Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

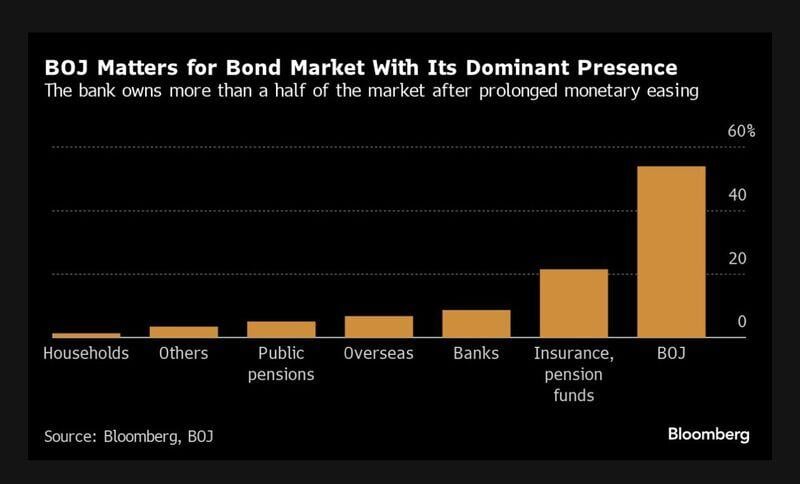

📢 📢 📢 The Bank of Japan kept its benchmark interest rate unchanged on Friday, but indicated it’s considering the reduction of its purchase of Japanese government bonds.

The central bank left short-term rates unchanged at between 0% to 0.1% at the end of its two-day policy meeting, as widely expected. But notably, the bank said in its statement it could reduce its purchases of Japanese government bonds after the next monetary policy meeting, scheduled for July 30 and 31. QE tapering in Japan has a lot more potency than in the U.S., sheerly because of how much of the bond market the BOJ owns. Following the BOJ decision, the Japanese yen weakened 0.5% to 157.8 against the U.S. dollar, while the yield on 10-year JGB fell 44 basis points to 0.924. So absolutely no panic... Source: Bloomberg, CNBC

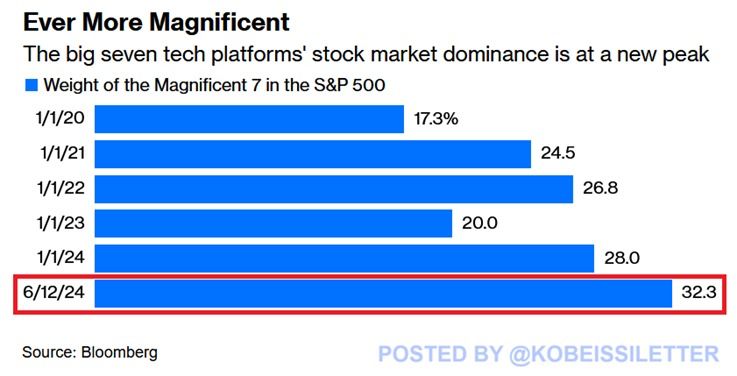

The Magnificent 7's share of the SP500 just hit another all-time high of 32%.

This is 12 percentage points higher than at the beginning of 2023. The weight of these 7 stocks in the index has almost DOUBLED in just over 4 years. This comes as the 3 largest stocks, Apple, Microsoft, and Nvidia, are all officially worth over $3 trillion. Meanwhile, the technology sector just hit another all-time high relative to the S&P 500. Tech is becoming even more dominant. Source: Bloomberg, The Kobeissi Letter

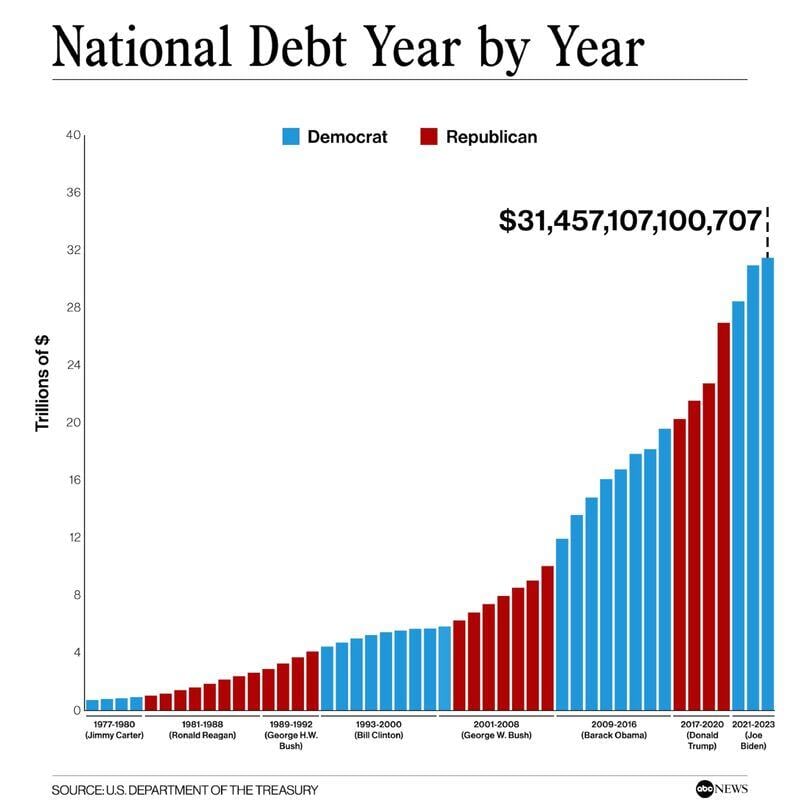

There are 3 sure things in life: death, taxes… and the rise of National debt (whoever is in the White House)

Source: EricOfRivia⚡️🍕

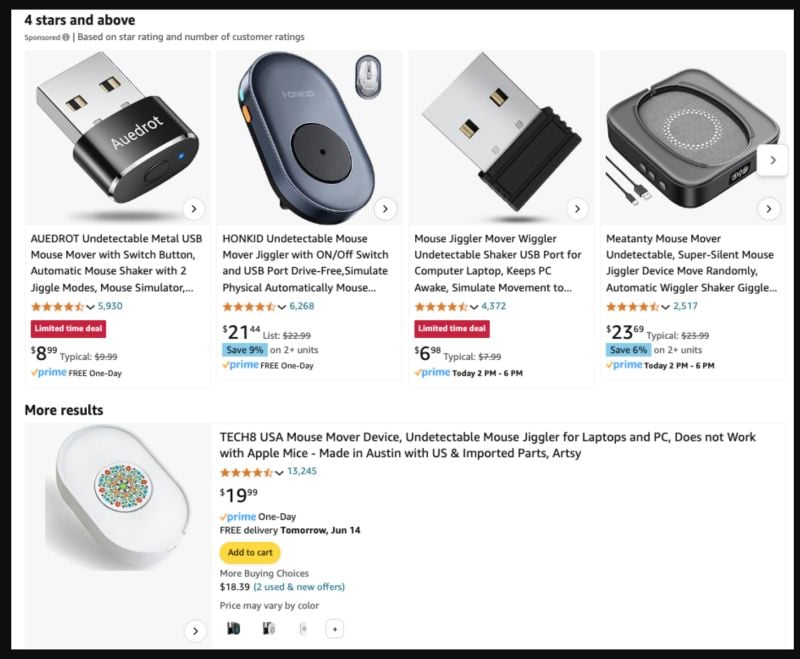

Wells Fargo Fires Employees Over "Mouse Jigglers"

In the era of hybrid work, with employees splitting their time between two days in the office and three days working remotely, employers have ramped up using productivity monitoring software. However, employees have outsmarted some of these surveillance programs with gadgets like mouse movers, otherwise known as 'mouse jigglers.' The popularity of mouse jigglers has exploded on TikTok in the last several years. Firms have been cracking down on these devices following a surge in fake work activity, which has weighed on productivity. Wells Fargo, in a new disclosure with the Financial Industry Regulatory Authority, first reported by Bloomberg, had terminated over a dozen employees in its wealth- and investment-management unit for their use of mouse jigglers. They were "discharged after review of allegations involving simulation of keyboard activity creating the impression of active work," according to the disclosures. On Amazon, some of the top-ranking mouse jigglers sold have thousands of reviews and range in price between $6 and $25. Google Trends shows a massive search spike for these devices in 2022. The bank's Finra disclosure does not indicate whether the employees were fired for faking work at home or in the office. It's unclear how the employees were caught, and if the bank opted to use other forms of surveillance to catch the employees faking work. Major banks, including JPMorgan Chase and Goldman Sachs, were among the most aggressive institutions in ordering workers back to the office after the government enforced lockdowns. The jiggler is just proof of the unintended consequences of remote working. Instead of employers micromanaging their workforce with mass surveillance, perhaps implementing baseline objectives for them... Source: www.zerohedge.com

Brent Crude Oil could plummet to $60/barrel in 2025 warns Citi

Source. Barchart

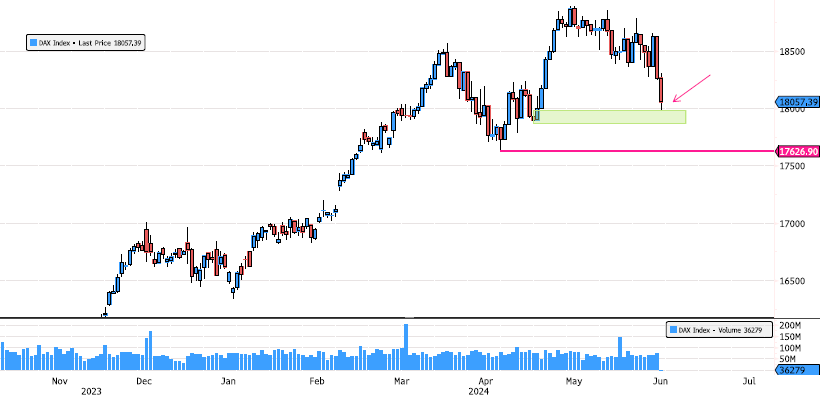

Dax Index Reached First Support

The Dax Index has just reached support zone 17,876-17,982. This level is also a 61.8% Fibonacci retracement of the last swing. The level that mustn't break remains the swing low at 17,626. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks