Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

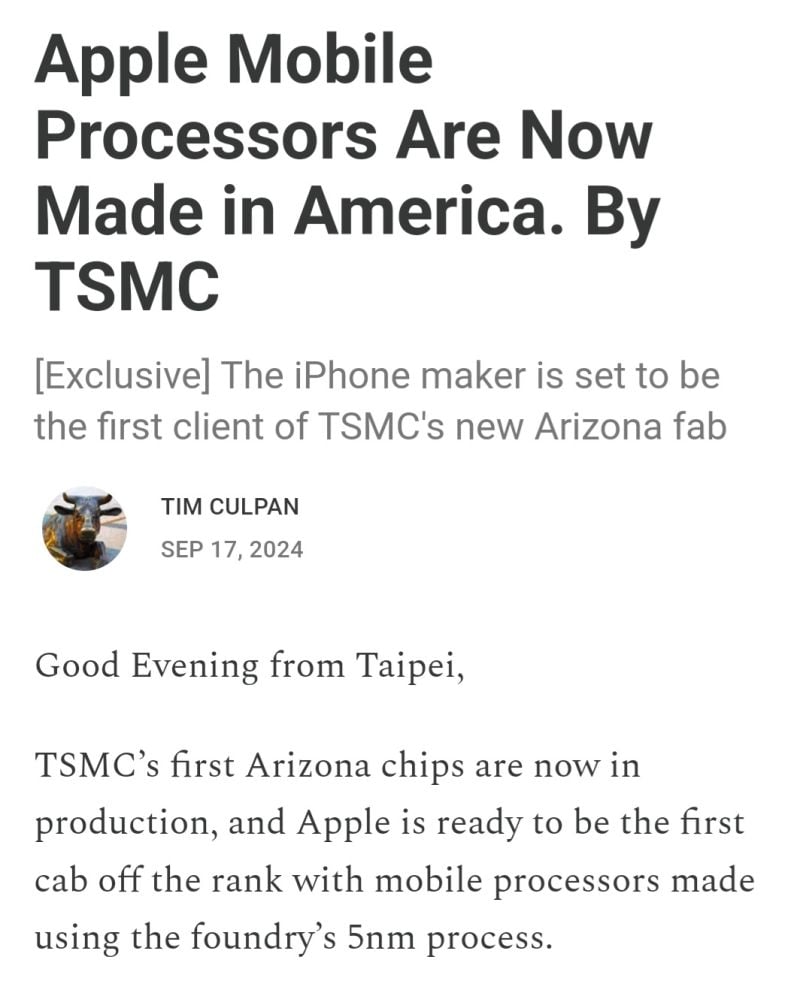

The outcomes of reshoring are already becoming apparent.

Thanks to chipact, the US can benefit from Taiwan Semiconductors $TSMC knowhow in Mobile processors on their home turf. TSMC Arizona is shipping wafers now. Source: 🌿 litho @lithos_graphein on X

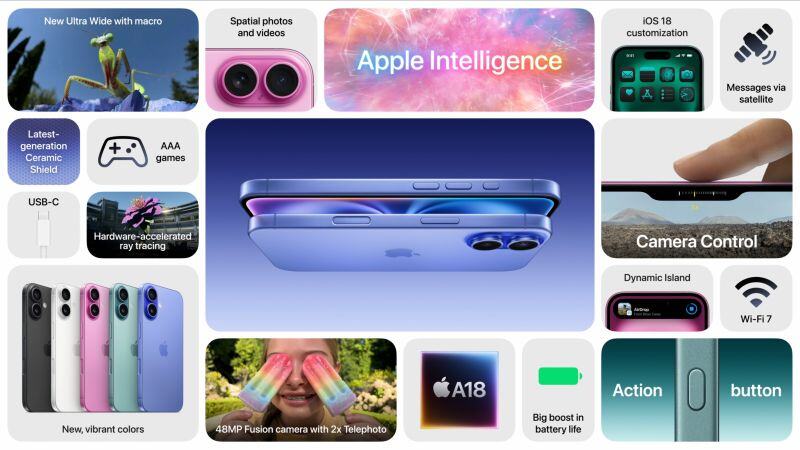

Here’s a full breakdown of the $AAPL iPhone 16 and 16 Plus Price starts at $799 and $899 for the Plus

Source: Stocktwits

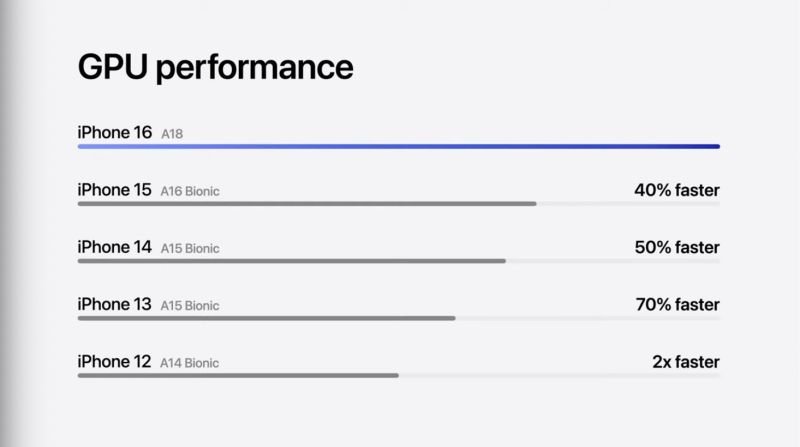

Apple's $AAPL new A18 chip for the iPhone 16 has 40% faster GPU performance than the iPhone 15

Source: Evan

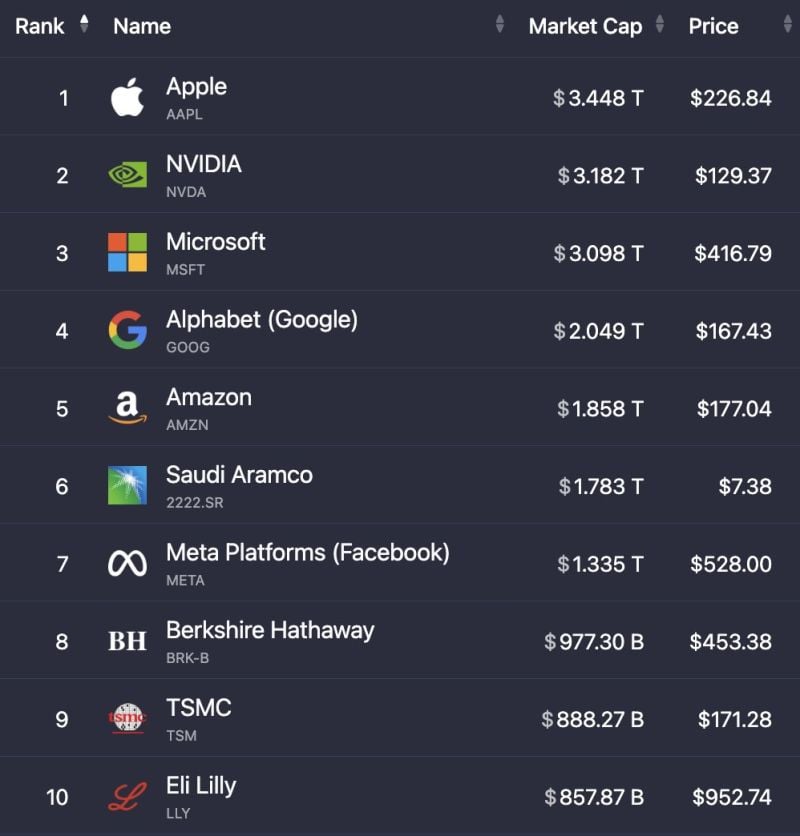

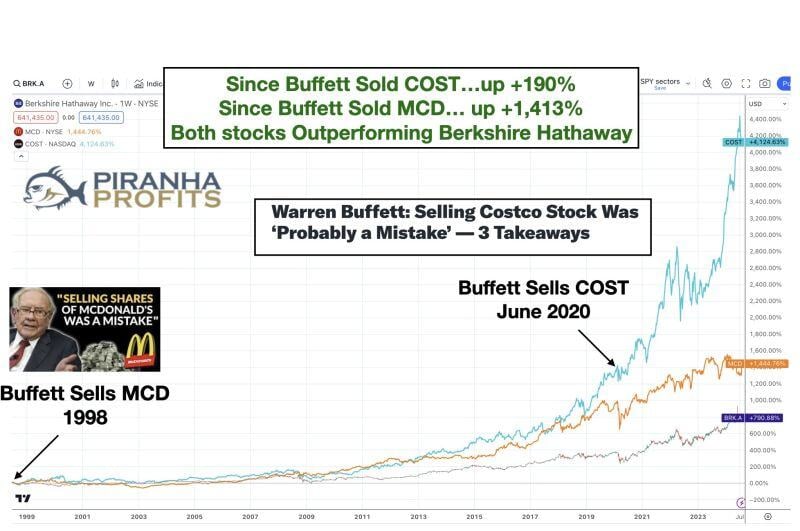

Should you sell your Apple because Buffet has been selling 50% of his Apple ($AAPL) shares?

Well, think twice. Buffett sold his entire Mcdonalds ($MCD) stock in 1998. Since then, MCD has increased +1,413%, outperforming Berkshire Hathaways returns. Buffett sold his entire Costco #($COST) stake in June 2020. Since then, COST has gained +190%, outperforming Berkshire as well. Buffett also sold all his stakes in airline stocks like Delta Airlines ($DAL) in March 2020. Since then, DAL is up +82% as well Lesson? Don't copy paste what other investors are doing, no matter how great they are. Source: Adam Khoo on X

What does he know about Apple and the stock market that we don't?

Also interesting to see that Warren Buffett and Berkshire Hathaway now own 4% of all T-Bills issued to the public… Buffett has ~$277 Billion. The Fed has $195 Billion. Warren Buffett is now a larger holder of US Treasury Bills than the Federal Reserve. Source: FT, Geiger Capital

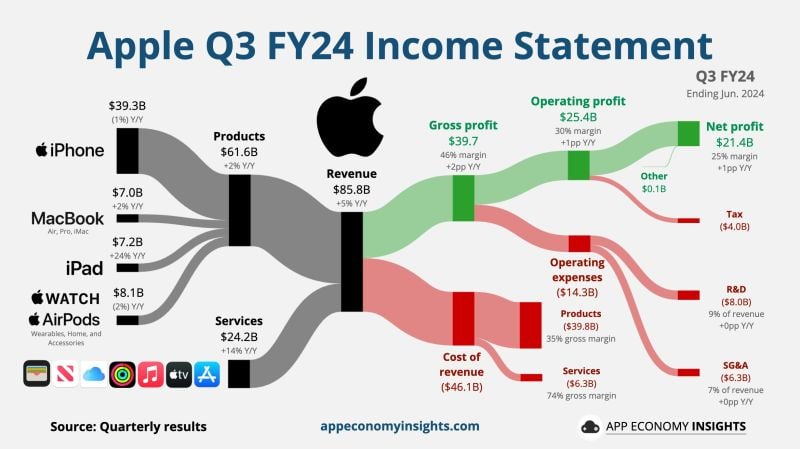

Apple reported fiscal third-quarter earnings on Thursday that beat Wall Street expectations, with overall revenue rising 5%. iPhone, iPad and Services revenue all beat analyst expectations.

Apple's most important business remains the iPhone, which accounted for about 46% of the company's total sales during the quarter. Apple expects similar overall revenue growth in the current quarter, company finance chief Luca Maestri said on a call with analysts. Apple also expects Services to grow at about the same rate as the previous three quarters, which was about 14%. The company sees operating expenditures between $14.2 billion and $14.4 billion in the current quarter, Maestri added, with gross margin of between 45.5% and 46.5%. Apple shares were flat in extended trading. Here's how $AAPL Apple did in Q3 FY24 (June quarter): 💳 Services +14% Y/Y to $24.2B. 📱 Products +2% Y/Y to $61.6B. • Revenue +5% Y/Y to $85.8B ($1.4B beat). • Operating margin 30% (+1pp Y/Y). • EPS $1.40 ($0.06 beat). Source: App Economy Insights, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks