Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Federal Reserve Chair Jerome Powell on Tuesday expressed concern that holding interest rates too high for too long could jeopardize economic growth.

Setting the stage for a two-day appearance on Capitol Hill this week, the central bank leader said the economy remains strong as does the labor market, despite some recent cooling. Powell cited some easing in inflation, which he said policymakers stay resolute in bringing down to their 2% goal. “At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face,” he said in prepared remarks. “Reducing policy restraint too late or too little could unduly weaken economic activity and employment.” Source: CNBC, Yusuf on X

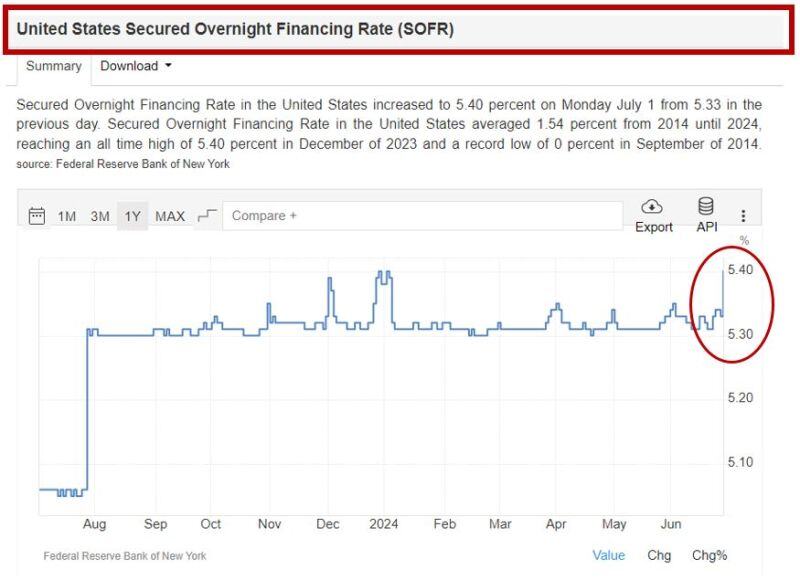

The Secured Overnight Financing Rate, a benchmark connected to overnight repo transactions, is back to the all-time-high of 5.40% , according to New York Fed data published yesterday.

Clogged bank balance sheets are behind the spike of this key repo funding rate. This move is similar to funding market pressures seen in late-2023. The Secured Overnight Financing Rate spiked seven basis points to 5.40% on July 1, according to Federal Reserve Bank of New York data published Tuesday. The return of such swings in SOFR is largely thanks to the Federal Reserve, which is still removing liquidity from the system via quantitative tightening, or QT, albeit at a slower pace with the intention to reduce potential strains on the market. Still, that’s reawakened volatility around key quarter-end funding periods as seen last week, when banks tend to pare repo activity to shore up balance sheets for regulatory purposes and borrowers either find alternatives or pay up. At the same time, the glut of government debt sales means more collateral needs financing from the repo market.

SUMMARY OF FED CHAIR POWELL'S COMMENTS (7/2/24):

1. The trend of disinflation appears to be resuming 2. Need to be more confident before reducing rates 3. Fed doesn't see 2% inflation "this year or next year" 4. Budget deficit is very large and unsustainable 5. 4% unemployment is still a very low unemployment rate 6. Moving too fast creates risk of inflation returning The Fed needs more data before rate cuts can begin. Source: The Kobeissi Letter

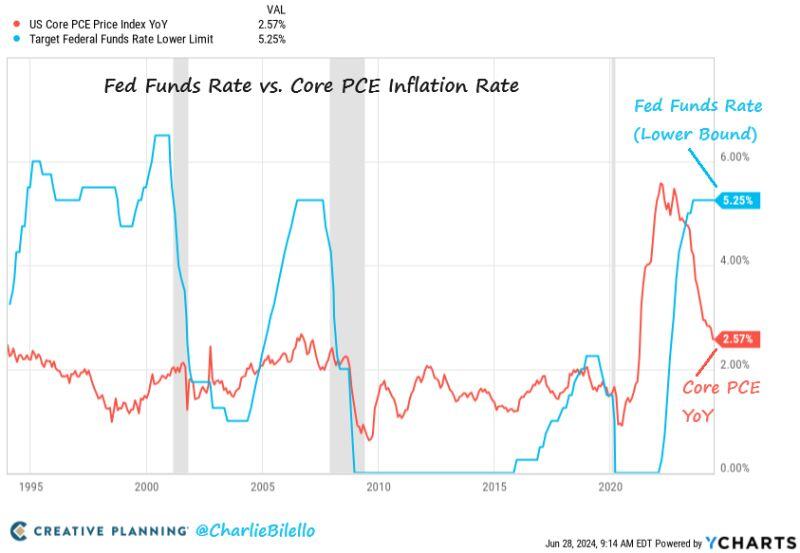

BREAKING: The Fed's preferred measure of inflation (Core PCE) moved down to 2.6% in May, in-line with expectations and the lowest since March 2021.

Core PCE inflation fell to 2.6%, in-line with expectations of 2.6%. So Both headline and Core PCE inflation declined last month. Another welcomed sign by the Fed. Note that "Supercore" PCE rose by 0.1% in May, its smallest monthly increase since August 2023. Health Care (light blue) was the dominant contributor, and 5 of the main sub categories actually declined (if it wasn't for soaring health insurance costs, supercore would be negative). The Fed Funds Rate is now 2.7% above Core PCE, the most restrictive monetary policy we've seen since September 2007. Source: Charlie Bilello

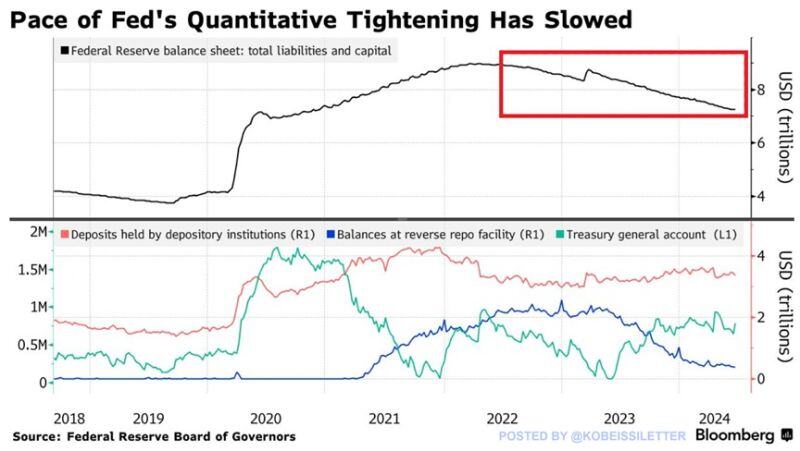

The Fed has been shrinking its balance sheet at the fastest pace ever:

Since April 2022, the Federal Reserve has reduced its balance sheet by $1.71 trillion to $7.25 trillion, a 19% decline. By comparison, from 2017 to 2019 the Fed’s balance sheet runoff amounted to 16%. However, the Fed's balance sheet still stands $3.1 TRILLION above pre-pandemic levels. Meanwhile, the Fed slowed the pace of runoff from $95 billion to $60 billion a month at the beginning of June. Will the Fed's balance sheet ever reach pre-pandemic levels?

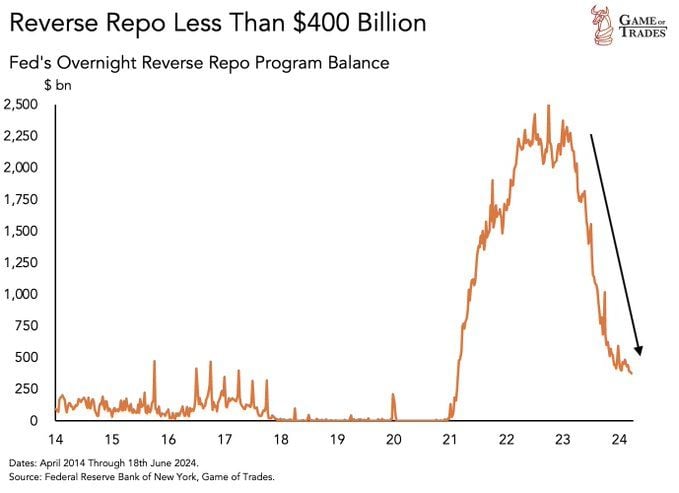

Reverse Repo has been falling off a cliff... Going from +$2300 billion to under $400 billion in just 1.5 years

Source: Game of Trades

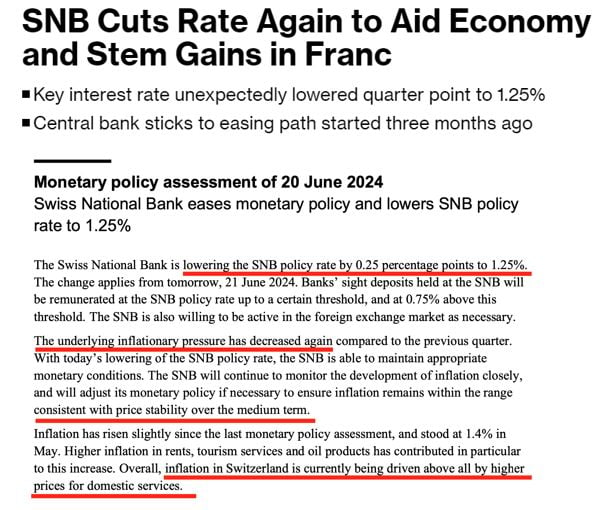

The SNB has lowered its key rate again today, to 1.25%, after the previous 25bp cut decided in March

The view by our Chief Economist Adrien Pichoud: • Going forward, we believe that the SNB is now done with the recalibration of its monetary policy and that it shouldn’t cut rate further this year. • Swiss monetary policy can now be deemed as “neutral” for inflation and economic activity, as the real short term rate is close to 0% (actually just below with a cash rate of 1.25% and an inflation rate of 1.4%). • Provided growth remains on a gradual upward trend toward potential in 2025 (1.5%) and there is no unexpected development on the inflation front, there will be no reason for the SNB to lower further the CHF short term rate. • Should European or global developments trigger volatility and upward pressures on the CHF, we believe the SNB would rather resort to interventions on the FX market to manage the impact on the economy, rather than use the interest rate lever.

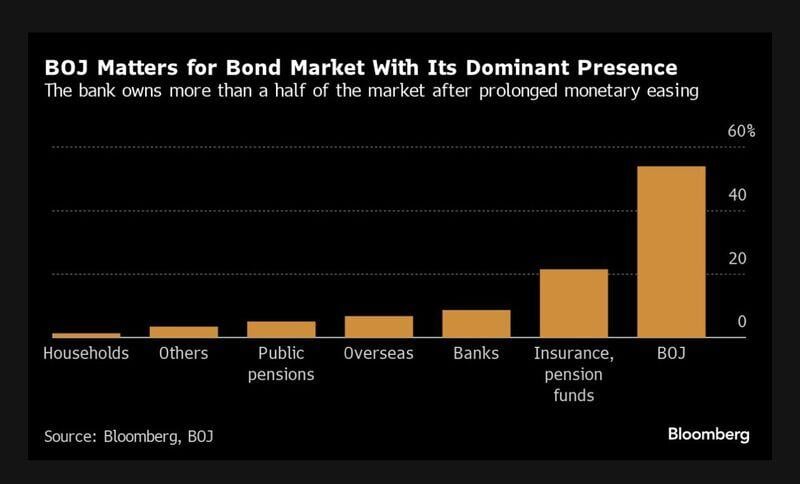

📢 📢 📢 The Bank of Japan kept its benchmark interest rate unchanged on Friday, but indicated it’s considering the reduction of its purchase of Japanese government bonds.

The central bank left short-term rates unchanged at between 0% to 0.1% at the end of its two-day policy meeting, as widely expected. But notably, the bank said in its statement it could reduce its purchases of Japanese government bonds after the next monetary policy meeting, scheduled for July 30 and 31. QE tapering in Japan has a lot more potency than in the U.S., sheerly because of how much of the bond market the BOJ owns. Following the BOJ decision, the Japanese yen weakened 0.5% to 157.8 against the U.S. dollar, while the yield on 10-year JGB fell 44 basis points to 0.924. So absolutely no panic... Source: Bloomberg, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks