Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

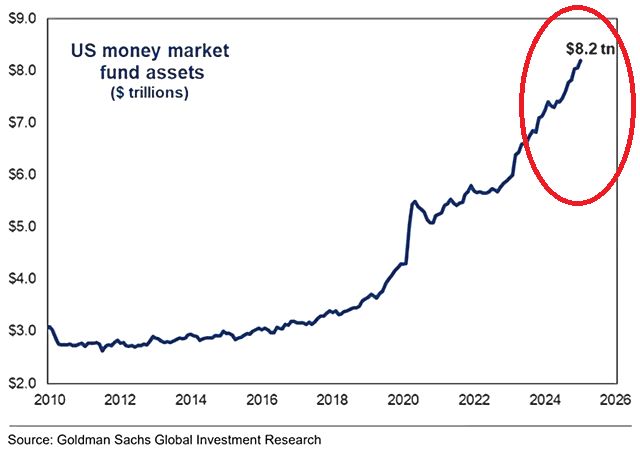

⚠️US money market fund assets jumped to a record of $8.2 TRILLION.

This comes as people expect the Fed to pause rate hikes for a few months. We have to remember, this is not money on the sidelines. Moreover, most of this cash has never been in and never will go to stocks. Last but not least, while the ABSOLUTE number is at record high, the RELATIVE number (cash as a percentage of total assets) is near record low. Source: Global Markets Investor, Goldman Sachs

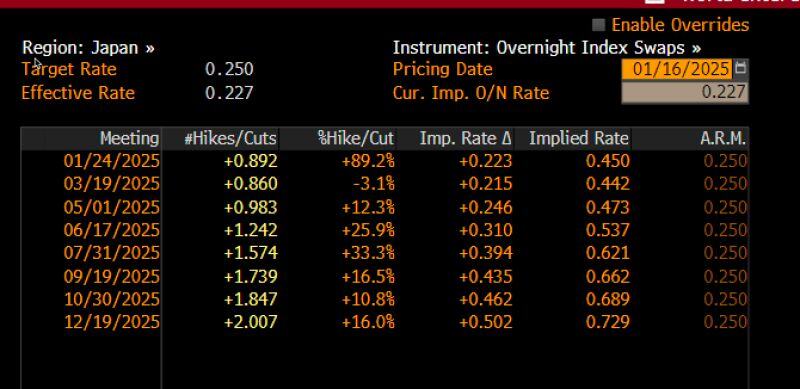

90% chance BOJ hikes next week.

Source: Michael J. Kramer @MichaelMOTTCM on X, Bloomberg

On this day of 2015, the SNB (Swiss National Bank) discontinued the minimum exchange rate of 1.20 EUR/CHF...

This "quasi-peg" level never got revisited. Meanwhile, the 0.95 new support level does not seem to hold. Today we trade at 94 cents and many traders do have 90 cents in mind. And even much lower levels... Good luck... Source chart: Brian Reutimann

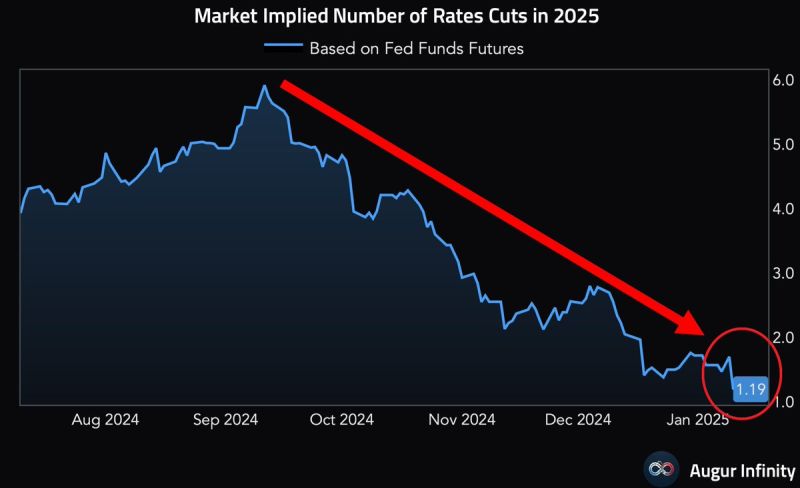

⚠️The market is pricing in just ONE Fed rate cut for 2025. This is down from nearly 5 rate cuts expected in September.

Great Chart: @AugurInfinity, Global Markets Investor

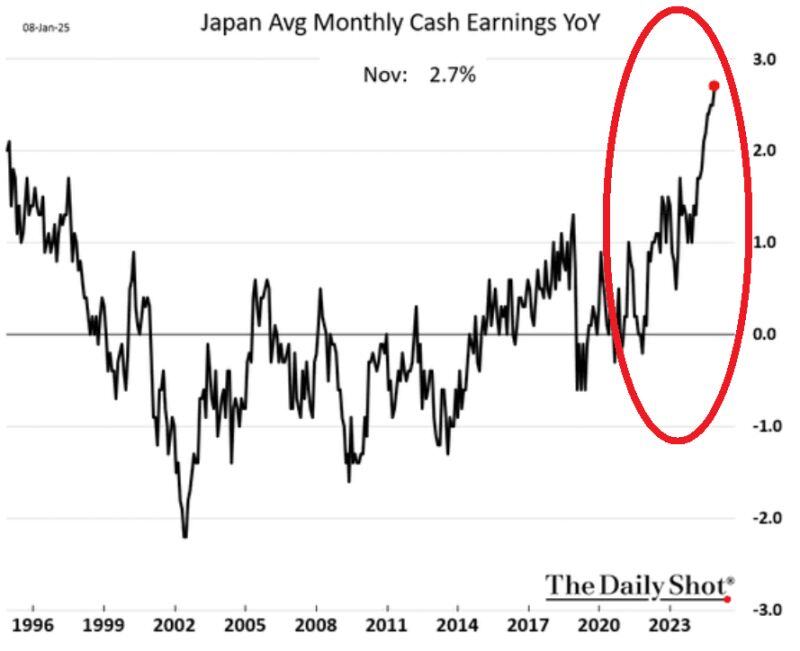

⚠️Bank of Japan is getting closer to deliver another rate hike:

Inflation has picked up while wages have jumped to the highest level in at least 3 DECADES. The market is pricing in about a 60% probability of a hike next week, and an 82% chance by March. Remember when in August 2024 the market flash crashed by suddenly waking up to BOJ's rate hikes? This is key to watch. Source: The Kobeissi Letter, The Daily Shot

French OAT 10-year just hit 3,40% while OAT-Bund spread is now at 86bps…

What is the pain threshold for ecb to step in?

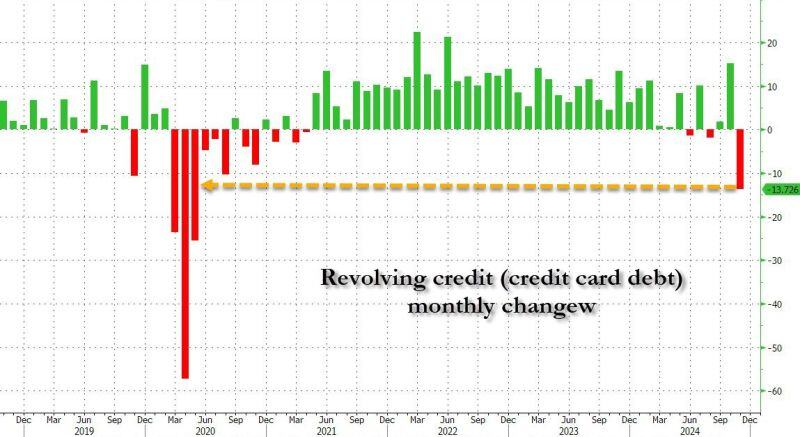

🚨 "Klarnageddon": Consumer credit card debt just plunged the most since covid; these prints are usually negative just ahead or inside of deep recessions.

🔈 According to the Fed's latest consumer credit data, in November consumer credit across US households tumbled by $7.5 billion to $5.102 trillion, a 1.8% annual rate of contraction and usually something one only sees in the middle of recessions (or worse). ❗ While non-revolving debt (i.e. student and auto loans) rose modestly, it was revolving, or credit card debt, that cratered by a whopping $13.8 billion the biggest drop since the covid crash shut down the economy and the prospect of future income for millions of Americans (hence the collapse in spending). ⚠️ It is not clear what sparked this sudden reversal in the favorite American pastime - i.e., to buy stuff one can't afford and hope to pay it back some time in the future for a modest 29.95% APR - but we know what didn't: falling rates... because they didn't. ❗ Three months after the Fed cut rates, taking them 100 bps below where they were in September, the average interest on credit card accounts across the US banking system as tracked by the Fed is at 22.8%, the second highest reading on record and a drop of 57bps from the highest rating on record taken in Q3 2024... Source: Bloomberg, www.zerohedge.com

FOMC Minutes Show 'Almost All' Fed Members See Higher Inflation Risks, Cite Trump Policies

👉 RATE POLICY: — A 25bps rate cut was broadly supported, with the majority favoring a cautious approach to further easing. — Many participants suggested that a variety of factors underlined the need for a careful approach to monetary policy decisions over coming quarters — Some participants noted it might be prudent to pause rate cuts if inflation readings remain above target or economic momentum persists. — A few officials highlighted potential scenarios to accelerate cuts if inflation trends lower or labor market softens more than expected. — Many emphasized the importance of carefully assessing the neutral rate and moving gradually to avoid policy missteps. 👉RISK OUTLOOK: — Inflation risks remain balanced, though higher-than-expected recent readings warrant close monitoring. — Labor market risks were deemed manageable, with no rapid deterioration expected. 👉ECONOMIC CONTEXT: — Inflation progress has slowed but remains on a downward path; core PCE inflation was noted at 2.8% in October. — Labor market conditions have eased slightly, but unemployment remains low at 4.2%. — Participants expect solid GDP growth to continue, though some noted financial strains for lower-income households. 👉BALANCE SHEET AND TECHNICAL ADJUSTMENTS: — Continued reduction in Treasury and mortgage-backed securities reaffirmed, with caps set at $25B and $35B per month, respectively. — Discussed adjusting the overnight reverse repo (ON RRP) rate to align with the bottom of the federal funds rate range. 👉 ADDITIONAL NOTES: — Fed emphasizes data-dependent decision-making, balancing risks to inflation and employment. — Gradual easing remains the likely path, with flexibility to adapt if economic or inflation conditions shift. - source: Wall St Engine @wallstengine

Investing with intelligence

Our latest research, commentary and market outlooks