Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Don't be too excited about Fed rate cuts.

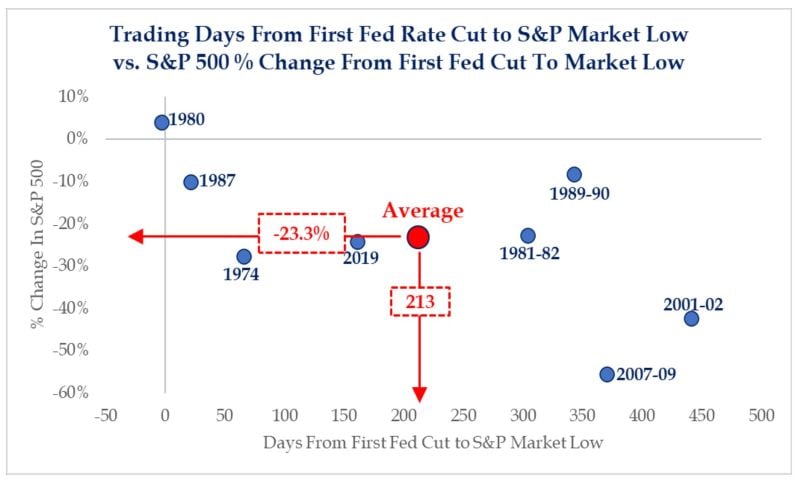

Examining Fed rate cycles since 1970s has revealed that investors have more to fear from 1st cut in a cycle than the pause. On average, sp500 is up +5% over 100 days between last Fed tightening and 1st cut. The trough in broader market is -23% over 200 days after 1st cut in a series, SRP has calculated. Source: HolgerZ

In case you missed it:

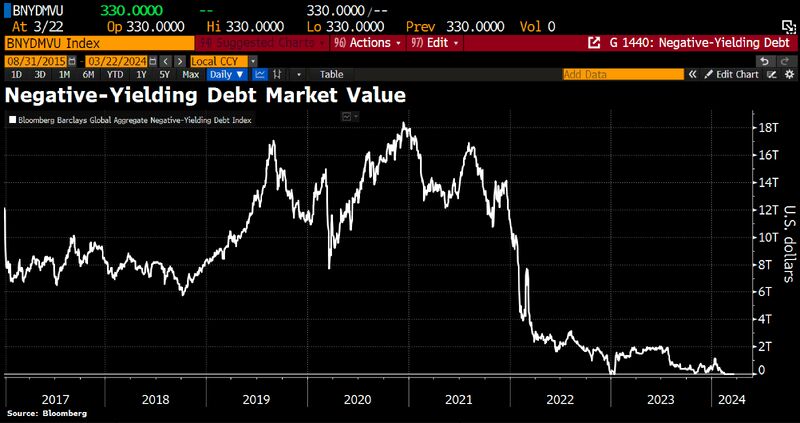

After bank of japan abolished negative interest rates this week for 1st time since 2016, the volume of bonds with negative interest rates has shrunk to $300mln. At its peak, there was a volume of $18tn worth of bonds with negative rates. But this weird experiment seems to be over – for now. Source: HolgerZ, Bloomberg

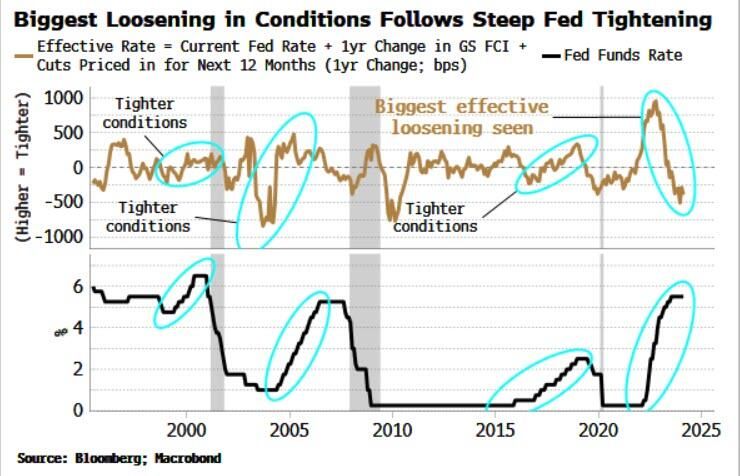

The Fed wants to loosen into what has already been the largest effective easing of financial conditions that we've seen from peak to trough...

equity markets, gold and digitalgold absolutely love it! Source: Markets & Mayhem

Swiss National Bank SNB cuts interest rates by 0.25%, chart

@BloombergTV

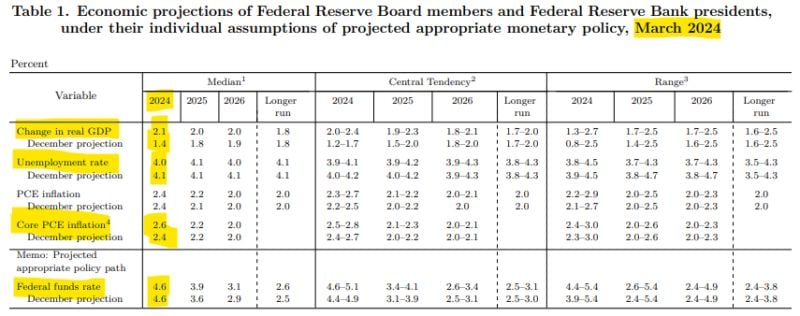

This table explains why markets were soooo... happy yesterday.

As shown by Charlie Bilello: as compared to their December forecasts, the Fed is expecting higher Real GDP growth (2.1% vs. 1.4%), lower Unemployment (4.0% vs. 4.1%), & higher Core PCE Inflation (2.6% vs. 2.4%) but is still anticipating 3 rate CUTS this year. This uber-dovish and bullish for risk assets and gold...

BREAKING: The Federal Reserve on Wednesday held interest rates steady as expected but signaled that it still plans multiple cuts before the end of the year.

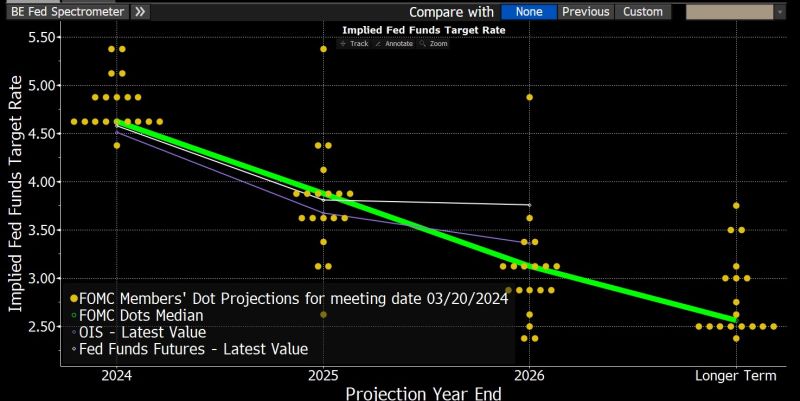

FED HOLDS BENCHMARK RATE IN 5.25-5.5% TARGET RANGE - BBG *FOMC MEDIAN FORECAST SHOWS 75 BPS OF RATE CUTS IN 2024 TO 4.6% *FED REPEATS WAITING FOR GREATER CONFIDENCE ON INFLATION TO CUT As expected, the Fed kept the Federal Funds Rate unchanged. The main news is that the 2024 median rate forecast in the new Federal Reserve dot plot remains UNCHANGED! The Fed continues to expect three rate cuts (-75BPS) for 2024 ! Fed Officials median view of Fed funds rate at end of 2024 4.6% (prev 4.6%). Fed projections show only one official sees more than three 25 bp rate cuts in 2024. Fed now only sees 2 rate cuts in 2025 and fewer cuts in 2026. Fed made only one change to the FOMC statement: Thus is in January: "Job gains have moderated since early last year but..." replaced by this in March: "Job gains have remained strong and..." The projected change in real GDP for 2024 was 2.1% in the March projection, up from 1.4% in December. Core PCE inflation projections also ticked up to 2.6% from 2.4%.. Fed says inflation "has eased but remains elevated". Fed does not expect rate cuts until "greater confidence" inflation is moving to 2%. Market reaction: Equity markets are rallying after the FOMC announcement: The S&P 500 has officially broken above 5200 for the first time in history. The dollar is weakening and US Treasury yields are stable (the 10 year initially lost 5 basis points). Our take: Markets are rallying on the initial headlines from this Fed rate decision. Primarily because Fed projections for 3 rate cuts in 2024 have been reaffirmed. Indeed, the risk of a hawkish surprise (lower dot plots for 2024) was quite elevated ahead of the FOMC decision based on recent economic activity data (Atlanta Fed GDPNow currently at 2.5% for Q1 24). The fact that the Fed keeps 2024 DOTS unchanged was the best scenario for the market. The two objectives of the Fed (maximum employment and stable prices) are (almost) perfectly reached. The Fed can relax and afford to “wait-and-see” before eventually recalibrating (most likely in June). Note that Powell’s press conference will also be important for the nuances and context around the potential adjustments to dots and economic projections. In terms of portfolio positioning, we remain constructive on equities but more cautious on fixed income. We keep some allocation to Gold.

SNB cut rates against market expectations

Swiss National Bank cut the policy rate by 25 BPS to 1.50%. USDCHF and EURCHF both jumped by more than one figure to 0.8970 and 0.9780 respectively. Market was only pricing in a 35% probability of this cut.

Investing with intelligence

Our latest research, commentary and market outlooks