Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

FOMC Minutes Show 'Almost All' Fed Members See Higher Inflation Risks, Cite Trump Policies

👉 RATE POLICY: — A 25bps rate cut was broadly supported, with the majority favoring a cautious approach to further easing. — Many participants suggested that a variety of factors underlined the need for a careful approach to monetary policy decisions over coming quarters — Some participants noted it might be prudent to pause rate cuts if inflation readings remain above target or economic momentum persists. — A few officials highlighted potential scenarios to accelerate cuts if inflation trends lower or labor market softens more than expected. — Many emphasized the importance of carefully assessing the neutral rate and moving gradually to avoid policy missteps. 👉RISK OUTLOOK: — Inflation risks remain balanced, though higher-than-expected recent readings warrant close monitoring. — Labor market risks were deemed manageable, with no rapid deterioration expected. 👉ECONOMIC CONTEXT: — Inflation progress has slowed but remains on a downward path; core PCE inflation was noted at 2.8% in October. — Labor market conditions have eased slightly, but unemployment remains low at 4.2%. — Participants expect solid GDP growth to continue, though some noted financial strains for lower-income households. 👉BALANCE SHEET AND TECHNICAL ADJUSTMENTS: — Continued reduction in Treasury and mortgage-backed securities reaffirmed, with caps set at $25B and $35B per month, respectively. — Discussed adjusting the overnight reverse repo (ON RRP) rate to align with the bottom of the federal funds rate range. 👉 ADDITIONAL NOTES: — Fed emphasizes data-dependent decision-making, balancing risks to inflation and employment. — Gradual easing remains the likely path, with flexibility to adapt if economic or inflation conditions shift. - source: Wall St Engine @wallstengine

YELLEN: "FISCAL POLICY NEEDS TO BE PUT ON A SUSTAINABLE COURSE"

As a reminder, Mrs Yellen was Fed vice chair and chair from 2010 to 2018 and has been treasury secretary since 2021. On an aggregate basis, she has been directly overseeing and presiding over a $15 TRILLION increase in US debt... Source: www.zerohedge.com

Swiss central bank faces call to hold bitcoin in reserves

Swiss citizens are advancing a new initiative to integrate Bitcoin into the financial reserves of the Swiss National Bank (SNB). This proposal has entered the official signature collection phase, aiming to secure 100,000 signatures within 18 months. If successful, the initiative will proceed to a national referendum to amend the Swiss federal constitution. The Swiss citizens initiative is an attempt to include Bitcoin in Article 99 (Clause 3) of the Swiss constitution which presently requires some amount of the country to be stored in gold. Bitcoin enthusiasts have suggested that Bitcoin should be considered as an instrument similar to gold. However, the initiative encounters numerous challenges even though the interest has been escalating. Switzerland being a neutral country does not often make changes to its constitution and the process is quite long and complicated. The proposal has to be supported and getting 100,000 verified signatures within the time limit is rather a challenging feat. source : coingape

The Federal Reserve has reduced the size of its balance sheet by 10.7% this year, the largest percentage decline of any year on record.

Source: Charlie Bilello

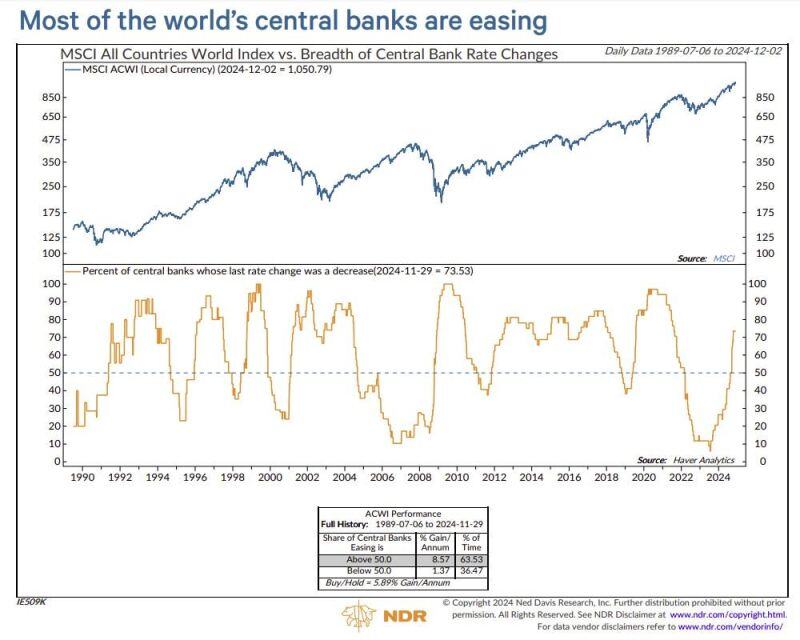

Most of the world's central banks are easing.

(see NDR analysis below)

🚨 S&P500 erased $1.8 TRILLION of market cap on Fed "hawkish cut".

‼️ Big Tech, Bonds, Bullion and Bitcoin fell sharply after the Fed cuts rates by 25 basis points - which is exactly what 97% of market participants expected. So what happened❓ 👉 Actually, today's market reaction had NOTHING to do with the rate decision. Rather, it would about the Fed's outlook for 2025 which shifted SHARPLY in the hawkish direction. 👉Indeed, the hashtag#Fed reduced their outlook from 3 to 2 rate cuts in 2025. 👉Furthermore, the Fed now sees hashtag#inflation at 2.1% at the end of 2026, still slightly above their 2.0% target. ⚠️ The stock market's decline accelerated after Powell said one specific sentence in his press conference today: "Today was a closer call but we decided it was the right call." ⚠️The US Dollar surged to its highest since November 2022 after he said that. Clearly, the Fed has acknowledged that inflation is an issue, once again. ⚠️On top of this, Cleveland Fed President Beth Hammack dissented in today's decision. 1 out of 19 Fed officials sees no rate cuts in 2025 and 3 officials see just 2 rate cuts. Only 5 Fed officials currently see 3 or more interest rate cuts in 2025 in a sudden hawkish shift. This led to what appears to have been the biggest panic sell in the market since the Yen carry trade collapsed. Small cap stocks fell nearly 5% today and the Dow posted a 10-day losing streak for the first time since 1974. Sentiment is shifting as we look into 2025.

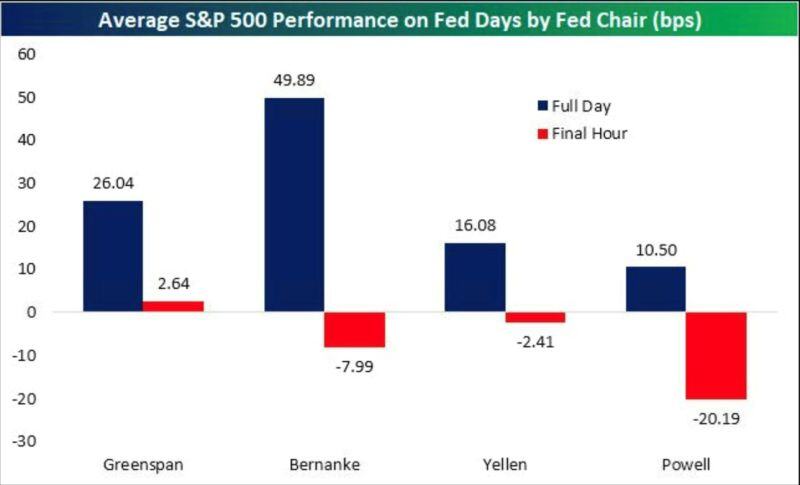

Powell is second to none when it comes to market reaction on Fed day.

He lived up to his reputation and track record yesterday. To say the least... Source: Bespoke

Santa Powell is coming to town.

Last FOMC interest rate decision of 2024 is today at 2PM ET, followed by the usual press conference. A 25bps rate cut looks like a done deal. Key questions:1) Why is he cutting while stocks are ATH and Core CPI above 3% 43 months in a row= 2) Will it be a "hawkish cut" with significant upside revisions to growth and inflation forecasts + downward revision to the dot plot? Merry Christmas Mr Powell Source image: TrendSpider

Investing with intelligence

Our latest research, commentary and market outlooks