Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Hedge Funds betting on a decline in US and European stockmarkets have suffered an estimated $43bn of losses in a sharp rally over recent days.

Short sellers, many of whom had built up bets against companies exposed to higher borrowing costs over the past year or so, have been caught out by a “painful” rebound in “low quality” stocks this month, said Barclays’ head of European equity strategy Emmanuel Cau. That has come as the market has grown more confident that the US Federal Reserve’s cycle of rate rises is finally over. Funds suffered $43.2bn of losses on short bets in the US and Europe from Tuesday to Friday inclusive last week, according to calculations by data group S3 Partners, which do not take account of gains that funds may have made in other stocks they own. Source: FT

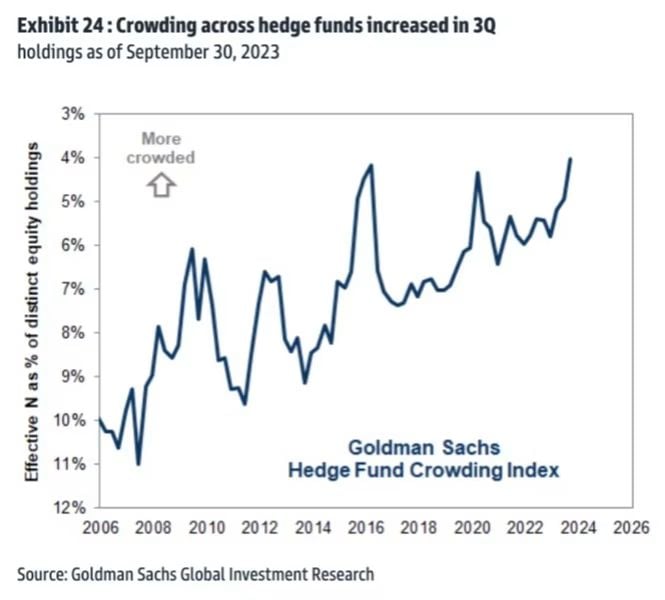

Hedge Fund Position Concentration hits all-time high 🚨 i.e. everyone chasing the same trades - Mag 7

Source: Barchart, Goldman Sachs

According to an FT article published on Tuesday, Blackstone is to close a fund that offers investors exposure to a range of hedge funds and other trading strategies

This comes after assets fell nearly 90 per cent in four years amid lacklustre returns. The US alternative asset manager has told investors it will wind down the Blackstone Diversified Multi-Strategy fund by the end of the year, the group told the Financial Times. The so-called Ucits fund is governed by EU rules that make it easier for non-specialist investors to buy. Multi-strategy Ucits funds such as this are in part an attempt by managers to capitalise on the success of giant hashtag#hedgefunds such as Citadel and Millennium, which employ teams of traders across a wide range of strategies and which were among the biggest hedge fund winners from the coronavirus pandemic. The fund’s closure, which has not previously been reported, demonstrates how hard it can be to capture and package that success for a wide audience. Source: Financial Times

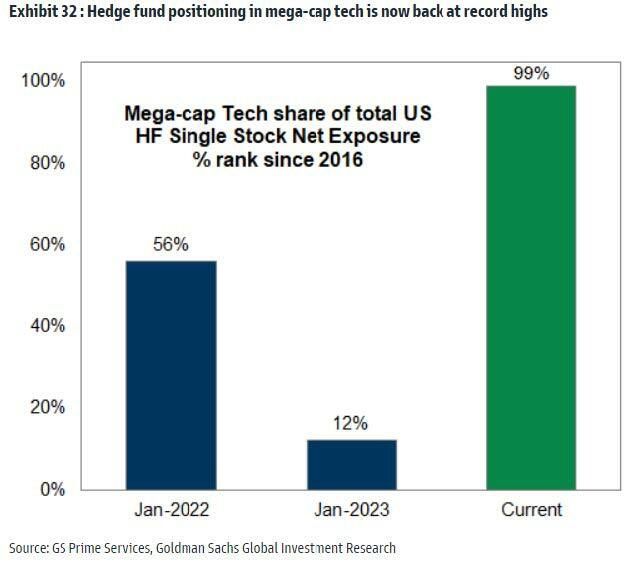

No buyers left? hedge fund net exposure to magnificent 7 was 12% at the start of the year. It is now 99%...

Source: Goldman Sachs, www.zerohedge.com

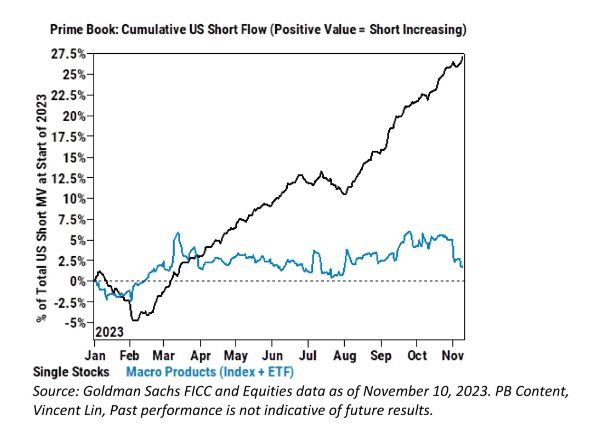

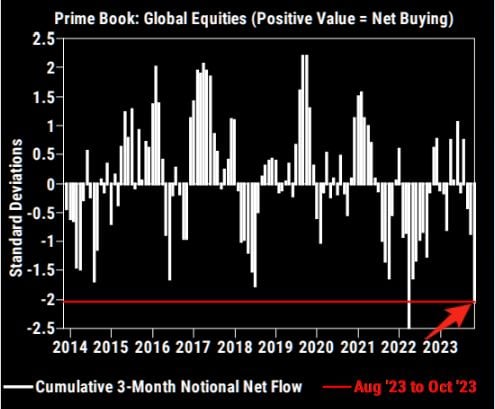

Hedge Funds have increased their short stock positions for 14 consecutive weeks, the longest streak in history

Source: Win Smart, Goldman

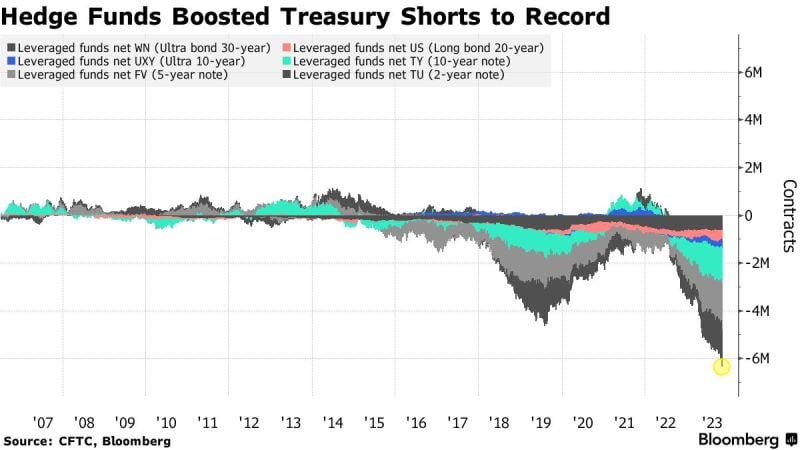

Hedge Funds extended short positions on Treasuries to a record just before smaller-than-expected US bond sales and weaker jobs data spurred a rally

Leveraged funds ramped up net short Treasury futures positions to the most in data going back to 2006, according to an aggregate of the latest Commodity Futures Trading Commission figures as of Oct. 31. The bets persisted even though the cash bonds had rallied the week before. Source: Bloomberg

Last week "pain trade" in one chart

-> Last week's Risk On move has pushed Hedge Funds to cover their shorts, triggering violent short squeezes. The Goldman Sachs Most Shorted Stocks Basket jumped by 13% over the week. Source: Bloomberg, HolgerZ

Hedge Funds were quite short going into November

Source: Markets Mayhem, GS

Investing with intelligence

Our latest research, commentary and market outlooks