Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

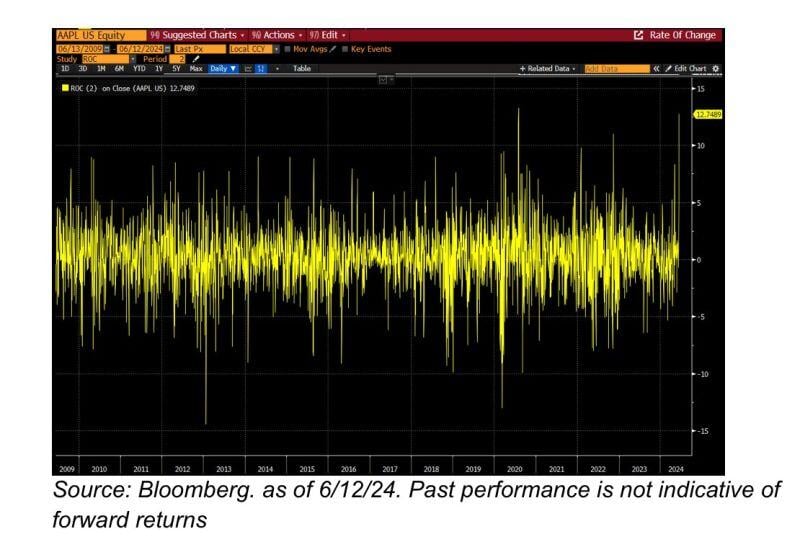

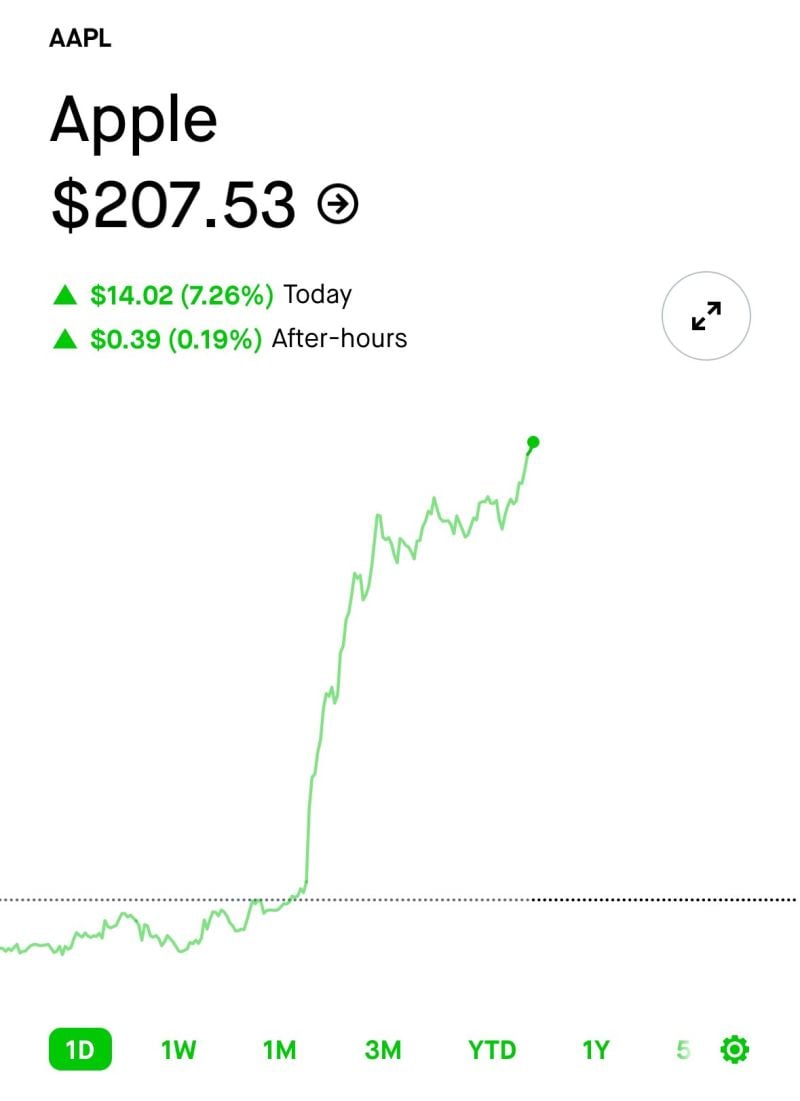

Apple $AAPL … stock up ~12.5% in 2-days, the biggest 2-day move in 15+ years (save a 2-day stretch in Mar’20 off the COVID lows) …

over this stretch, Apple has added nearly ~$400bn in mrkt cap .. larger than the current market cap of 480 co’s ..” - GS desk Source: Carl Quintanilla, Bloomberg

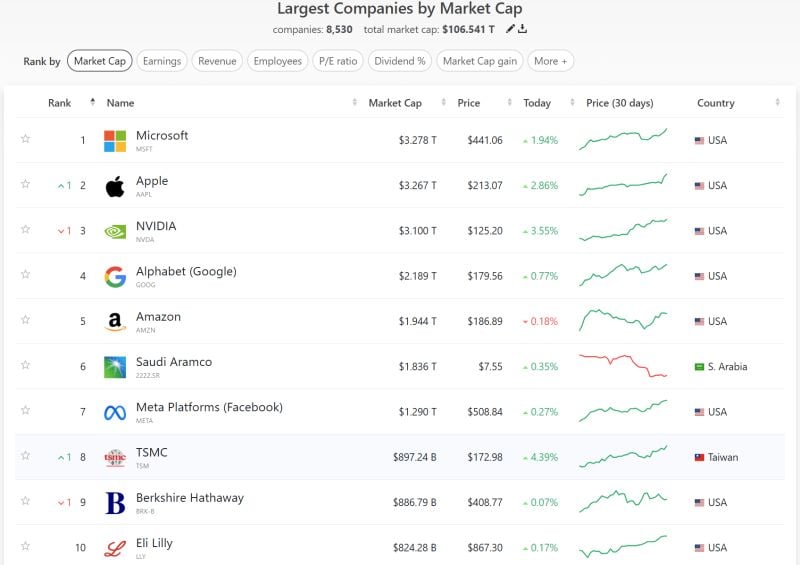

Apple almost overtook Microsoft as the largest market cap in the world.

Source: Companies Marketcap

Chief executive Tim Cook said the iPhone maker’s 'next big step' will be driven by generative AI and large language models.

Apple on Monday said it has partnered with OpenAI to integrate ChatGPT into its devices, as chief executive Tim Cook set out the iPhone maker’s “next big step” driven by generative artificial intelligence and large language models. Cook and his team outlined upgrades to the company’s software ecosystem coming this year at Apple’s annual developer conference on Monday, aiming to leverage the power of AI to provide a smarter Siri voice assistant and more personalised features on its devices to enhance productivity and tap into more advanced computer intelligence. This year’s Worldwide Developers Conference has been watched especially closely as investors waited to see how Cook will position the company to take advantage of generative AI, amid concerns it is falling behind its Big Tech competitors. Link >>> https://lnkd.in/eNQdmDW9 Source: FT

Billionaire Elon Musk said he would ban Apple devices from his companies if OpenAI’s software is integrated into the products at the operating system level.

In a series of posts on his social media platform X, Musk shared concerns about whether Apple and OpenAI will protect users’ information. He called the software integration between the two companies “an unacceptable security violation,” and said Apple has “no clue what’s actually going on.” “It’s patently absurd that Apple isn’t smart enough to make their own AI, yet is somehow capable of ensuring that OpenAI will protect your security & privacy!” Musk wrote after the event. The remarks followed a presentation Monday by Apple, when it said that customers would have access to OpenAI’s ChatGPT chatbot through the Siri digital assistant. Apple plans to roll out the capabilities as part of a suite of new AI features later this year. Musk co-founded OpenAI but had a falling out with the San Francisco-based startup. Source: HolgerZ

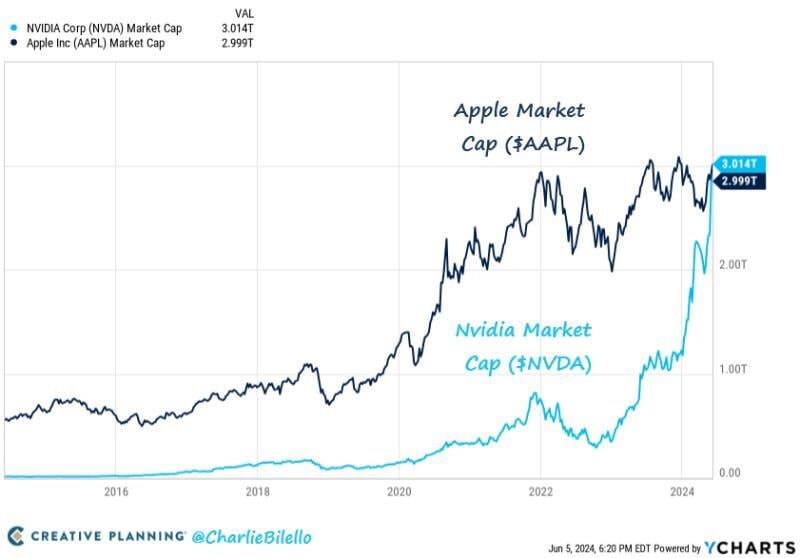

Nvidia, $NVDA, was up another 6% yesterday (including after hours) moving to a record $1,237/share.

This puts the stock up 155% in 2024 ALONE, adding $1.83 TRILLION of market cap. To put this in perspective, Nvidia has now added as much market cap as the entire value of Amazon, $AMZN, in 6 months. 10 years ago Apple had a market cap 53x higher than hashtag#Nvidia. Today, Nvidia ended the day with a market cap of $3 trillion, surpassing Apple to become the 2nd largest company in the world. Note that Nvidia has also accounted for almost HALF of the S&P 500's YTD market cap gain... Source: Charlie Bilello. The Kobeissi Letter

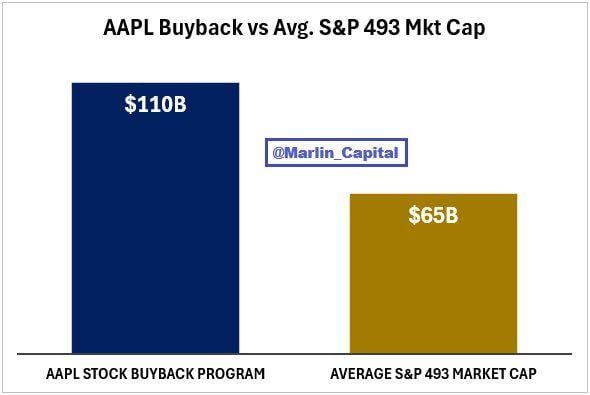

1 of the craziest stats in the market right now 👇

$AAPL announced a $110B stock buyback program in Q1. If you strip out the Mag 7 from the index, the average market cap for the S&P 493 is just $65B. $AAPL buyback program is 169% larger than the average S&P 493 company. Source: David Marlin

Investing with intelligence

Our latest research, commentary and market outlooks