Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

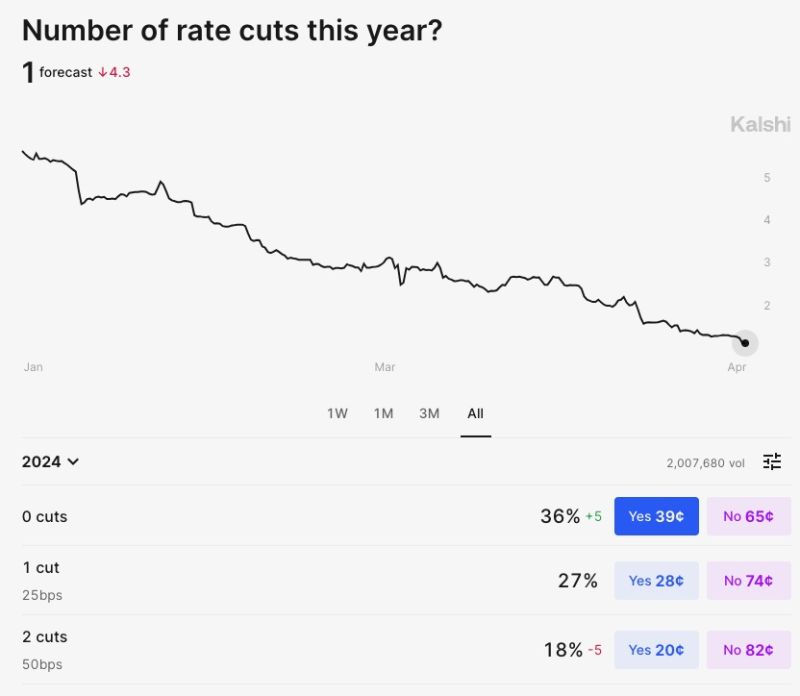

Prediction markets now show a 36% chance of ZERO interest rate cuts in 2024, according to Kalshi.

To put this in perspective, 4 months ago there was a ~3% chance of no rate cuts in 2024. The base case has gone from 6 rate cuts to 1 rate cut this year. There is just a 31% chance of 2 or more interest rate cuts this year. In other words, there is a higher chance of NO cuts than 2 OR MORE cuts. Could it be the fastest shift in Fed expectations of all time? Source: The Kobeissi Letter

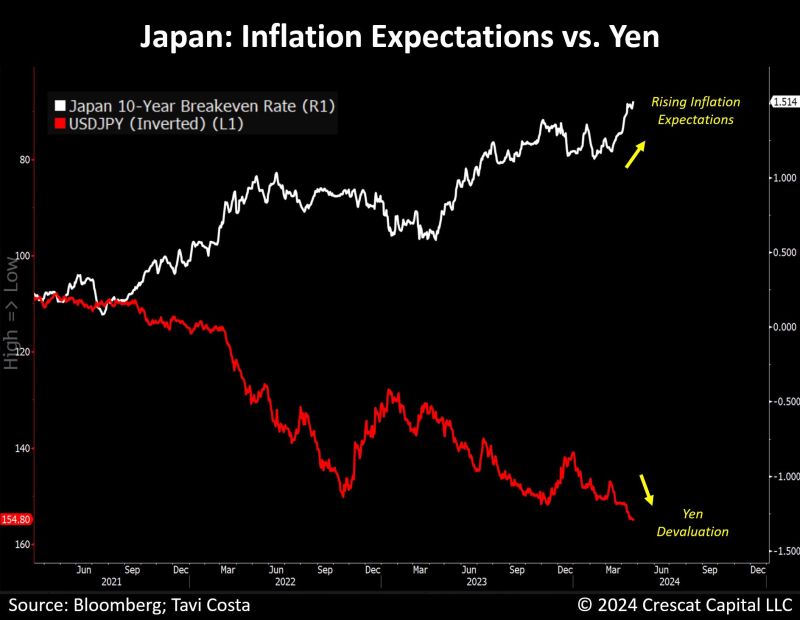

Excellent tweet by Otavio (Tavi) Costa on how money debasement looks like and why the BoJ is "trapped” in one chart.

"Japan is experiencing increasing inflation expectations alongside a continuous devaluation of the yen, exhibiting an almost perfectly negative correlation. This reflects the dilemma of an economy burdened by excessive debt, necessitating continuous accommodative monetary policies in the face of structural inflationary pressures. While this might be more pronounced in Japan, this trend is reflective of a global fiat debasement phenomenon". Source: Crescat Capital, Tavi Costa

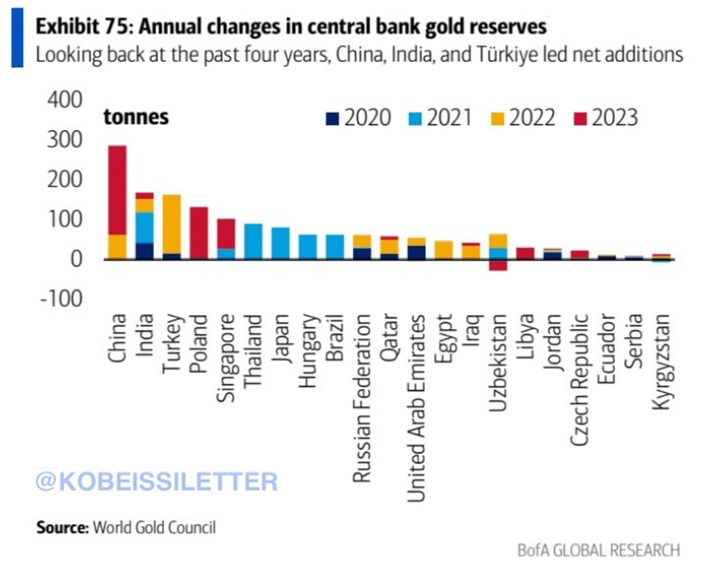

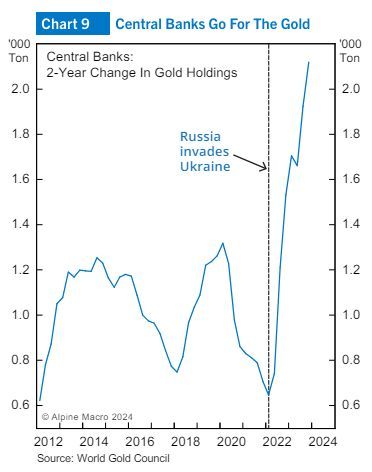

Central banks are STOCKING UP on gold:

Since 2022, China has bought a record ~290 tonnes of gold. Last year alone, China acquired more than 225 tonnes of the metal. China's central bank increased its gold holdings for 17 straight months. In 2022 and 2023, world central banks bought 1081 and 1037 tonnes of gold, respectively. Prior to 2022, there was never a year in history with 1,000+ tonnes of central bank gold purchases. Source: The Kobeissi Letter, BofA

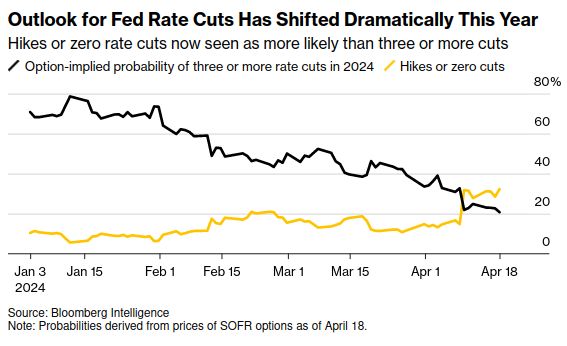

What a difference five months makes for the Fed rate cut outlook. 😉

Source: Bloomberg Intelligence, Markets & Mayhem

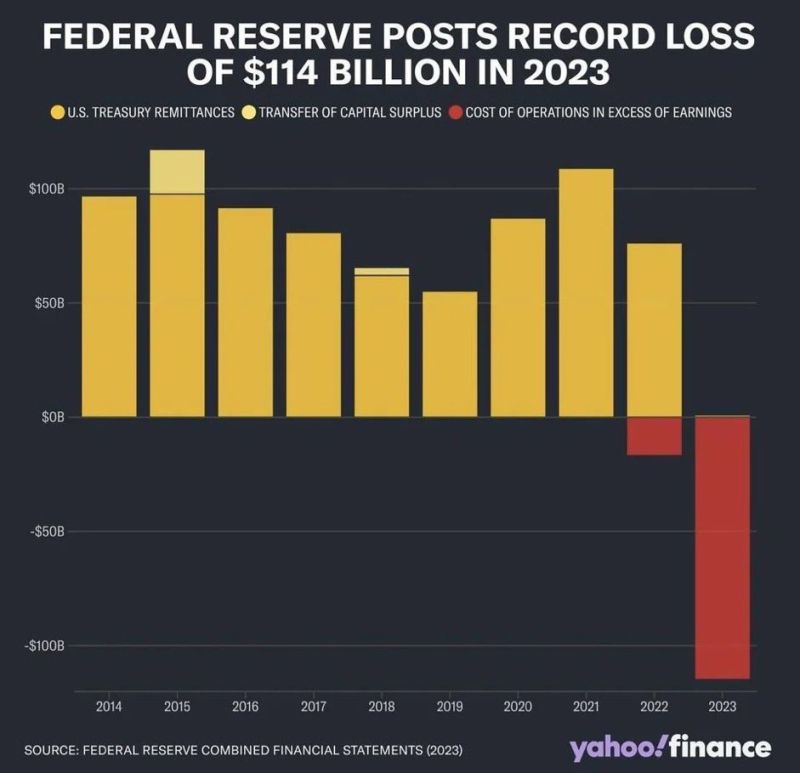

Federal Reserve posted its biggest loss in history of $114 billion last year 👀

Source: Yahoo Finance

2022-2024 summarised in one cartoon

Thru Andreas Steno Larsen

A number of Central Banks have begun to add gold to their reserves since Russia invaded Ukraine.

Chart from Alpine Macro. According to the IMF there is about $12 trillion of currency reserves held globally. That is nearly the market value of the gold stock, but according to Alpine Macro only about $3 trillion of gold is potentially available for central banks to purchase. While other factors need to be taken into account, Central banks buying is likely creating a supply/demand imbalance. Source: Crit Thomas, Alpine Macro

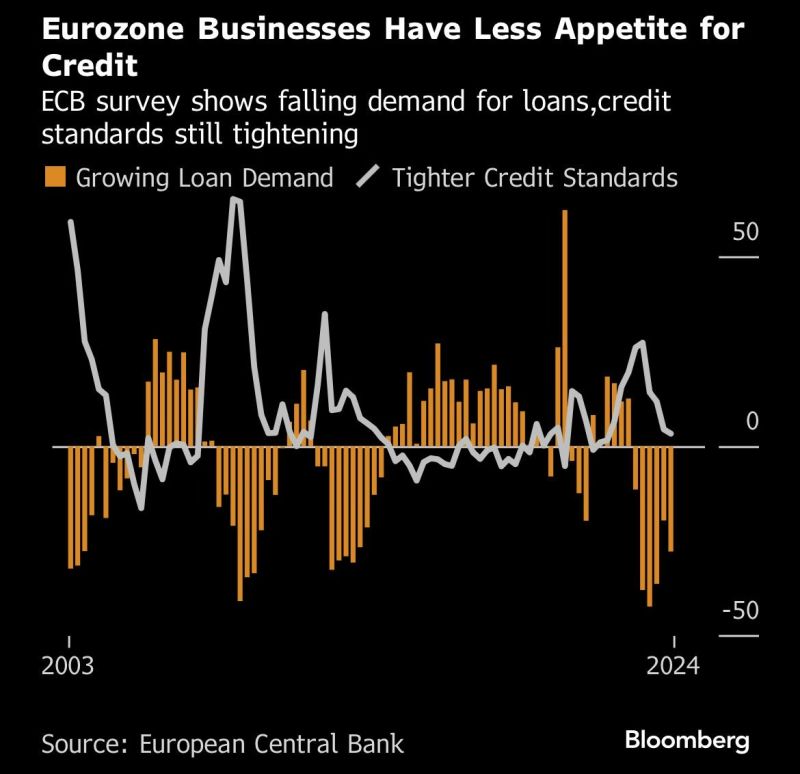

Could an ECB rate cut change reverse this trend?

It might not be enough to offset some of teh structural issues the old continent is facing (overregulation, demographics, lack of tech innovation and energy dependence among others). Source: Bloomberg, Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks