Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Retail investors are winning big this year – meme stocks are back.

The Goldman Sachs Meme Stock Index, which tracks some of the market’s most shorted names, is up 39% – a full 30 percentage points ahead of the S&P 500. Even the Goldman Sachs Retail Favorites Index, packed with stocks popular among small investors, has outperformed the broader market. Source: Bloomberg, HolgerZ

XAI, the artificia lintelligence startup run by Elon Musk, raised a combined $10 billion in debt and equity, Morgan Stanley said.

Half of that sum was clinched through secured notes and term loans, while a separate $5 billion was secured through strategic equity investment, the bank said on Monday. The funding gives xAI more firepower to build out infrastructure and develop its Grok AI chatbot as it looks to compete with bitter rival OpenAI, as well as with a swathe of other players including Amazon -backed Anthropic.

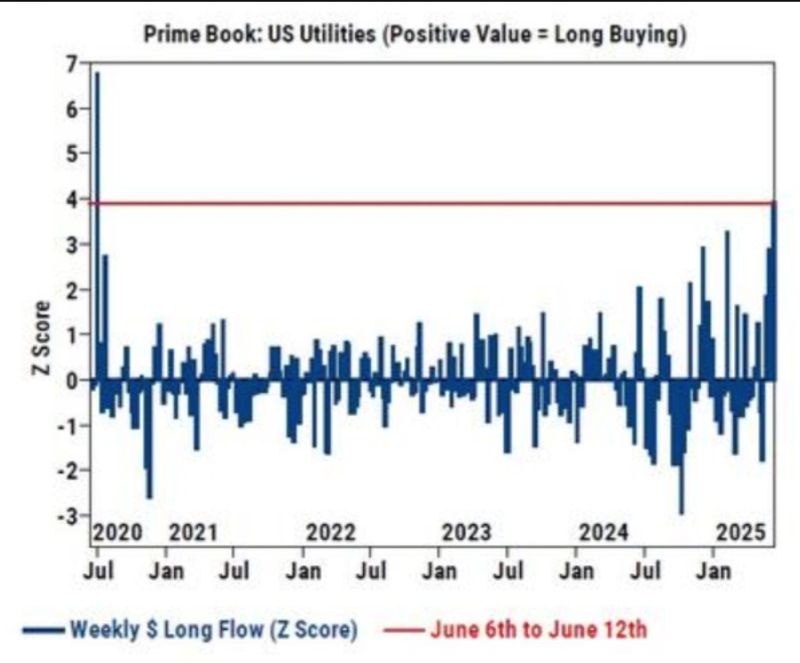

Hedge Funds are loading up on Utility Stocks at the fastest pace in 5 years

source : barchart

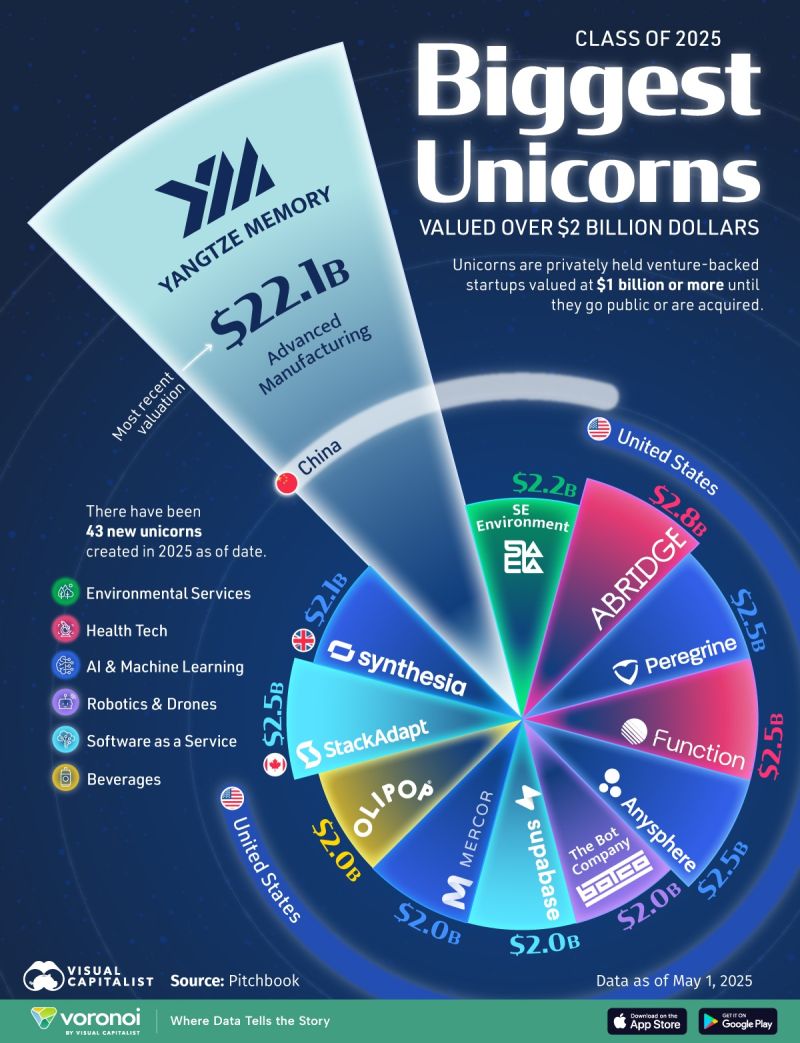

This graphic visualizes unicorns valued at $2 billion or more that became unicorns ($1 billion+ in valuation) in 2025.

Data comes from PitchBook, as of May 1, 2025. PitchBook defines unicorns as venture-backed companies valued at $1 billion or more after a funding round, until it goes public, gets acquired, or drops below that valuation. Yangtze Memory, a Chinese flash memory chip developer, is 2025’s biggest unicorn so far with a $22.1 billion valuation. The company became a unicorn, by PitchBook’s definition, in April 2025 after it secured a $222 million investment from Quanhong Investment. Even if a company’s internal or market valuation exceeds $1 billion, PitchBook’s definition requires a qualifying funding event for official unicorn status. Abridge, an American healthcare AI startup that summarizes clinician-patient conversations into documentation, is the second-most valuable unicorn in the class of 2025. AI-driven companies dominate the list of the biggest unicorns of 2025—such as Synthesia (AI video generation), AnySphere (AI programming assistants), and The Bot Company (AI agents)—and have attracted significant investment in recent years. There have been 43 new unicorns created in 2025, as of May. The largest share (65%) of new unicorns in 2025 are from North America, followed by Europe (23%). Currently, the most valuable unicorns in the world are ByteDance, the creator of TikTok, and Elon Musk’s SpaceX. Source: Visual Capitalist

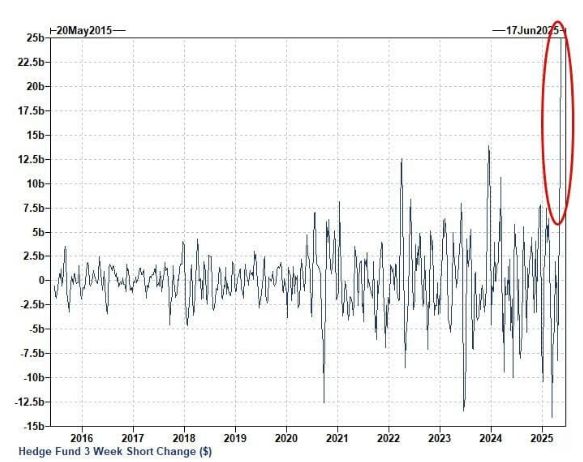

HedgeFunds have added $25 Billion of short equity futures exposure over the last 3 COT reports, the largest increase AT LEAST the last decade 🚨🚨

Source: Barchart

BREAKING: Hedge Funds

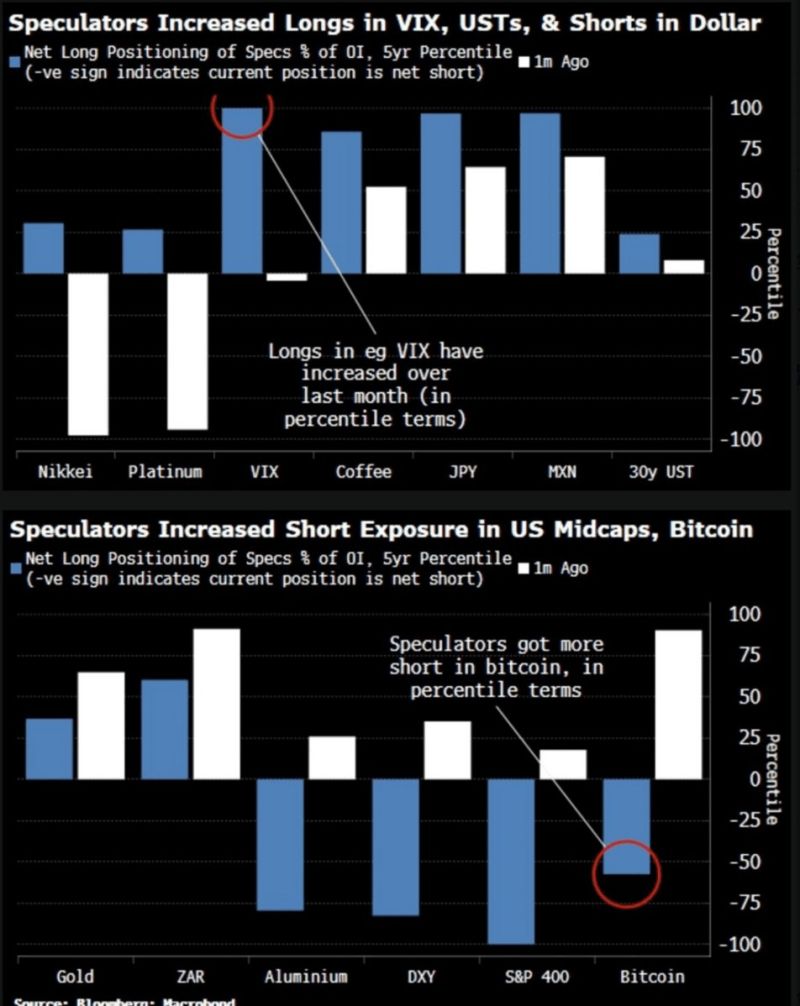

Hedge Funds were long volatility, short U.S. Dollar, short equities, and short Bitcoin $BTC before the U.S.-China trade agreement was announced... Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks