Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

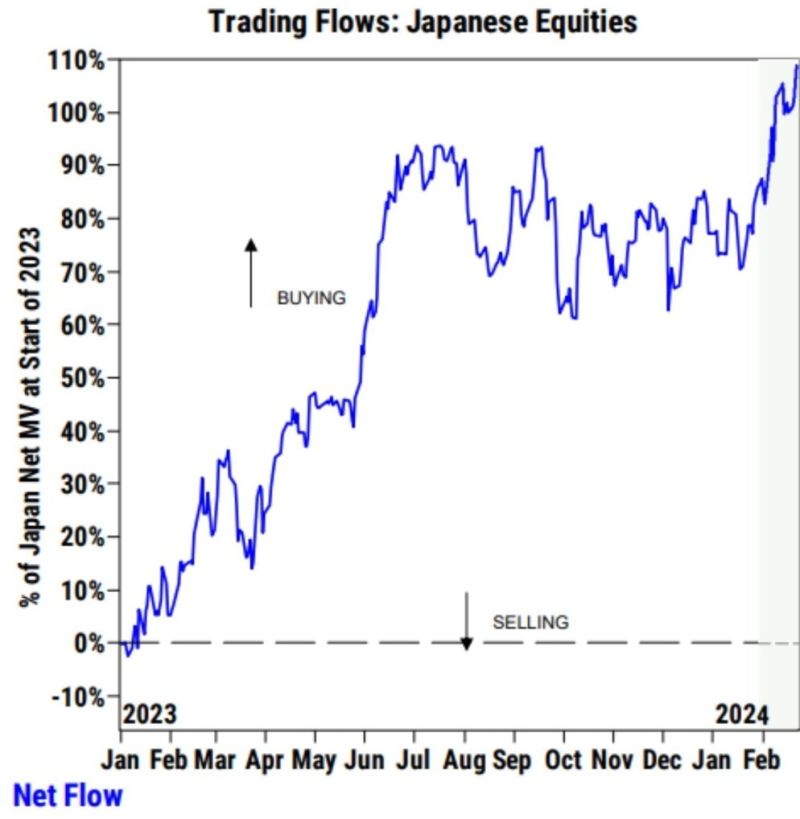

Hedge funds are loading up on japanese stocks with the Nikkei at all-time highs

Source: Win Smart, CFA

Chinese Authorities froze a quant hedge fund's account for 3 days after it dumped more than $360 million worth of stocks within the first minute of trading.

Source: Barchart

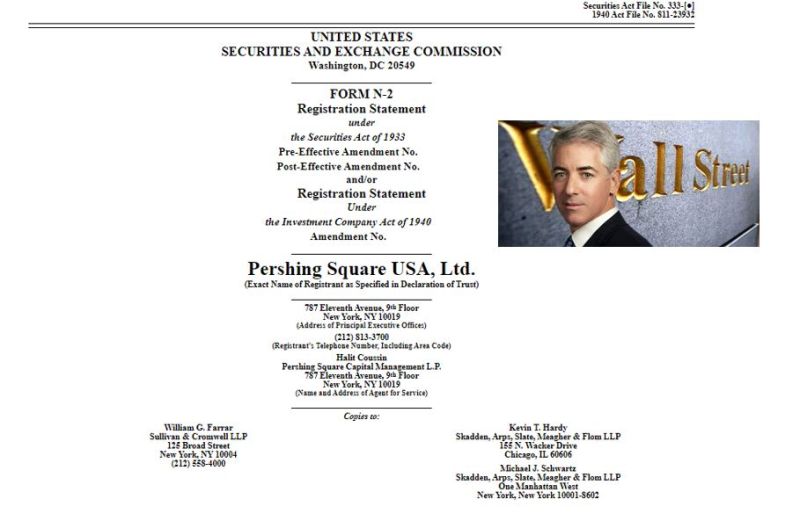

Hedge fund billionaire Bill Ackman to launch a NYSE-listed fund for regular investors

The hedge fund billionaire is planning to launch a closed end fund, investing in 12 to 24 large-cap, investment grade, “durable growth” companies in North America, according to a regulatory filing. There will be no minimum investment. Unlike traditional hedge funds that typically charge a 2% management fee on the total assets under management plus a performance fee of 20% of the fund’s profits, Ackman’s new fund doesn’t have a performance fee in place. source : cnbc

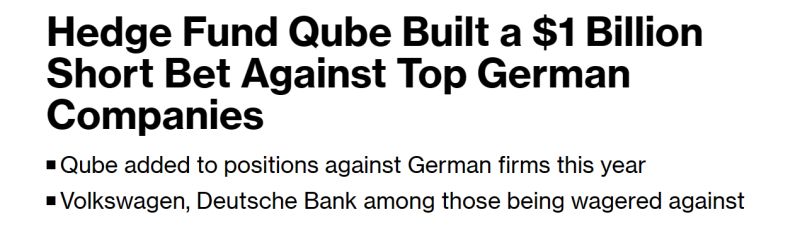

Germany's Dax closed at fresh all-time-high just as hedge fund Qube built a $1bn short bet against top German stocks

Volkswagen, Deutsche Bank, Rheinmetall, Siemens Energy, Hellofresh, and Morphosys are among those being wagered against. Source: Bloomberg

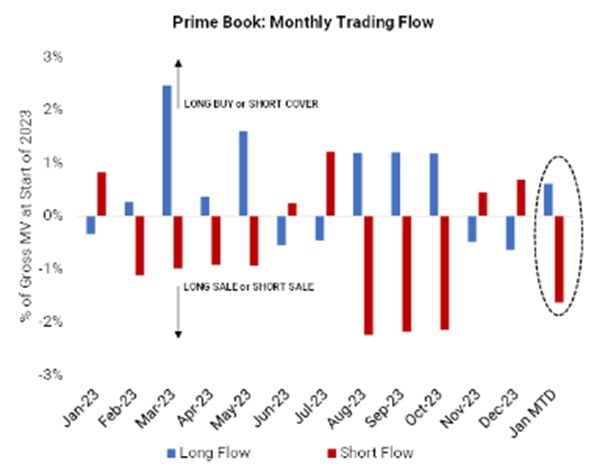

As stocks hit all-time highs, hedge funds are massively shorting stocks Goldman trading desk: "equity skeptics have piled on short bets

Per our Prime Team, shorts outpaced longs by 2:1 this past week, and 3:1 YTD. " Source: Goldman Sachs, www.zerohedge.com

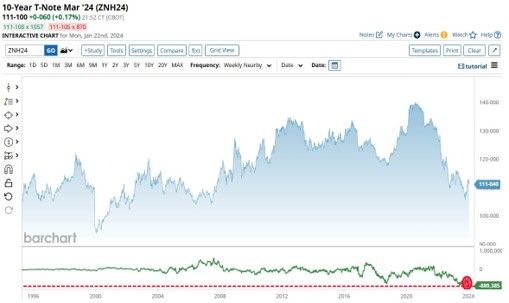

10-Year Treasury Largest Short Position in History 🚨: Hedge Funds are now short more than 889,000 contracts on the 10-Year Treasury, the largest 10-Year Treasury short position in history

Source: Barchart

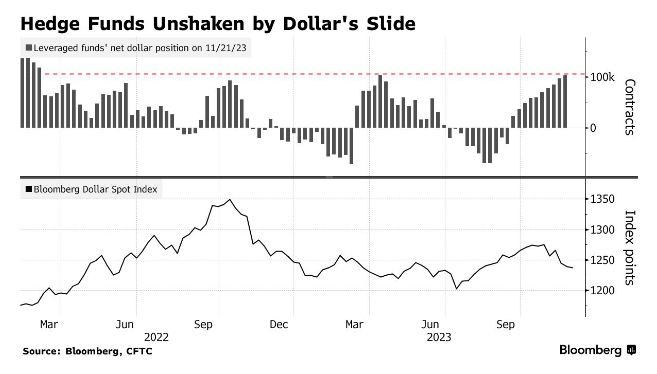

Hedge Funds now have the largest long position in the US dollar since February 2022

Source: Barchart, Bloomberg

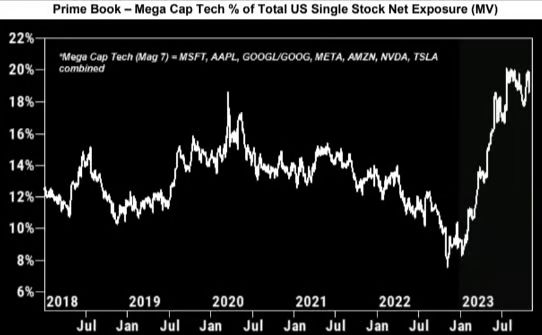

Hedge Fund exposure to the Magnificent Seven is quite high, according to data from Goldman Sachs

Source: Markets Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks