Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

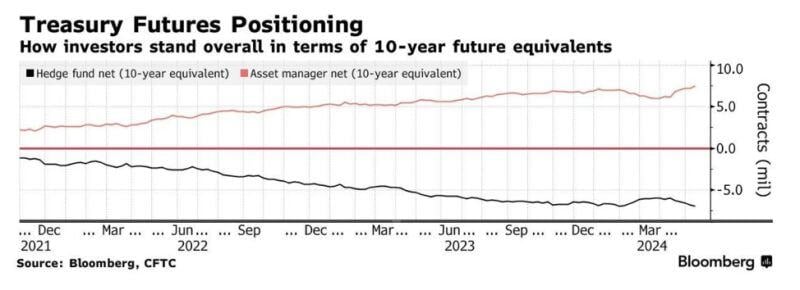

Hedge Funds have now built the largest 10-year Treasury short position in history while Asset Managers have built the largest long position.

Source: Barchart, Bloomberg

13F filings showing a number of the top HedgeFunds trading the US Bitcoin ETF’s

Source: River

Radar🚨

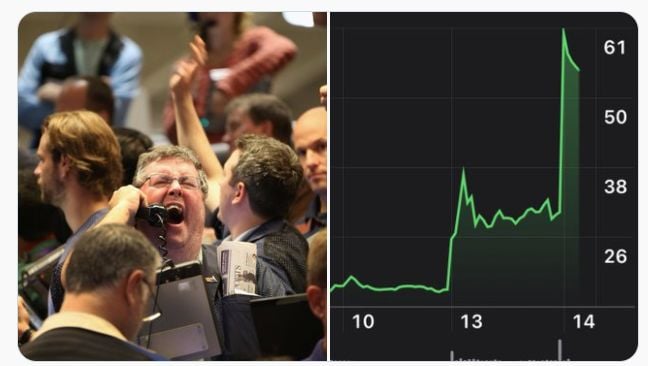

BREAKING: Short sellers of GameStop $GME and $AMC have lost $5 billion in 2 days. Who are the short sellers by the way hedge funds ?

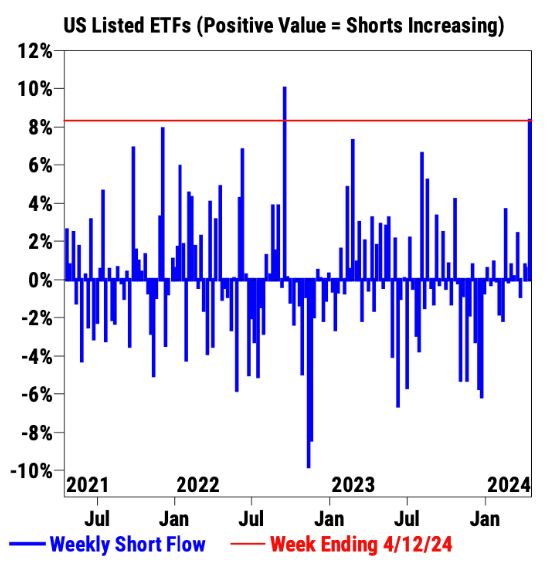

Hedge funds increased ETF short positions by largest amount in 20 months according to Goldman Sachs

Source: barchart

Pension Funds are now withdrawing billions of dollars from the stock market and instead allocating to bonds and private markets.

CalPERS, the country's largest public pension fund, is reportedly planning to withdraw $25 billion from stocks soon. Source: Barchart, Reuters

Financial Stability Board urges Hedge Funds to hold more liquid assets in order to meet margin calls in case of market shocks 😱👀

Source: FT >>> https://lnkd.in/eJuU4sg2 Financial policymakers have urged hedge funds, pension investors and commodities traders to keep more liquid assets on hand and develop stress tests to better withstand shocks from extreme market moves. The Financial Stability Board, which includes the world’s leading finance ministers, central bankers and regulators, said on Wednesday that after assessing a series of recent market panics, many funds and traders had made “inadequate” preparation for sudden price moves. Its call increases the scrutiny of so-called non-bank financial institutions, which have become a larger part of trading in financial markets since the 2008 financial crisis. Many have come under deep strain from unexpected moves in market prices, from the March bond market meltdown at the onset of the coronavirus pandemic in 2020, to the UK’s pension fund crisis in 2022, when a wave of selling by some pension fund strategies forced a Bank of England intervention.

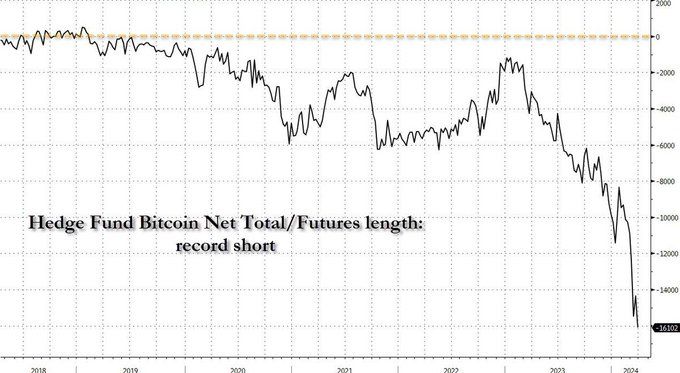

Hedge funds are shorting Bitcoin at record levels.

Is another massive short squeeze ahead of us ? Source: Bloomberg, www.zerohedge.com

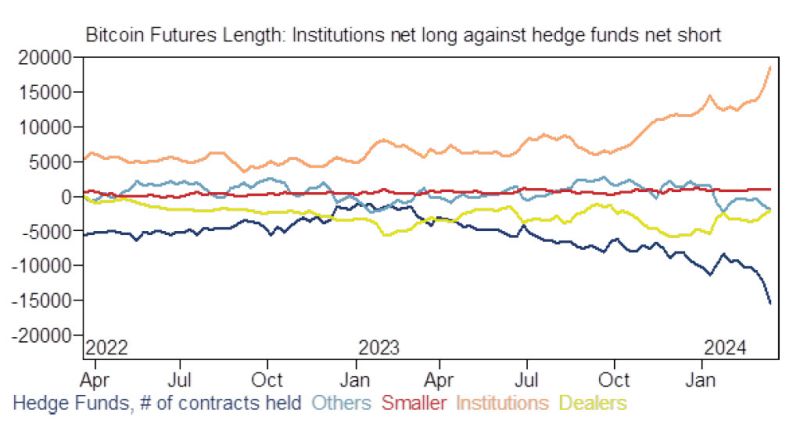

Goldman: "The institutional Bitcoin net long and hedgefund Bitcoin net short lengths are at record levels".

Is another epic squeeze coming? Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks