Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What were hedge funds buying in Q2?

(source: App Economy Insights) Here are some findings when diving into 13F: 🤖 AI models ⚙️ Semiconductors 🎤 A bit of Taylor Swift 💊 And... weight-loss drugs?!

Hedge funds top 5 holdings Q2 2023

Recurring #themes: Hyperscalers $AMZN $GOOG $MSFT Semiconductor $AMD $NVDA $TSM Consumer tech $AAPL $TSLA Specialty Retail $BBWI $RH Global apps $META $NFLX Payments $MELI $V Source: App Economy Insights

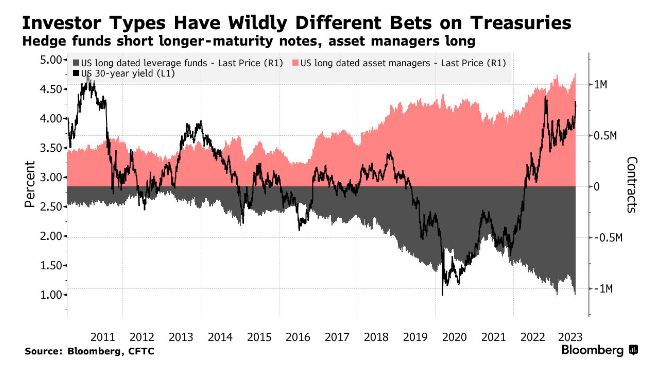

One asset class - two different bets => hedge funds are shorting US treasuries at historic levels while asset managers are doing the exact opposite 👀

Source: Barchart, Bloomberg

Microsoft is in talks to acquire a 49% stake in ChatGPT owner OpenAI

OpenAI is currently raising funds at a $29 billion valuation and is allowing employees along with early investors to sell their shares at that valuation. Microsoft has already invested $1bn into the company in 2019 and is now looking to invest another $10B into OpenAI. Microsoft would receive 75% of OpenAI’s income until it has recovered its initial investment. Once they hit that threshold, they would have a 49% stake in OpenAI, with other investors taking another 49% and OpenAI's nonprofit parent getting 2%. Open AI are expected to generate ~1 Billion in revenue in 2024. Source: Finimize Image: The first day of OpenAI, 7 years ago (by Sam Altman)

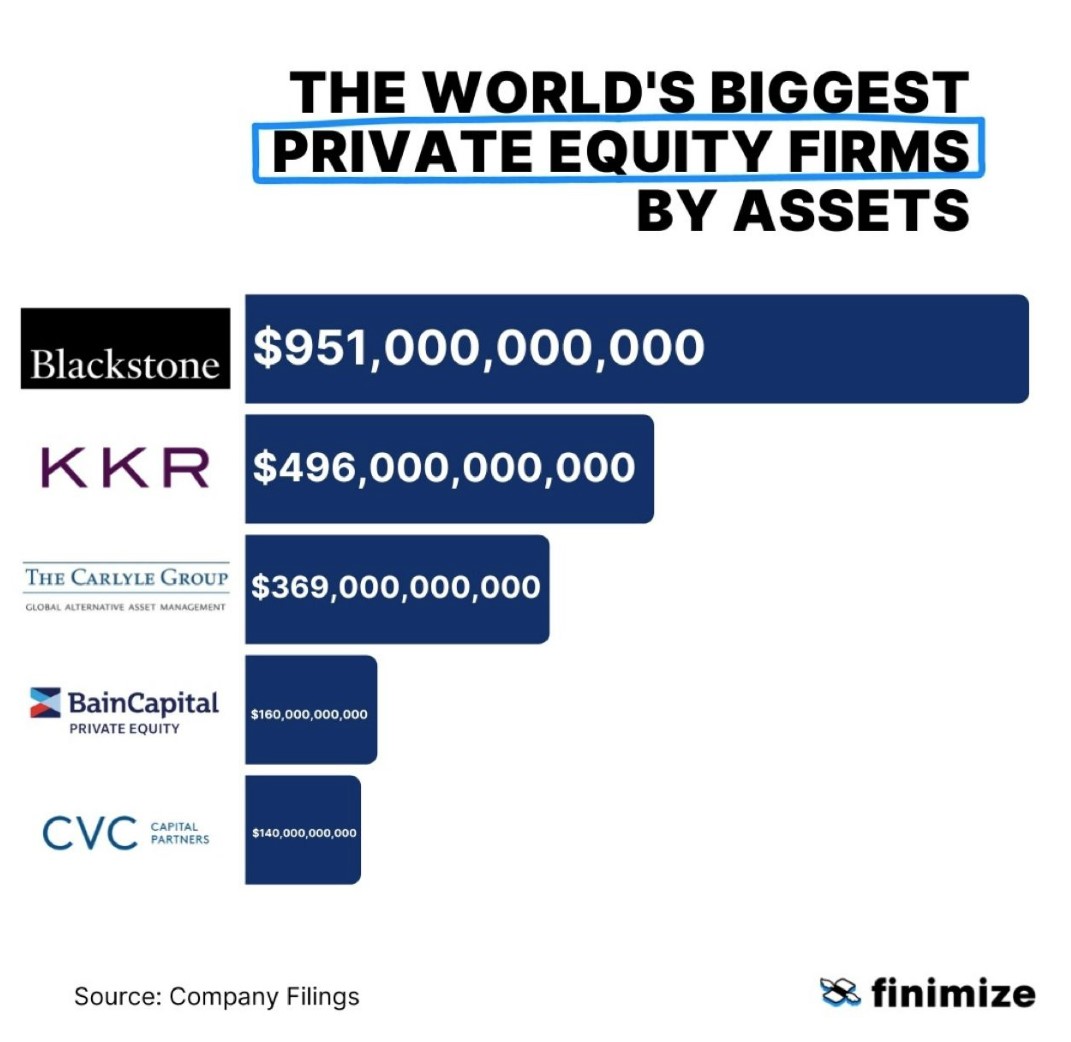

The World's Largest Private Equity Firms By Assets Under Management (AUM)

Source: Finimize

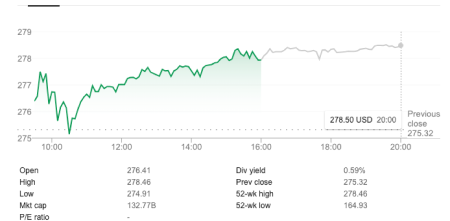

#Samsung posts upbeat #earnings ! #stocks #trading #markets #Nasdaq #trending

Samsung reported better than expected revenue, signaling tech earnings may not be as bad as some feared about weakening demand and a rise in material costs. Investors are slowly shifting toward the view that the economic slow down may not be as painful as thoughts a few weeks earlier and there are increasing signs that inflation should ease in the medium term.

Investing with intelligence

Our latest research, commentary and market outlooks