Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US 2s/10s yield spread is now flat for the 1st time since 2022 on aggressive repricing of Fed rate cuts

US 2y yields have plunged by 70bps to 3.69% since last Wed while US 10y yields only dropped by 40bps in the same time. Source: Bloomberg, holgerZ

Fed's emergency rate cut never happened when the VIX was below 40.

It seems that we are getting there... Source chart: Yahoo finance

💥 Treasuries surge as traders bet on emergency Fed rate cut 💥

.

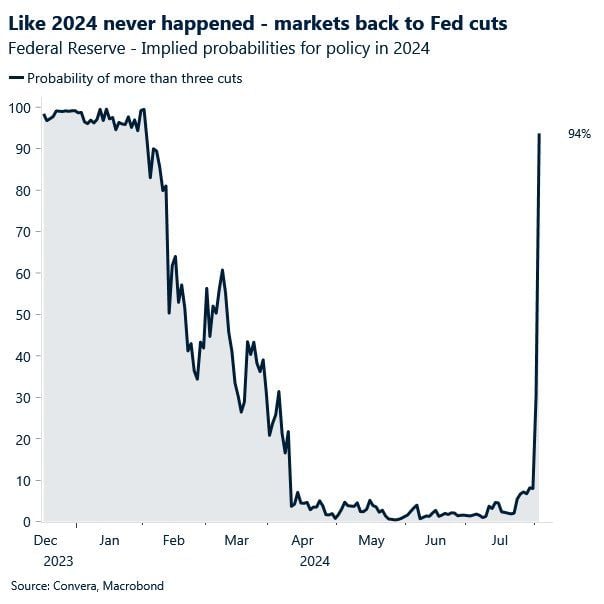

What a chart...

Source. Michel.A Arouet, Ht @MacroKova, Convera, Macrobond

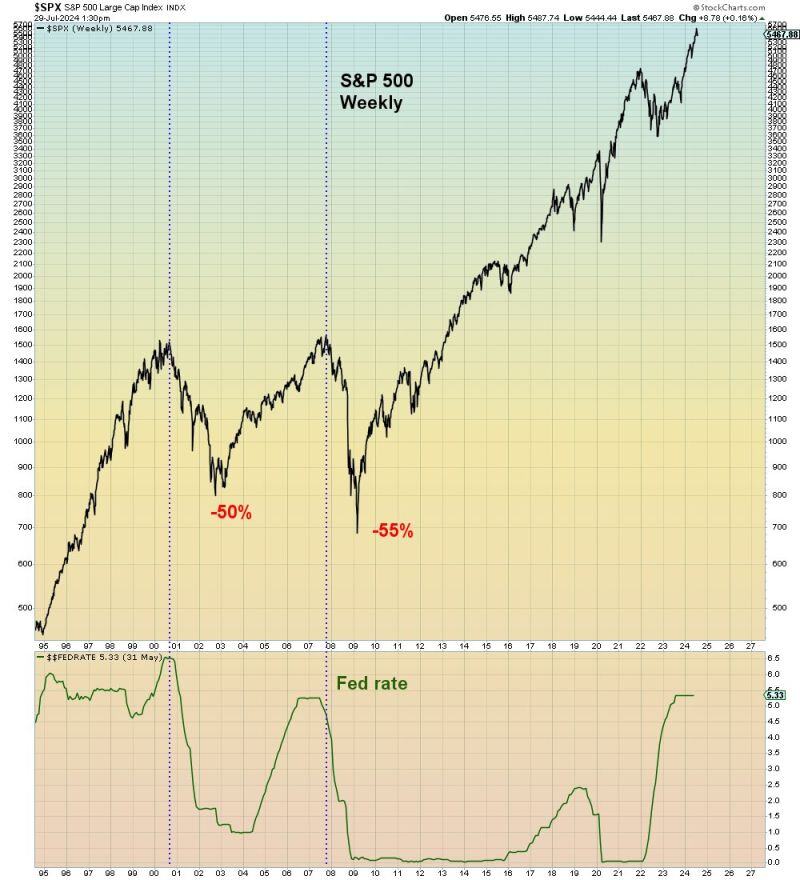

Should the FED wait for a financial accident to happen BEFORE cutting interest rates?

Source chart: Mac10

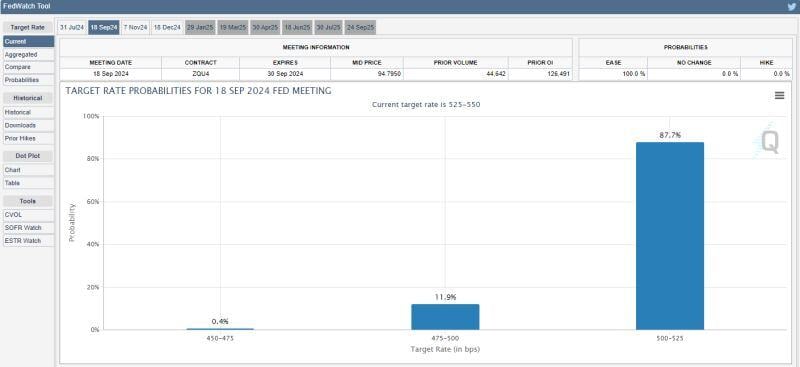

JUST IN 🚨: There is now a 100% chance of a 25 bps interest rate cut by September, according to CME FedWatch

Source: Barchart

Bulls praying to Lord Powell for a rate cut next week

Source; Barchart

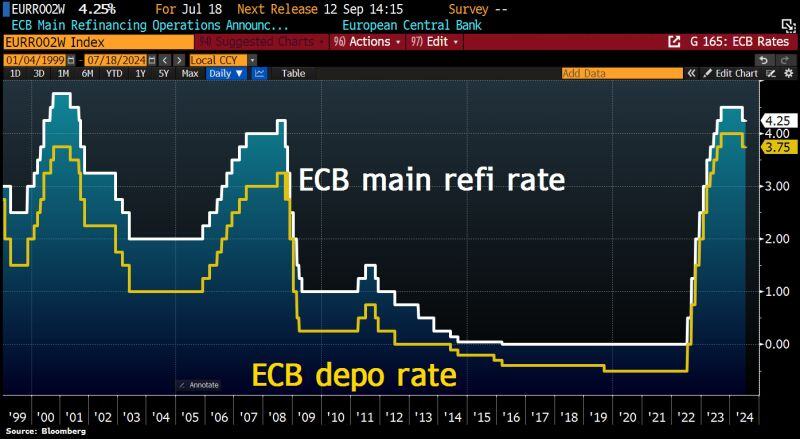

ECB leaves all rates unchanged as expected.

Main Refi at 4.25%, deposit rate at 3.75%. Guidance on interest rates also stays unchanged: Not pre-committing to particular path. ECB to follow data-dependent, meeting-by-meeting approach. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks