Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

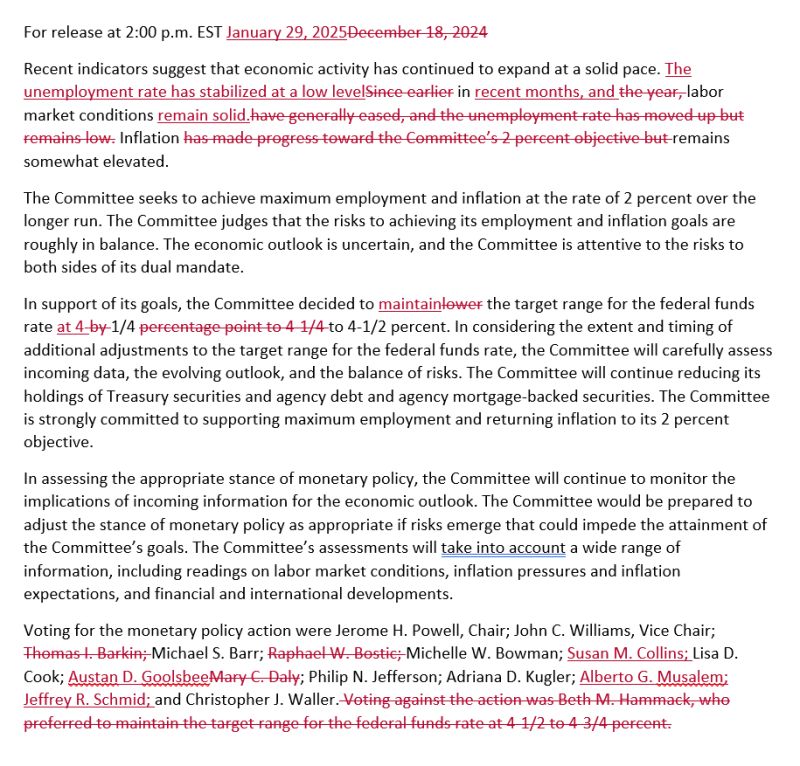

The Fed held rates steady as widely expected.

The FOMC statement contains only minor changes that mark to market recent economic developments: 👉 "Labor market conditions remain solid" = Hawkish❗ 👉 "Inflation remains somewhat elevated." (The central bank notably removed reference to inflation making progress towards the goal) = Hawkish❗ The Fed will continue its QT program at an unchanged pace of $60 billion a month. The market does not expect rate cuts at least until June 2025. Source: Nick Timiraos, The Kobeissi Letter

Czech Central Bank Plans Bitcoin Reserve

Source: Bloomberg thru Willem Middelkoop

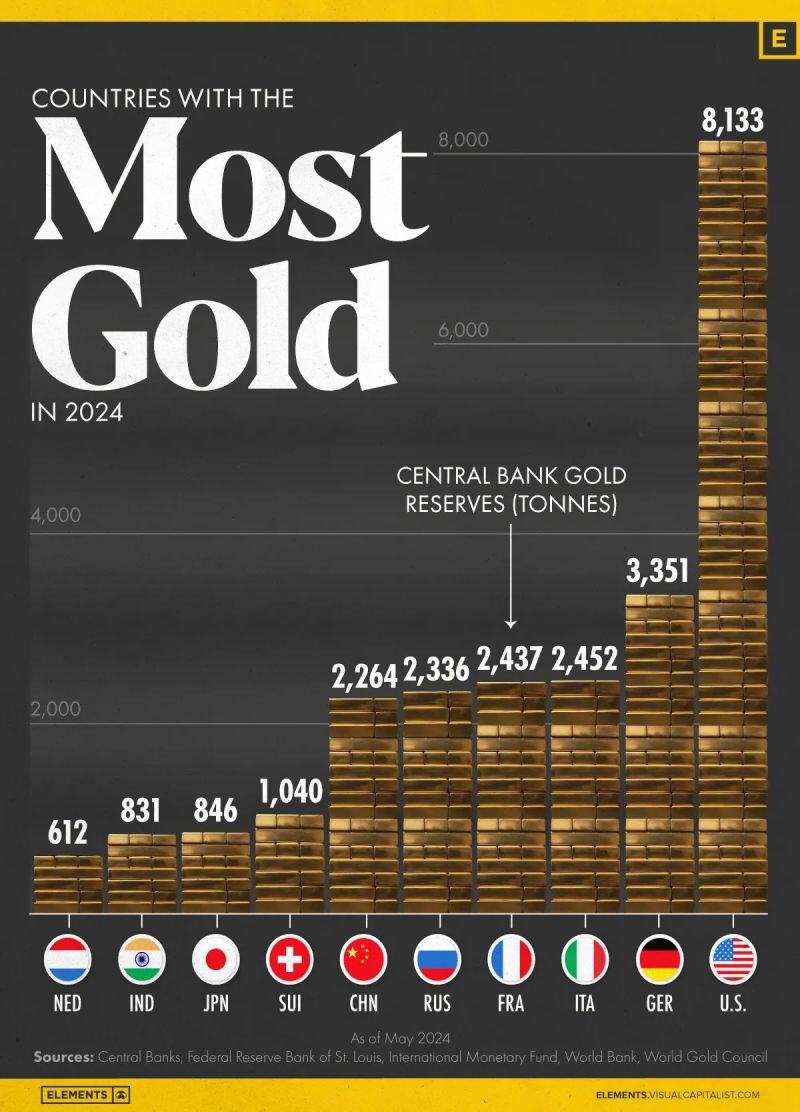

Central Bank Gold Reserves

Interesting thing on this is how even after their big buy-up, Russia & China lag far behind USA + Eurozone holdings of gold. Source: Callum Thomas, Visual Capitalist

*TRUMP: I WILL DEMAND THAT INTEREST RATES DROP IMMEDIATELY

US President Donald Trump said Thursday he would seek to bring interest rates lower, speaking remotely to the World Economic Forum in Davos, Switzerland. "I'll demand that interest rates drop immediately," he said, in a signal that he might pressure US Federal Reserve officials on the matter. "Likewise, they should be dropping all over the world. Interest rates should follow us all over." Source: Barron's, www.investing.com

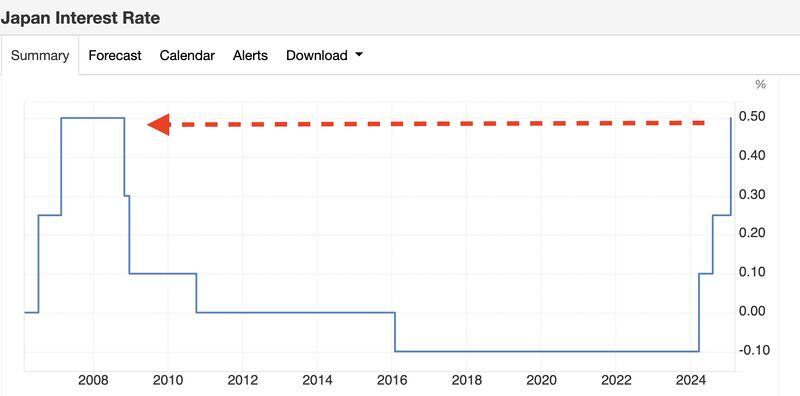

BREAKING: The Bank of Japan boj raises interest rates by 25 basis points to their highest level since 2008.

The Bank of Japan hiked rates by 25 basis points Friday to 0.5%, bringing its policy rate to its highest level since 2008, as it seeks to normalize its monetary policy. The move comes in line with expectations from CNBC’s survey from Jan 15-20, which saw an overwhelming majority of economists predict a hike. In its statement, the BOJ revealed that the decision was a 8-1 split, with board member Toyoaki Nakamura dissenting. Nakamura said the central bank should only make change in policy after confirming a rise in firms’ earning power from reports that would be out by the next monetary policy meeting. Following the decision, the Japanese yen strengthened 0.3% to trade at 155.61 against the dollar, while country’s benchmark Nikkei 225 stock index was slightly up. The yield on the 10-year Japanese government bonds rose 1.7 basis points to 1.222%. Announcement is pretty much in-line with market expectations - no big surprise. Source. The Kobeissi Letter, CNBC

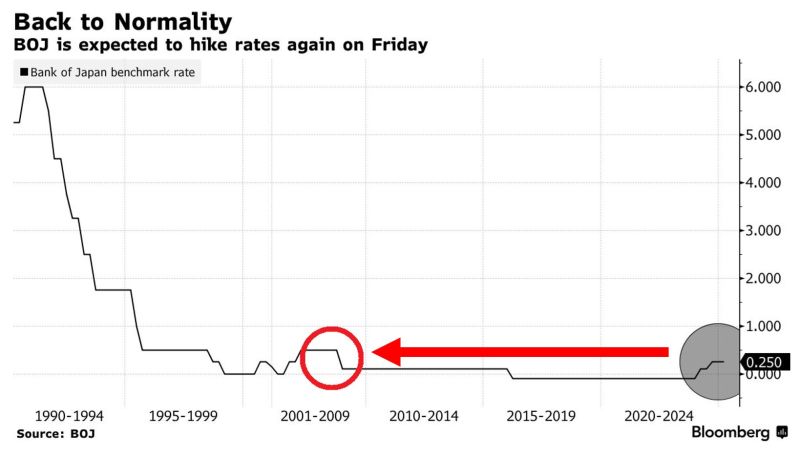

‼️The Bank of Japan is set to HIKE rates again on Friday:

The market is pricing a 90% chance that the BoJ will raise rates by 0.25% to 0.50% on Friday, the highest in 16 years. That would be the 3rd rate hike in less than 12 months, after 17 years without an increase. Source: The Kobeissi Letter, Bloomberg

Trump is inheriting a Federal Reserve w/ not only unprecedented losses of $218 billion, but it's still losing money;

the Fed won't send the Treasury a dime for the entirety of Trump's term; that's never happened since the inception of the Fed - another challenge for Trump... Source: E.J. Antoni, Ph.D. @RealEJAntoni

The ECB shields high debt countries from bond market crises via the combined effect of past interventions and its TPI anti-fragmentation tool.

Underlying assumption is that high debt countries will do what it takes to bring down debt without crises. That assumption is wrong... - Robin Brooks on X

Investing with intelligence

Our latest research, commentary and market outlooks