Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

ECB leaves all rates unchanged as expected.

Main Refi at 4.25%, deposit rate at 3.75%. Guidance on interest rates also stays unchanged: Not pre-committing to particular path. ECB to follow data-dependent, meeting-by-meeting approach. Source: Bloomberg, HolgerZ

Some good news for Wall Street?

Donald Trump will not seek to remove Federal Reserve Chair Jerome Powell before the central banker’s term ends and would consider JPMorgan CEO Jamie Dimon for Treasury secretary if he won the Nov. 5 election, the former president told Bloomberg in an interview published on Tuesday. JPMorgan declined to comment on Trump’s remarks. Powell’s term as chairman runs through January 2026, and his position as a Fed governor continues until 2028. The interview was conducted in late June, according to Bloomberg.

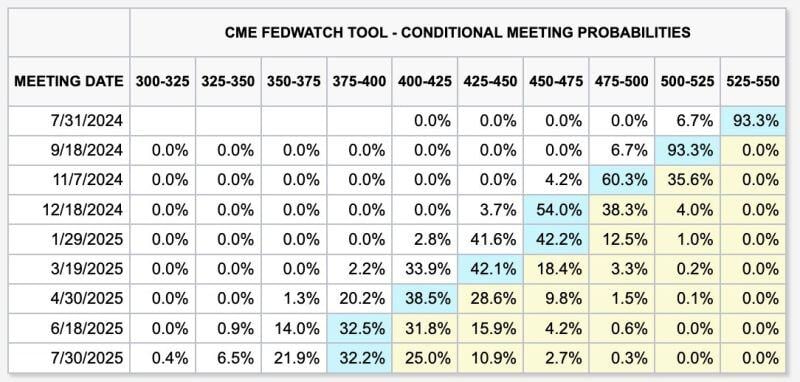

Markets now have a BASE CASE of 6 FED interest rate cuts over the next year.

The base case shows rate cuts at every meeting remaining in 2024 starting in September. Discussions of a 50 basis point interest rate cut have even begun to emerge. This feels a lot like January 2024 when the market went from pricing-in 3 rate cuts in 2024 to 7 in a matter of weeks. Source: The Kobeissi Letter, CME

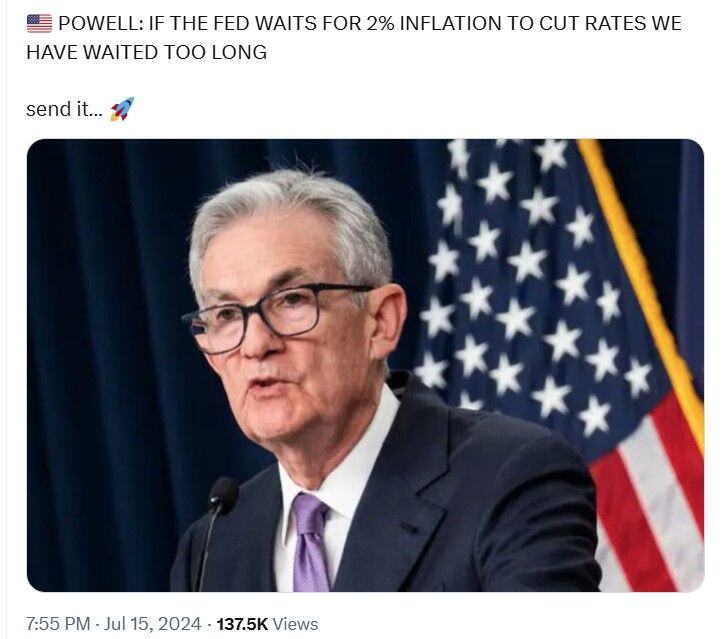

🚨 Federal Reserve Chair Jerome Powell said Monday that the central bank will not wait until inflation hits 2% to cut interest rates.

Speaking at the Economic Club of Washington D.C., Powell referenced the idea that central bank policy works with “long and variable lags” to explain why the Fed wouldn’t wait for its target to be hit. “The implication of that is that if you wait until inflation gets all the way down to 2%, you’ve probably waited too long, because the tightening that you’re doing, or the level of tightness that you have, is still having effects which will probably drive inflation below 2%,” Powell said. Instead, the Fed is looking for “greater confidence” that inflation will return to the 2% level, Powell said. “What increases that confidence in that is more good inflation data, and lately here we have been getting some of that,” he said. Powell also said he thinks a “hard landing” for the U.S. economy was not “a likely scenario.” Source: CNBC, Radar

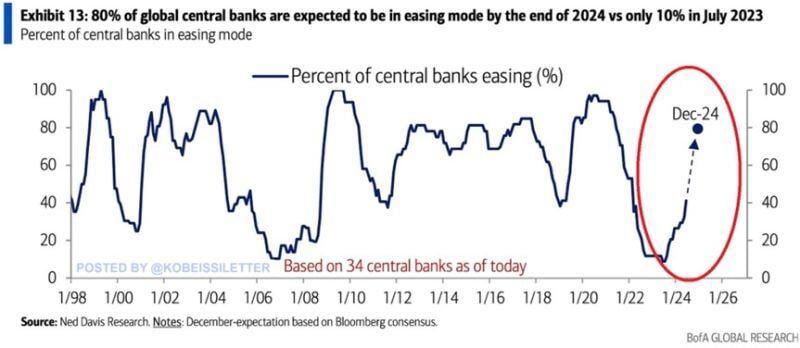

Monetary policy monetization => 27 of 34 global central banks, or 80% are expected to ease their monetary policy by the end of 2024, the highest since 2021.

By comparison, in July 2023 just 10% of central banks were expected to cut rates. Currently, 42% of central banks have been easing monetary policy. Canada and the European Central Bank were the latest to cut interest rates in June. Meanwhile, the market is pricing the first Fed rate cut in September and a total of 2 cuts this year. Source: The Kobeissi Letter, BofA

Gold >2400 as markets believe lower than expected CPI report is opening the door to rate cuts by the FED starting in September.

Source: www.zerohedge.com

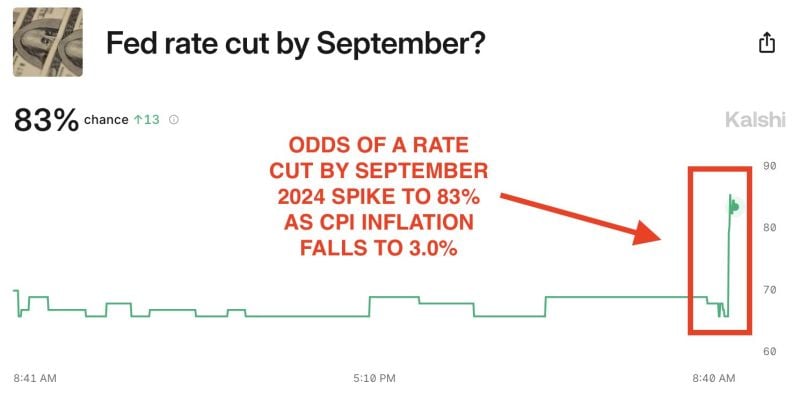

BREAKING: Odds of a Fed rate cut by September 2024 skyrocket to 83% after June CPI inflation, according to Kalshi.

June 2024 marked the first NEGATIVE month-over-month inflation print since May 2020. Headline inflation is now at a 12-month low and 100 basis points away from the Fed's 2% target. Prior to the CPI inflation report today, prediction markets saw a 67% chance of rate cuts by September. Exactly 1 year ago, the Fed stopped raising interest rates. Does the Fed have the green light to cut rates? Source: The Kobeissi Letter

📉 Is a Fed Rate Cut on the Horizon Before the Elections?

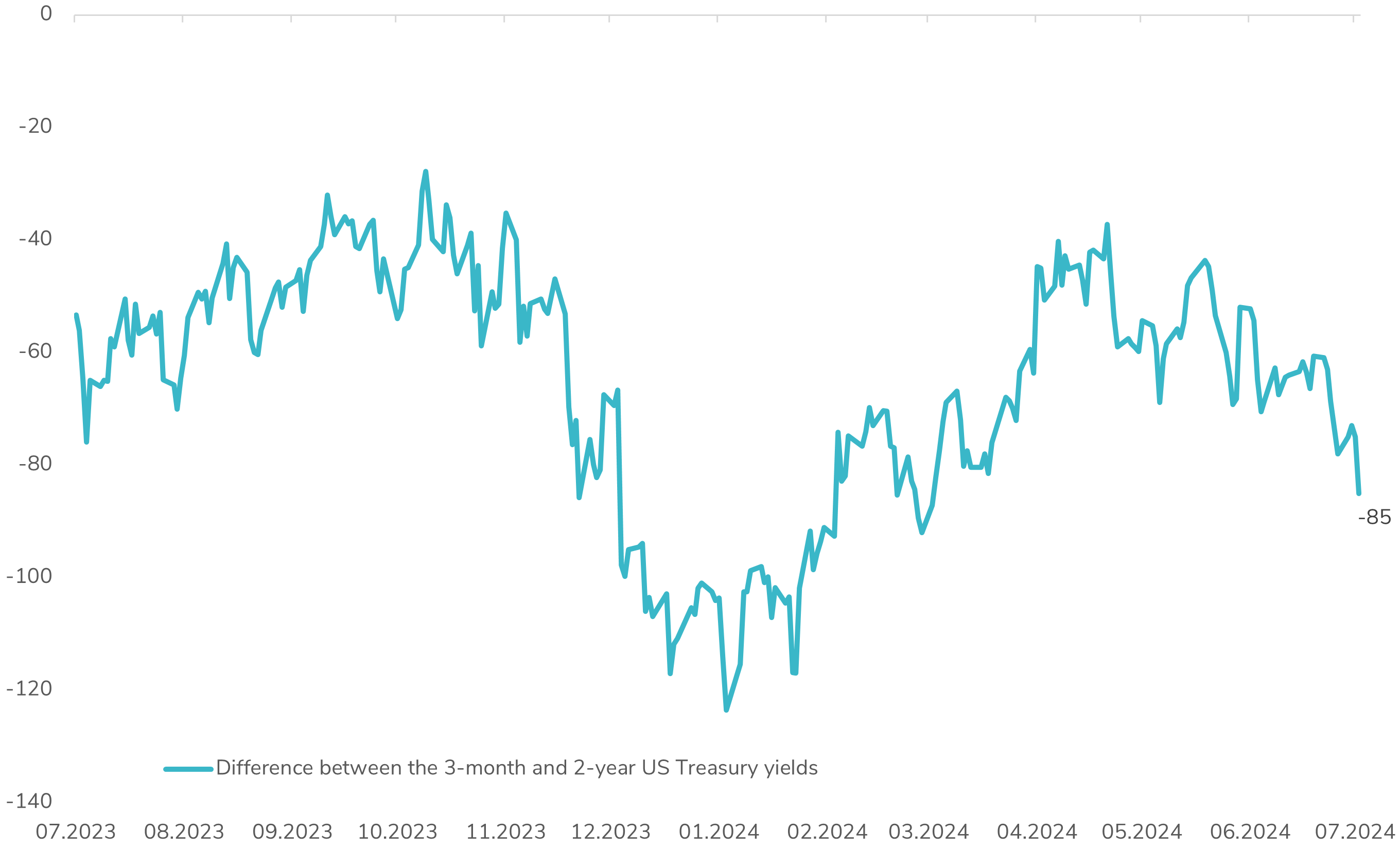

Recent economic data, especially in the job market, has underperformed, and Fed Chairman Jerome Powell's dovish remarks at the Sintra Forum have shifted market expectations. Reinforcing this sentiment, the just-released US Core CPI came in below expectations at 3.3%. Investors are now buzzing about a potential rate cut as early as the Fed’s September meeting, right before the US Presidential Elections. This is clearly reflected in the yield curve, with the spread between the 3-month and 2-year US Treasury yields dropping sharply from -60 bps to -85 bps over the past three days. This significant drop indicates an 85% probability that the market is pricing in a rate cut by September. The critical question remains: Will the US macroeconomic landscape deteriorate enough to prompt the Fed to start normalizing its monetary policy before the elections? #Fed #MonetaryPolicy #InterestRates #EconomicOutlook #Investing #FinancialMarkets #SyzGroup

Investing with intelligence

Our latest research, commentary and market outlooks