Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

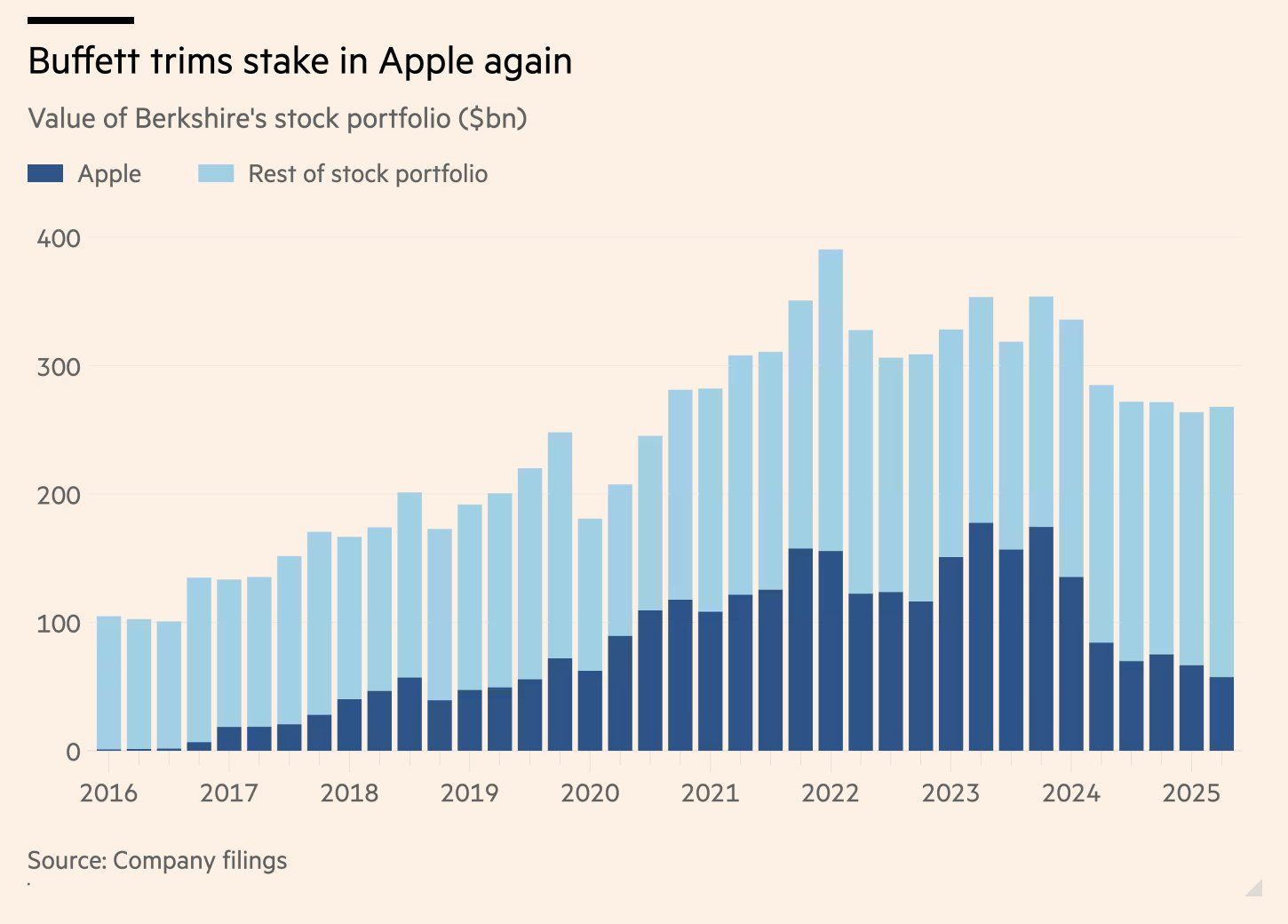

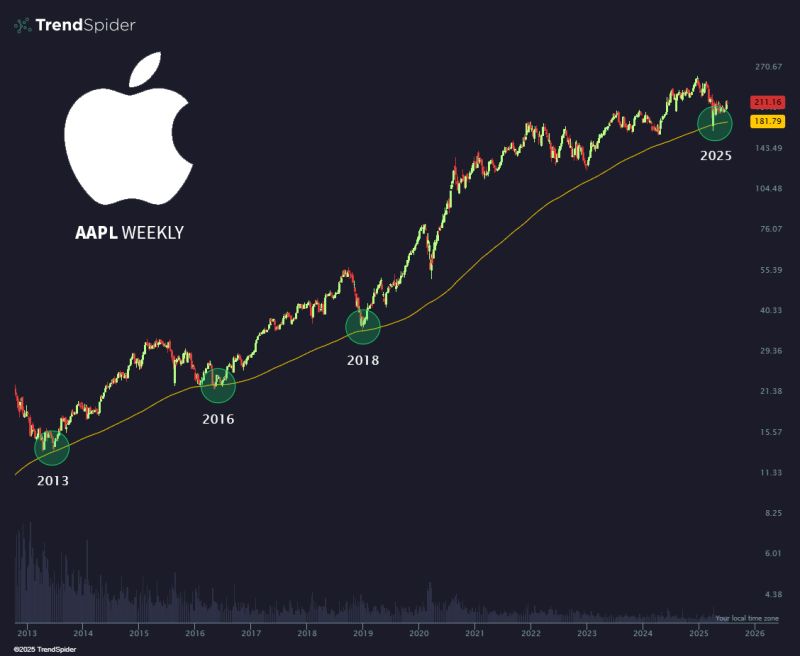

Apple $AAPL gets a downgrade from Needham which warns that investors shouldn't enter a position until the price hits $170-$180

Source: Barchart

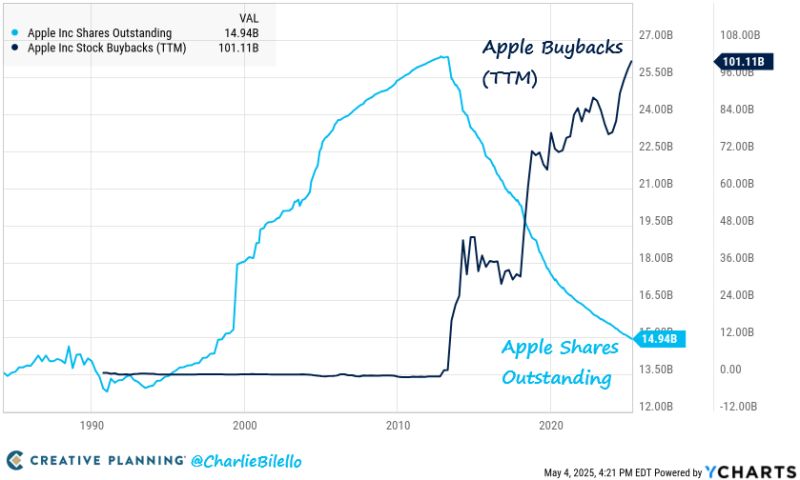

Apple has bought back $693 billion in stock over the past 10 years, which is greater than the market cap of 488 companies in the S&P 500

Source: Charlie Bilello

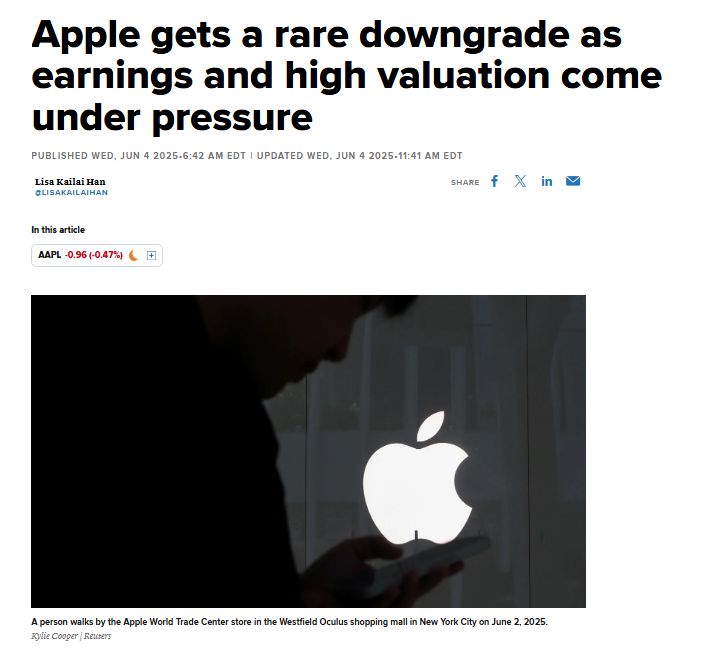

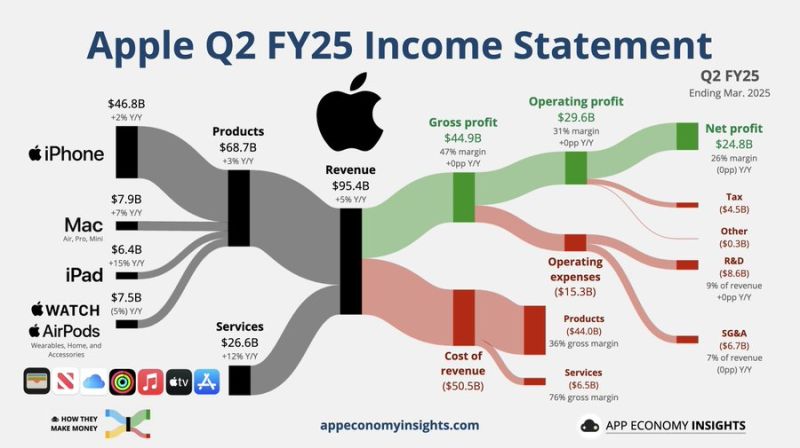

Apple reported second fiscal-quarter earnings Thursday that beat Wall Street expectations, but the company’s closely-watched Services division came up light versus estimates.

➡️ $AAPL Apple Q2 FY25 (March quarter): Services +12% Y/Y to $26.6B. Products +3% Y/Y to $68.7B. • Revenue +5% Y/Y to $95.4B ($0.8B beat). • Operating margin 31% (+0pp Y/Y). • EPS $1.65 ($0.03 beat). Source: App Economy Insights

$AAPL Apple gets upgrade at KeyBanc, Wedbush keeps bullish views amid Trump's tariffs scenario.

$APPL is up +4% Source: @DivesTech

Investing with intelligence

Our latest research, commentary and market outlooks