Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

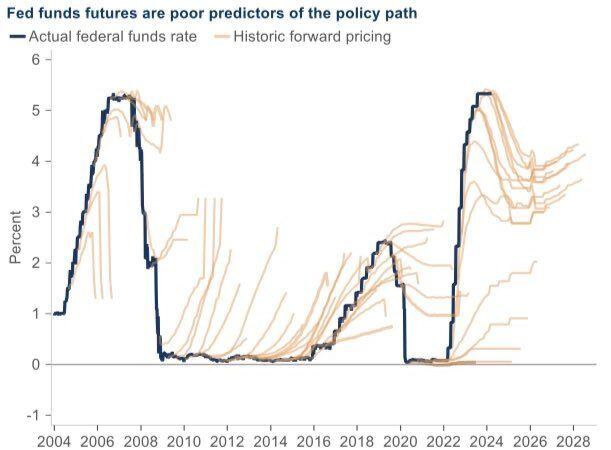

Friendly reminder that markets are always wrong about future Fed funds rate.

Source: Michel A.Arouet

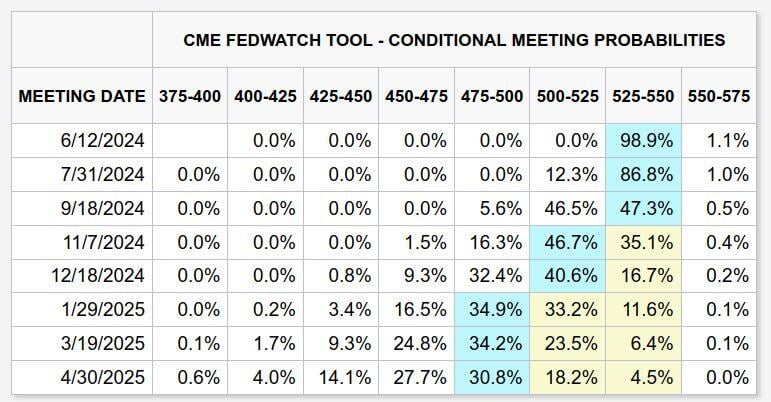

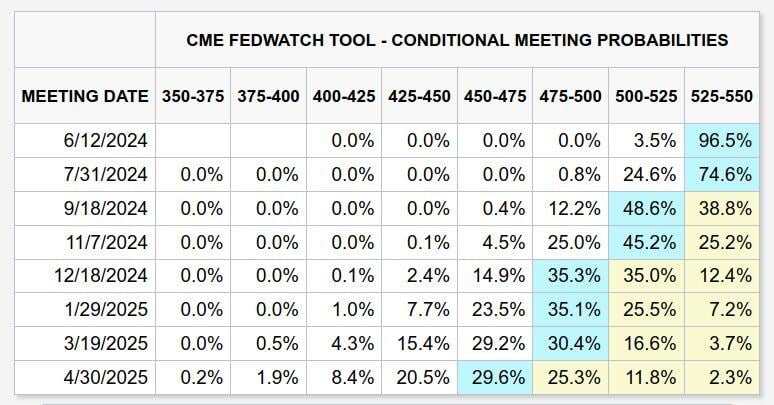

After the hotter than expected Flash PMI prints yesterday, the market is pricing in one cut for this year to occur in November or December, and another in early 2025.

Source: Markets & Mayhem

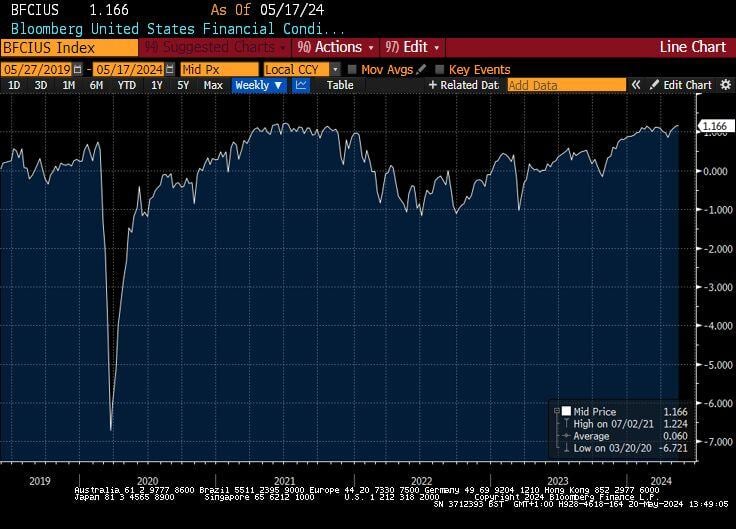

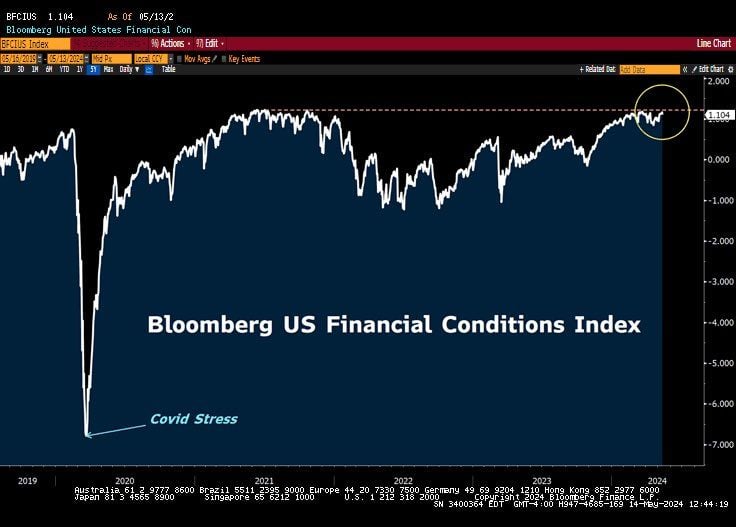

While the FED monetary policy is seen as restrictive, the Bloomberg US Financial Conditions Index is at record highs.

Risk premia in stocks and credit are near all-time tights as commodities are breaking higher. Source: Bloomberg

Today’s inflation numbers are seen as a relief by investors… and the FED

Indeed, the just released data shows that US inflation cooled down in April for the first time in 6 months, following several reports of upside surprises. While yoy headline inflation is in-line with expectations (+3.4pct) the positive surprise came from the MoM number (+0.3pct) which is BELOW estimates (+0.4pct). Core inflation number MoM came in as expected (+0.3pct). The core yoy number (+3.6pct as expected) is at the lowest level since April 2021. Bottom-line: this report is bullish equities, bonds, gold and cryptos as it indicated that the disinflation trend might have further to go. Still, we believe that the Fed might wait for some confirmation before turning dovish. We note that the SuperCore (core ex-shelter) rose 0.5pct MoM to 5.05pct YoY. Source: CNBC

“We have to let restrictive policy do its work on inflation.”

Fed Chair Jay Powell Source: Lawrence McDonald, Bloomberg

SUMMARY OF FED CHAIR POWELL'S COMMENTS (5/14/24):

1. "Overall a good picture looking at US economic data" 2. Inflation was notable in Q1 for the lack of further progress 3. Housing inflation has been a bit of a puzzle for the Fed 4. Restrictive policy may take longer than expected to lower inflation 5. Unlikely the Fed's next move will be an interest rate hike 6. "Credibility is everything for central banks" Source: The Kobeissi Letter

Markets are currently anticipating the first Fed cut in September and a potential second cut in December.

This week's US inflation data could shift these expectations backward or forward depending on how the data comes in. Source: Markets & Mayhem

Bank of England declares independence from the US Fed ->

BoE's Bailey pushed back against a slower rate cutting cycle for the UK: “Quite a lot of the market movements of late appear to have been US-originated. Inflation dynamics here are different to inflation dynamics in the US. (It’s a) very different sort of situation in terms of our economies.” Percentage odds of a June cut were similar for the BOE and Fed at the start of the quarter, but now the market sees a wide gap. Source: Jeffrey Kleintop, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks