Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

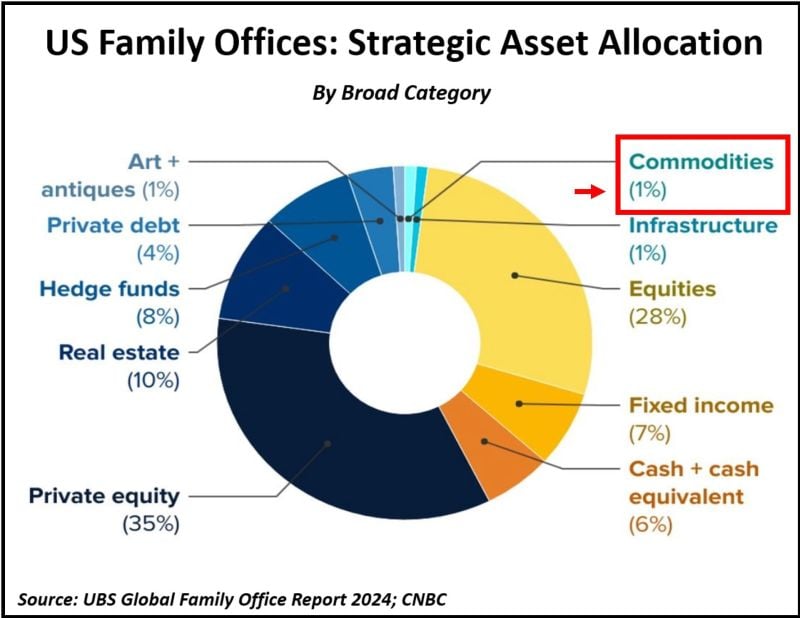

US family offices currently allocate just 1% of their assets to commodities, including gold.

Source: UBS, Tavi Costa

BREAKING >>> The Fed held rates unchanged as expected...

*FED HOLDS BENCHMARK RATE IN 5.25-5.5% TARGET RANGE And changed wording on inflation (from a "lack" of progress): *FED: INFLATION MADE MODEST FURTHER PROGRESS IN RECENT MONTHS BUT... The dot-plot was hawkish, adjust to just one 25bps cut in 2024 (and four 25bps cuts in 2025) *FOMC MEDIAN FORECAST SHOWS 25 BPS RATE CUTS IN '24 VS 75 BPS *FOMC MEDIAN FORECAST SHOWS 100 BPS RATE CUTS IN '25 VS 75 BPS There is another notable development: The longer-run estimate of the federal funds rate has gone up to 2.8% now, in the median forecast. That’s the second straight increase. Last time it had ticked up to 2.6% from 2.5%. So, in six months, policymakers have added more than a quarter percentage point to where they see the benchmark rate over the longer haul -- the so-called neutral rate. Additionally, The Fed increased its end-2024 expectations for inflation...but kept its unemployment expectations unchanged... There were 10 Fed members who saw rates at 4.625% or below by end 2024 in March... now there are none... There were NO dissents today, extending the streak of zero votes against the FOMC policy decision to 16 meetings, the longest period of no dissents since Alan Greenspan’s 17-meeting streak from August 2003 to September 2005. Today’s reassuring CPI report was relayed to FOMC members during the meeting, but many may be waiting for additional inputs (eg, PPI, PCE) before changing their forecasts. Bottom-line: The Fed re-arranged 2024-2025 dots from (2+3) to (1+4), and marked-to market their Core PCE forecast for year-end - signalling they are just being extra careful, and want some more evidence before committing to a cut. On our side, we still expect monetary policy to normalize in the months to come. We expect the Fed to continue their "meeting by meeting" approach with our base case being a cut in September. Indeed, it will take at least several more months of data to gain confidence that inflation is behaving in a manner the Fed finds acceptable. One key takeaway from today is that there’s a significant number of FOMC members that may prefer to wait even longer than September if upcoming data do not give them additional cover. Source: Bloomberg, www.zerohedge.com

June FOMC decision >>>

The biggest surprise in the dot plot: 3 cuts in 2024 revised to just 1 cut Source: zerohedge

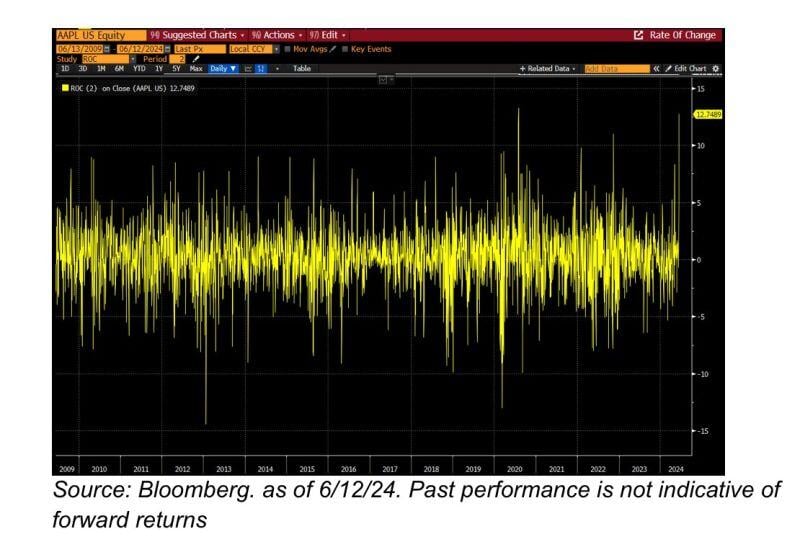

Apple $AAPL … stock up ~12.5% in 2-days, the biggest 2-day move in 15+ years (save a 2-day stretch in Mar’20 off the COVID lows) …

over this stretch, Apple has added nearly ~$400bn in mrkt cap .. larger than the current market cap of 480 co’s ..” - GS desk Source: Carl Quintanilla, Bloomberg

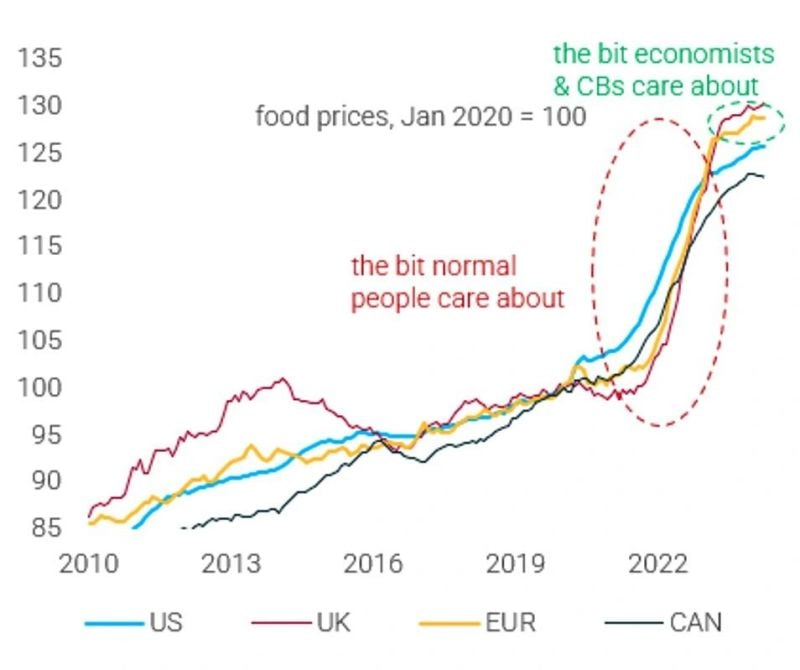

This chart from BofA is among Powell worst nightmares... and explain the FED reluctance in cutting rates too fast.

They will remain data dependent.

Mains Street vs. Wall Street: "Normal people have a different way of looking at inflation compared to economists/central bankers."

(There is one consequence of this dichotomy by the way: the rise of populists parties which will increase public spending bringing in more inflation...) Source: TS Lombard Research Partners Dario Perkins via Daily Chartbook

With fiscal deficit over 5% during good times France is at risk of facing a debt crisis whoever wins next elections

Source: Bloomberg, Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks