Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

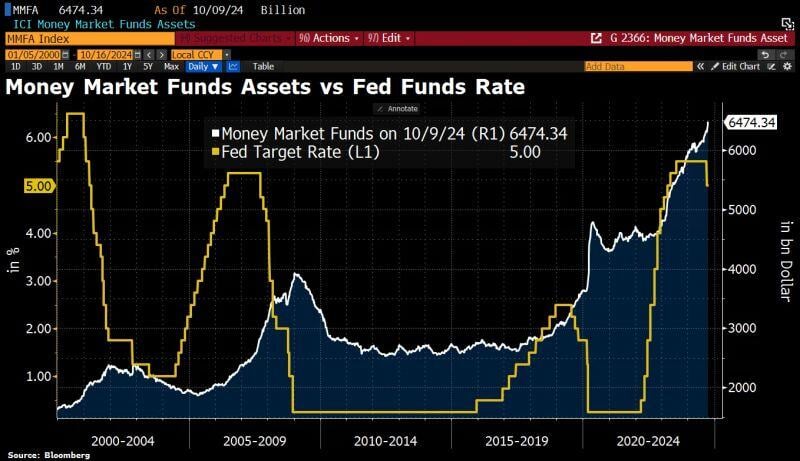

Mind the gap: Assets in US money market funds have hit a fresh ATH at $6.5tn, although the relevant Fed Funds Rates have fallen and are likely to fall further.

Note however that the "relative" figures (i.e money market funds AuMs as a % of total assets AuMs) currently stand at all-time low whereas equities weight is at all-time high... Source. Bloomberg, HolgerZ

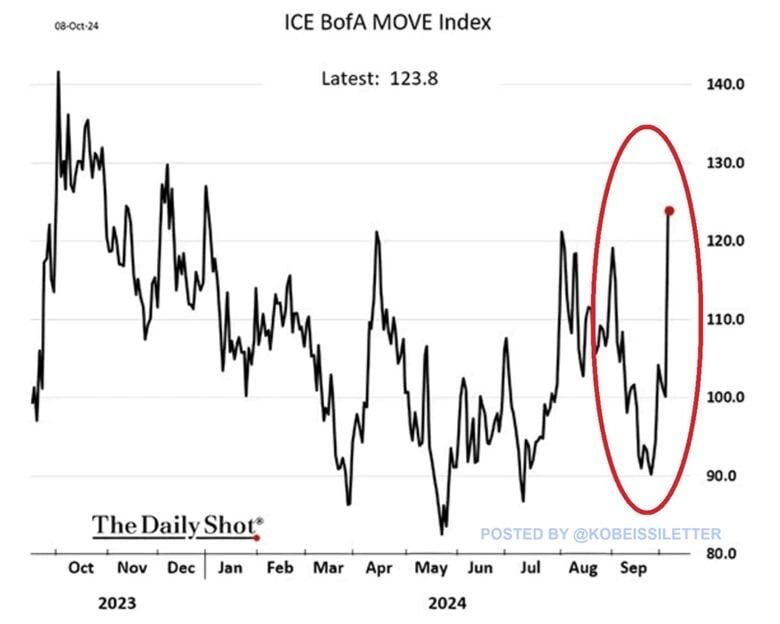

Bond market volatility is spiking:

The ICE BofA MOVE Index hit 123.8 points last week, the highest level since January. The MOVE index, also called the “VIX of bonds” is a metric measuring yield volatility of 2-year, 5-year, 10-year, and 30-year Treasuries. The index has skyrocketed 38% in just 3 weeks as yields started rising following the Fed's decision to cut rates by 50 bps. Over this period, the 10-year Treasury yield jumped from 3.64% to 4.10%. At the same time, the popular bond-tracking ETF, $TLT, fell by 6.8%. What happened to the "Fed pivot?" Source: The Kobeissi Letter, The Daily Shot

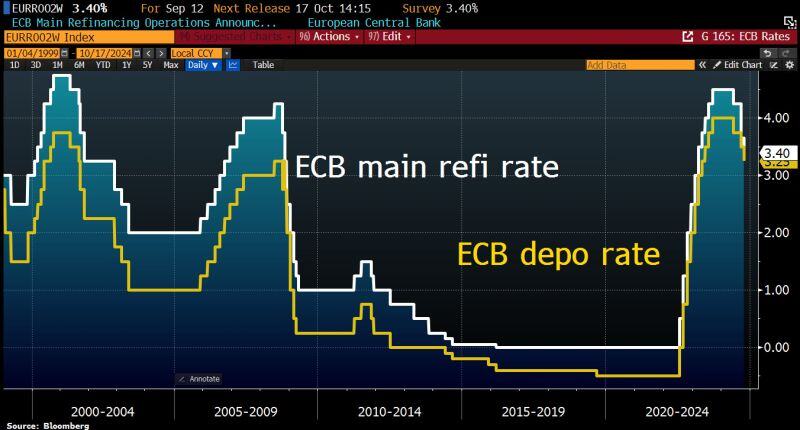

ECB cut the key rates by 25bps as expected.

Depo rate to 3.25%, Main Refi to 3.4%. Guidance is unchanged: ECB to follow data-dependent, Meeting-by-Meeting approach. • Even after this third rate cut of the year, monetary policy remains restrictive in Europe, with the real short-term rate still at a level not seen over the past 15 years. Given the ongoing dynamics in economic activity and inflation, this implies that the ECB will have to continue to lower rates in the coming months, in order to bring its monetary policy to a neutral stance at minimum. Rate cuts at the coming meetings are therefore to be expected, in December and in the course of 2025. Given the worrying trend in economic activity data, an acceleration in the pace of rate cuts, with a possible 50bp cut at the December meeting, cannot be ruled out. If growth in the Eurozone stalls, a faster pace of rate cuts to remove the restrictiveness of the monetary policy, or even to move it into supportive territory, might prove to be warranted. Source chart: Bloomberg

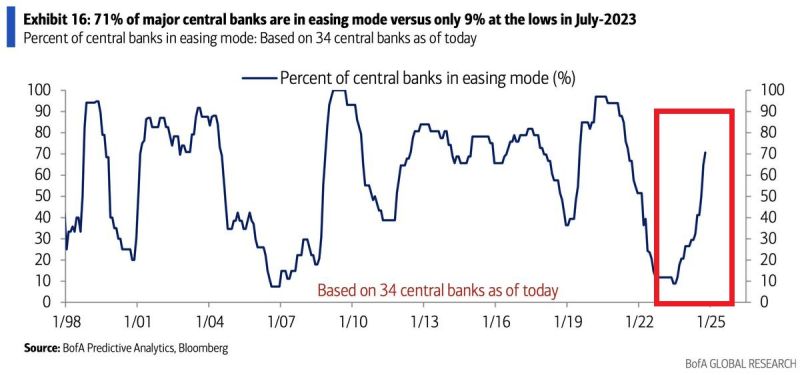

👉 A SYNCHRONIZED GLOBAL MONETARY POLICY EASING

71% of major central banks are now easing their monetary policy, the most since the 2020 CRISIS. This is also in line with the Financial Crisis and the 2001 recession. Source: BofA

Central Bankers from Mexico, Mongolia, and the Czech Republic say they will buy more Gold to add to their Reserves

Source: Barchart

In case you missed it... Atlanta Fed President Raphael Bostic is okay with skipping rate cut in November 🚨

Source: Barchart

FOMC MINUTES WERE PUBLISHED TODAY, here are the highlights 👇

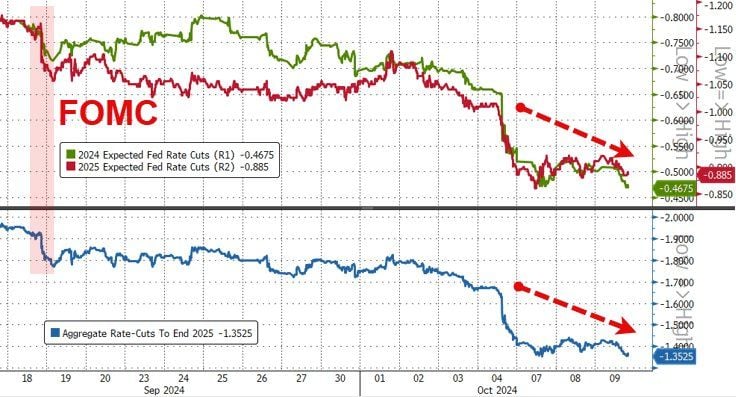

▪ ‘Substantial majority’ backed half-point rate cut ▪ ‘Some’ officials would have preferred quarter-point cut ▪ ‘Almost all’ officials saw higher risks to labor market ▪ ‘Almost all’ participants saw lower inflation risks The key takeaway >>> FOMC Minutes Show Fed Considerably More Divided Over Size Of Rate Cut While there was only one dissent, the FOMC Minutes show "some" officials preferred a 25bps cut. Despite the apparent dovish pivot, expectations for rate-cuts (this year and next) has plunged dramatically - see chart below Source: Stocktwits, zerohedge

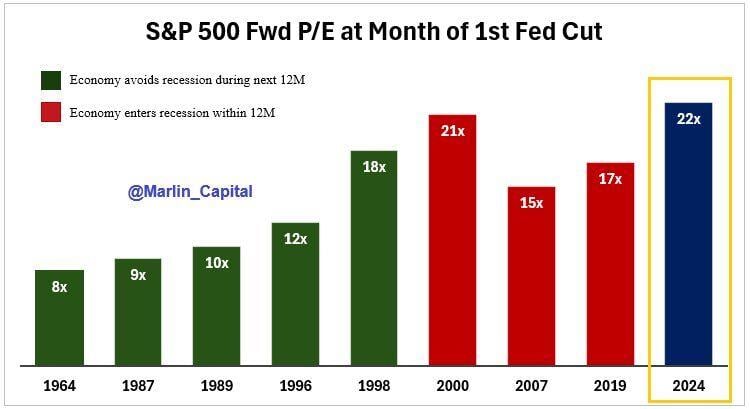

This time is different…

Historically, Fed rate cuts triggered market rallies led by valuation expansion. But this time, it seems that markets front-loaded the Fed by accumulating us stocks AHEAD of the Fed decision. Bottom-line: Current market valuation is now on the high side vs. other instances in history when the Fed cut rates. This should limit the amplitude of the current bull equity Source: David Marlin

Investing with intelligence

Our latest research, commentary and market outlooks