Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

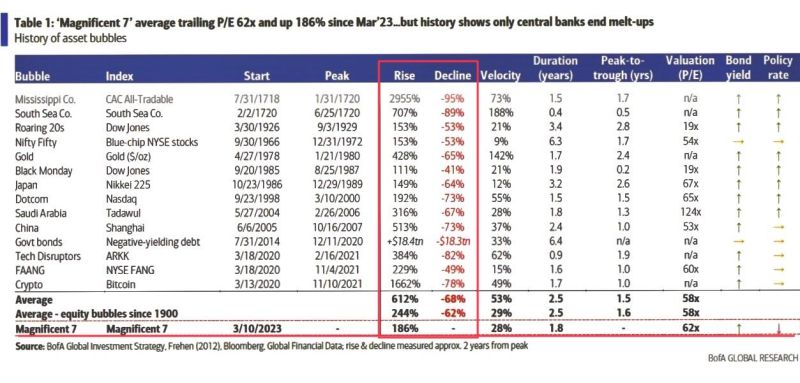

Historical asset bubble summary from BofA, including the current Mag7 frothiness.

”History shows only central banks end melt-ups”… Source: BofA, Wasteland Capital

Apollo made a HUGE call on Sunday:

For the first time since the "Fed pivot" began, Apollo has officially declared inflation back on the rise. They warn of a potential repeat the 1970s as the Fed cuts rates into rising inflation. Apollo says the probability of the Fed RAISING interest rates in 2025 is now rising. Here's why: 👉 First, measures of inflation stickiness are all now well above the Fed's 2% target. In fact, the Atlanta Fed Core Sticky CPI index has leveled off near 4%. ALL major measures of CPI stickiness are now above 3%. 👉 Meanwhile, core CPI has levelled off at 3.3% fore multiple months in a row. This was "fine" because headline CPI was moving in a straight-line to 2% all year. However, as of the latest CPI inflation data, it's now RISING and back to 2.7%. Source: The Kobeissi Letter, Apollo

🚨 JUST IN: CANADA SLASHES RATES BY 50 BPS

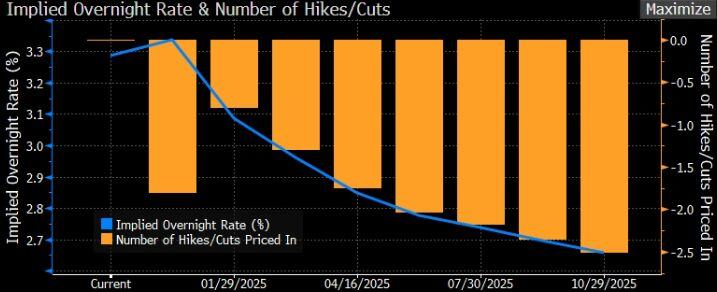

Fifth cut in a row... Dropping the policy rate from 5% to 3.25% in 2024—150 bps total. But it’s not working fast enough: -Unemployment: 6.8% (highest in 8 years). -GDP per capita: Down 6 straight quarters. -Canadian Dollar $CAD at 4.5-year low -Former BOC Governor says “We’re already in a recession.” Market is pricing in another ~50bps of cuts by July 2025 ➡️ 2.75% overnight rate. Source: Genevieve Roch-Decter, CFA, Bloomberg

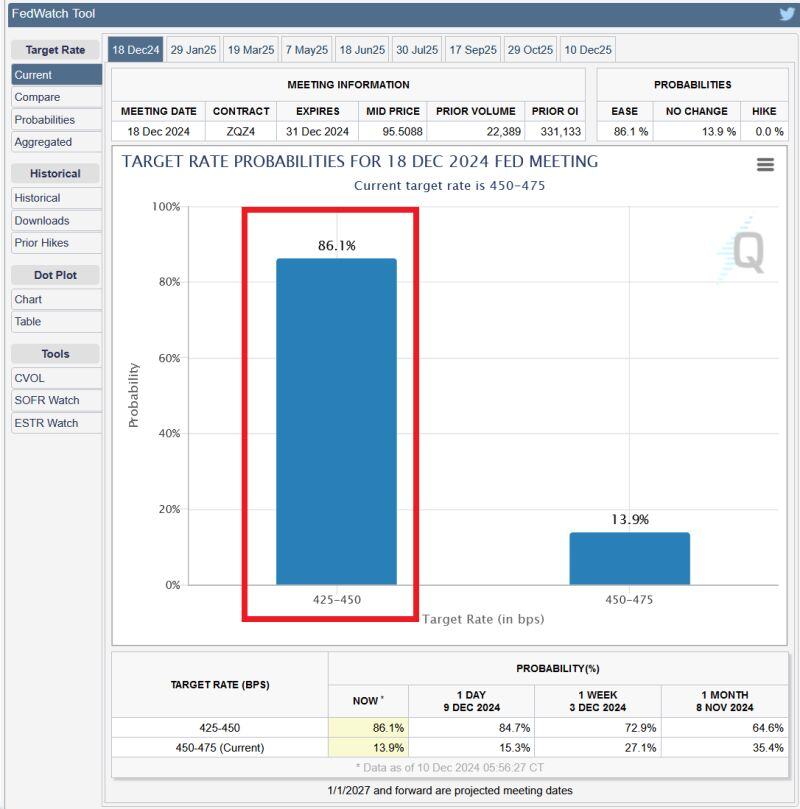

THERE ARE 7 DAYS TO THE LAST FED'S MEETING THIS YEAR

Market is pricing an 86% probability of a 0.25% rate cut, up from 73% last week. This comes after the November job report showed a lot of weakness under the surface. The Fed cut rates by 0.50% and 0.25% in Sep and Nov. Source: Global Markets Investor

‼️ BREAKING: This doesn't sound like a great mark of confidence...

The Bank of England will hide the identities of any pension funds, insurers or hedge funds bailed out under a new financial stability tool to prevent crisis contagion... Source: Radar @RadarHits - Bloomberg

🚨BIG WEEK FOR CENTRAL BANK DECISIONS AHEAD🚨

The European Central Bank, the Bank of Canada, the Swiss National Bank and the Reserve Bank of Australia will announce rate decisions. ECB and SNB are expected to cut by 0.25%, and BoC by 0.50%, while RBA to leave rates unchanged. Source; Global Markets Investor @GlobalMktObserv, Bloomberg

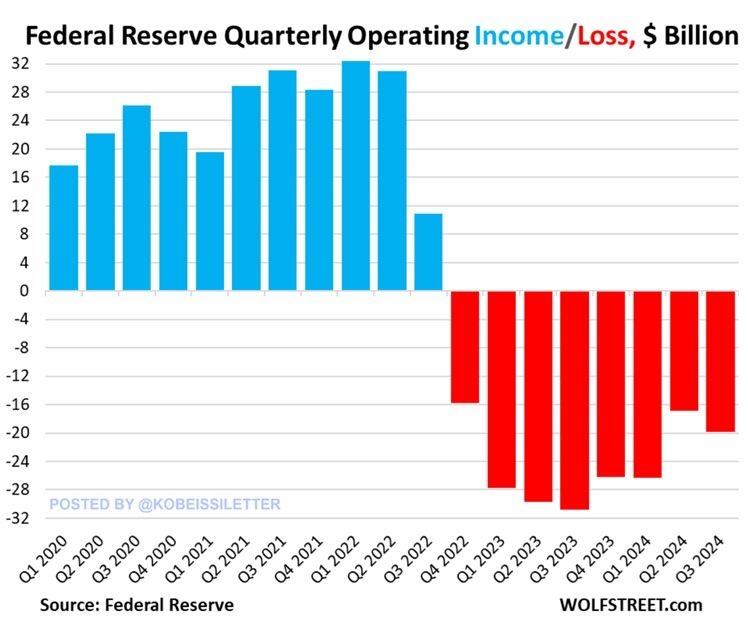

BREAKING: The Federal Reserve just reported a $19.9 BILLION operating loss in Q3 2024 up from $16.9 billion in Q2.

This marks the 8th consecutive quarter of operating losses for the central bank. As a result, cumulative operating losses reached a massive $210 billion over the last 2 years. This comes as the Fed has been paying hundreds of billions in interest to banks and money market funds. At the same time, income the Fed has earned on Treasuries and Mortgage-Backed-Securities has declined. Source: The Kobeissi Letter

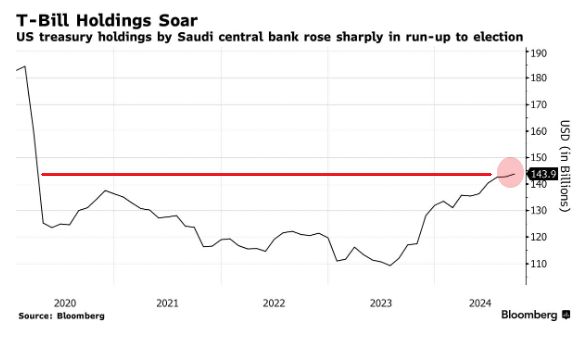

🚨 Saudi Arabia's U.S. Treasury Holdings are now the largest in more than 4.5 years

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks