Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Apple Maps has just been updated for Paris2024 Summer Olympics.

New update includes stunning 3D models of Olympic venues, including temporary ones. Source: Nikias Molina

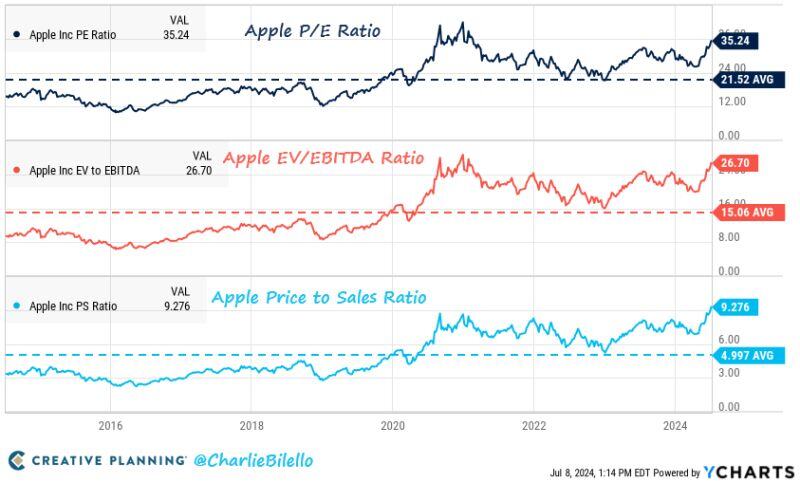

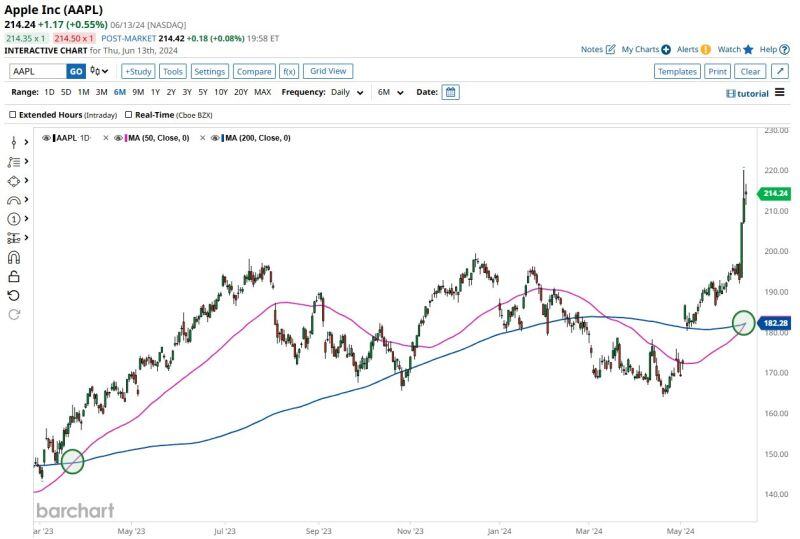

Apple's P/E Ratio: 35x

10-year average: 22x Apple's EV/EBITDA Ratio: 27x 10-year average: 15x Apple's Price to Sales Ratio: 9.3x 10-year average: 5.0x $AAPL Source: Charlie Bilello

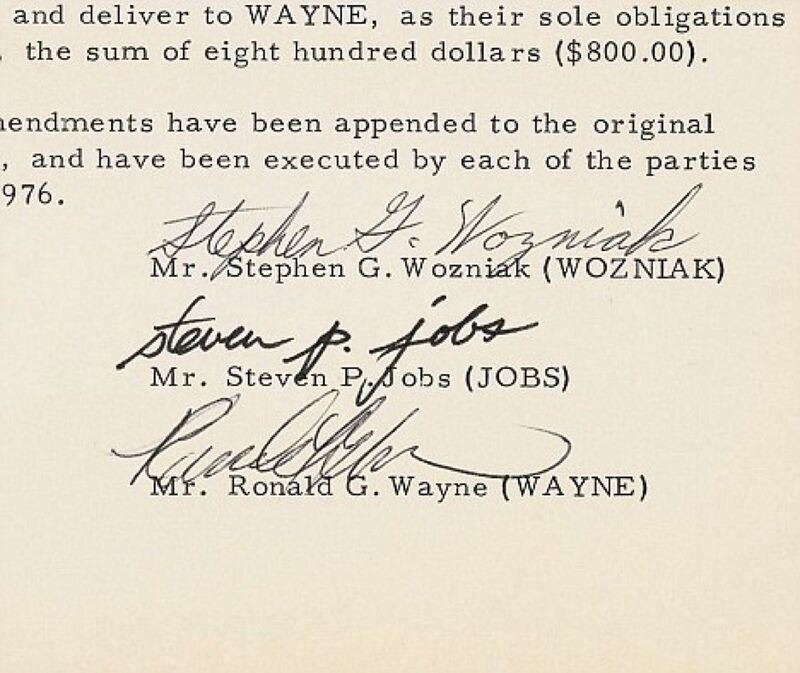

If you ever get upset for selling too early just know it could have been worse.

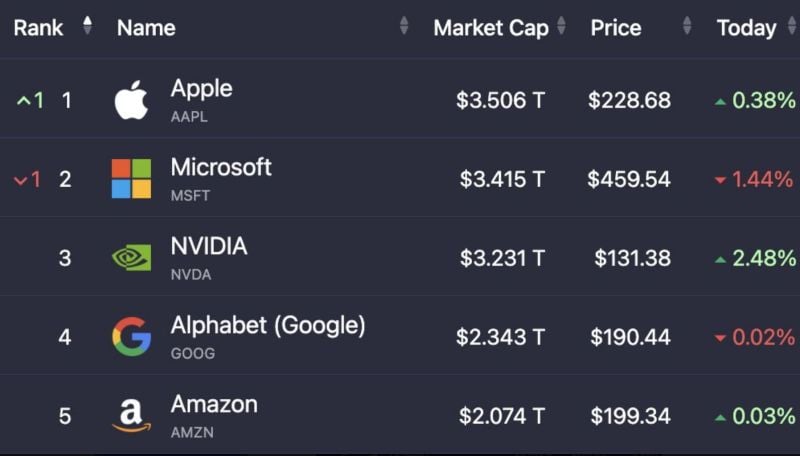

Meet Ronald Wayne Apple's 3rd co-founder who sold his entire 10% stake in the company for $800 back in 1976. 10% of Apple $AAPL is currently worth ~$328 Billion... Source: Evan

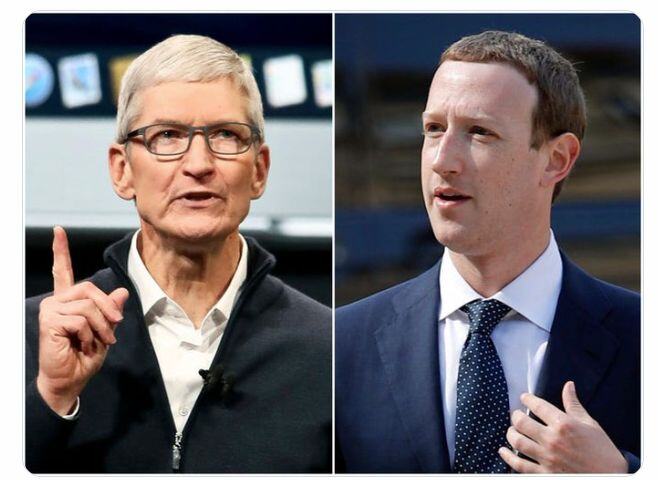

JUST IN: *META, APPLE REPORTEDLY DISCUSSED AI COOPERATION - WSJ

The Wall Street Journal is reporting that Apple and Meta have discussed a partnership that would see Meta AI models integrated into iOS 18 for Apple Intelligence. This integration would likely be similar to the deal Apple has struck with ChatGPT, which is currently the only third-party partner for Apple Intelligence.

JUST IN: 🍏 Apple stops work on the Apple Vision Pro 2 due to slow demand

Apple is now working on a cheaper model to launch late 2025 Radar🚨

Investing with intelligence

Our latest research, commentary and market outlooks