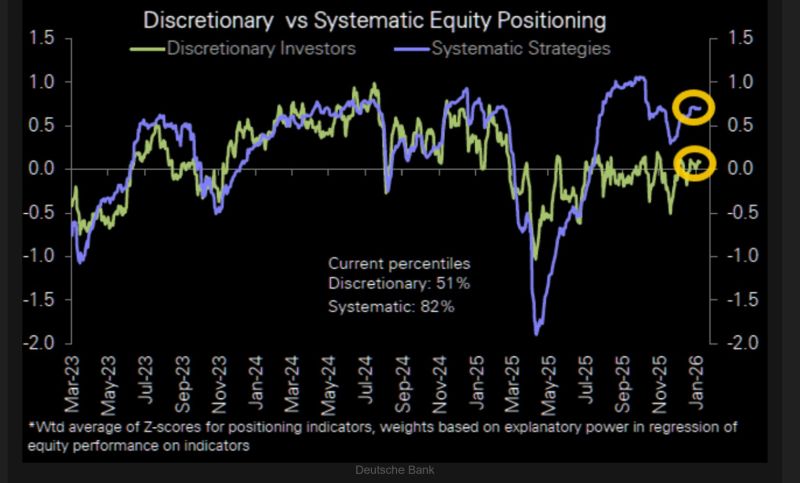

Believe it or not, investor's positioning on equities is still not over-extended.

Deutsche Bank: "Notably, while investor sentiment has risen meaningfully over the last 6 weeks, positioning in our reading has not yet followed, with discretionary investors are still holding cautiously near neutral (0.09sd, 51st percentile). Systematic strategy positioning though is higher (0.71sd, 82nd percentile)." Source: DB, TME

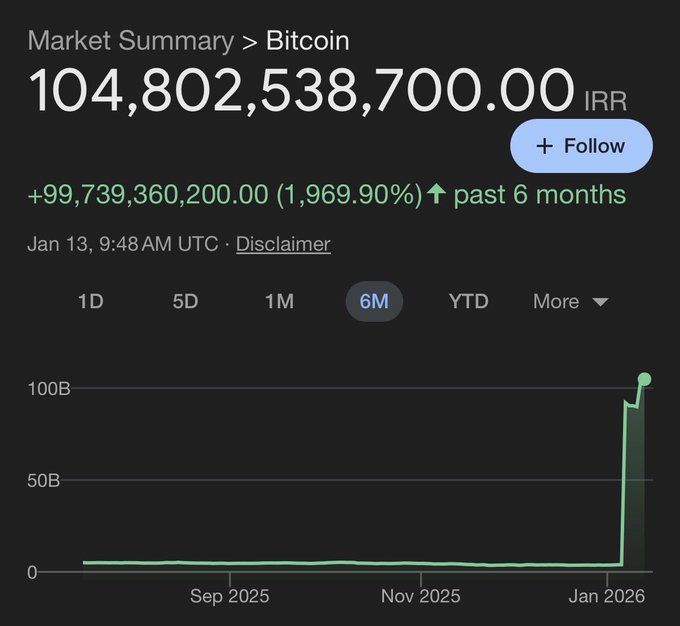

Bitcoin becomes King in Iran

As Iran’s currency collapses, Bitcoin is shifting from a theoretical hedge to a practical necessity. Hyperinflation in the rial is pushing citizens toward BTC as a store of value, while sanctions have made crypto an effective alternative to the traditional banking system. At the same time, Iran’s extremely cheap energy makes Bitcoin mining highly profitable, sustaining local supply that feeds sanction-bypassing channels. The combination of fiat collapse, sanctions, and energy arbitrage is driving a sharp surge in Bitcoin adoption and pricing relative to the rial. Source: Mario Nawfal

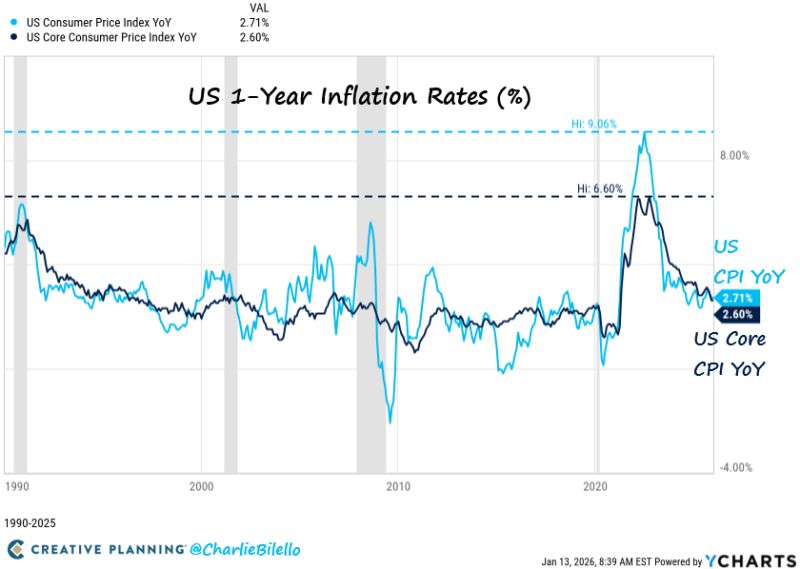

CPI Holds at 2.7% YoY as December Rebound Falls Short of Fears

The headline CPI print rose 0.3% MoM (vs +0.3% MoM exp) driving prices up 2.7% on a YoY basis (vs +2.7% YoY exp). Many expected a December pickup due to the unwinding of distortions from data-collection disruptions during the government shutdown, which amplified seasonal discounting in November. So the headline number is basically below most of “Whisper” numbers. Source: Charlie Bilello

U.S. Companies issued $95 Billion worth of bonds during the first week of the year, the highest weekly volume since Covid

Source: Barchart

Global Central Bankers in "Full solidarity" with Fed's Powell

Claims that the Fed is “losing independence” are being reframed by James E. Thorne as misleading. According to this view, Chair Powell publicly suggested the DOJ was threatening a criminal indictment over his testimony on costly Fed building renovations—despite the DOJ never using that term. The U.S. Attorney’s Office had repeatedly sought clarification on cost overruns and testimony accuracy, but those requests were ignored until grand jury subpoenas were issued, after which Powell framed the situation as retaliation. Monetary policy independence remains intact, but it does not imply immunity from fiscal or legal oversight. Invoking “central bank independence” in this context is seen as an attempt to shield the Fed from accountability rather than a genuine threat to rate-setting autonomy. Source: Bloomberg, James E. Thorne @DrJStrategy

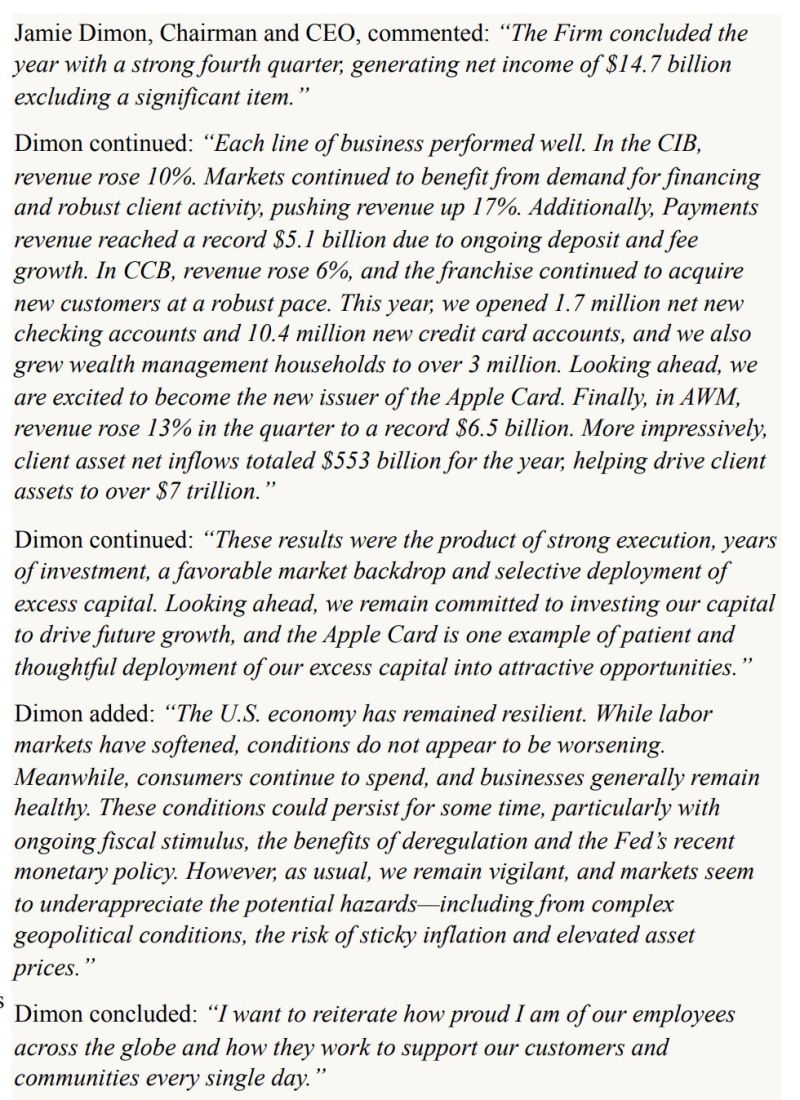

Jamie Dimon: U.S. Economy Remains Resilient Despite Softer Labor Markets

$JPM JP Morgan CEO Jamie Dimon: "The U.S. economy has remained resilient. While labor markets have softened, conditions do not appear to be worsening. Meanwhile, consumers continue to spend, and businesses generally remain healthy. These conditions could persist for some time..." Source: The Transcript

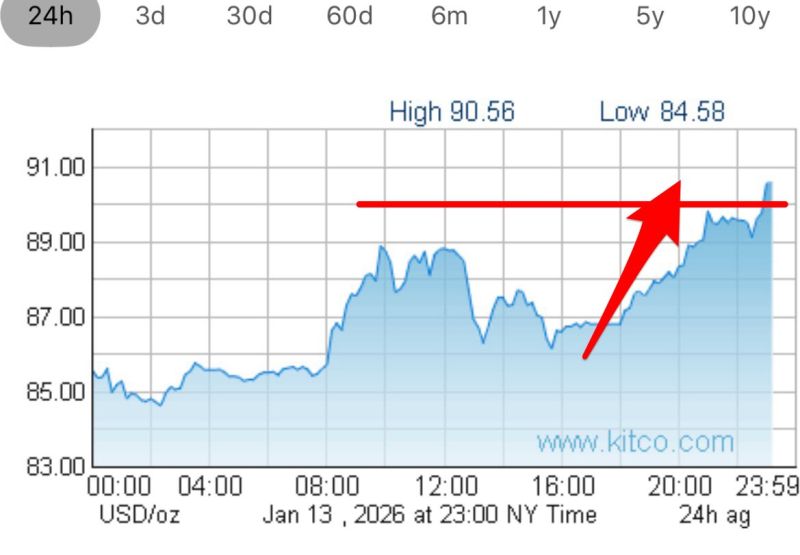

Silver storms through the $90 level. This is unprecedented! Both exciting & concerning at the same time.

Source: Silver Gold News

Investing with intelligence

Our latest research, commentary and market outlooks