Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Treasury Secretary Scott Bessent goes full fire on Powell

Sec. Bessent says the probe into Fed Chair Jerome Powell is 100% justified, “NOBODY is above the law!” “There NEEDS to be some accountability!” “The Fed is now LOSING $100B a year! $100B! With NO accountability!” Jerome should RESIGN, NOW. The Fed’s bleeding billions under Powell’s watch, time for real oversight and America First monetary sanity. No more excuses! Source: @GuntherEagleman

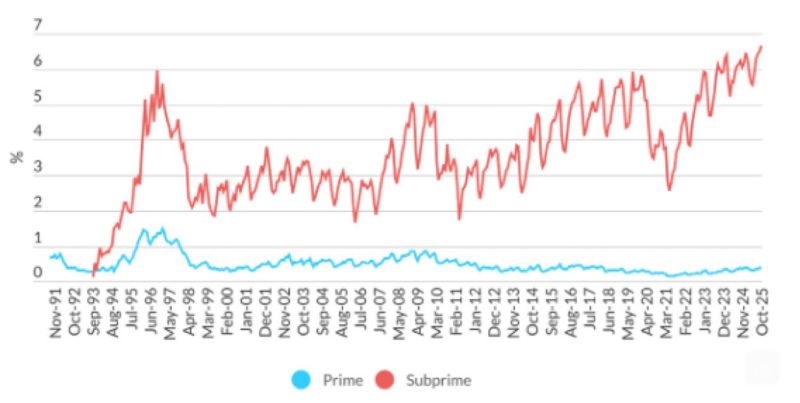

% of subprime auto loans that are 60 days or more overdue on their payments hit an all-time high of 6.65%

Source: Barchart

"Winner Winner": $CRML's Record-Breaking Day

Critical Metals $CRML, which controls one of the largest rare earth deposits in the world (also in Greenland), just soared more than 32% yesterday for one of its best days in history Source: Barchart

The Correlation Between Gold Prices and Japanese Bond Yields (2013–2025)

Gold (in organe) and 10-year JGB yields (in blue). Japan was always the endgame Source: www.zerohedge.com

Germany's Merz admits: It was a serious strategic mistake to exit nuclear energy.

Friedrich Merz just plainly admitted: ditching nuclear was "a serious strategic mistake" and Germany's running the world's most expensive energy transition. "At least 3 years ago we had to leave the last remaining nuclear power plants in Germany on the grid so that we at least had the power generation capacities we had at that time. We have taken over something that we now have to correct. But we just don't have enough energy generation capacities." Source: Mario Nawfal on X

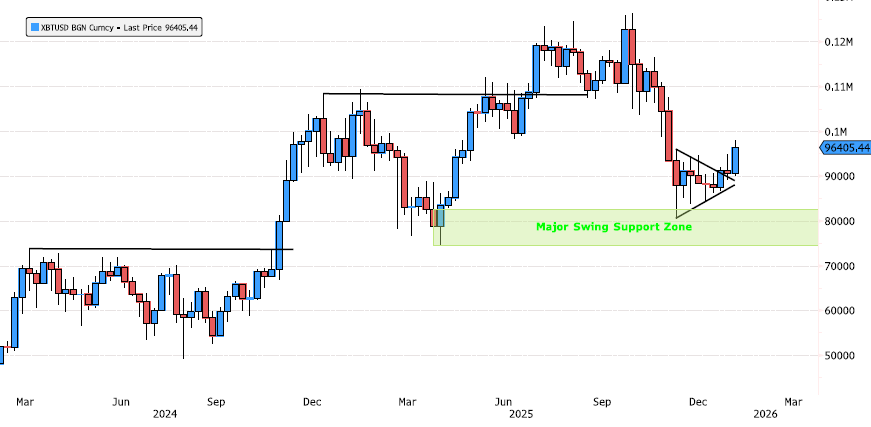

Bitcoin: Breakout After a 36% Consolidation – Strength Building Up

Bitcoin has consolidated 36% since the October highs, digesting gains in a healthy and structured way. 🔺 Over the past 8 weeks, price action formed a triangle consolidation, now breaking out to the upside 📉 The move successfully tested the major swing support zone at 74’545 – 82’531 📐 Price traded back to the 78.6% Fibonacci retracement, a level often seen in strong continuation trends 🔍 What matters next: ➡️ A weekly close above 96’000 would significantly strengthen the bullish scenario and confirm renewed upside momentum. As always, patience and confirmation remain key at these levels. Source: Bloomberg

THE HOUSING MARKET JUST WOKE UP

The U.S. housing market is showing a sharp revival, driven by a 28.5% surge in mortgage activity last week. Triggered in part by President Trump’s plan for Fannie Mae and Freddie Mac to buy $200 billion in mortgage-backed bonds, the 30-year fixed rate briefly dipped below 6%, fueling demand. Refinances jumped 40% week-over-week (up 128% vs. last year), while total applications soared as long-idle borrowers finally acted. Economists note this reflects pent-up demand rather than just temporary post-holiday noise, signaling a potential broader market rebound. Is the sub 6% era back for good, or is this a temporary window? Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks