Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

FOMC: No rate change, QT tapering in June is DOVISH (timing + amount)

Stocks, bonds, gold, bitcoin are all rallying. dollar dumped In a nutshell: 1. Fed leaves rates unchanged for 6th straight meeting *FED HOLDS BENCHMARK RATE IN 5.25%-5.5% TARGET RANGE 2. Rate cuts not appropriate until greater confidence inflation is heading to 2% 3. Fed adds following sentence to the statement: "In recent months, there has been a lack of further progress toward the Committee's 2 percent inflation objective." Inflation has eased "but remains elevated" 4. Fed to slow pace of balance sheet runoff starting in June. The Fed is tapering QT by MORE than the $30BN consensus estimate, instead will taper QT by $35BN, meaning monthly redemption cap on us treasuries goes down from $60BN to $25BN (starting June 1st). This means $105BN less gross issuance needed in Q3 (i.e The Fed implicitly saying 'yields are too high'). 5. Fed maintains mortgage-backed securities redemption cap at $35 bln per month, will reinvest excess MBS principal payments into treasuries. 6. Economic activity continues to expand at solid pace, job gains have remained strong, unemployment rate has remained low. 7. Risks to achieving employment and inflation goals 'have moved toward better balance over the past year,' as opposed to 'are moving into better balance' in the March policy statement. 8. Fed Chair Powell says it is "unlikely that the next policy move will be a rate HIKE." BOTTOM-LINE: There are some hawkish comments but overall Fed QT tapering in June is DOVISH (timing + amount) -> Stocks, bonds, gold, bitcoin are all rallying. dollar dumped Fed Chair Powell's press conference is dovish as well in terms of content and the tone of his remarks. As a reminder, we live at a time of fiscal dominance, i.e fiscal policy leads monetary policy.

WELCOME TO FOMC WEEK. Here's what's happening:

In the US: ◦ April ADP employment ◦ April ISM manufacturing ◦ March Job openings ◦ FOMC interest rate decision ◦ Fed Chair Powell press conference ◦ April employment rate ◦ $AAPL, $AMZN, $LLY, $MA, $KO, $AMD, $MCD, $QCOM earnings Rest of the world: ◦ In Europe, the focus will be on April CPI prints as well as the Q1 GDP reports. ◦ The latest economic activity and labour market indicators will also be in focus in Japan, and PMIs are due in China. Source: Trend spider

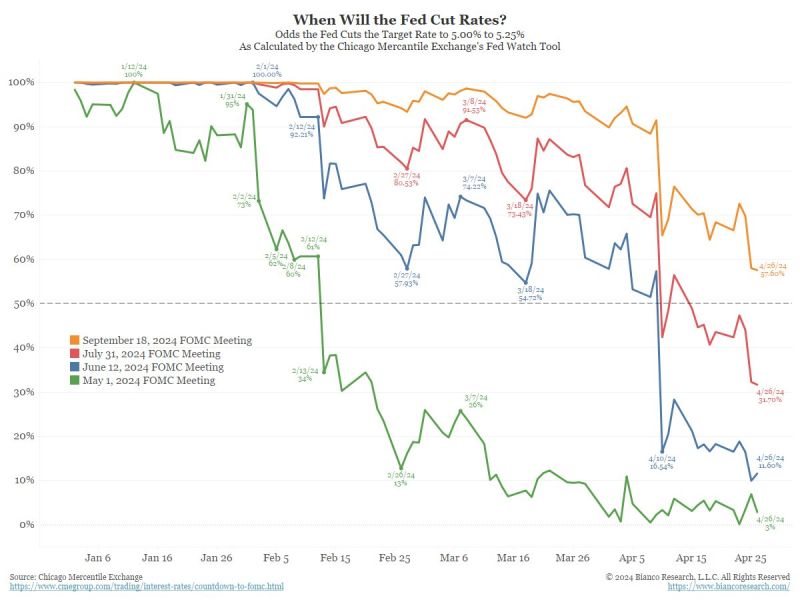

Fed Cut Probability Update - Jim Bianco (Bianco Research)

- May 1 FOMC meeting (green) less than 50% (meaning no move) - June 12 FOMC meeting (blue) less than 50% (meaning no move) - July 31 FOMC meeting (red) less than 50% (meaning no move) - September 18 FOMC meeting (orange) less than 60% (since it is 5 months away, effectively a coin-toss) After this, the next FOMC meeting is Thursday, November 7, two days after the election.

Bonds rally as the Fed’s preferred inflation metric cam out not as bad as feared.

PCE deflator rose to 2.7% in March from 2.5% in Feb vs 2.6% expected. Core PCE, the Fed's preferred measure of underlying price pressures, remained at 2.8%, compared with an anticipated fall to 2.7%. First full rate cut is now priced for November. Note that we now have CPI, PPI and PCE inflation RISING for 2 straight months. Source: HolgerZ, Bloomberg

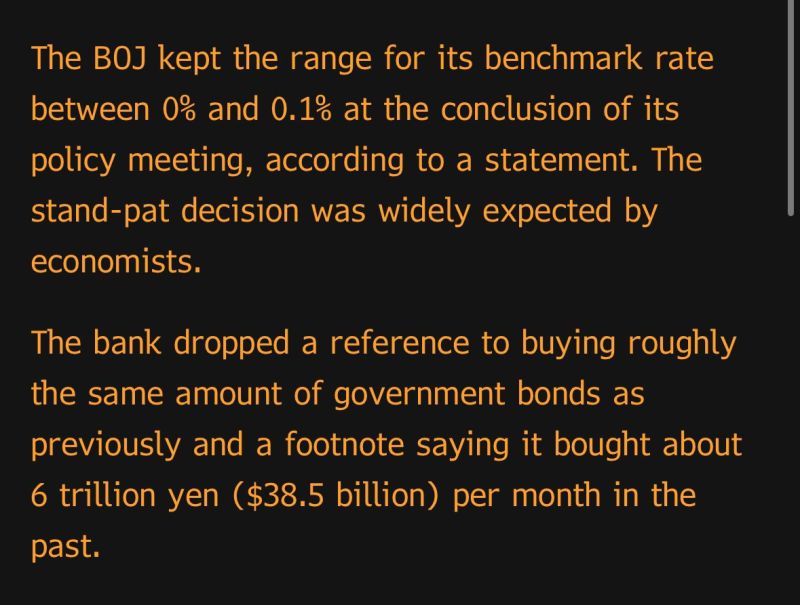

Bloomberg on the outcome of the BoJ Bank of Japan’s monetary policy meeting.

The Bank of Japan kept its policy rate unchanged Friday after its monetary policy meeting, holding its benchmark policy rate at 0%-0.1%. This is in line with expectations from economists polled by Reuters. While the move was expected, this comes after Tokyo’s April inflation came in lower than expected, with the core inflation rate at 1.6% compared to expectations of 2.2% from Reuters. The BOJ also said it will continue to conduct bond purchases. However, they dropped a reference to buying roughly the same amount of bonds as previously. No comment was made by the BOJ on the yen, which has steadily weakened since the BOJ ended its negative interest rate policy last month and abolished its yield curve control policy. The currency broke through the 156 mark against the U.S. dollar Friday after the decision, most recently trading at 156.11. Separately, the central bank also released its second-quarter outlook for Japan’s economy, raising its outlook for inflation in fiscal 2024. The BOJ now expects inflation between 2.5% and 3% for fiscal 2024, up from 2.2% to 2.5% in its January forecast. Inflation is then predicted to decelerate to “around 2%” in fiscal 2025 and 2026, the bank added. The BOJ also downgraded gross domestic product growth forecasts for fiscal 2024 to a range of 0.7% to 1%, down from January’s prediction of 1%-1.2% growth. Think of this as another small step in what the BoJ sees as a relatively long policy normalization journey. As mentioned by Mohamed El Erian, the length of this journey, both on a standalone basis and relative to the US, helps explain the weak Yen. Source: Bloomberg, CNBC

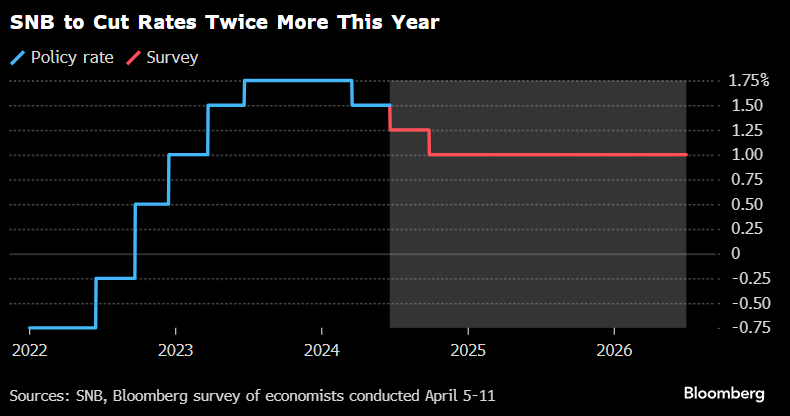

SNB’s Jordan Warns New Inflation Shocks Could Hit "At Any Time"

Speaking in Bern this morning, Jordan said: “We will therefore monitor the ongoing development of inflation closely and adjust our monetary policy again if necessary.” and also cautioned there’s “no guarantee” that the current favorable consumer-price outlook will hold.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks