Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US Fed officials see interest rate cuts ahead, but only ‘gradually,’ meeting minutes show - CNBC

Federal Reserve officials expressed confidence that inflation is easing and the labor market is strong, allowing for further interest rate cuts albeit at a gradual pace, according to minutes from the November meeting released Tuesday. The meeting summary contained multiple statements indicating that officials are comfortable with the pace of inflation, even though by most measures it remains above the Fed’s 2% goal. With that in mind, and with conviction that the jobs picture is still fairly solid, Federal Open Market Committee members indicated that further rate cuts likely will happen, though they did not specify when and to what degree.

It has been a very quiet year... Can we expect the same in 2025??? (Clone)

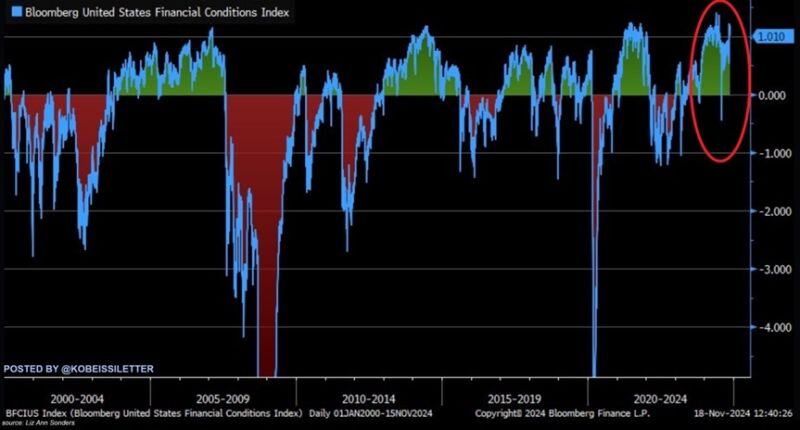

Financial conditions are now even easier than previous records seen in late 2020 and 2021. In fact, this makes financial conditions easier than when the Fed cut rates to near 0% overnight in 2020. Meanwhile, the market is pricing in a 59% chance of another 25 bps Fed rate cut in December. Source: The Kobeissi Letter, Bloomberg

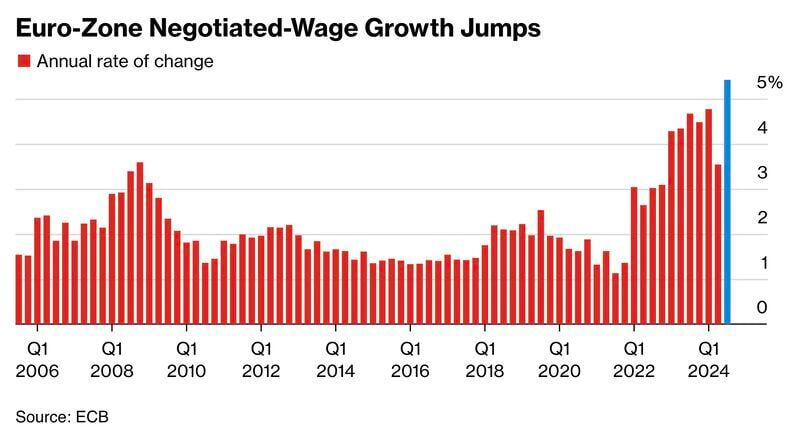

Eurozone wages jumped 5.4% YoY, the biggest increase since the euro was introduced.

The data may complicate the ECB’s easing plans. Source: HolgerZ, Bloomberg

WORLD INVESTING LANDSCAPE IS CHANGING

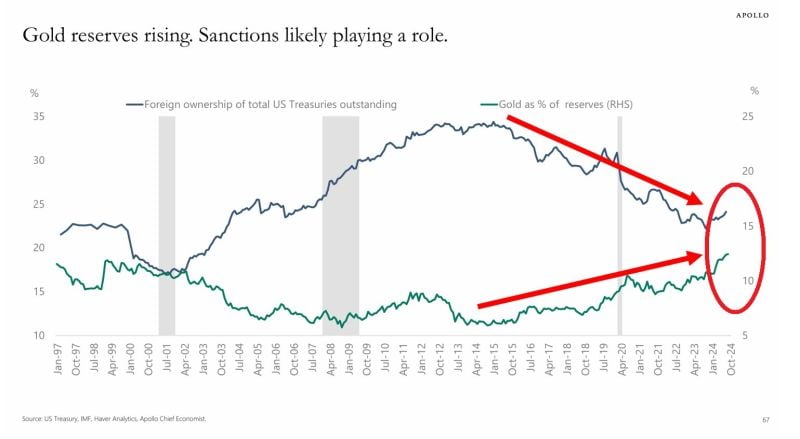

Global central banks gold reserves hit 13%, the highest in at least 3 decades. At the same time, foreign ownership of US government bonds fell to ~24%, near the lowest in 2 decades. World is embracing gold at the expense of Treasuries. Source: Global Markets Investor, Apollo

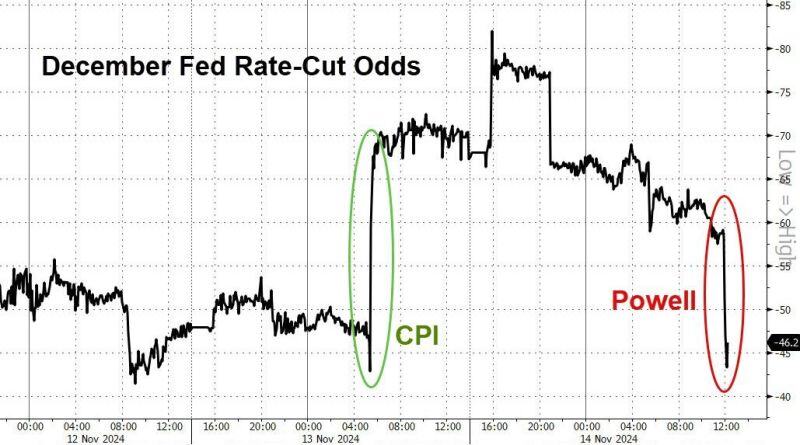

Higher than expected US PPI + Powell's remarks yesterday sent rate-cut expectations notably lower - December less than 50-50 now...

Source: Bloomberg, www,zerohedge.com

Has J Powell handed Trump a ticking time bomb?

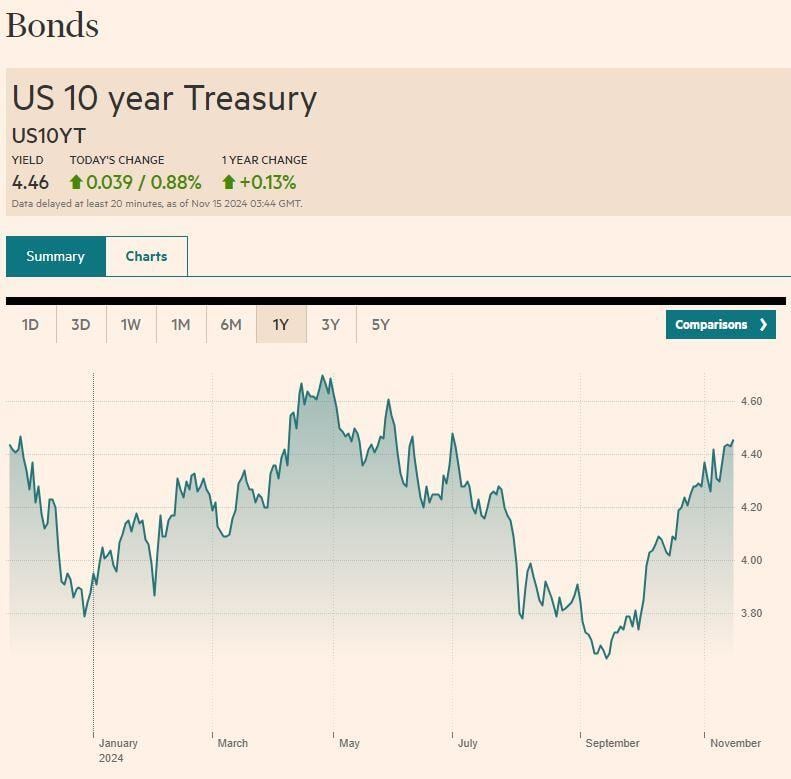

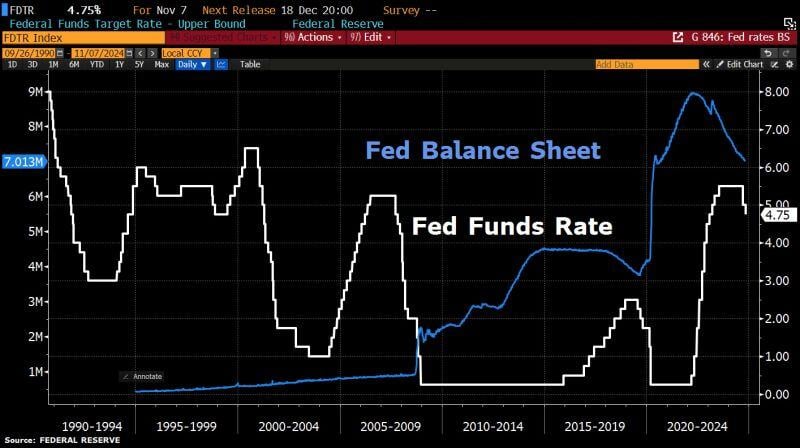

By prematurely cutting rates by 50 bps ahead of the election, even with inflation still running above target, the Fed has set the stage for an inflationary resurgence. The latest October inflation data released yesterday confirmed the trend, with PPI coming in at 2.4%, hotter than the expected 2.3% Meanwhile, core PPI rose to 3.1%, ahead of the expected 3.0% increase The bond market starts to price in this risk, with 10-year Treasury yields up nearly 70 bps since the Fed's began cutting overnight rates in September Rising borrowing costs will become a major headwind for Trump's pro-growth, and likely pro-inflationary, fiscal policies. And it could soon become a major problem for equity investors paying a near record high 28x (TTM) earnings in today's stock market. Source: Porter Stansberry @porterstansb on X, Marketwise,T

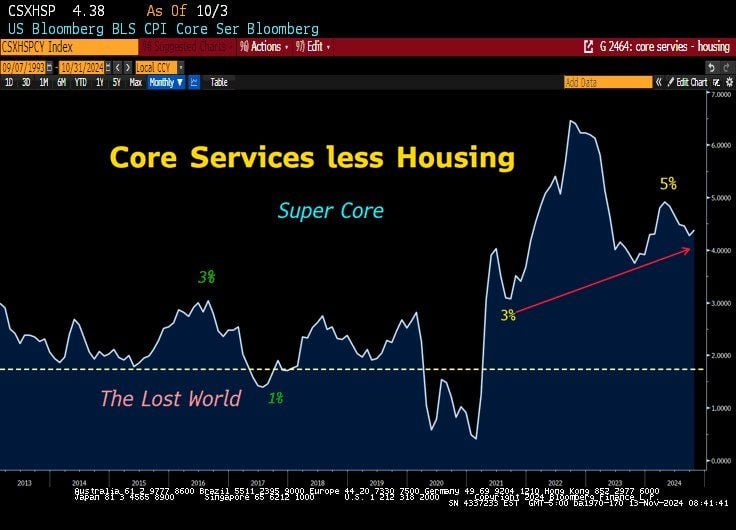

It seems that the FED's neutral rate is higher.

Are they going to throw the towel on the 2% target? Source: Bloomberg, Lawrence McDonald

Fed cuts rates by 25bps in unanimous decision as expected. So what did the Fed do?

👉 FED LOWERS BENCHMARK RATE 25 BPS TO 4.5%-4.75% RANGE 👉 FED SAYS RISKS TO GOALS REMAIN 'ROUGHLY IN BALANCE’ 👉 FED: LABOR MARKET CONDITIONS HAVE 'GENERALLY EASED' No dissent on this rate-cut decision. 🚨 Key changes: - Most notably, removing language that Fed has "gained greater confidence that inflation is moving sustainable toward 2 percent". - Adding that labor market conditions have "generally eased" since earlier in the year, replacing "job gains have slowed". Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks