Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

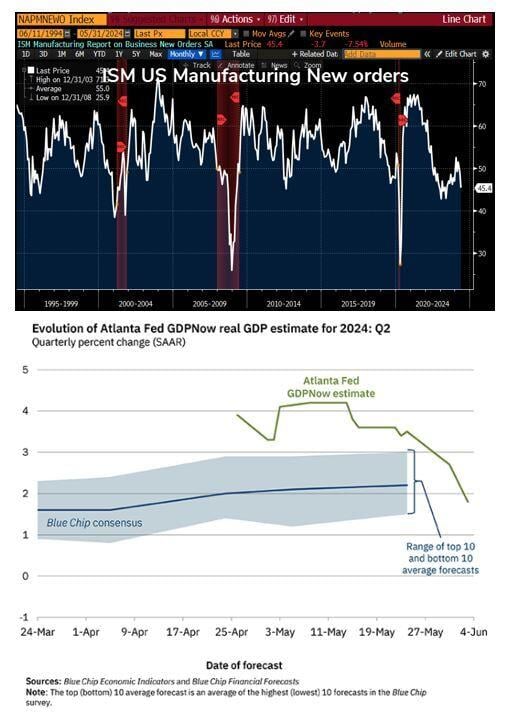

Atlanta Fed US Q2 GDP estimate plunges to 1.8% from 2.7% on May 31, and from 4.1% two weeks ago

Source: zerohedge

BREAKING: Mexico's stock market ETF, $EWW, crashes 11% after as the Mexican stock market posts its worst day since 2008.

The Mexican Peso also lost 4.5% against the US Dollar in its biggest one-day drop in years. This comes after Claudia Sheinbaum was elected as the next president of Mexico. Source: The Kobeissi Letter

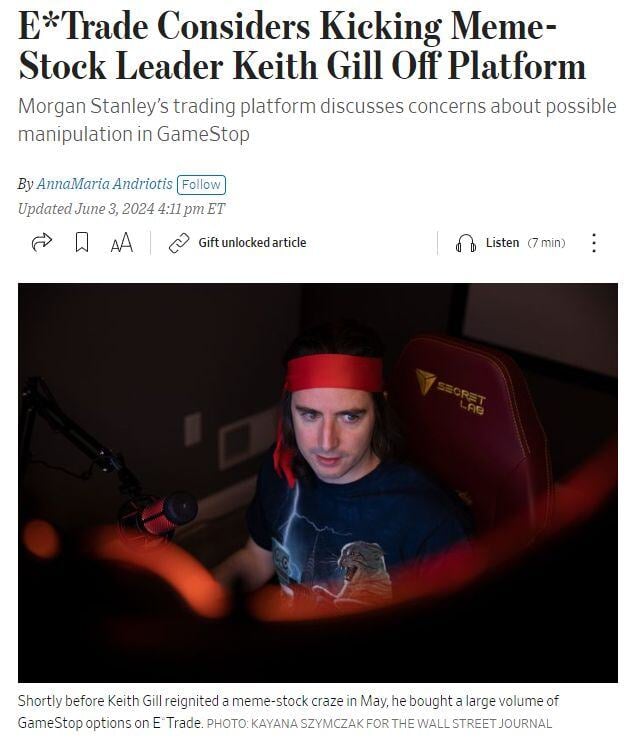

BREAKING 🚨: Roaring Kitty

E*Trade is reportedly discussing whether to remove Roaring Kitty from its platform Source: Barchart

Japan owns $1.2 trillion of US Treasuries.

As Japanese yields rise, the domestic market will attract dollars away from US debt. "Rising long-term interest rates in Japan put upward pressure on long-term US Treasury yields:" Apollo's Torsten Slok Source: Bloomberg, Lisa Abramowitz

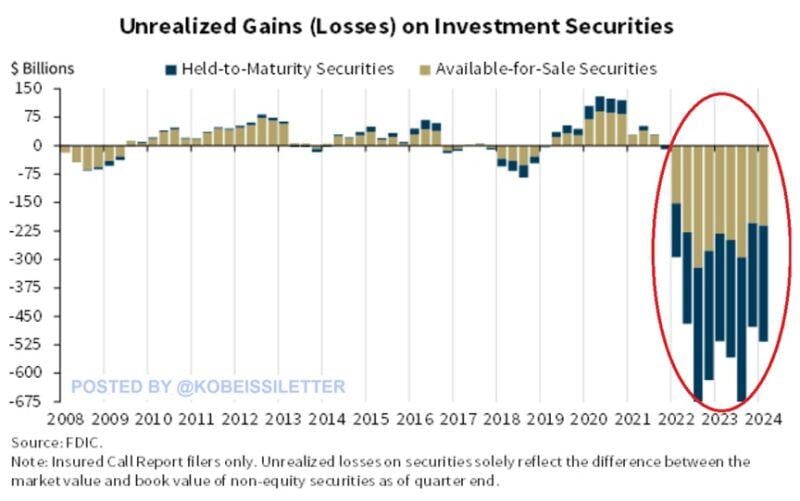

BREAKING: U.S. Banking System >>> FDIC warns that 63 Lenders are on the brink of insolvency due to banks sitting on $517 billion in unrealized losses

This is $39 billion higher than the $478 billion recorded in Q4 2023. The surge was driven by higher residential mortgage-backed securities losses held by banks due to rising mortgage rates. Q1 2024 also marked the 10th consecutive quarter of unrealized losses, an even longer streak than during the 2008 Financial Crisis. As “higher for longer” returns, unrealized losses are likely to continue rising. Source: BofA, The Kobeissi Letter

Two clear indications yesterday that the US economy is (finally) slowing down:

1) ISM Manufacturing New Orders rolling back over to 45.4 vs survey of 49.4; 2) Atlanta Q2 GDPNow dropped to 1.8% from 2.7% last week. And down from 4.2% in mid May... Source: Bloomberg, AtlantaFed

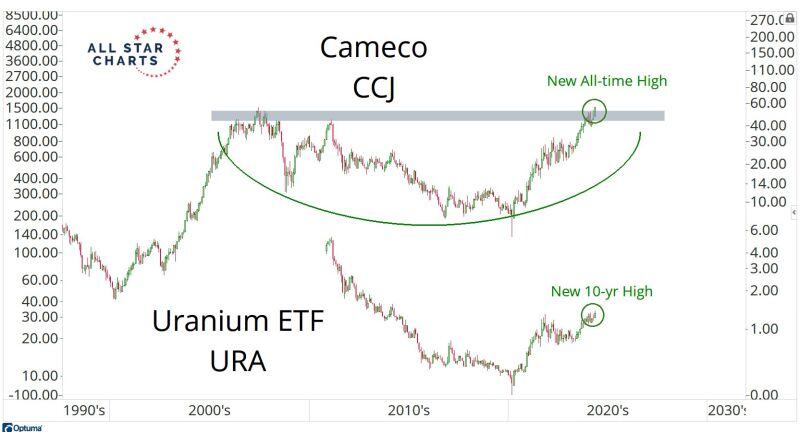

Interesting technical development for the uranium mining stocks with the $URA ETF trading at a 10-year high while sector leader Cameco $CCJ is trading at a new all-time-high.

Source: J-C Parets

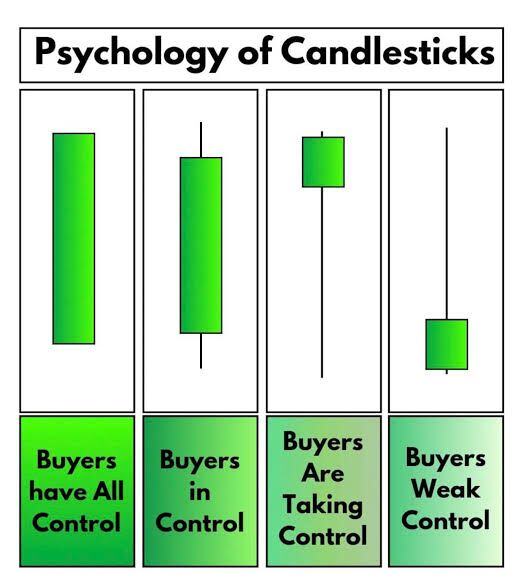

Psychology of candlestick in one image courtesy of Market Insights

Source: Market Insights

Investing with intelligence

Our latest research, commentary and market outlooks