Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

📢 📢 📢 The Bank of Japan kept its benchmark interest rate unchanged on Friday, but indicated it’s considering the reduction of its purchase of Japanese government bonds.

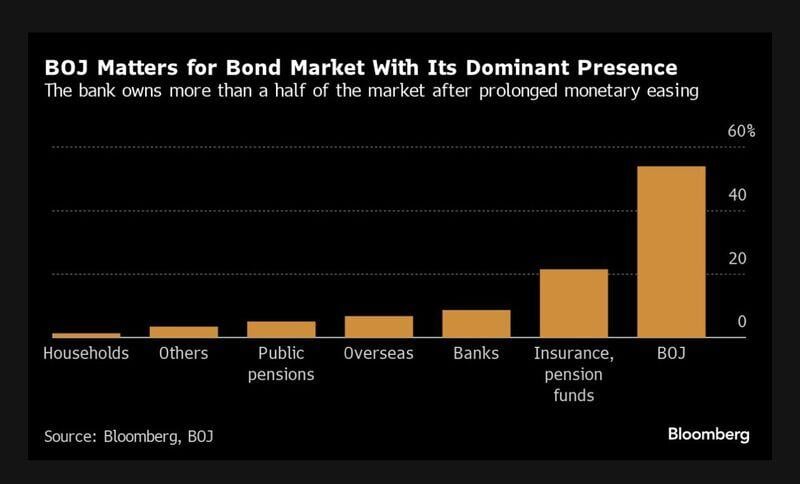

The central bank left short-term rates unchanged at between 0% to 0.1% at the end of its two-day policy meeting, as widely expected. But notably, the bank said in its statement it could reduce its purchases of Japanese government bonds after the next monetary policy meeting, scheduled for July 30 and 31. QE tapering in Japan has a lot more potency than in the U.S., sheerly because of how much of the bond market the BOJ owns. Following the BOJ decision, the Japanese yen weakened 0.5% to 157.8 against the U.S. dollar, while the yield on 10-year JGB fell 44 basis points to 0.924. So absolutely no panic... Source: Bloomberg, CNBC

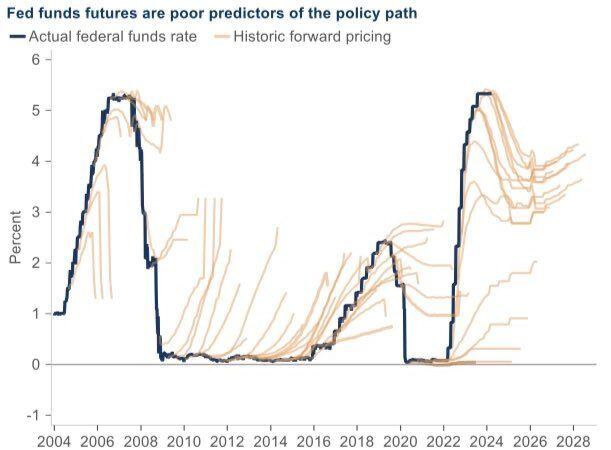

Friendly reminder that markets are always wrong about future Fed funds rate.

Source: Michel A.Arouet

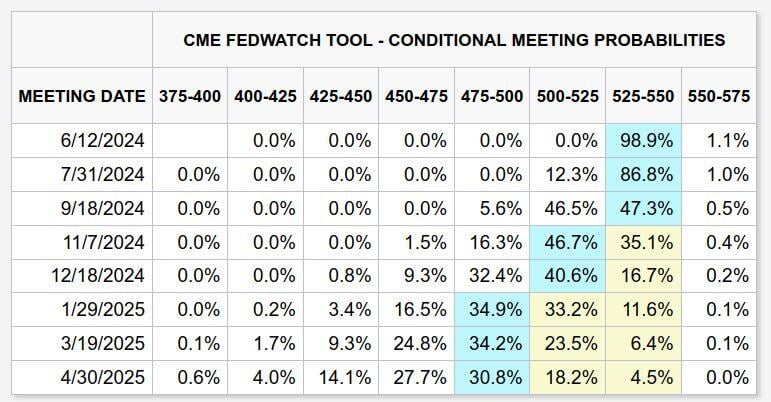

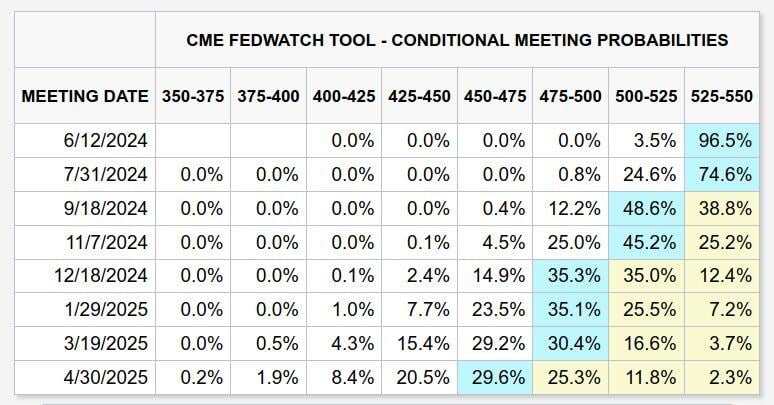

After the hotter than expected Flash PMI prints yesterday, the market is pricing in one cut for this year to occur in November or December, and another in early 2025.

Source: Markets & Mayhem

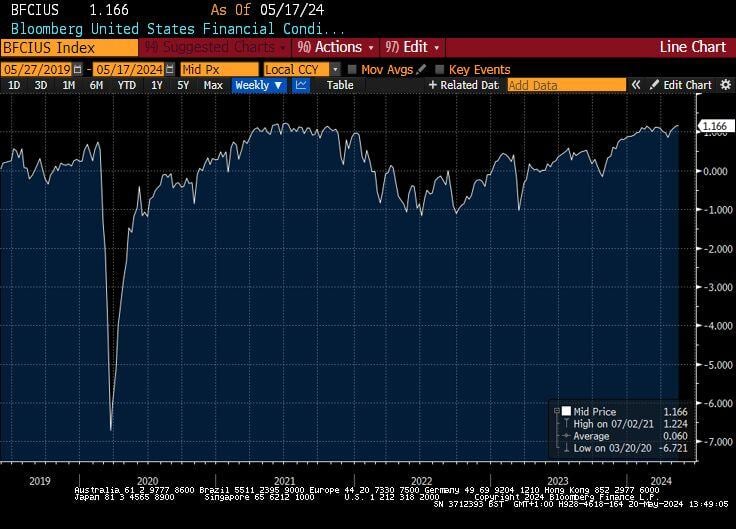

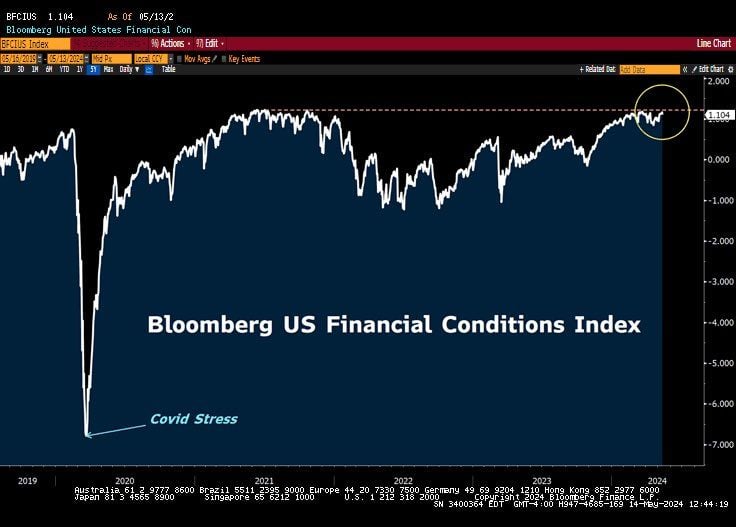

While the FED monetary policy is seen as restrictive, the Bloomberg US Financial Conditions Index is at record highs.

Risk premia in stocks and credit are near all-time tights as commodities are breaking higher. Source: Bloomberg

Today’s inflation numbers are seen as a relief by investors… and the FED

Indeed, the just released data shows that US inflation cooled down in April for the first time in 6 months, following several reports of upside surprises. While yoy headline inflation is in-line with expectations (+3.4pct) the positive surprise came from the MoM number (+0.3pct) which is BELOW estimates (+0.4pct). Core inflation number MoM came in as expected (+0.3pct). The core yoy number (+3.6pct as expected) is at the lowest level since April 2021. Bottom-line: this report is bullish equities, bonds, gold and cryptos as it indicated that the disinflation trend might have further to go. Still, we believe that the Fed might wait for some confirmation before turning dovish. We note that the SuperCore (core ex-shelter) rose 0.5pct MoM to 5.05pct YoY. Source: CNBC

“We have to let restrictive policy do its work on inflation.”

Fed Chair Jay Powell Source: Lawrence McDonald, Bloomberg

SUMMARY OF FED CHAIR POWELL'S COMMENTS (5/14/24):

1. "Overall a good picture looking at US economic data" 2. Inflation was notable in Q1 for the lack of further progress 3. Housing inflation has been a bit of a puzzle for the Fed 4. Restrictive policy may take longer than expected to lower inflation 5. Unlikely the Fed's next move will be an interest rate hike 6. "Credibility is everything for central banks" Source: The Kobeissi Letter

Markets are currently anticipating the first Fed cut in September and a potential second cut in December.

This week's US inflation data could shift these expectations backward or forward depending on how the data comes in. Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks