Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

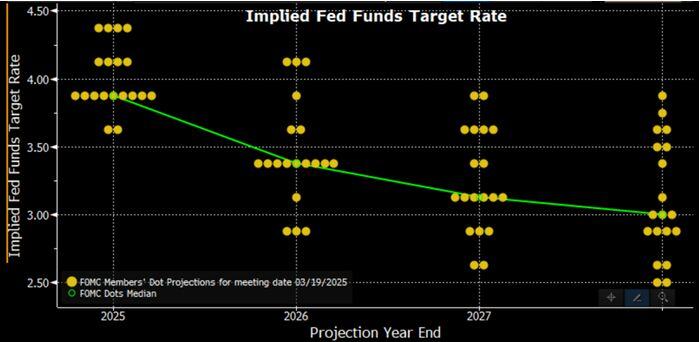

The fed dot plot >>> Look at the wide dispersion around the "longer run" dots.

No real agreement on where they're heading. Source: Seek Wiser @SeekWiser_

👉 The Bank of Japan held interest rates on Wednesday as the rising risk of a global trade war and potential downturn in the US weighed on Japan’s hope for a sustained economic revival.

👉The unanimous decision, which came at the conclusion of a two-day meeting of the Japanese central bank’s policy board, left the short term policy rate at about 0.5 per cent. 👉The result was widely forecast by economists and had been priced in by markets, according to traders. 👉In a statement accompanying the decision, the BoJ warned that “high uncertainties” remained around Japan’s economic activity and prices. The central bank made particular reference to the “evolving situation regarding trade and other policies in each jurisdiction”. Source: FT

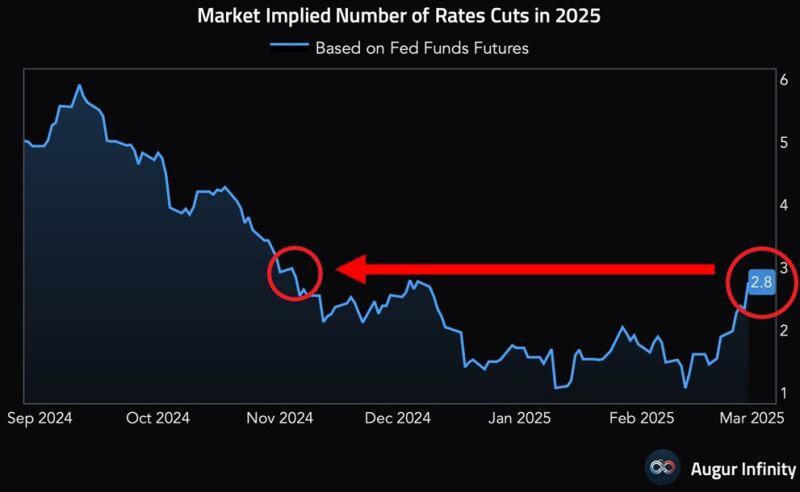

⚠️Markets are RAPIDLY shifting again:

The market is pricing in almost 3 Fed rate cuts in 2025, the highest since November. This is up from just 1 reduction expected just 2 weeks ago. This comes as US economic data has deteriorated sharply, and Treasury yields have dropped. Source: Global Markets Investor, Augur Infinity

2025 rate cut odds:

from just ONE 2 weeks ago to MORE THAN TWO now... Source: zerohedge

The ECB has recorded the biggest loss in its 25y history.

This is the result of its aggressive policy responses to Eurozone crises & surging inflation—1st buying large amounts of bonds & then sharply raising interest rates. As a result, ECB is earning less interest from the bonds it holds than it has to pay to banks for their deposits. Source: HolgerZ, Bloomberg

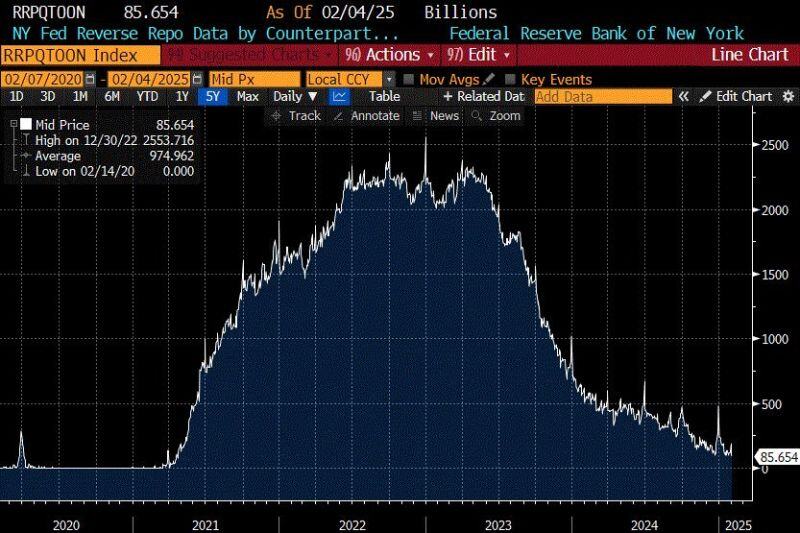

Federal Reserve's Reverse Repo Facility is plummeting

QE & money printing might start aggressively when this drains to 0 Source: Quinten | 048.ethm@QuintenFrancois, Bloomberg

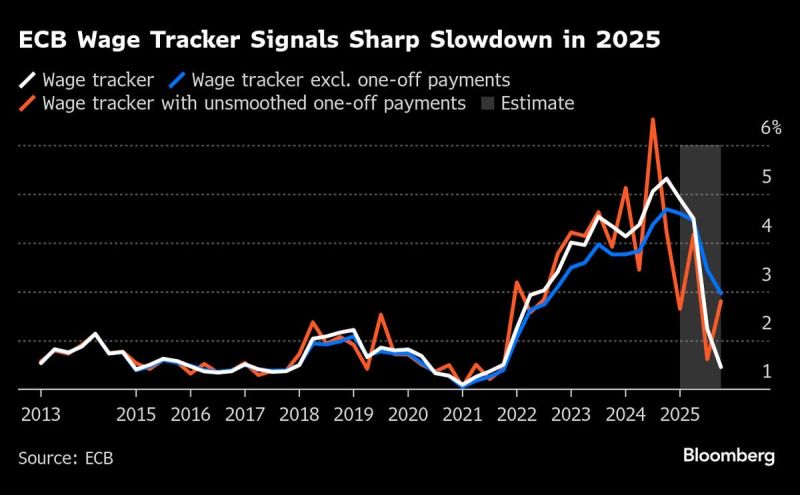

Cut cut cut...

ECB’s Wage Tracker Points to Steep Slowdown This Year - Bloomberg Source: Bloomberg

BOC (Bank of Canada) ANNOUNCES AN END OF QUANTITATIVE TIGHTENING

AND WILL GRADUALLY RESTART ASSET PURCHASES IN EARLY MARCH. Who will be next?

Investing with intelligence

Our latest research, commentary and market outlooks