Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Fed Chair Jerome Powell just said the recent 50BPs interest rate cut shouldn’t be interpreted as a sign that future moves will be as aggressive - CNBC

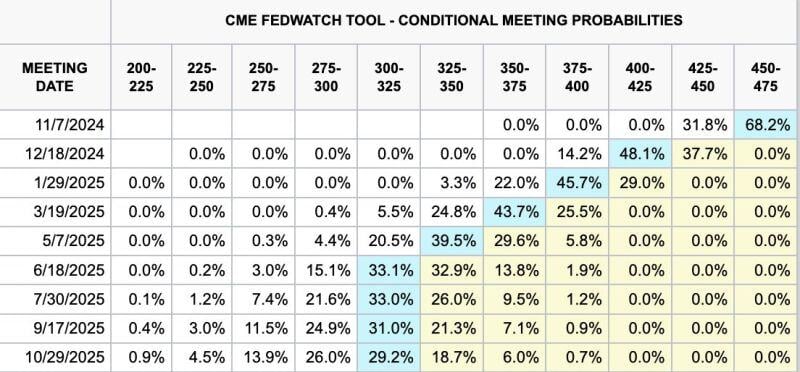

“Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course,” he told the National Association for Business Economics in prepared remarks. “The risks are two-sided, and we will continue to make our decisions meeting by meeting” The market currently thinks there's a 68.2% chance Jerome Powell and the Fed cut rates by 25BPs at the next FOMC meeting Source: CME FedWatch Tool

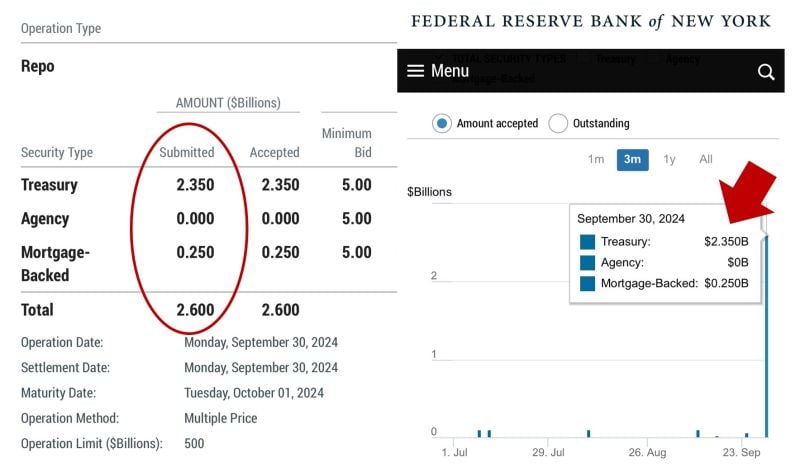

😱 The shocking chart of the day: THE FED REPO FACILITY FOR EMERGENCY LIQUIDITY HAS BEEN TAPPED FOR 2.6BN$! 😱

Is a big bank in troubles ??? Source: JustDario on X

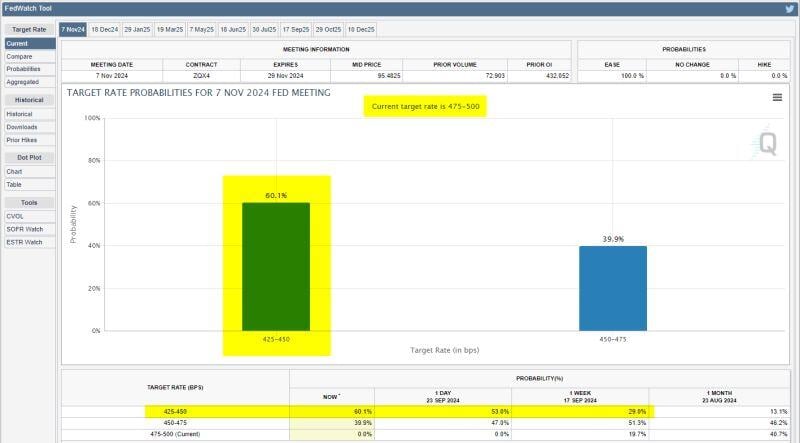

Market pricing for another 50 bps rate cut at the Fed's next meeting two days after the election is now up to 60%.

@CMEGroup

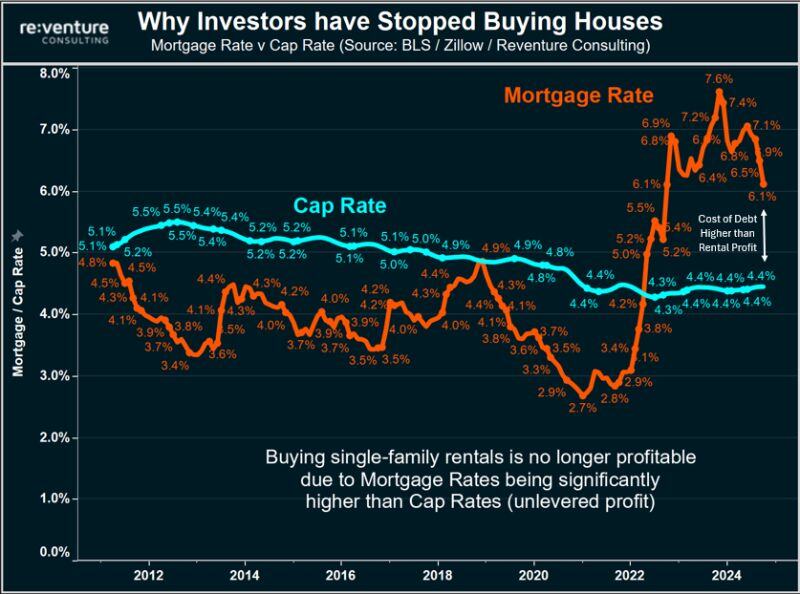

Buying a rental property in America is no longer profitable.

Because the current mortgage rate (6.1%) is significantly higher than the profit/cap rate (4.4%) of rentals. This means that any investor who uses debt to finance their purchase is likely losing money on cash flow from Day 1. Note how from 2012-2022, the opposite was true. Cap Rates were higher than mortgage interest. Which is why so many people piled into single-family rentals. This is no longer the case... Will the Fed jumbo rate cut start to fix this? Source: Nick Gerli, re:venture

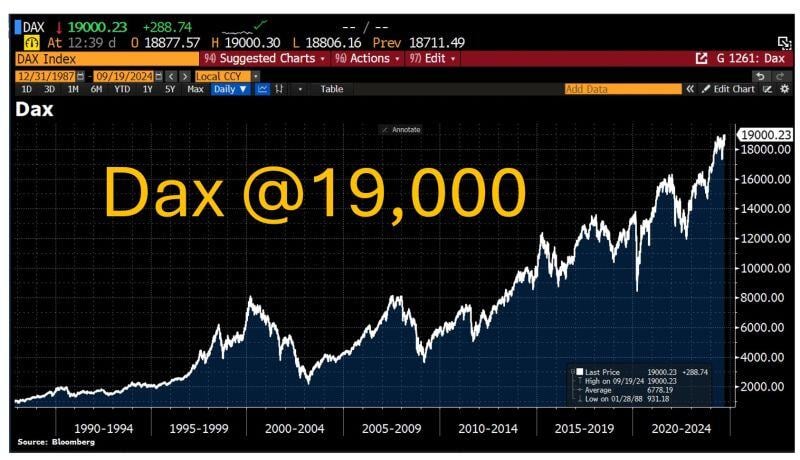

In case you missed it... While the german economy is struggling, the stock market doesn't care...

Germany's blue-chip index Dax jumped >19,000 points for the first time after Fed's jumbo rate cut. Source: HolgerZ, Bloomberg

BREAKING 🚨 The Federal Reserve has cut interest rates by 50 basis points in their first rate cut since March 2020

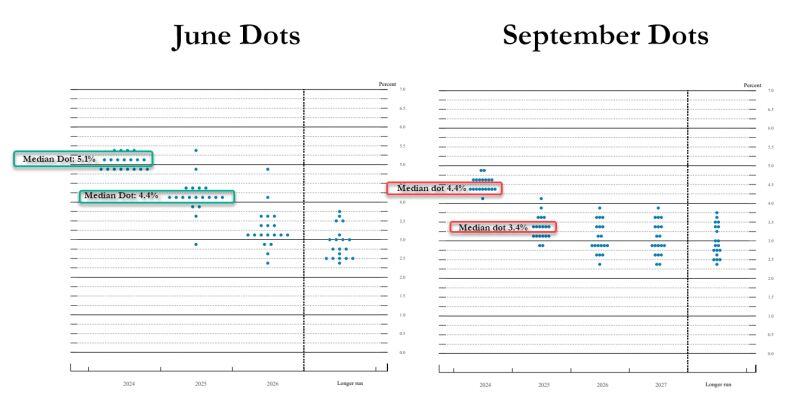

The long awaited "Fed pivot" has officially begun... By starting their monetarypolicy easing cycle with an aggressive 50 basis points rate cut it seems that the fed decided to focus on the labor market part of their dual mandate rather than the inflation one... Here's a summary of Fed decision: 1. Fed cuts interest rates by 50 bps for first time since 2020 2. Fed sees 2 more 25 basis point rate cuts in 2024 3.Fed governor Miki Bowman dissented in favour of a smaller 25 bps cut. It's the first dissent by a *governor* since 2005. 4. Fed gained "greater confidence" that inflation is moving to 2% 5. Fed will "carefully asses incoming data" and evolve outlook 6. Fed sees 100 bps of rate cuts in 2025 and 50 bps of cuts in 2026 This is a CLEAR Fed pivot and the Fed is signaling that they believe the disinflation trend remains in place but also that they now see making unemployment their top priority as the labor market has weakened. Their decision sounds almost like a risk management one. (Initial) Market reaction >>> -> The SP500 rises to a new all time high but the equity market reaction is rather mixed so far -> Yield curve steepens with a modest yield rise on the long-end -> The dollar weakens Gold and bitcoin slightly rise

Live look at JP Morgan after being the only ones who correctly predicted a 50bps cut:

Source: Trend Spider

Amazing to see the effect of 818K downward jobs revision on the fed dots...

Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks