Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

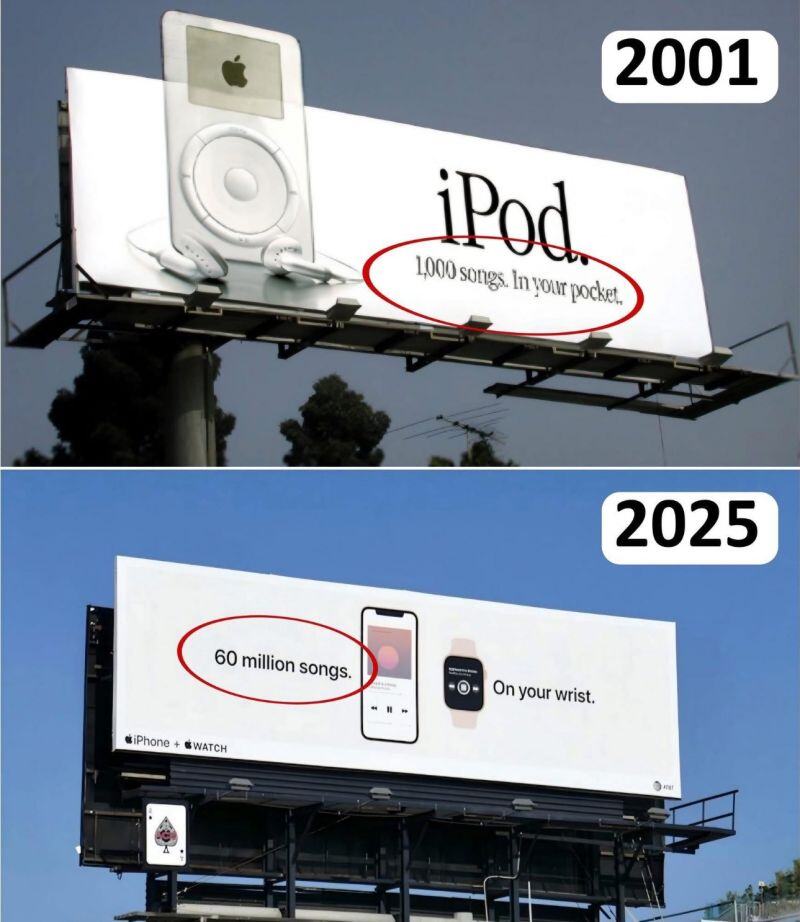

We have come along way...

Source: Out of Context Human Race @NoContextHumans

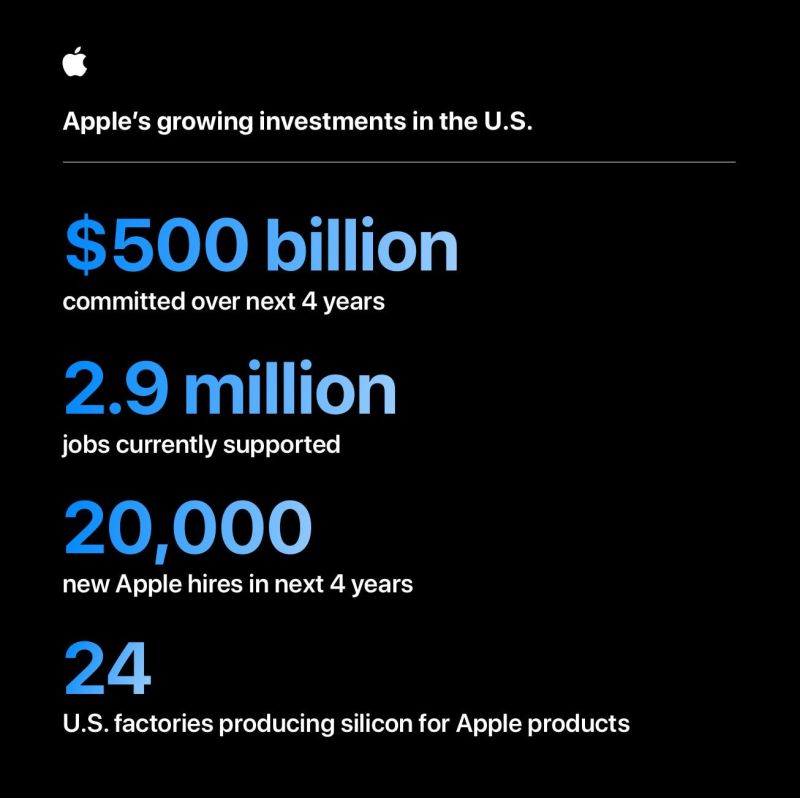

Apple's largest-ever investment commitment, by the numbers:

• Includes work in all 50 states • Doubles its US Manufacturing Fund • Creates Detroit manufacturing academy The project will start later this year with construction of a Houston-based AI server facility Source: Morning Brew

Is Apple ringing the doorbell of smart home innovation?

According to Bloomberg, Apple might be working on a smart doorbell featuring its renowned FaceID technology. The concept? As you approach the door, the doorbell scans your face, communicates with a connected deadbolt lock, and unlocks seamlessly for residents. While still in early development and not expected before late 2025, the product could either integrate with HomeKit-compatible locks or involve a partnership with a specific lock maker. This move could position Apple as a competitor to Amazon's Ring, but also exposes the brand to unique challenges. For instance, concerns around security breaches or misuse of the system could spark debates on privacy and reliability. source : techcrunch

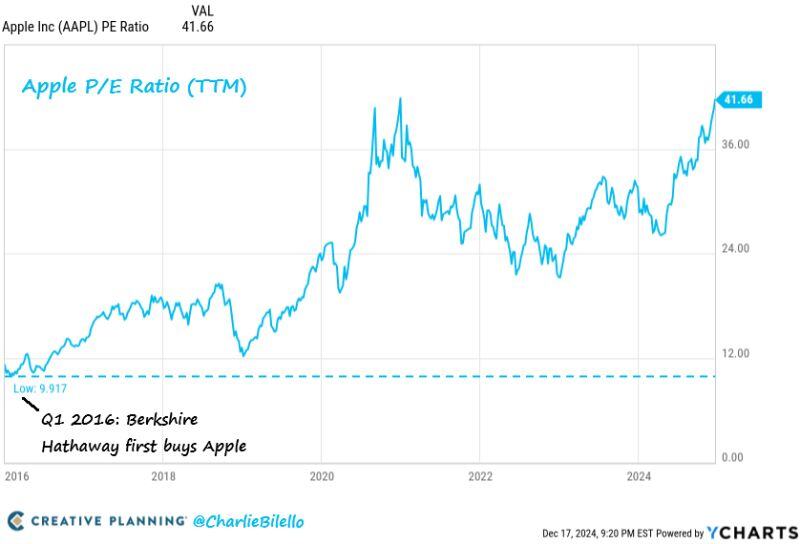

Apple now trades at over 41x earnings, its highest P/E ratio since 2007 (first iPhone was released).

When Berkshire Hathaway started buying Apple in 2016 it was trading at less than 10x earnings. Berkshire sold 67% of their stake this year. $AAPL Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks