Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Some hawkish comments by fed officials seemed to be behind yesterday sell-off in stocks.

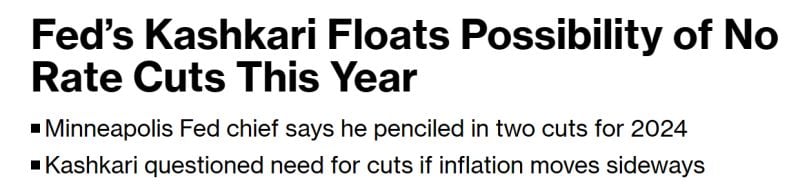

Among the comments: *BARR: BANKS' OFFICE COMMERCIAL REAL-ESTATE ISSUES TO TAKE TIME *KUGLER: `SOME LOWERING' OF RATES THIS YEAR LIKELY APPROPRIATE *FED'S HARKER SAYS INFLATION IS STILL TOO HIGH *BARKIN: FED HAS TIME TO GAIN MORE CLARITY BEFORE LOWERING RATES *GOOLSBEE: WORTH STAYING ATTUNED TO DETERIORATION IN JOBS MARKET *MESTER: NEED MORE PROGRESS ON HOUSING, CORE SERVICES INFLATION But the key market driver (to the downside) was Kashkari - President and CEO of the Federal Reserve Bank of Minneapolis - who hinted at the potential of NO RATE-CUTS. *KASHKARI: QUESTION OF WHY CUT RATES IF ECONOMY REMAINS STRONG “In March I had jotted down two rate cuts this year if inflation continues to fall back towards our 2% target,” Kashkari said in a virtual event with LinkedIn on Thursday. “If we continue to see inflation moving sideways, then that would make me question whether we needed to do those rate cuts at all.” His comments seemed to trigger a wave of selling in stocks.

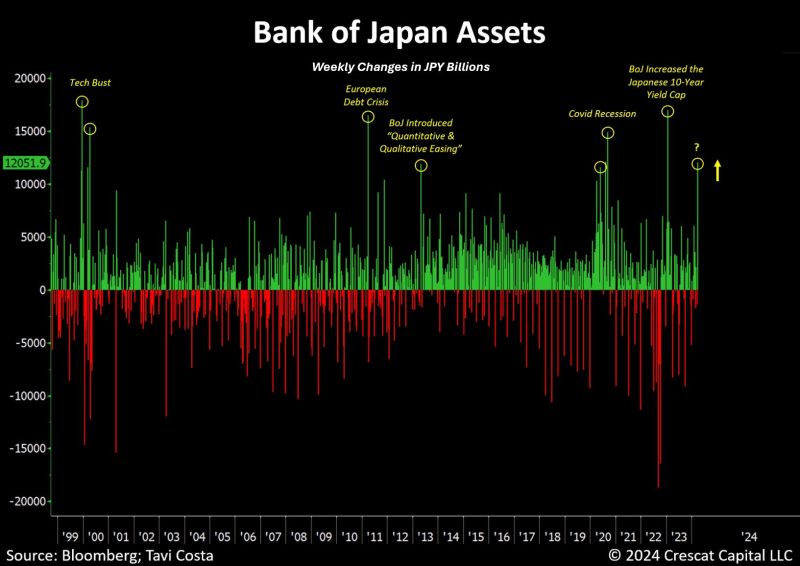

The global economy is addict to easy-money policies.

While everyone is talking about boj hiking rates, we just experienced one of the largest weekly changes in the BoJ balance sheet assets in history. In USD terms, this move accounted for nearly $80 billion in one week... Source: Tavi Costa, Bloomberg

NOTHING NEW FROM POWELL YESTERDAY...

Fed Chairman Powell reiterated the Federal Reserve's cautious stance on interest-rate cuts, stating that they would wait and observe before making any decisions. While Powell didn't introduce any significant changes, his comment provided relief to Wall Street by suggesting that recent inflation data hadn't substantially altered the overall economic outlook. He also reiterated the likelihood of rate reductions at some point during the year. “On inflation, it is too soon to say whether the recent readings represent more than just a bump,” Mr. Powell stated. “We do not expect that it will be appropriate to lower our policy hashtag#rate until we have greater confidence that inflation is moving sustainably down toward 2 percent.” At the same time, he said that cuts to the benchmark federal funds rate are “likely to be appropriate at some point this year” as he does not believe “inflation is reversing higher.”

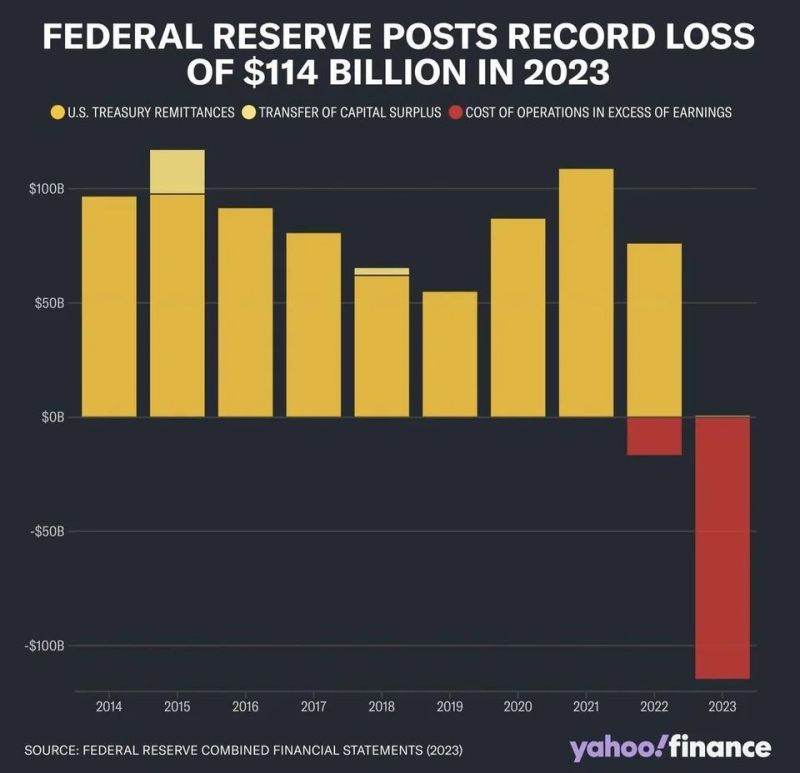

BREAKING: Federal Reserve

The Fed said on Tuesday that it officially saw a net negative income of $114.3 billion in 2023, a record loss tied to expenses related to managing the U.S. central bank's short-term interest rate target. The loss last year follows $58.8 billion in net income in 2022, the Fed said. Source: Barchart

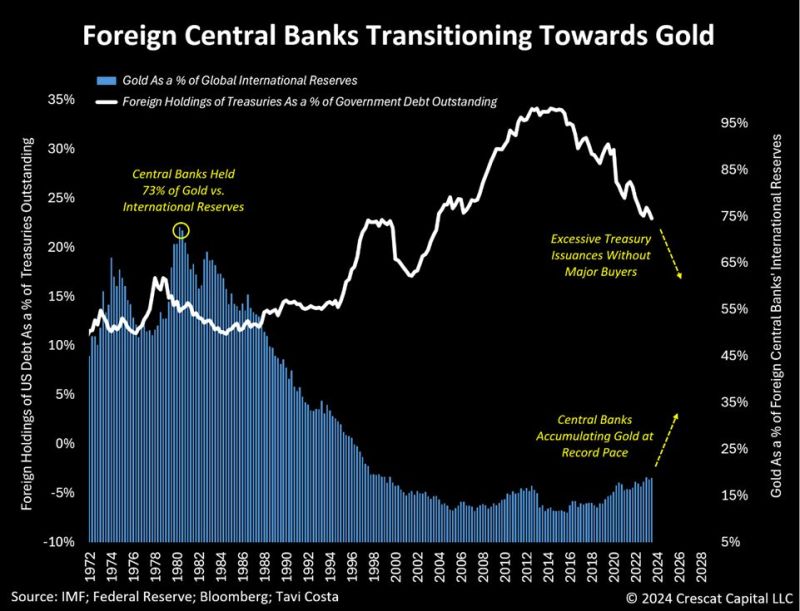

Gold's role as a neutral asset with millennia of history as money is experiencing a resurgence relative to US Treasuries for global central bank reserve accumulations.

Source: Tavi Costa, Bloomberg

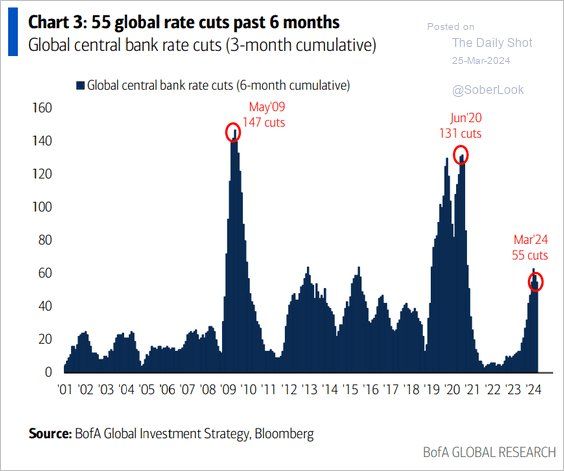

Central banks cut rates at the fastest pace since heading into the pandemic.

Source: BofA, The Daily Shot

THE WEEK AHEAD... All eyes on inflation data + Powell speech on Friday

>>> In the US: 1. New Home Sales data - Monday 2. CB Consumer Confidence - Tuesday 3. US Q4 2023 GDP data - Thursday 4. February PCE Inflation data - Friday 5. hashtag#Fed Chair Powell Speaks - Friday 6. Total of 5 Fed Speaker Events >>> Inflation will also be the key theme in europe as flash CPI reports start to come in. >>> In Japan, the focus will be on the summary of opinions from this week's BoJ meeting as well as the Tokyo CPI, labour market data and industrial production. Picture via openart.ai/midjourney

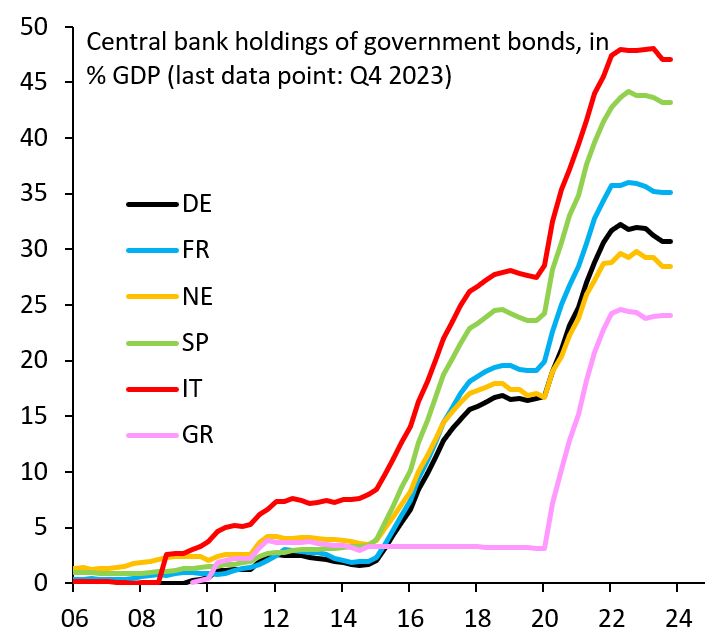

Below central bank holdings of government bonds...

Greece was excluded from ECB QE under Draghi, but was included in COVID QE, giving it a big boost (pink). Greece then undermined the G7 cap on Russia at every turn, protecting its shipping oligarchs at the expense of the EU. If you can't behave properly, there should be no QE... Source; Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks