Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

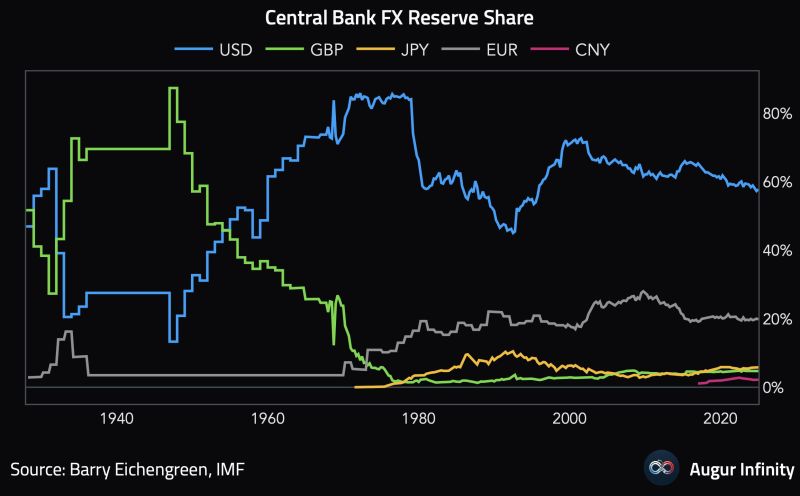

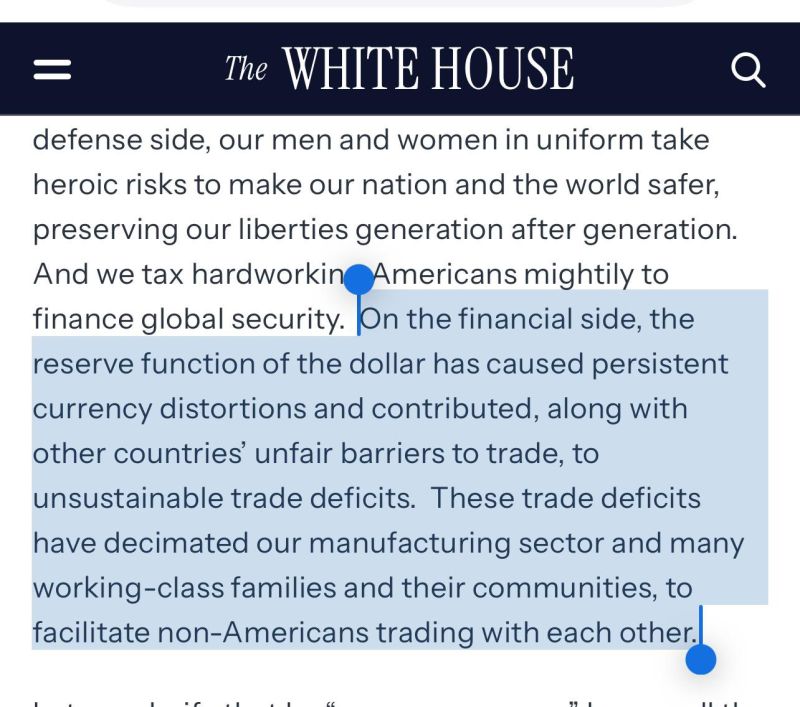

A currency's reserve status should not be taken for granted.

Just look at what happened to the pound... Source: Augur Infinity

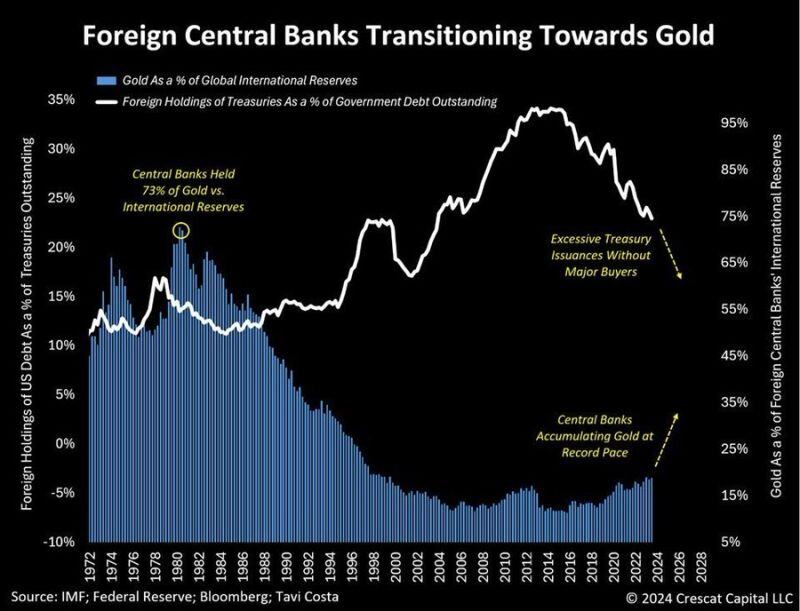

Should investors look at overbought signals on gold or focus on the long-term perspective?

Tavi Costa believes that when it comes to the yellow metal this as one of those key moments when traditional technical analysis like overbought conditions become largely irrelevant. We are likely in the midst of a monetary realignment, and attempting to time short-term corrections based on extreme RSI levels misses the forest for the trees, in his view. "This perspective underestimates the structural macro imbalances that continue to compel governments to accumulate gold" he added. He might be right...

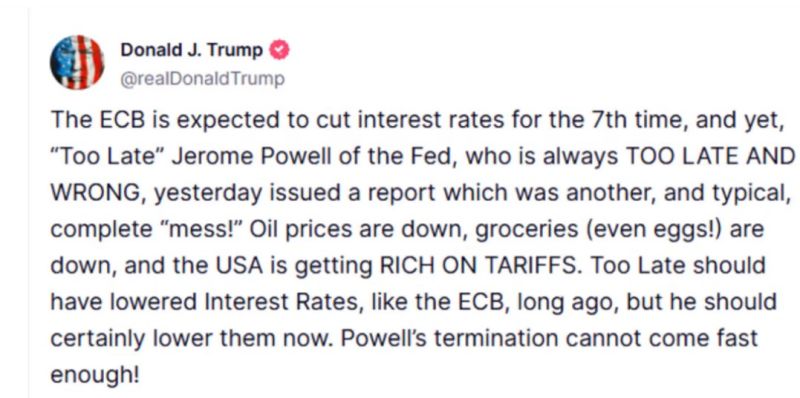

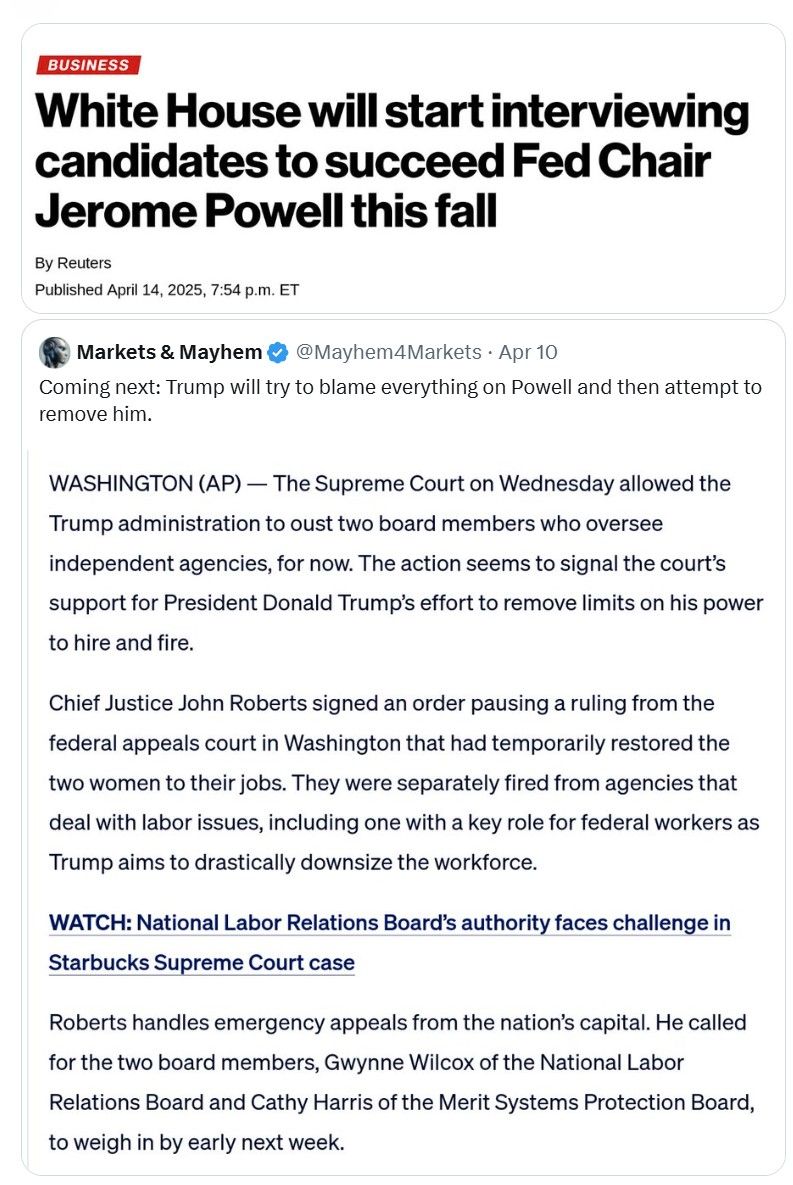

President Trump’s reaction to what Fed Chair Powell said yesterday.

"‘termination cannot come fast enough"

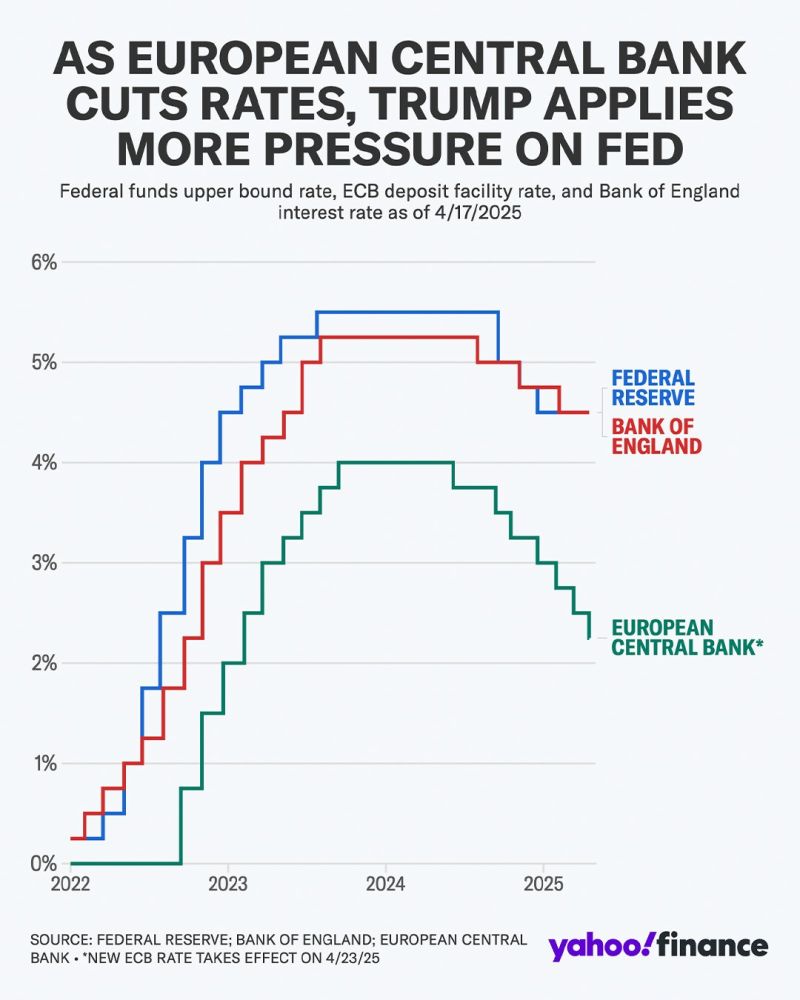

🔴 BREAKING:

THE ECB CUTS INTEREST RATES BY 0.25% for seventh time in a year ▶️ The European Central Bank made yet another 25-basis-point interest rate cut on Thursday as global tariff turmoil has created widespread uncertainty and spurred fears about the euro zone’s economic growth. ▶️ A rate cut was fully anticipated by markets, with an around 94% chance of a 25-basis-point trim being priced in ahead of the decision, according to LSEG data. ▶️ The cut takes the ECB’s deposit facility rate, its key rate, to 2.25%. At its highs in mid-2023 it had been at 4%. ▶️ Tariff developments in recent weeks are widely seen by analysts and economists as a key reason for the ECB to cut interest rates. Even though many of the initial duties imposed by the U.S., as well as retaliation measures, have been put on ice or eased, fears about how they could affect economic growth have been rife. ▶️ In its policy statement, the ECB said that the “outlook for growth has deteriorated owing to rising trade tensions.” ▶️ It added, “Increased uncertainty is likely to reduce confidence among households and firms, and the adverse and volatile market response to the trade tensions is likely to have a tightening impact on financing conditions.” Source: Yahoo Finance, CNBC

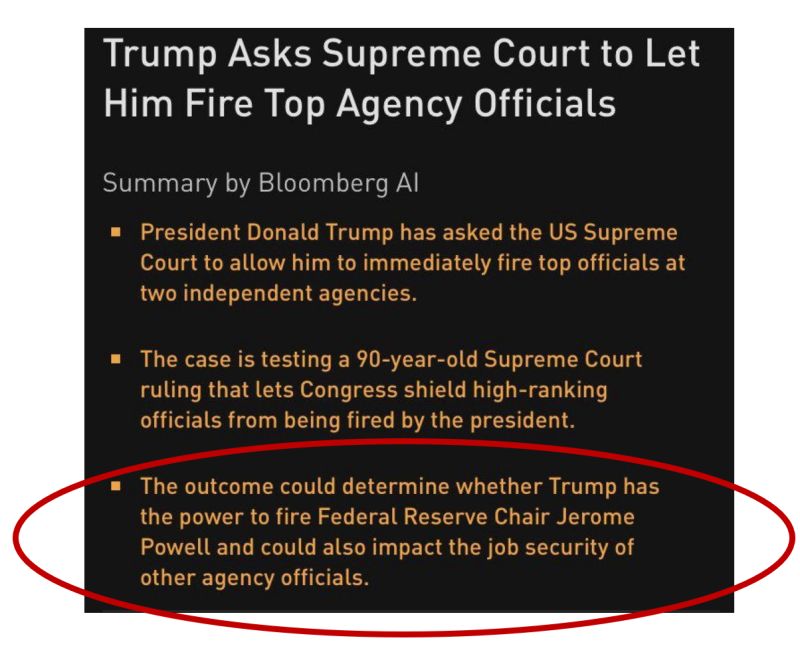

‼️ Will we get a "shadow Fed chair" as soon as this Fall ?

On Monday, Treasury Secretary Scott Bessent has indicated that the discussion for the next Federal Reserve Chair could take place sometime in the fall. ➡️It now looks very clear that Powell's term ends in May 2026. Trump will not reappoint him. ➡️Will Trump fire him? This is very messy (and unknown legally). The alternative, proposed last year by Scott Bessent, was to create a "shadow Fed Chairman." 🔴 How will the Trump administration use a "shadow Fed Chariman"? 1) They appoint Powell's replacement months earlier. 2) They send the nominee regularly go on financial TV, tweet, etc., giving his/her personal opinion and criticising Powell views and decisions, thereby undermining his authority. The shadow Fed Chair could be nominated as soon as this fall...

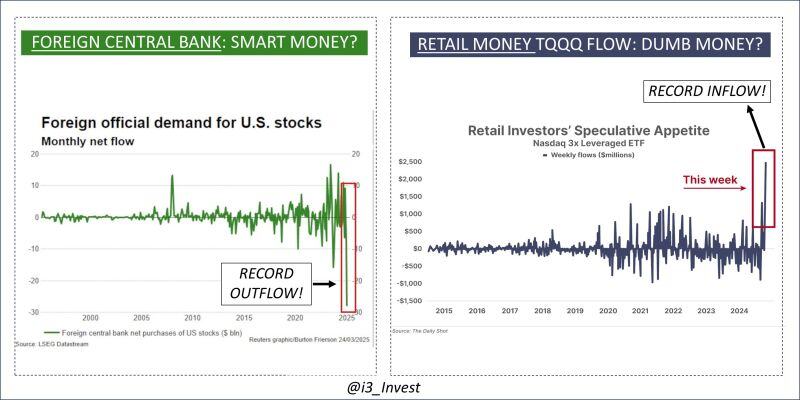

Who do you think is smarter here?

Source: Guilherme Tavares @i3_invest

🔴 BREAKING: PRESIDENT TRUMP JUST ASKED THE SUPREME COURT FOR THE AUTHORITY TO FIRE FEDERAL RESERVE CHAIR JEROME POWELL

Source: Bloomberg

CEA (Council of Economic Advisors at the White House) Chairman Stephen Miran says USD reserve asset status is a problem.

The Trump administration may move to purposely dismantle dollar hegemony. Source: Philip Pilkington @philippilk

Investing with intelligence

Our latest research, commentary and market outlooks