Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Federal Reserve's next move might be to raise interest rates warns Former Treasury Secretary Larry Summers.

Source: Barchart

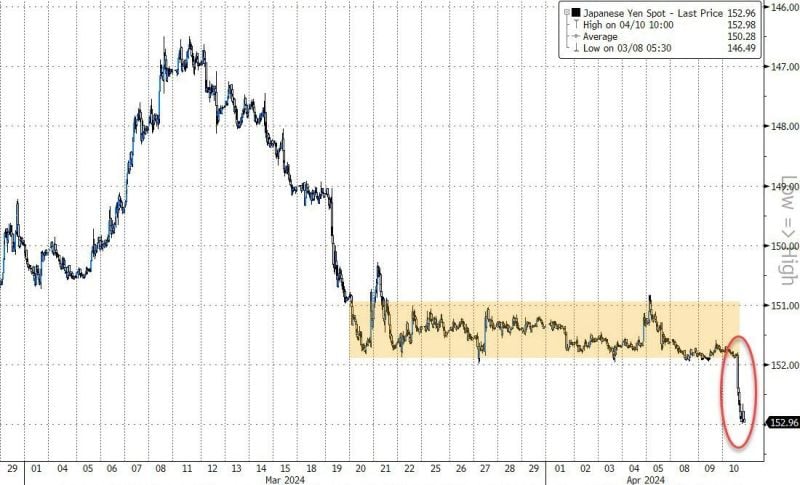

The Bank of Japan (BOJ) has a real problem now as USDJPY surged up to 153 - a fresh 34-year-low for the yen against the dollar and below the level at which the BoJ last intervened...

Source: Bloomberg, www.zerohedge.com

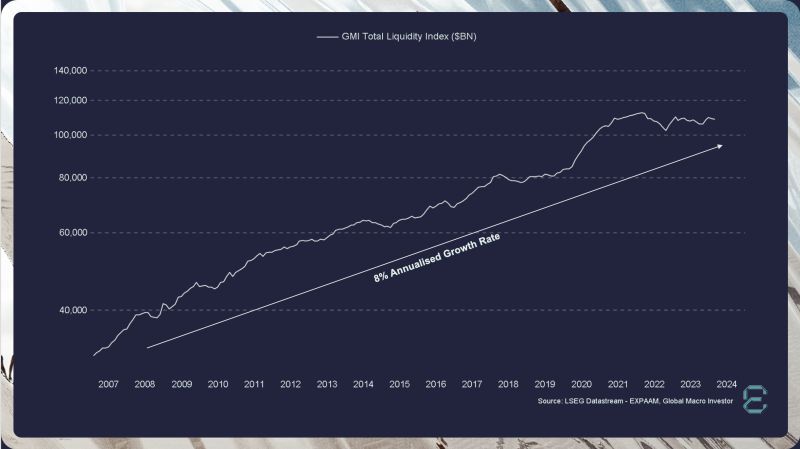

Raoul Pal - Global Macro Investors (GMI) has shared this chart on X showing Global liquidity growing at a CAGR of 8%.

His view: "While everyone is worried about 3.5% inflation, the real issue is the ongoing 8% per annum debasement of currency, on top of inflation. Your hurdle rate to break even is around 12%, which is the 10-year average returns of the S&P 500...just to keep your purchasing power". Key takeaway: if you want to protect your purchasing power in a global monetary debasement, you have 3 choices: 1/ spend; 2/ invest into risk assets; 3/ invest into store of values

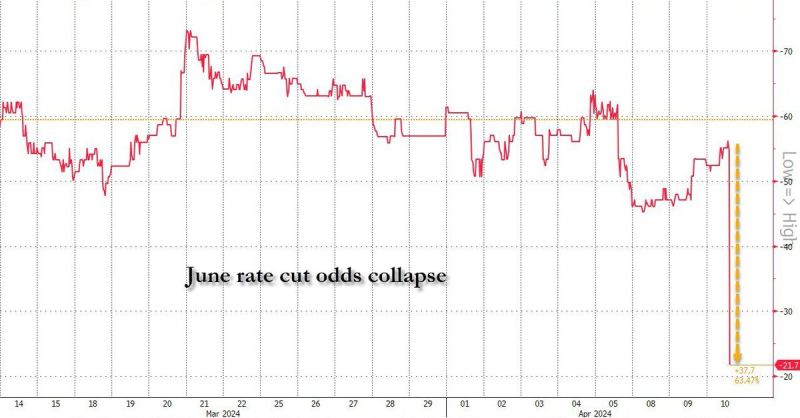

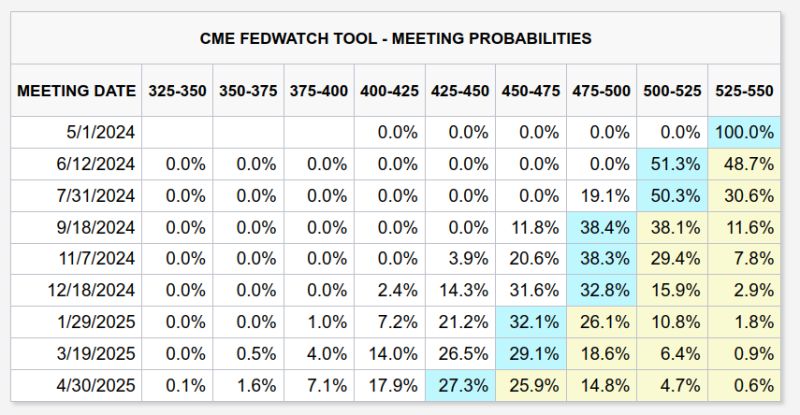

BREAKING: Interest rate futures are now pricing in just 2 interest rate cuts for the entire 2024.

This is the first time that markets are pricing-in LESS rate cuts than Fed guidance. Just 4 months ago, markets saw 6-8 rate cuts in 2024 with cuts beginning in March. Odds of a rate cut in June are down from ~60% before the CPI report to ~22% now. Source: The Kobeissi Letter, www.zerohedge.com

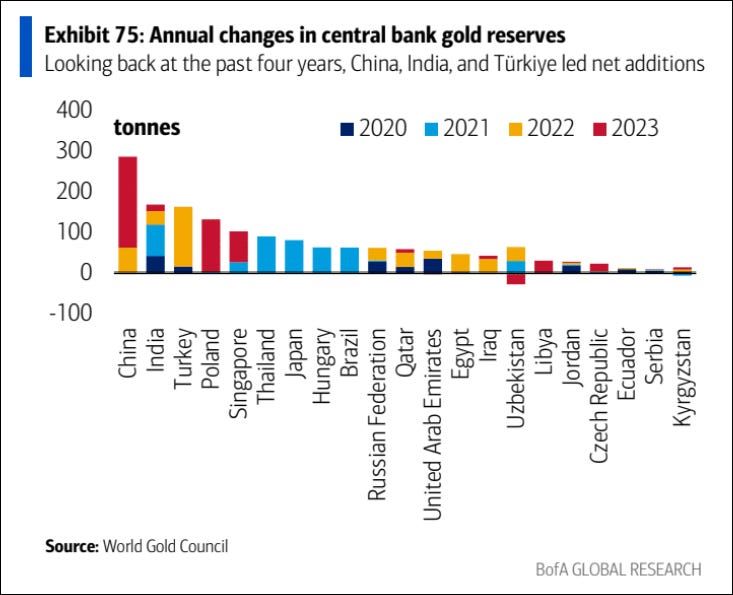

Nice chart by BofA showing central bank gold purchases from 2020-2023

Thru Ronnie Stoeferle

From expecting 6 Fed rate cuts to just two in 2024 😉

Source: Markets & Mayhem

Gold is rallying despite retail and institutional investors dumping.

This is bullish. But who is buying by the way? Central banks... Do they know something investors don't know? Source: BofA

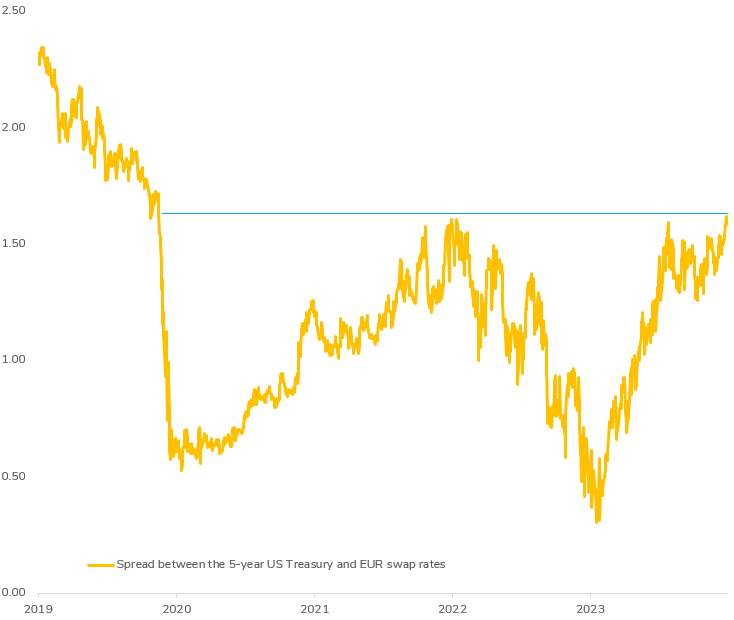

A Pivotal Moment Between the ECB and the Fed?

This week unfolds as a critical juncture for the interest rate disparity between the US and Europe. As the spread between the 5-year US Treasury and EUR swap yields hits its highest level since the pandemic, the upcoming release of US CPI data and the ECB meeting carry the potential to reshape this landscape once again. All eyes are on ECB President Lagarde as she navigates the challenge of maintaining ECB independence from the Fed, especially amidst differing inflation dynamics across the Atlantic. The implications for currency exchange rates, interest rates, and monetary policy are captivating areas to watch closely in the coming days.

Investing with intelligence

Our latest research, commentary and market outlooks