Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

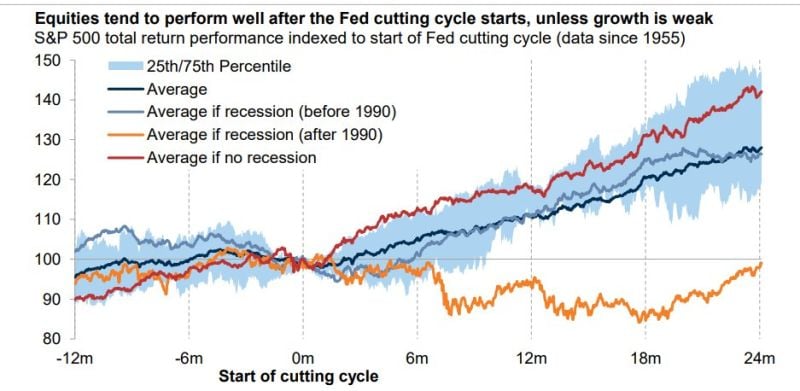

Equities tend to perform well after the Fed cutting cycle starts, unless growth is weak

Source: Goldman Sachs, Mike Z.

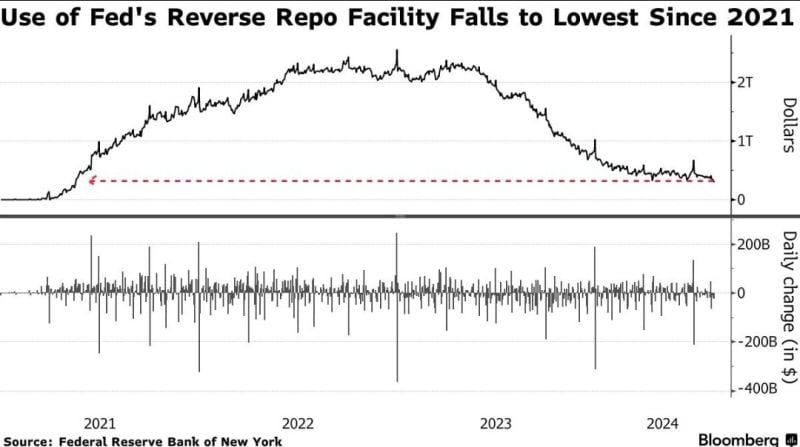

Use of Fed's Reverse Repo Facility Falls to Lowest Since 2021

Analysts said investors may have pulled their money from the reverse repo market and placed cash in the overnight repo market, where banks and financial firms such as hedge funds borrow short-term cash using Treasuries or other debt securities as collateral. In addition, a large rise in the supply of Treasury bills on Tuesday and Thursday, is likely to further drain cash from the RRP facility, analysts said. Source: Win Smart, Bloomberg, Yahoo finance

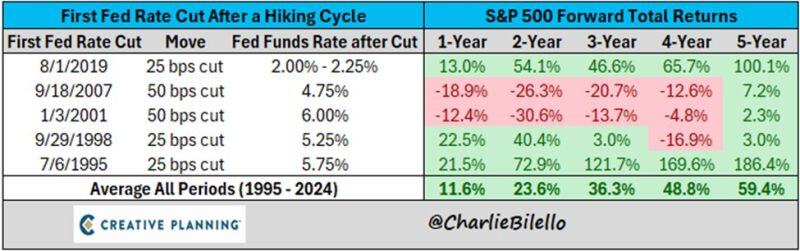

The market is pricing in a 50 basis point rate cut next month.

Market returns following rate cuts have been positive except for periods when the market is generally in crisis. Source: Charlie Bilello, Peter Mallouk

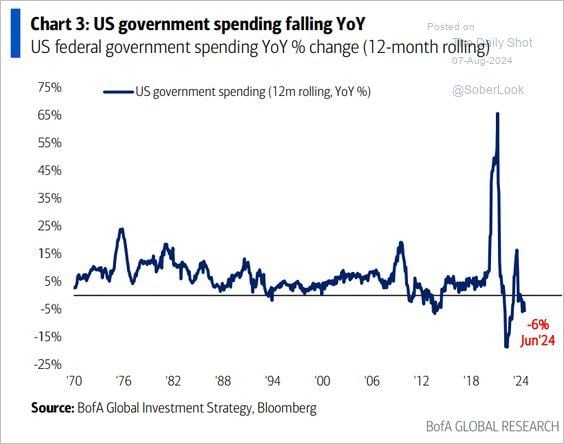

The main reason the economy has been able to avoid a recession over the last 2-years

was due to the massive spending from the inflation reduction and CHIPs Acts. However, the rate of that spending is declining which could potentially weigh on economic growth going forward. Source: BofA, The Daily Shot, Lance Roberts

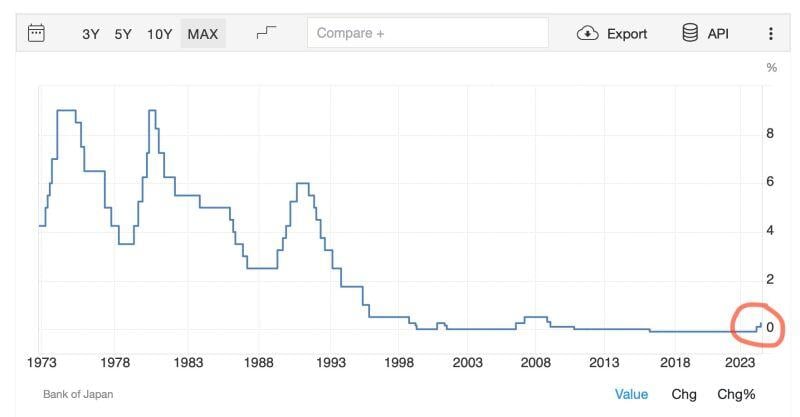

This is what triggered a global-scale sell-off of every major asset class...

A harsh remainder how shaky the global financial system is... Source: Bank of Japan, Sina 21st Capital on X

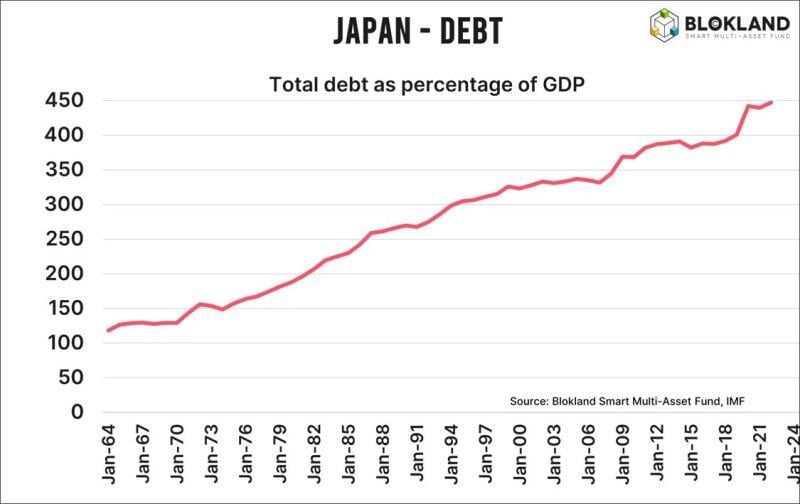

This is the ultimate reason why the Bank of Japan ‘needs to maintain monetary easing.’ DEBT

i.e the yen carrytrade is likely to resume sooner rather than later Source: Jeroen Blokland

It seems that many companies are in desperate need for rate cuts...

Source: Bloomberg

BREAKING: Is the BoJ capitulating?

The Bank of Japan Deputy Governor says they WON’T raise rates when the market is unstable. The Yen is getting absolutely destroyed…and the Nikkei is up nearly +3%, Nasdaq Futures is up +1.2% A wild start of August... Source: TradingView

Investing with intelligence

Our latest research, commentary and market outlooks