Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

An intentional leak to give markets further hope?

Source: Adam Taggart @menlobear on X

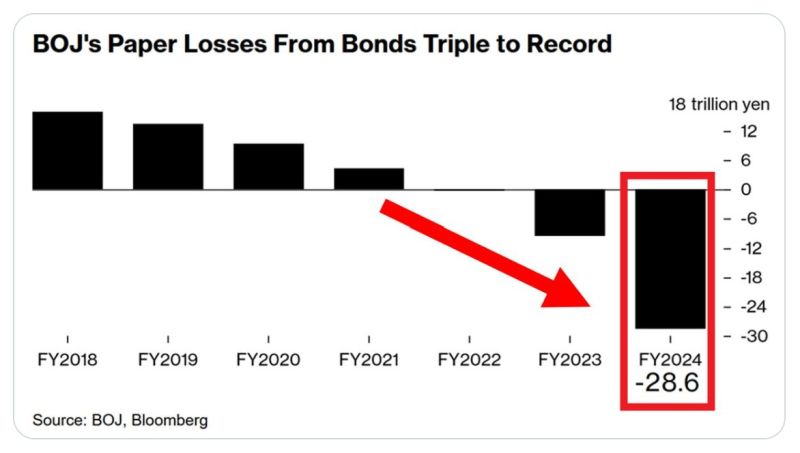

The Bank of Japan's unrealized losses hit a record ¥28.6 trillion ($198 billion) in Fiscal Year 2024 ending March 31, 2025.

Paper losses from Japanese government bonds TRIPLED from the last year. However, the BOJ's reported net income was ¥2.26 trillion ($16 billion). It can take years until these bonds mature. Source: Global Markets Investor, Bloomberg

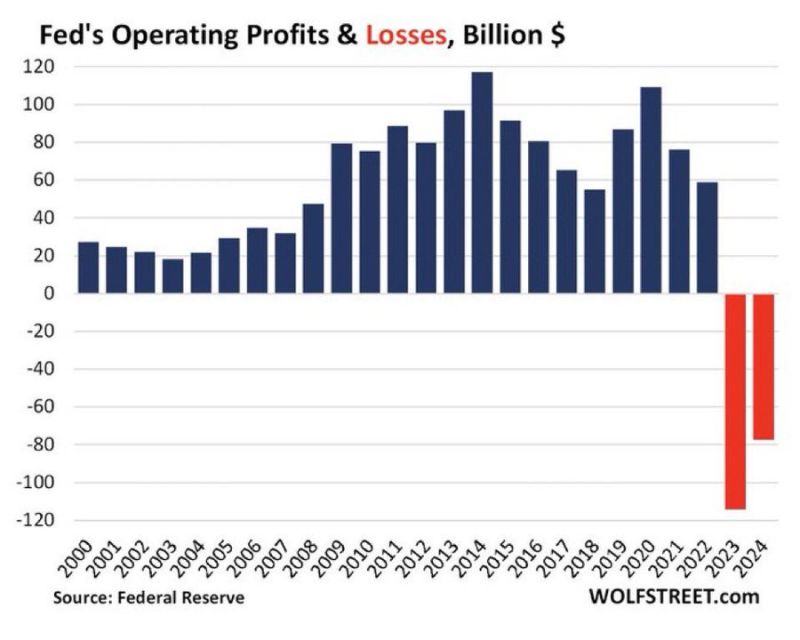

The Federal Reserve has now lost a combined $192 Billion over the last 2 years

Source: Barchart, Wolfstreet.com

The People’s Bank of China trimmed the 1-year loan prime rate to 3.0% from 3.1%, and the 5-year LPR to 3.5% from 3.6%.

A slew of state-backed commercial lenders moved to cut their deposit rates by as much as 25 basis points earlier Tuesday. As mentioned by Mo El Erian, the question remains: will this prolonged period of policy incrementalism reach a critical mass that fundamentally alters household sentiment and consumer behaviour? So far, it has failed to do so. Source: Bloomberg, CNBC

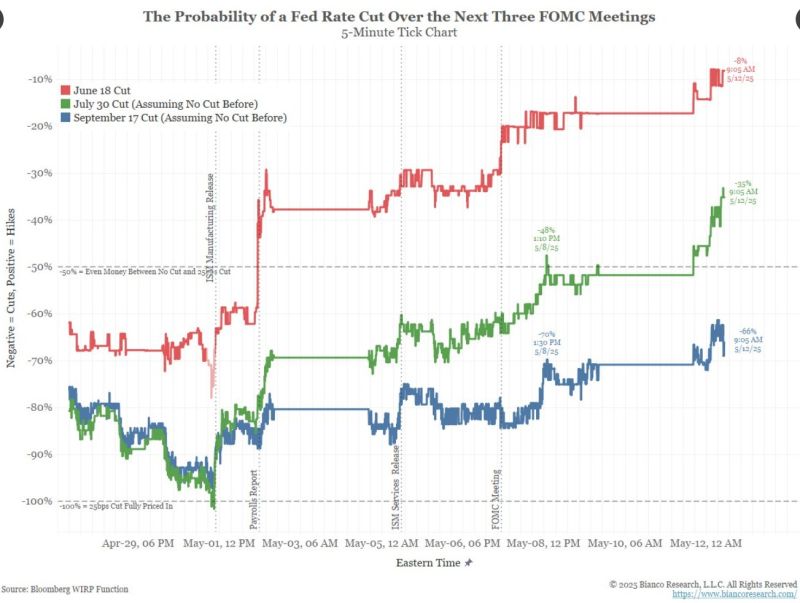

The number of Fed rate cuts continue to be revised downwards:

* June 18 (red) now 8% (92% no move) * July 30 (green) now 35% (65% no move) No cut is priced until September 17. And even that cut (blue) is disappearing. It was more than 100% ~10 days ago and is now 66% (34% no move) and continuing to fall. Source: Jim Bianco @biancoresearch

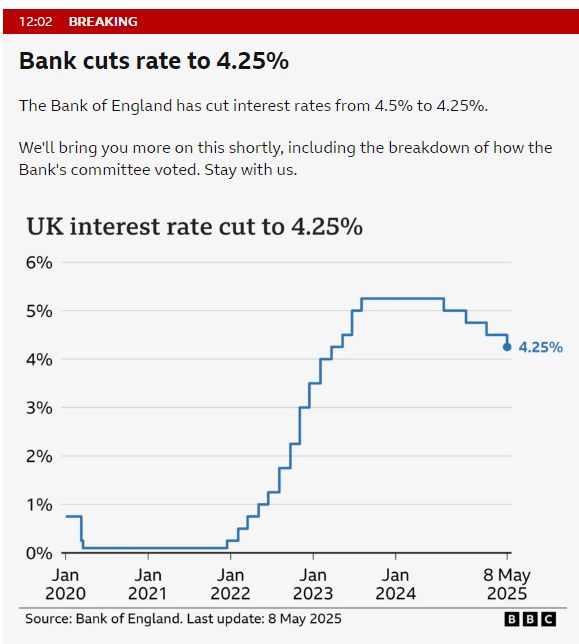

As expected, BoE cut rates by 25bps! (5-4 vote).

It came as Donald Trump hinted a UK-US trade pact was imminent. Some MIXED SIGNALS - Two members (Swati Dhingra and Alan Taylor) preferred to reduce Bank Rate by 0.5 percentage points, to 4%. Two members (Catherine L Mann and Huw Pill) preferred to leave Bank Rate unchanged, at 4.5%.

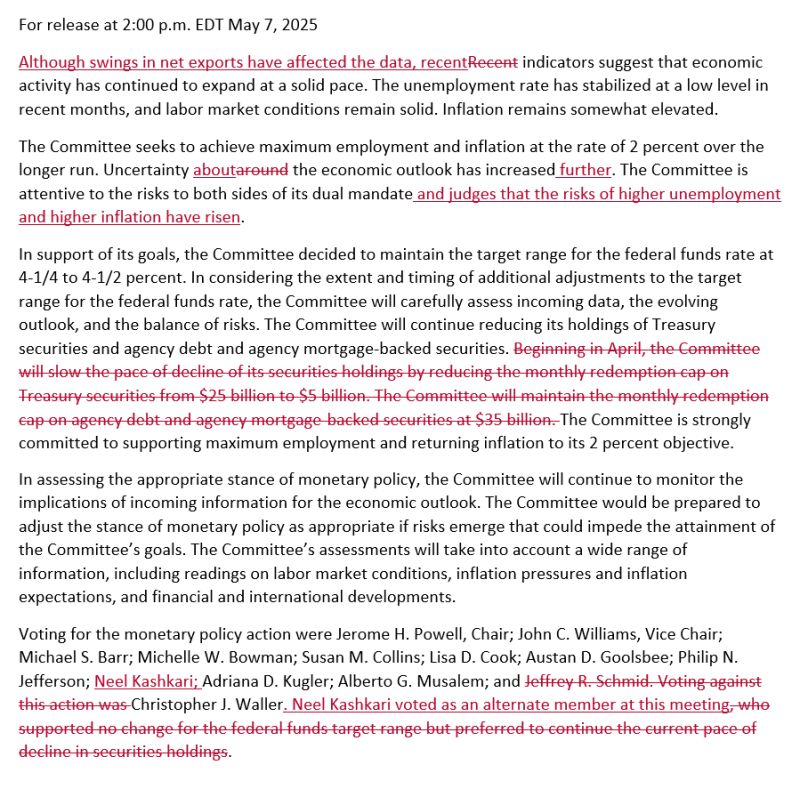

Fed leaves rates unchanged, as expected

“The committee … judges that the risks of higher unemployment and higher inflation have risen.” Powell is facing the worst outcome for a Fed President... The Federal Reserve's dual mandate is to promote two main economic goals: maximum employment and price stability... and uncertainty is on both sides How will President Trump react to this? ECB is cutting rates. PBOC as well as they see a disinflationary shock coming. Meanwhile, the Fed stays put. He is not going to like this...

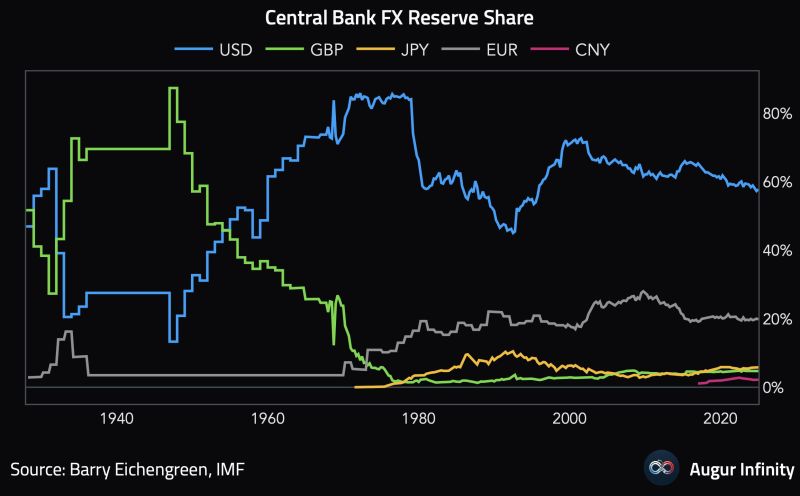

A currency's reserve status should not be taken for granted.

Just look at what happened to the pound... Source: Augur Infinity

Investing with intelligence

Our latest research, commentary and market outlooks