Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

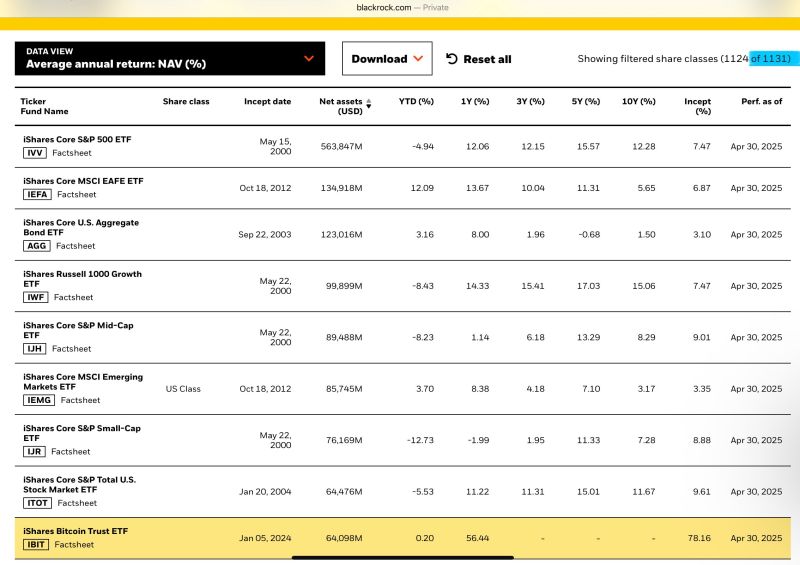

BlackRock, the world's largest asset manager with $11.6 Trillion in assets under management, has 1,131 funds.

BlackRock's BITCOIN ETF, $IBIT, is #9 of all funds after 16 months 👇 Source: HODL15Capital 🇺🇸 @HODL15Capital

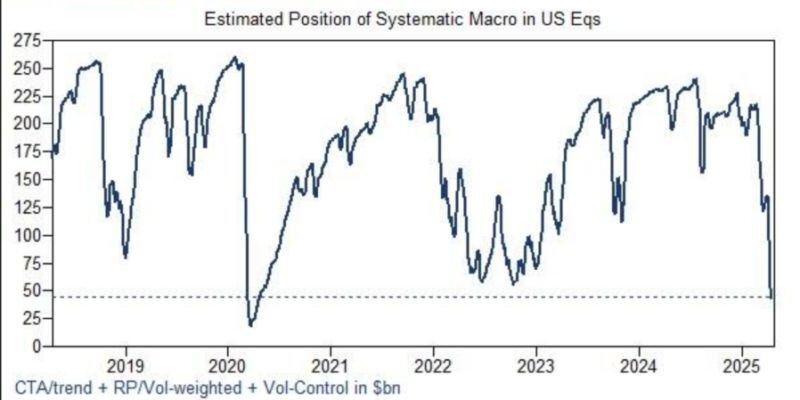

Wow. Systematic macro hedge funds have reduced exposure to US equities to levels not seen since the COVID crash.

They sure have a lot of buying to do if the market stays bid. Chart: Goldman Sachs thru Markets & Mayhem

Chinese state-backed funds are cutting off new investment in US private equity, according to several people familiar with the situation, in the latest salvo against President Donald Trump’s trade war.

State-backed funds have been pulling back from investing in the funds of US-headquartered private capital firms in recent weeks, according to seven private equity executives with knowledge of the matter. The moves come in response to pressure from the Chinese government, three of the people said. Some of the Chinese funds are also seeking to be excluded from private equity investments in US companies, even if those investments are made by buyout groups based elsewhere, some of the executives added. The change in approach to the US comes as China has borne the brunt of US tariffs announced in the past three weeks that threaten to significantly curtail trade between the world’s two biggest economies. Source: FT

Non-exhaustive list of Macro, Systematic & Multi-strategy hedge funds returns for 2024.

Source: Bloomberg, The Long view

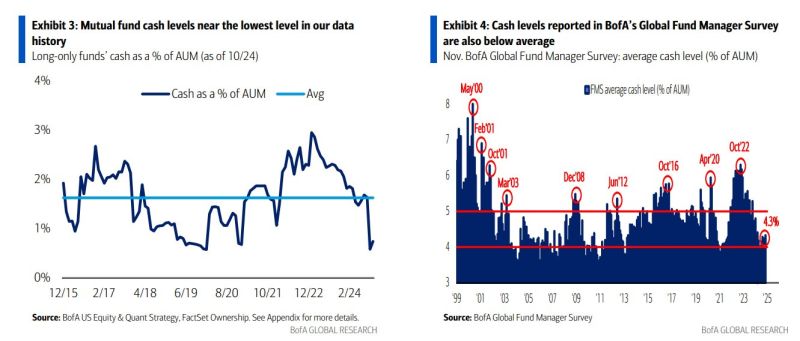

2025 is going to start and mutual funds and hedge funds managers cash levels are near record lows

Source: BofA

Here are the current most valuable private companies in the world 🌎

Source: Evan @StockMKTNewz

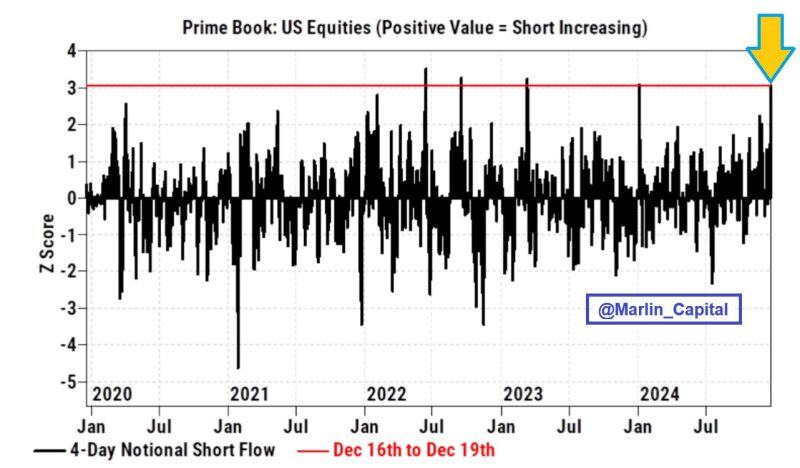

Hedge funds sold US equities at the fastest pace in 8+ months last week, driven heavily by short selling.

This was the fastest pace of HF short selling in ~12 months. Source: David Marlin $SPY $QQQ $IWM

SPACEX SHOOTS FOR THE MOON WITH $350B VALUATION

Elon's rocket empire might be worth more than Portugal's entire GDP. SpaceX is floating a tender offer that would launch its valuation to a mind-bending $350 billion—up from last month's mere $255 billion price tag. This astronomical jump would make SpaceX not just the most valuable startup on Earth, but worth more than many Fortune 500 companies. For context, they were "only" worth $210 billion earlier this year. Source: Mario Nawfal Source: Bloomberg @SpaceX

Investing with intelligence

Our latest research, commentary and market outlooks