Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Michael Burry's hedge fund has 80% of it's $1.38B portfolio on Nvidia & Palantir puts

Can't wait for The Big Short 2 Source: Wall Street Memes on X

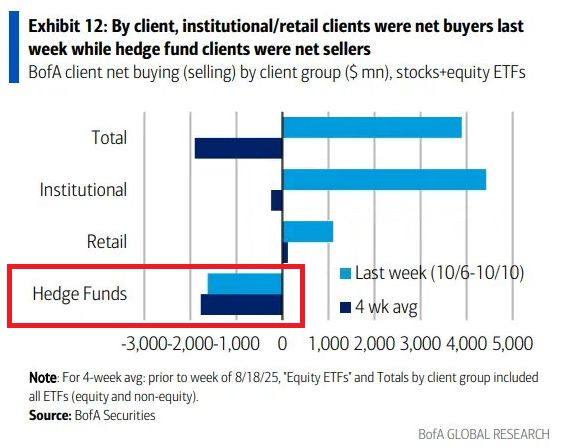

Hedge funds are SELLING massive amount of US equities:

Hedge funds sold $1.7 BILLION last week and $2.1 billion in the prior week, marking their 5th STRAIGHT week of selling. Retail and institutional investors turned to buyers. Nevertheless, the total 4-week selling was $1.9 billion. Source: BofA, Global Markets Investor

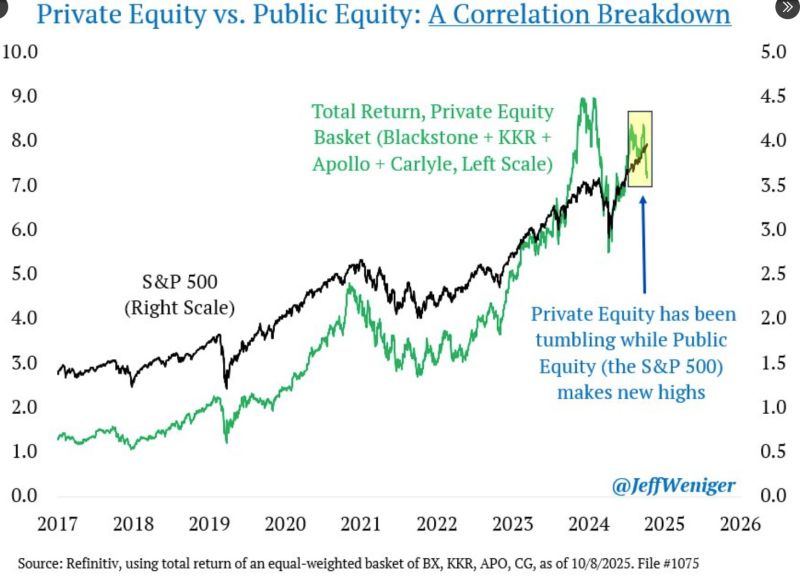

A correlation breakdown:

Private equity stocks (Blackstone, KKR, Apollo, Carlyle) dropped 14.5% in just 3 weeks, while at the same time the S&P 500 just hit another high. What does it mean? Source: Jeff Weniger, Refinitiv

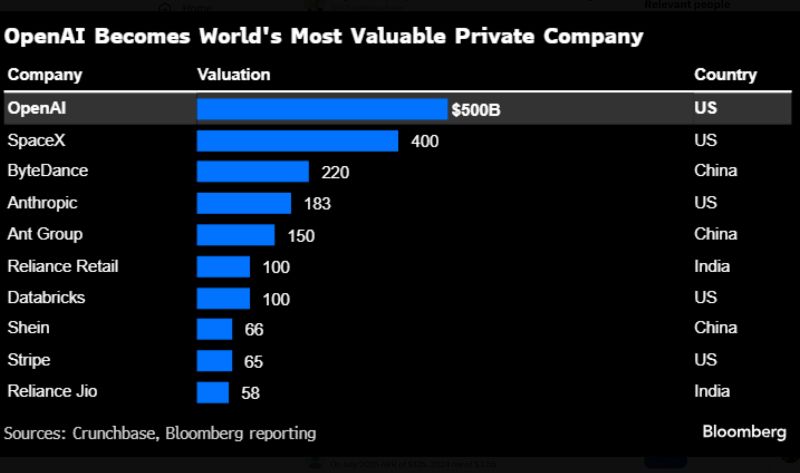

OpenAI valuation soars to $500bn, topping Musk’s SpaceX

Current and former OpenAI employees sold ~$6.6bn of stock to investors at a $500bn valuation, boosting the US company’s price tag well past its previous $300bn level. Source: HolgerZ, Bloomberg

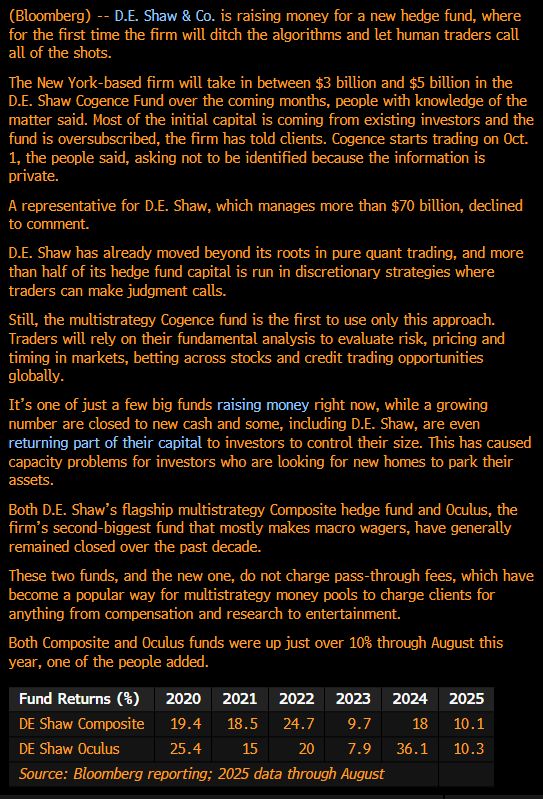

While everyone is moving away from humans towards ai, hedge fund giant de shaw is doing the opposite and launching its first ever fund run by humans, not ai.

DE Shaw is raising as much as $5 Billion in its first Hedge Fund run by humans. The D.E. Shaw Cogence Fund will trade stocks and credit. Source: Bloomberg, Nishant Kumar @nishantkumar07, Gurgavin

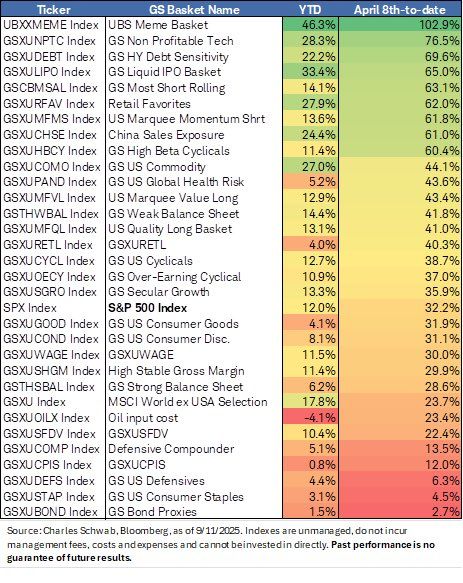

Meme stocks continue to power higher since early-April lows, alongside other retail trader favorites; while classically-defensive baskets bring up the rear

Source: Liz Ann Sonders, Bloomberg

Should we consider this as a leading indicator?

Sotheby’s revenue from commissions and fees on sales fell -18% Profit before tax at Sotheby’s Holdings UK fell -21% Source: The Coastal Journal

Investing with intelligence

Our latest research, commentary and market outlooks