Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

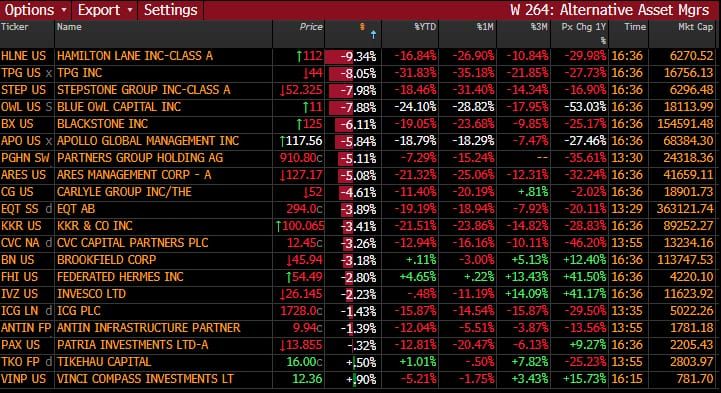

How are alternative asset managers stocks doing?

Source: Nico 15% only 🇨🇭🇹🇭 @NicoGladia

Shares of alternative asset managers tumbled on Thursday

After Blue Owl Capital Inc. restricted withdrawals from one of its retail-focused private credit funds, a fresh blow to a sector that’s faced heightened scrutiny in recent weeks. ... The selloff extended to Europe as big private equity players there tracked US peers lower in afternoon trading. CVC Capital Partners Plc fell as much as 4.5% in Amsterdam, while Switzerland’s Partners Group Holding AG slid as much as 5.3%. Source: zeibars @zeibars

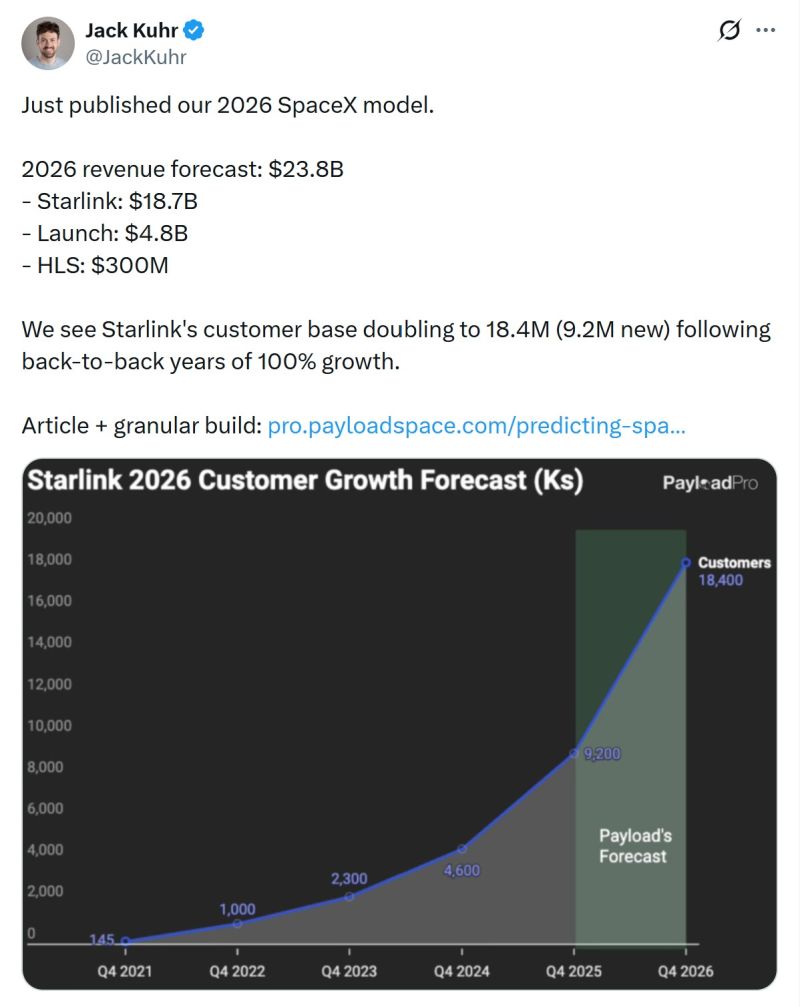

$1.5T valuation at $24B puts SpaceX at a P/S of 62.5.

Current P/S of other popular space companies: - $RKLB: 85 - $PL: 30 - $RDW: 7 - $FLY: 42 - $LUNR: 16 Source: RocketMan @RKLBMan on X

President Trump announces steps to ban large institutional investors from buying single-family homes.

"People live in homes, not corporations." Blackstone shares are tumbling. Source: Brew markets

"Macro hedge funds are enjoying their best year since at least 2008…"

Per the @FT thru Mo EL Elrian: "An index from data provider HFR tracking the returns of such funds — which aim to profit from economic trends by trading equities, bonds and commodities — was up 16 per cent at the end of November”

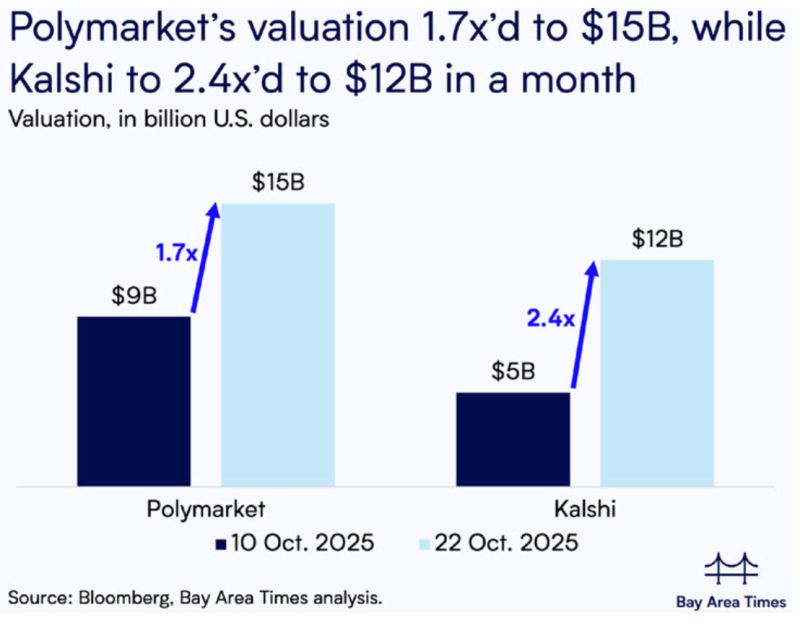

Kalshi and Polymarkets are among the pre-IPOs superstars right now...

Source: Bloomberg, Bay Area times, RBC

Morgan Stanley analysts project that global AI-related capex will approach $3 trillion

~$1.5 trillion needing to be financed across public and private credit markets.

More "crockroaches" in private credit land.

Last week, lending giant BlackRock wrote down a private loan made to home improvement company Renovo Home Partners to zero. As recently as last month, BlackRock valued the loan at 100 cents on the dollar. The drastic revision comes as Dallas-based Renovo — a roll-up of regional kitchen and bathroom remodeling businesses created by private equity firm Audax Group in 2022 — abruptly filed for bankruptcy last week, indicating it plans to shut down. BlackRock held the majority of Renovo’s roughly $150 million of private debt, while Apollo Global Management Inc.’s MidCap Financial and Oaktree Capital Management held smaller chunks, according to people with knowledge of the matter, who asked not to be identified discussing a private transaction…” When one of America’s largest, most sophisticated lenders takes a 100% loss on a loan over the course of one month, it begs the question: what other "cockroaches" are hiding in the shadows? Source: Ross Hendricks @Ross__Hendricks

Investing with intelligence

Our latest research, commentary and market outlooks