Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Excellent tweet by Otavio (Tavi) Costa on how money debasement looks like and why the BoJ is "trapped” in one chart.

"Japan is experiencing increasing inflation expectations alongside a continuous devaluation of the yen, exhibiting an almost perfectly negative correlation. This reflects the dilemma of an economy burdened by excessive debt, necessitating continuous accommodative monetary policies in the face of structural inflationary pressures. While this might be more pronounced in Japan, this trend is reflective of a global fiat debasement phenomenon". Source: Crescat Capital, Tavi Costa

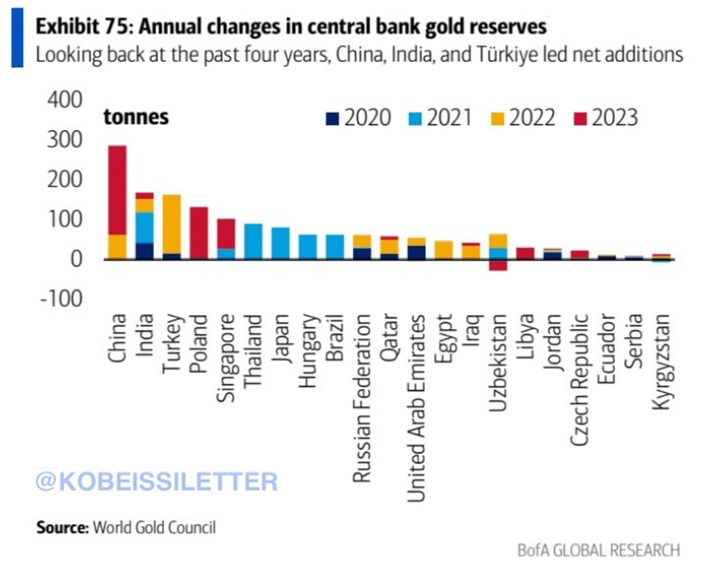

Central banks are STOCKING UP on gold:

Since 2022, China has bought a record ~290 tonnes of gold. Last year alone, China acquired more than 225 tonnes of the metal. China's central bank increased its gold holdings for 17 straight months. In 2022 and 2023, world central banks bought 1081 and 1037 tonnes of gold, respectively. Prior to 2022, there was never a year in history with 1,000+ tonnes of central bank gold purchases. Source: The Kobeissi Letter, BofA

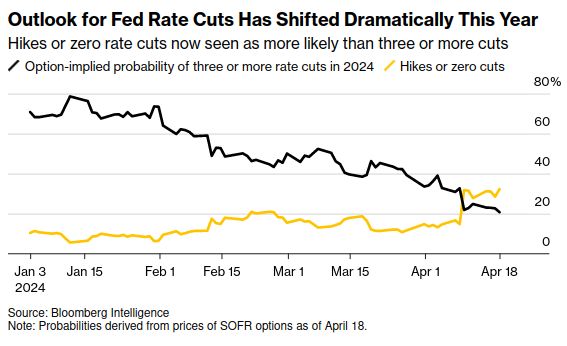

What a difference five months makes for the Fed rate cut outlook. 😉

Source: Bloomberg Intelligence, Markets & Mayhem

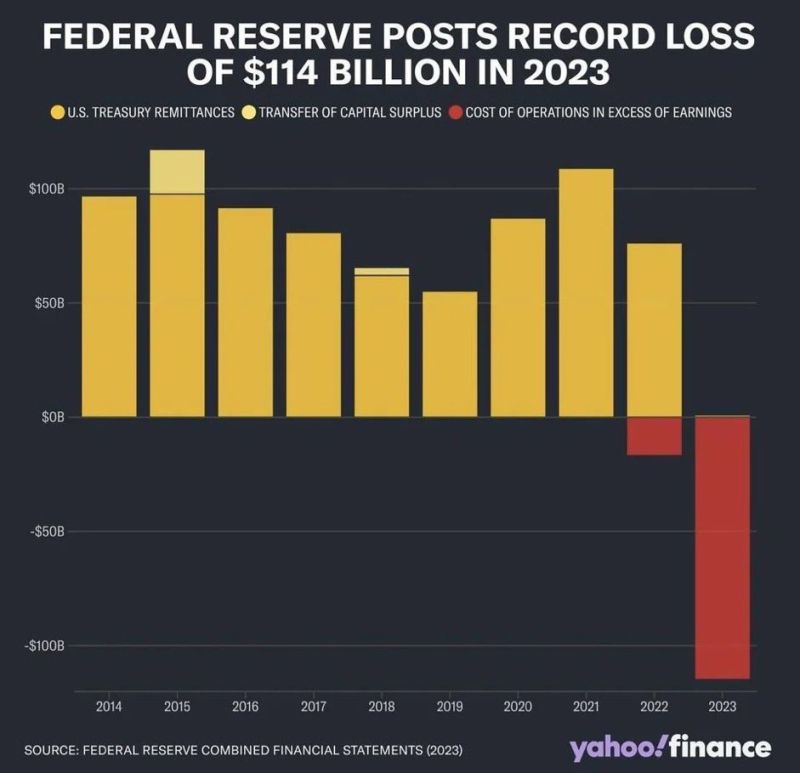

Federal Reserve posted its biggest loss in history of $114 billion last year 👀

Source: Yahoo Finance

2022-2024 summarised in one cartoon

Thru Andreas Steno Larsen

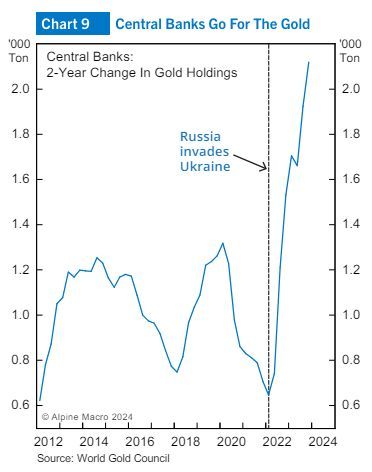

A number of Central Banks have begun to add gold to their reserves since Russia invaded Ukraine.

Chart from Alpine Macro. According to the IMF there is about $12 trillion of currency reserves held globally. That is nearly the market value of the gold stock, but according to Alpine Macro only about $3 trillion of gold is potentially available for central banks to purchase. While other factors need to be taken into account, Central banks buying is likely creating a supply/demand imbalance. Source: Crit Thomas, Alpine Macro

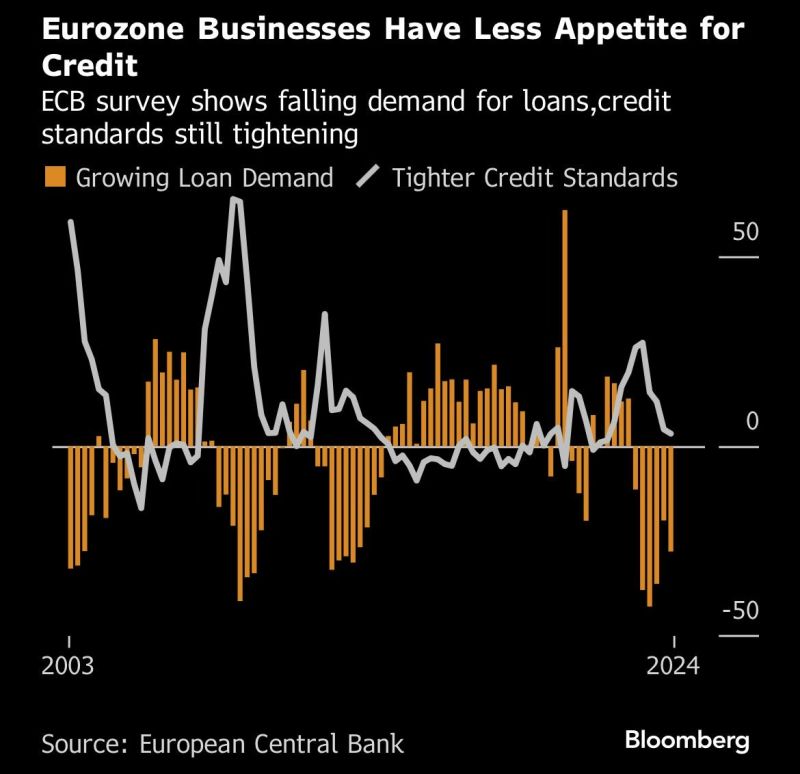

Could an ECB rate cut change reverse this trend?

It might not be enough to offset some of teh structural issues the old continent is facing (overregulation, demographics, lack of tech innovation and energy dependence among others). Source: Bloomberg, Michel A.Arouet

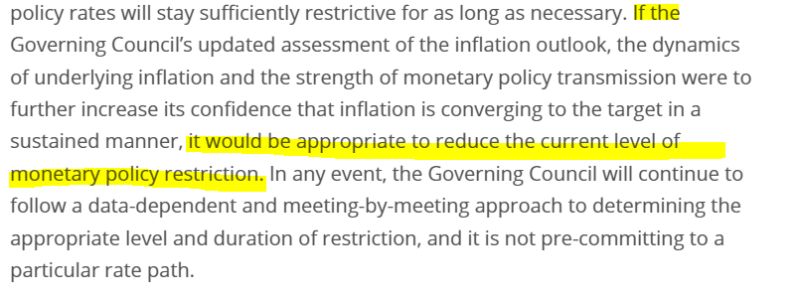

BREAKING >>> ECB rates unchanged as expected but ECB gives quite explicit indication of coming rate cut in June - unless they are surprised. No rate cut size given.

Note also a Critical Change In The ECB's Language (UBS): "The ECB noted that wage pressures are moderating and those wage gains there are, are tending to be absorbed by companies in their profits. That is something ECB President Lagarde said a month ago was a prerequisite – indeed it was a worrisome signal as far as equity was concerned, specifically requiring lower profit margins. But contrast today's wording with last month's: that inflation remained high because in part of high wages. So, having set up a margin squeeze on wage absorption as a critical requirement, Lagarde should draw attention to that in the press conference". The first indication out of today’s ECB governing body meeting is consistent with President Lagarde’s previous statment that the Eurozone’s central bank is not “Fed dependent.” Source: Piet Haines Christiansen

Investing with intelligence

Our latest research, commentary and market outlooks