Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

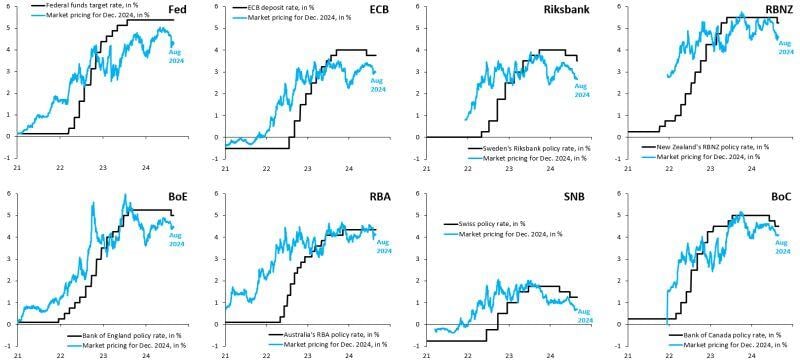

Now that the Fed has given the "all clear" for cuts, the global easing cycle that is likely to gather force

Between 50 - 100 bps in cuts are priced for most central banks across advanced economies for this year alone. Source: Robin Brooks

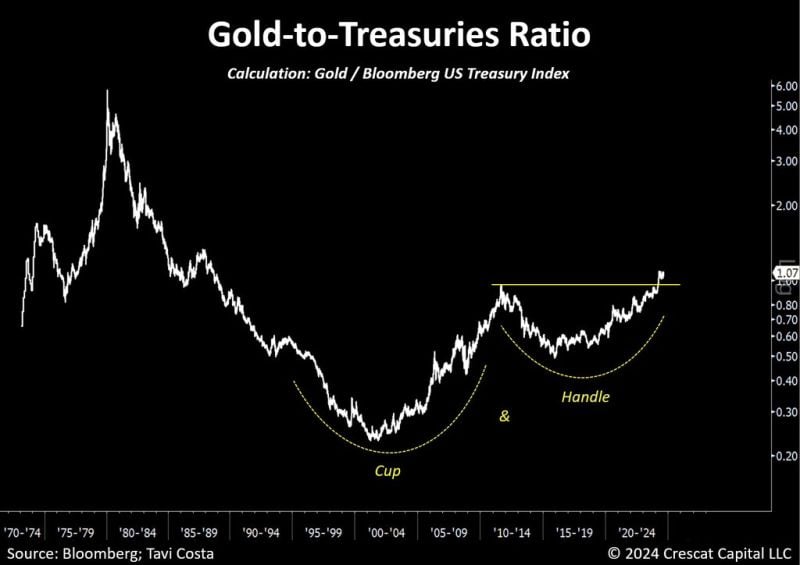

What would a central bank rather own?

Source: Tavi Costa, Crescat Capital, Bloomberg

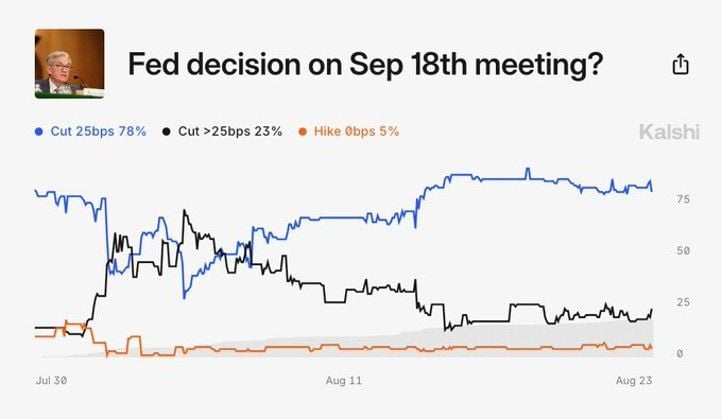

BREAKING: Odds of a 50 basis point interest rate cut at the September Fed meeting rise to 23%

There's now a 95%+ chance that interest rates are cut in September with a 78% chance of a 25 bps rate cut, according to @Kalshi Source: The Kobeissi Letter

BREAKING - Jackson Hole - it seems the Fed Pivot is here

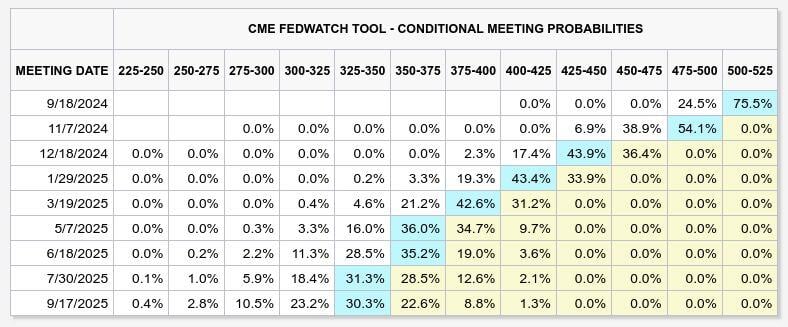

Here's a summary of Fed chair Powell's remarks (8/23/24): 1. "The time has come for Fed policy to adjust" 2. Fed "will do everything" to support a strong labor market 3. Fed does not welcome further weakening of the labor market 4. Confidence has grown that inflation is heading to 2% 5. Balance of risks to Fed mandates has changed 6. Inflation has declined significantly toward the goal As mentioned by Nick Timiraos, the Powell pivot is complete: “The cooling in labor market conditions is unmistakable.” “It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon.” “We do not seek or welcome further cooling in labor market conditions.” “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” “We will do everything we can to support a strong labor market as we make further progress toward price stability.” equities, bonds, cryptos, gold, etc. are all rallying post-statement. Bottom-line: Fed Chair Powell validates rate cuts soon, but didn't make any promises on size and extent. We believe that moving away from a restrictive monetary policy, to a more neutral stance, makes sense. We continue to believe the first fed funds rate cut will be -25bp in September.

Fed Funds Futures pricing in nearly 200 bps of cuts over the next year, which seems quite aggressive and presumes a rather hard landing scenario

Based on current macro data, there's no reason for the Fed to cut this aggressively. Let's see how Powell manages it today at jacksonhole. Source: Markets & Mayhem

Fed rate cuts are imminent...

Here's a quick recap of the FOMC minutes... ▪ Fed Minutes said risk to inflation goal had decreased. ▪ The FOMC minutes indicate a "likely" rate cut in September as most Fed members are leaning towards a rate cut at the next meeting—if the data stays positive. ▪ July Debates: SEVERAL PARTICIPANTS SAID RECENT PROGRESS ON INFLATION AND INCREASES IN THE UNEMPLOYMENT RATE PROVIDED A PLAUSIBLE CASE FOR A 25-BASIS-POINT RATE CUT AT JULY'S MEETING OR THAT THEY COULD HAVE SUPPORTED SUCH A MOVE. ▪ ⚠️ Rising Unemployment Risks: Fed believed the labor market is in a better place but payrolls were overstated (made sense given the 818k job revision today). The majority are concerned about increasing unemployment. 📉 Economic Growth Downgraded: The outlook for growth in the second half of 2024 has been revised downward. Fed believed consumer spending did start to weaken based on delinquencies going up ▪ 📊 Inflation Confidence: Recent reports have strengthened the Fed’s belief in managing inflation. ▪ 🕰️ Timing Matters: Delaying easing could significantly weaken the economy. => The first rate cut since 2020 likely coming next month. => S&P 500, Nasdaq close higher as Fed minutes lift investors’ hopes for a September rate cut!

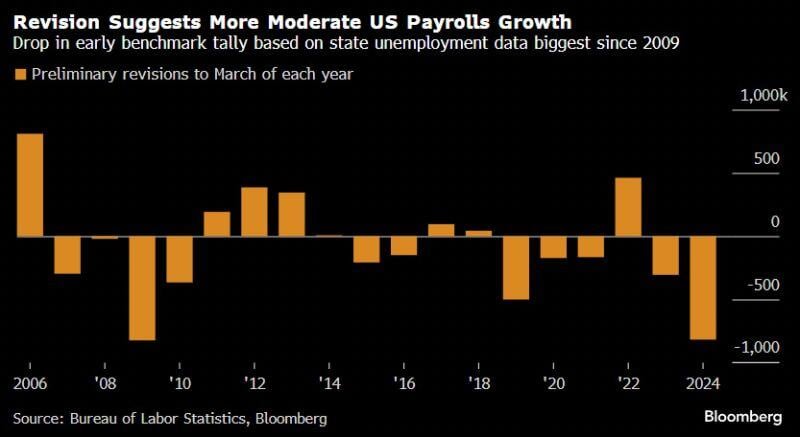

Nonfarm payroll growth revised down by 818,000 for the 12 months through March — or around 68,000 less each month – most since 2009

Before the report, the BLS’s initial payrolls figures indicated employers added 2.9mln total jobs in the period, or an avg of 242k per month. Now the monthly pace is more likely to be ~174k, still a healthy rate of hiring but a moderation from post-pandemic peak At the sector level, the biggest downward revision came in professional and business services, where job growth was 358,000 less than initially reported. => The labor market appears weaker than originally reported. This should allow the Fed to prepare markets for a cut at the September meeting. Source: Bloomberg, HolgerZ, CNBC

BREAKING 🚨 US employment data...

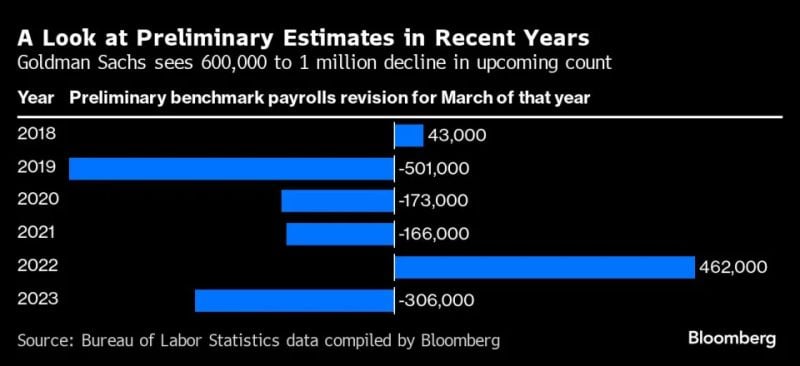

Federal Reserves faces up to 1 million US jobs "vanishing" in potentially the largest downward jobs revision in 15 years, according to Bloomberg Goldman Sachs Group Inc. and Wells Fargo & Co. economists expect the government’s preliminary benchmark revisions on Wednesday to show payrolls growth in the year through March was at least 600,000 weaker than currently estimated — about 50,000 a month. While JPMorgan Chase & Co. forecasters see a decline of about 360,000, Goldman Sachs indicates it could be as large as a million. There are a number of caveats in the preliminary figure, but a downward revision to employment of more than 501,000 would be the largest in 15 years and suggest the labor market has been cooling for longer — and perhaps more so — than originally thought. The final numbers are due early next year. Such figures also have the potential of shaping the tone of Fed Chair Jerome Powell’s speech at week’s end in Jackson Hole, Wyoming. Investors are trying to gain insight as to when and how much the central bank will start lowering interest rates as inflation and the job market cool. Source: Yahoo Finance, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks