Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

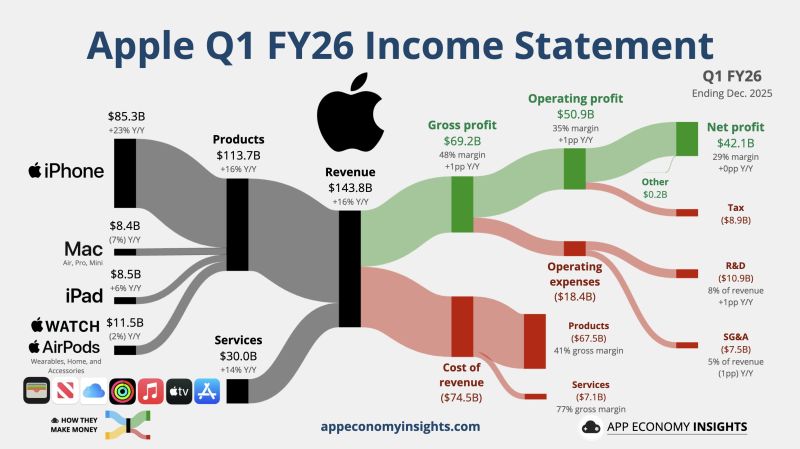

📢 Apple reported fiscal first-quarter earnings on Thursday that surpassed expectations, with revenue soaring 16% on an annual basis.

📌 The company reported $42.1 billion in net income, or $2.84 per share, versus $36.33 billion, or $2.40 per share, in the year-ago period. 🚀 Apple saw particularly strong results in China, including Taiwan and Hong Kong. Sales in the region surged 38% during the quarter to $25.53 billion. Apple quarterly results by App Economy Insights $AAPL Apple Q1 FY26 (Dec. quarter): 📱 Products +16% Y/Y to $113.7B. 💳 Services +14% Y/Y to $30.0B. • Revenue +16% Y/Y to $143.8B ($5.2B beat). • Operating margin 35% (+1pp Y/Y). • EPS $2.84 ($0.17 beat).

BREAKING: Apple

Over the past week, • Apple’s chip chief considers leaving • Apple’s AI chief leaves • Apple’s Policy chief leaves • Apple’s Head of UI leaves • Now a 53% chance Tim Cook leaves (according to Kalshi) What is going on? Source: Kalshi @Kalshi

Apple $AAPL is set to ship more smartphones than Samsung in 2025

This would be the first time it will have done so in 14 years ... Apple will ship around 243M iPhone units this year vs 235M shipments from Samsung. Bloomberg reported that Counterpoint Research expects Apple to become the No. 1 brand by shipments this year with a 19.4% market share. The report says Samsung’s Galaxy line will grow only 4.6% this year, while iPhone sales are likely to increase by 10% compared to last year.

APPLE $AAPL JUST REPORTED EARNINGS EPS of $1.85 beating expectations of $1.75

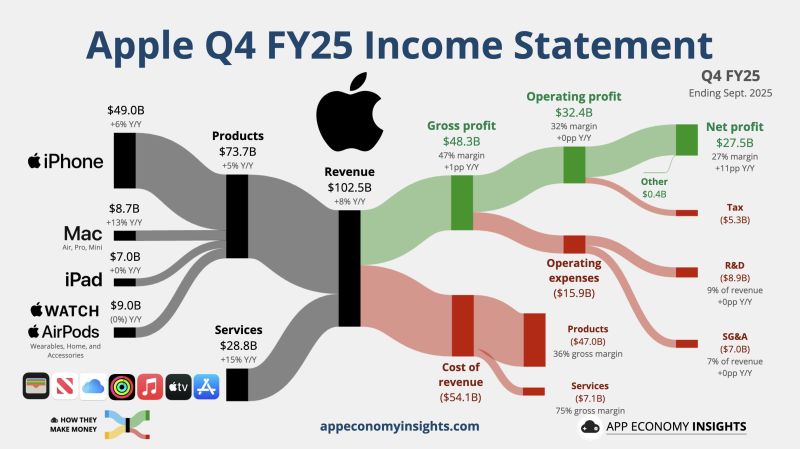

Revenue of $102.5B beating expectations of $101.8B🟢 Stock is up 5% in after hours 🚀 The company's chief financial officer said Apple expects total company revenue to grow 10 to 12% year over year in the three months to December, with iPhone revenue growing double digits $AAPL Apple Q4 FY25 (Sept. quarter): 💳 Services +15% Y/Y to $28.8B. 📱 Products +5% Y/Y to $73.7B. • Revenue +8% Y/Y to $102.5B ($0.2B beat). • Operating margin 32% (+0.5pp Y/Y). • EPS $1.85 ($0.08 beat). Source: App Economy Insights @EconomyApp

Apple on the verge of forming a Golden Cross for the first time since June 2024

The last one sent $AAPL soaring 21% over the next 6 months. Source: Barchart

For the first time ever

Apple $AAPL is reportedly planning 3 straight years of major iPhone redesigns, according to Bloomberg 2025: The iPhone Air 2026: Foldable iPhone 2027: 20th anniversary iPhone with a curved glass Source: Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks