Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

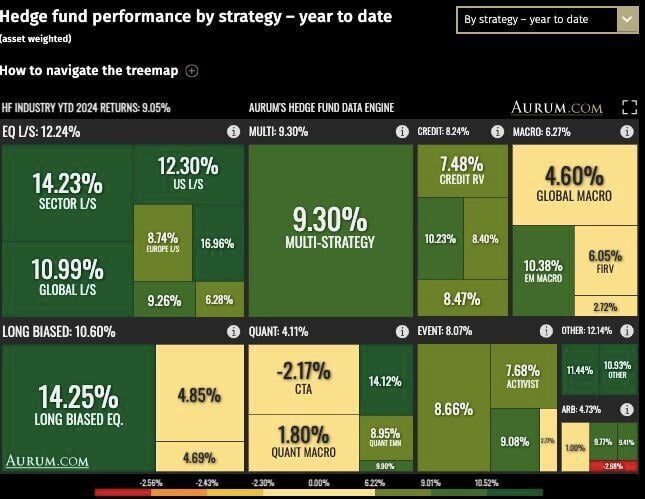

Hedge fund indices YTD performance by strategy as of 31/10/2024.

The top 5 hedgefund strategies according to Aurum database as of October 2024 were: 1) Equity long/short - AsiaPac (L/S) stands at 16.9% YTD. 2) Long biased equity stands at 14.2% YTD. 3) Equity long/short - Sector (L/S) stands at 14.2% YTD. 4) Quant - Multi stands at 14.1% YTD. 5) Equity long/short - US (L/S) stands at 12.3% YTD.

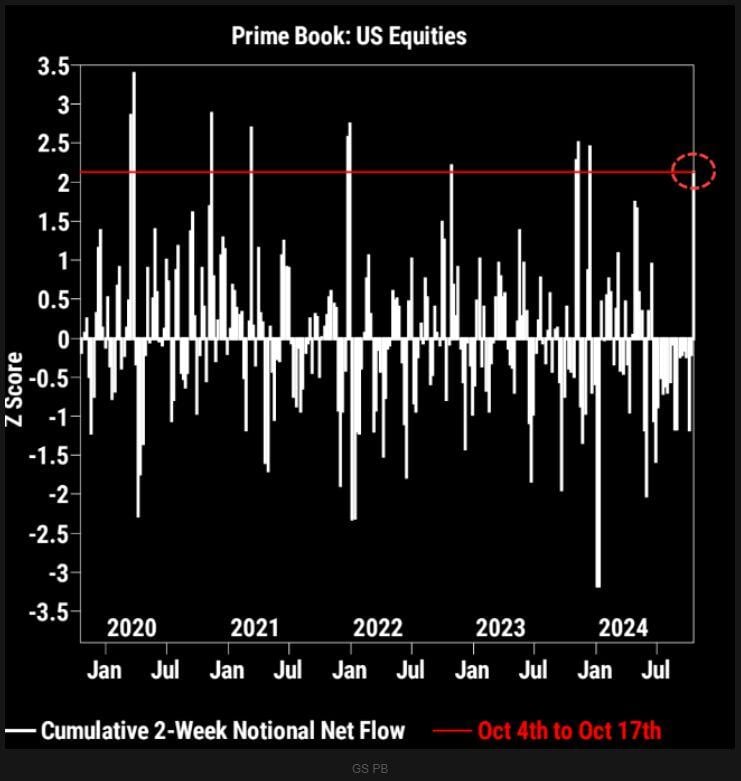

Hedge Funds are buying U.S. Stocks at the fastest pace this year 🚨

Source: Barchart

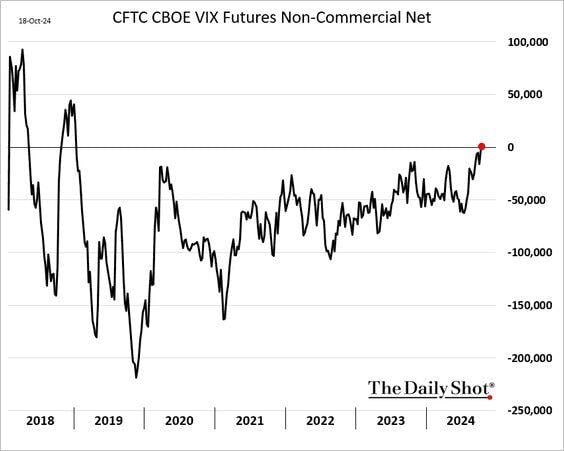

Hedge funds are net long VIX futures for the first time since 2019 ahead of the US elections.

Source: (((The Daily Shot))) @SoberLook

HedgeFunds are buying Chinese Stocks at the fastest speed in history

Source: Barchart

STILL BREAKING 🚨 China Short Sellers

This just got exponentially worse for Hedge Funds shorting Chinese stocks! Source: Barchart

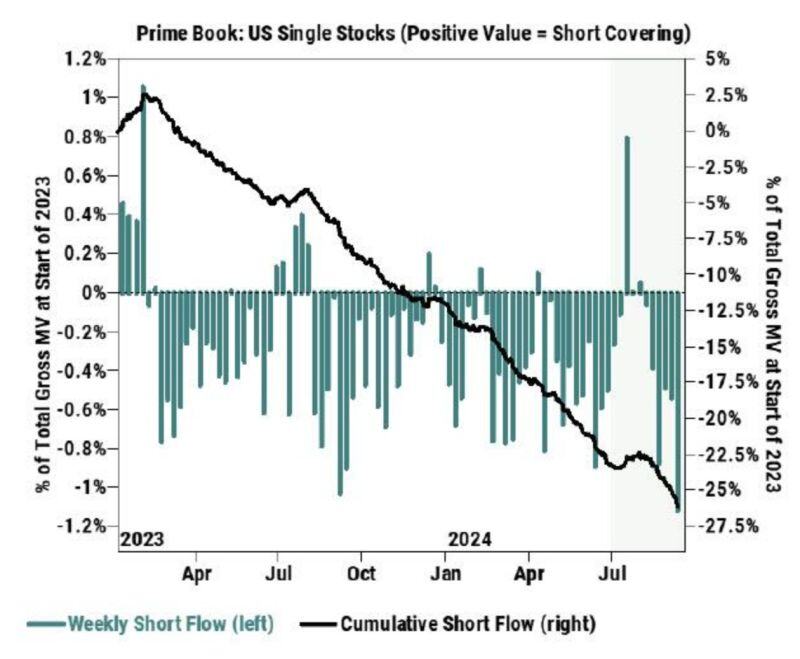

Hedgefunds piled into shorts against stocks for the fifth week in a row last week, per Goldman

Source: Markets & Mayhem

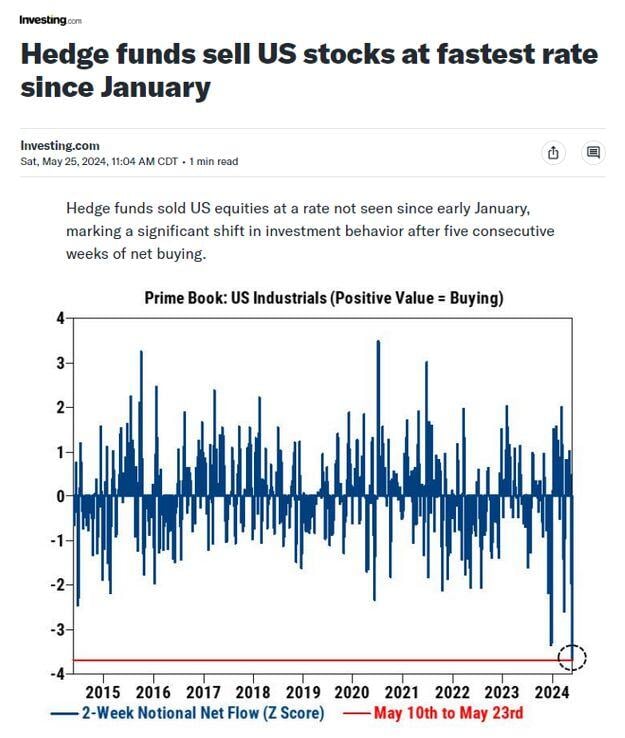

Hedge Funds dumped stocks at the fastest rate since January and, in particular, sold Industrials at the fastest pace in a decade.

Source: Goldman Sachs thru Barchart

Hedge funds build largest long Gold position in more than 4 years

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks