Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

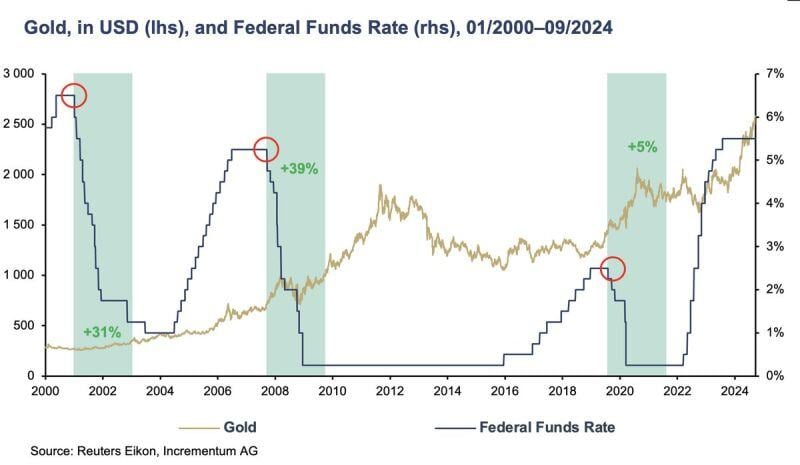

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

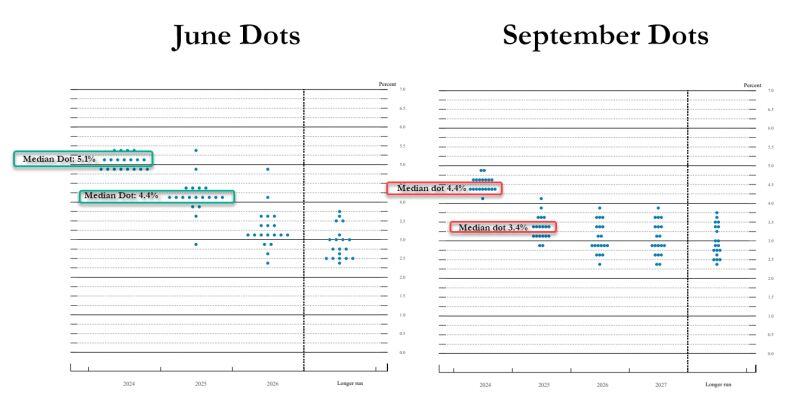

Amazing to see the effect of 818K downward jobs revision on the fed dots...

Source: www.zerohedge.com

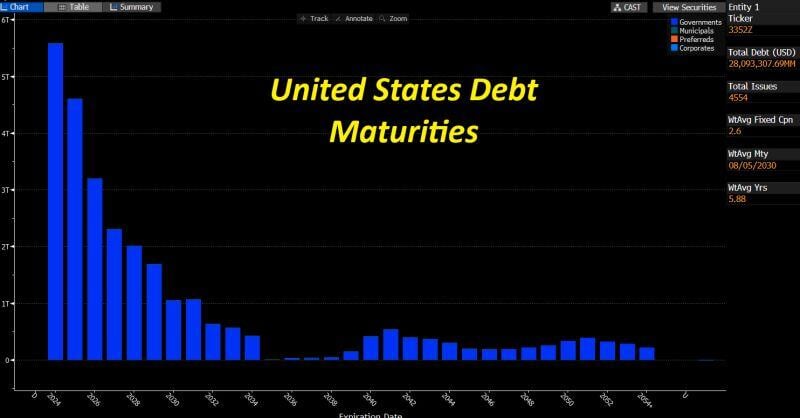

Among the reasons why the Fed cut 50bps this week:

1) Inflation risk is LOWER than Employment and Consumer risk 2) The sticky component of inflation is shelter. For shelter inflation to go down we need to see more housing supply and for this we need to get lower mortgage rates = jumbo rate cut does help 3) They MUST get front-end rates lower as this colossal wall of debt matures (source: Lawrence McDonald, Bloomberg)

FED cuts rates by 50bp to 4.75%-5% range

The Federal Reserve lowered its benchmark interest rate by a half percentage point Wednesday, in an aggressive start to a policy shift aimed at bolstering the US labor market.Committee sees another half-point of cuts in rest of 2024Policymakers penciled in an additional percentage point of cuts in 2025, according to their median forecast.

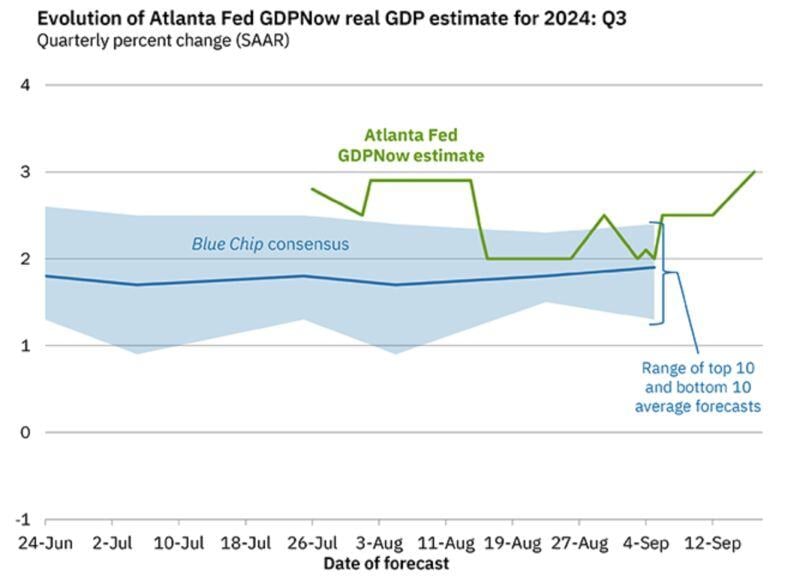

Soft landing? Hard landing? Or no landing?

Atlanta Fed Q3 Real GDP growth Nowcast model just hit 3%...

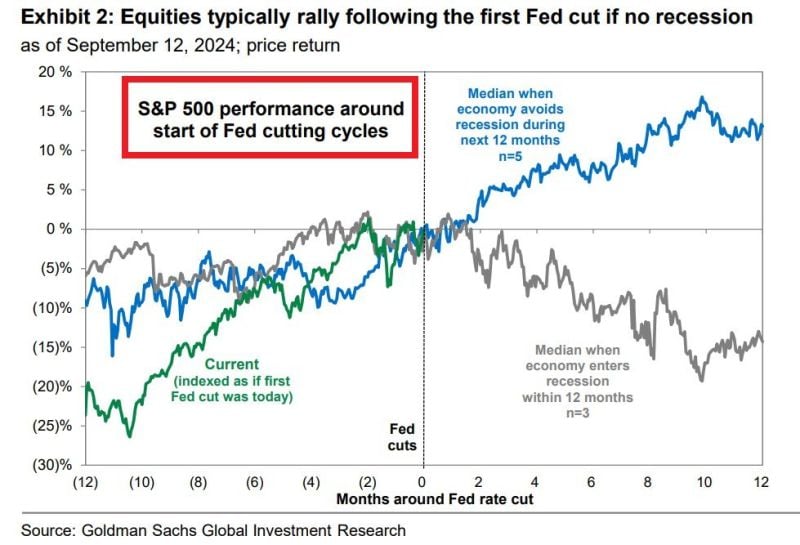

FED WILL CUT RATES ON WEDNESDAY FOR THE 1ST TIME IN 4.5 YEARS Stocks usually fall ~15% within 12 months following the 1st cut if there is a recession

If no recession, stocks rise by >10%. Key caveat is, that we will know if there was a recession a few months after the cut. Source: Global Markets Investor

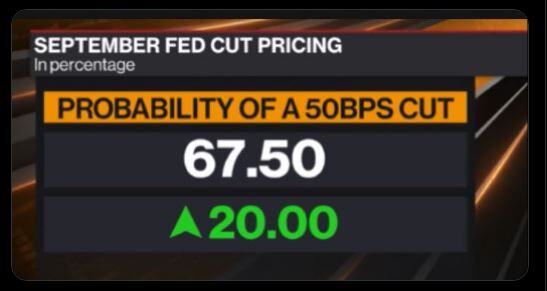

Market pricing now suggests a 50bps cut from the Fed is now base case (nearly 70% probability)

Source: Bloomberg, David Ingles

Investing with intelligence

Our latest research, commentary and market outlooks