Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

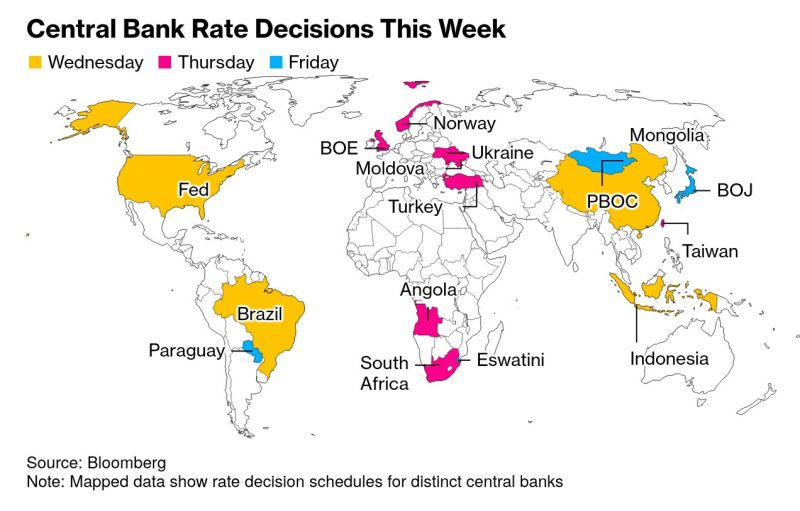

This is a big week for central bank decisions! We've got the fed, PBoC, boe, boJ and many more!

Source: Bloomberg

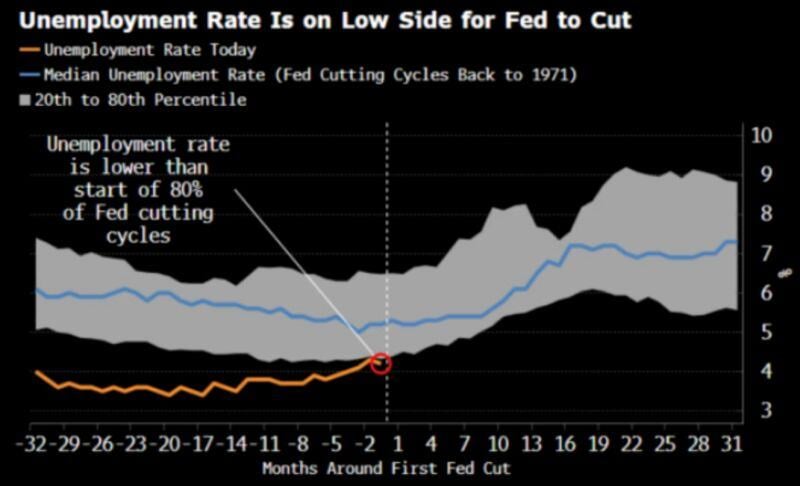

Should the FED cut rates next week, the easing cycle will start with an unemployment rate which is on the low side vs. history

Source: RBC, Bloomberg

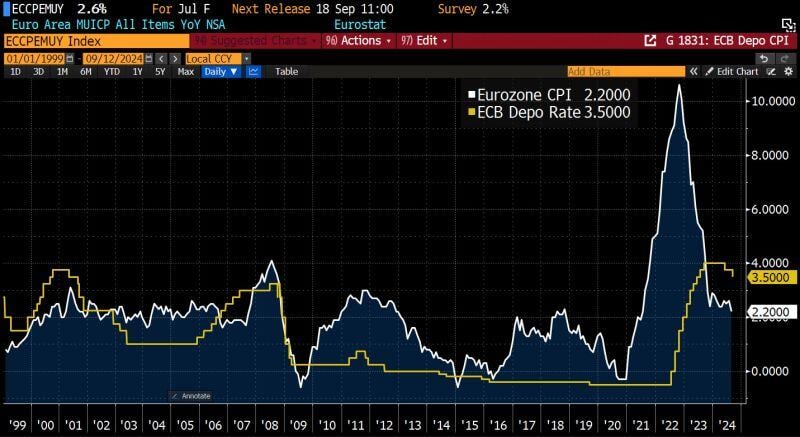

ECB's Lagarde: ECB decision on the size of the depo rate cut was unanimous.

Says inflation will drop to 2% in course of 2025. Our take: 👉 As widely expected, the ECB just cut its key rates for the second time this year after a first move in June. The Deposit Facility Rate (the rate at which commercial banks’ deposits at the ECB are remunerated) was lowered by 25bp to 3.50%. The main Refinancing rate (the rate applied to short-term liquidity lent by the ECB to commercial banks) was lowered to 3.65%. 👉After those rate cuts, monetary policy remains restrictive, as short-term interest rates are still significantly above the inflation rate of the euro area. However, this is “another step in moderating the degree of monetary policy restriction”, as stated by the ECB. 👉The ECB appears willing to proceed cautiously and gradually in bringing back its monetary policy stance to a neutral level, as domestic inflation remains higher than its target and wages are still rising at an elevated pace. The encouraging trend toward slowing wage growth witnessed recently has apparently not fully relaxed ECB’s concerns on the risk of persistent underlying inflationary pressures. 📈 ECB macroeconomic projections ECB staff’s projections have been revised slightly lower for GDP growth this year and in the following two. As reflected by the most recent economic data, growth will be soft this year, but it is expected to gradually accelerate in the next two years. Inflation is still expected to slow down toward the 2% target by 2026, with already a significant deceleration due next year. “Core inflation” projections have been marginally revised up for this year and the next on the back of firmer-than-expected price pressures in the service sector. 🚨 Conclusions • Since the rate cut was widely anticipated, today’s main news lies in the outlook for ECB rates. • A rate cut in December already appeared highly likely before today’s meeting and it remains so today, in the continuation of the quarterly pace initiated in June. • There was uncertainty around a potential additional rate cut at the October meeting, with future markets previously assigning a 34% chance on another rate cut at the ECB next meeting in October. • As inflation projections have not been revised lower today (even marginally higher for “core” inflation), and GDP growth expectations have only been marginally lower, the case for a step up in the pace of rate cuts appears less pressing now. The probability of an October rate cut dropped immediately after the announcement, to only 17%. Adrien Pichoud Source chart: Bloomberg

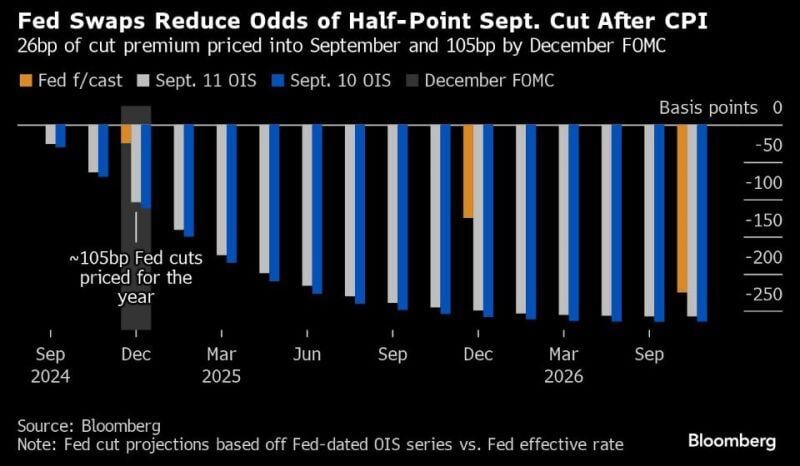

Fed Expected to Cut Rates by 25 Basis Points After Inflation Data; Bitcoin Remains Stable

U.S. inflation came in as expected, increasing the likelihood of a 25 basis point Fed rate cut, with market expectations rising to 83%. A 50 basis point cut is now only 17% likely. The bond market now expects a 25 bps Fed rate cut this month, not 50 bps. The 2-year yield hit 3.69%, and the hashtag#Fed's held rates at 5.25%-5.5% since July 2023. Investors eye 140 bps in cuts by Jan '25. Source: Luc Sternberg, coinoptix, Bloomberg

Morgan Stanley's CIO Michael Wilson says "yen carry trade risk lingers for US stocks"

Source: Bloomberg

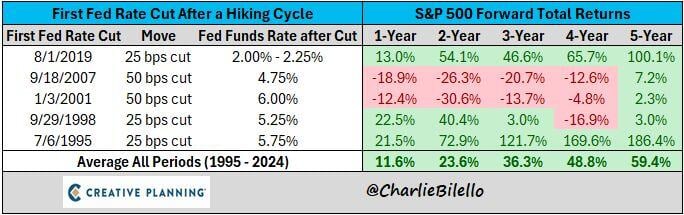

Those calling for a 50 bps rate cut next week should take a look back at January 2001 & September 2007 when the Fed started cutting cycles with a 50 bps move

If the Fed feels the need to go big because of a weakening economy, that's not bullish. Source: Charlie Bilello

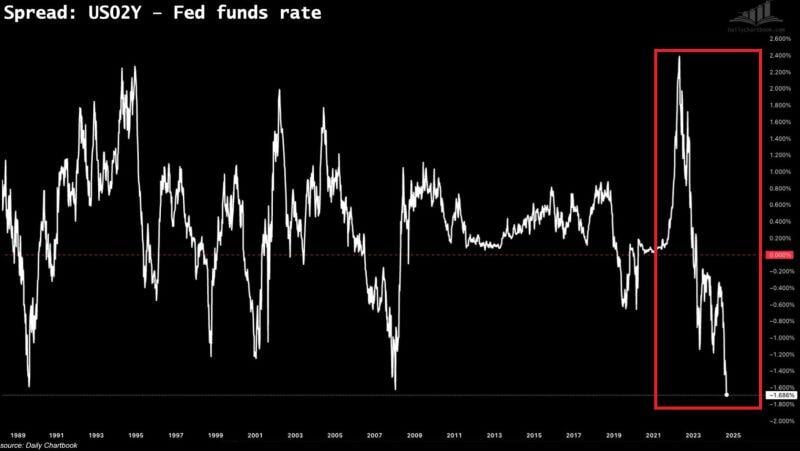

‼️THIS HAS NOT HAPPENED IN AT LEAST 35 YEARS‼️

The spread between the 2-year US government bonds and Fed's rates FELL to -1.686%, the most in over 3 decades. In other words, bond market expects the Fed to cut BIG in the next months. Question: Is the bond market too dovish? Or is the Fed too much behind the curve? Source: Global Markets Investor, Bloomberg

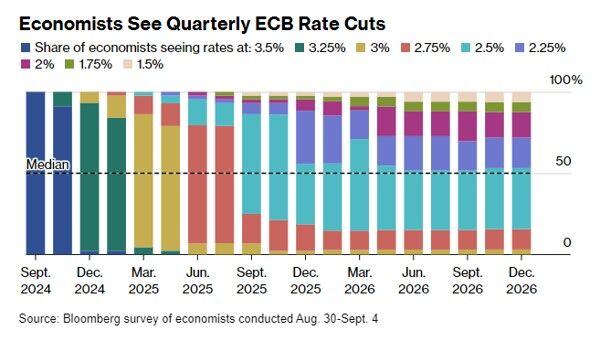

Ahead of ECB meeting, we got some mixed messages about the central bank speed and extent of rates cuts - see below.

Meanwhile, the market see quarterly ECB rate cuts - see chart below. - European Central Bank (ECB) Governing Council member Gediminas Simkus told Econostream Media that he saw a “clear case” for an interest rate cut in September but regarded the potential for another one in October was “quite unlikely.” - Executive Board member Piero Cipollone told France’s Le Monde newspaper that recent economic data so far had confirmed that inflation was slowing, giving scope for the ECB to lower borrowing costs. “There is a real risk that our stance could become too restrictive and harm the economy”. - However, Bundesbank’s Joachim Nagel continued to warn about premature easing, given elevated wage growth and services inflation, in an interview with the Faz newspaper. Source: Bloomberg, T Rowe

Investing with intelligence

Our latest research, commentary and market outlooks